Definition of Accounting Rate Of Return

Accounting rate of return (ARR) is a method of finding out the expected amount we will earn from the projects which we have started today and the investment made on the initiation of those projects.

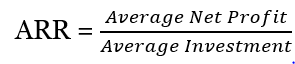

The Formula for ARR:

The ARR formula divides an average net income expected against the average capital cost incurred to derive an expected annual return over the investment or assets. The ARR formula is used to make capital budgeting decisions by managers. Companies use this percentage in deciding on whether or not to invest in a specific project or buying an asset based on the expected return they will earn as compared to the capital cost.

View More Cost Accounting Definitions

Related Questions of Accounting Rate Of Return

Peng Company is considering an investment expected to generate an average net

B2B Co. is considering the purchase of equipment that would allow

Yummy Candy Company is considering purchasing a second chocolate dipping machine in

Southern Cola is considering the purchase of a special-purpose bottling

Lethbridge Company runs hardware stores in Alberta. Lethbridge’s management estimates that

Nate Stately, a manager of the Plate division for the Great

A number of terms are listed below: /

Cindy Alexander, Turner, Inc.’s vice president of marketing

Crichton Publications uses the accounting rate of return method to evaluate proposed

Homer Inc. plans to purchase a new rendering machine for its

Show All