Definition of Capital Asset Pricing Model

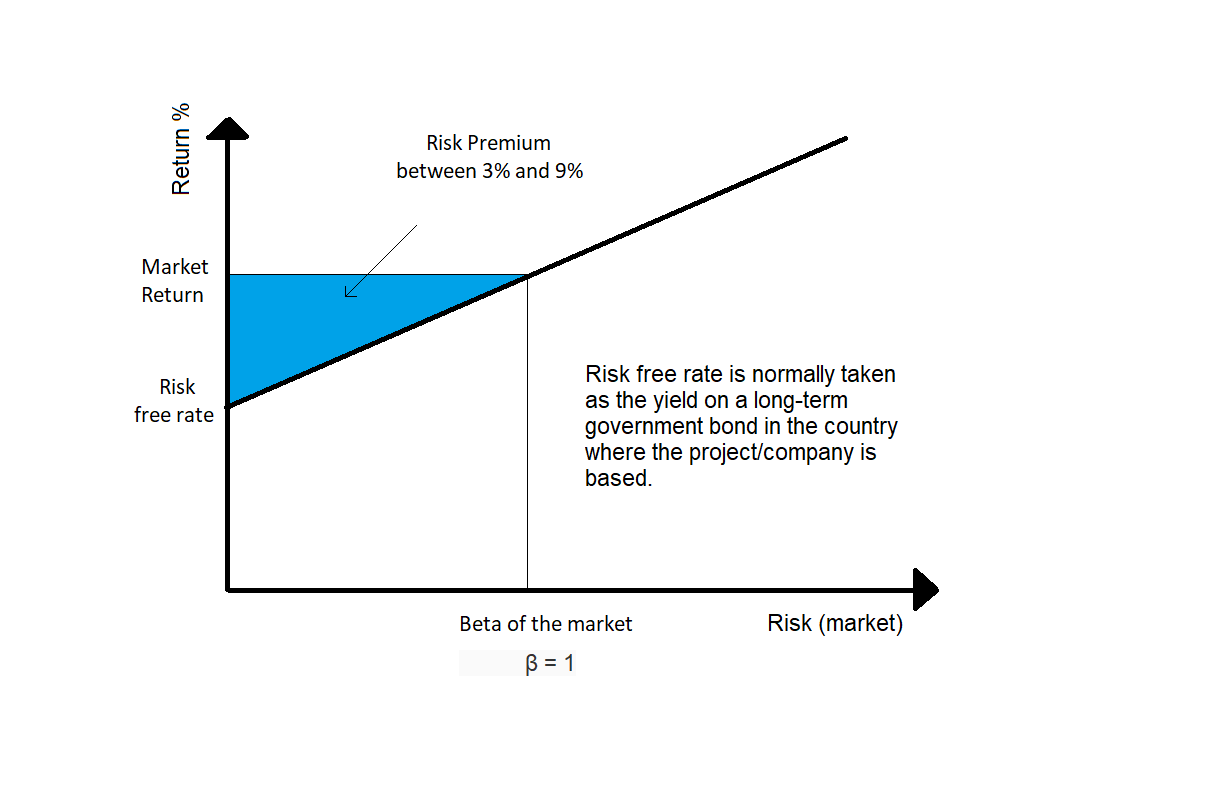

This is a model that elaborates the graphical representation between the investment you made on highly risky securities and the return which you will gain from that investment. This model is usually used in finance to measure the expected rate of return on the assets considering the risk on those assets and capital investment made.

Underneath is an outline of the CAPM concept.

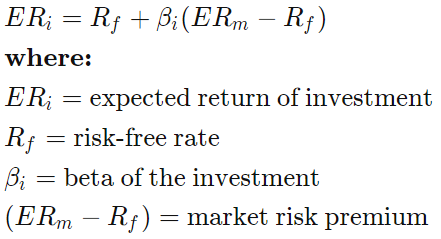

Formula of CAMP:

The beta in the below formula measures how much riskier the investment is. The stock will be risker for investment if the beta value comes out to be greater than 1. The stock is risker from an investment point of view if the value of the beta coefficient is higher than 1. The formula predicts low risk on the investment on any portfolio if the beta value came under 1.

View More Cost Accounting Definitions

Related Questions of Capital Asset Pricing Model

You have been provided the following data about the securities of three

Discuss risk from the perspective of the Capital Asset Pricing Model (

You are using the arbitrage pricing model to estimate the expected return

A portfolio that combines the risk-free asset and the market

Define the following terms, using graphs or equations to illustrate your

Suppose you observe the following situation: /

Define the following terms, using graphs or equations to illustrate your

The capital asset pricing model illustrates how risk is incorporated into user

Gamma Airlines has an asset beta of 1.5. The

Suppose you observe the following situation: /

Show All