Definition of Coverage Ratio

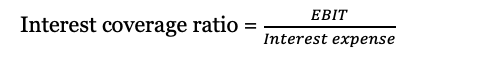

Coverage ratio measures the company’s ability to absorb a shock of payments such as interest and dividends. Coverage ratios are normally calculated for interests and it is called as interest coverage ratio. The interest coverage ratio measures the company’s ability to pay interest out of its earnings before interest and taxes. The higher the interest coverage ratio is, the more safe is the debtholders’ interest payments will be.

Assume a company has a total debt of $50 million that pays interest of 8% i.e. $4 million ($50 million x 8%). The company’s EBIT is $13 million. Calculate the interest coverage ratio.

Interest coverage ratio = $13 million / $4 million = 3.25 times

View More Financial Management Definitions

Related Questions of Coverage Ratio

You are analyzing the leverage of two firms and you note the

Find the following financial ratios for Smolira Golf Corp. (use

Aero Inc. had the following statement of financial position at the

Pop Evil Inc.’s net income for the most recent year

Titan Inc.’s net income for the most recent year was

Sunny Day Stores operates convenience stores throughout much of the United States

Use the information in E5-14 for Carmichael Industries.

To meet the increasing demand for its microprocessors, Intelligent Micro Devices

Sherwood Inc.’s net income for the most recent year was

Define each of the following terms: a. Liquidity ratios:

Show All