Definition of Compounding

Compounding is the process of adding interest to the principal to make a new principal to charge interest on. It is different from simple interest like a coupon payment on a corporate bond. When a corporate bond pays interest it multiplies the interest rate with the principal value. In the case of compound interest, the interest is accumulated over each period into the principal. The fixed deposit accounts have a compounding mechanism.

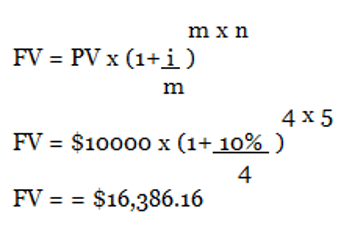

Assume you have $10000 in cash that you don’t need for the next five years. The bank offers 10% interest compounded quarterly for five years. After five years you will get $16,386.16.

View More Corporate Finance Definitions

Related Questions of Compounding

Refer to the data in BE6-7. Assuming quarterly compounding

LEW Company purchased a machine at a price of $100,

How long will it take $200 to double if it earns

Find the future values of these ordinary annuities. Compounding occurs once

How does continuous compounding benefit an investor?

Your firm sells for cash only; but it is thinking of

Suppose that 3-month, 6-month, 12-

Lakesha recently found out that her credit card balance was compounded daily

Bank A pays 4% interest compounded annually on deposits, while

Your firm is considering a project that will cost $4.

Show All