Definition of Annuity Due

Annuity due is a series of exact same amounts of cash flows with the first cash flow starting immediately. It is like the first installment paid as a down payment on the inception of a lease agreement.

Assume that you lease a car from a bank that has a 10 years installment plan with the first installment starting from now. The Installment amount is set to be $10000 a year and the interest rate implicit is 12%.

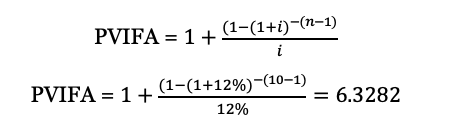

To find out the present value of an annuity we use present value interest factor of annuity also called PVIFA. As the annuity associated with the car lease is an annuity due the formula for calculating PVIFA is:

To find out the current worth of the car based on the installment plan we will simply multiply the annuity amount with PVIFA.

PV = Annuity x PVIFA

PV = $10,000 x 6.3282 = $63,282

View More Financial Management Definitions

Related Questions of Annuity Due

Bidwell Leasing purchased a single-engine plane for $400,

Bidwell Leasing purchased a single-engine plane for its fair value

Explain how the future value of an ordinary annuity interest table is

You want to buy a new sports car from Muscle

Wilson Foods Corporation leased a commercial food processor on September 30,

As discussed in the text, an annuity due is identical to

Prepare a time diagram for the present value of a four-

Listed below are several terms and phrases associated with concepts discussed in

You want to buy a new sports car from Muscle Motors for

As discussed in the text, an annuity due is identical to

Show All