Definition of Diluted Eps

A diluted eps is the earning per share calculated using the total number of shares outstanding and also the potentially convertible shares. It is often lower than the basic eps that is calculated using the weighted average number of shares. The concept assumes what would be the earnings per share if all the potentially convertible securities are exercised. The convertible securities can include convertible bonds, share options, and warrants.

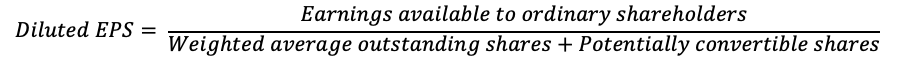

The formula for diluted EPS is as follow:

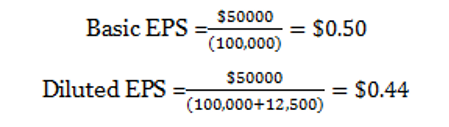

Assume a company has after-tax earnings of $50,000 and has 100,000 shares outstanding each trading at $6. The company also has 15000 share options that employees can exercise at $5. The Number of shares that can be converted into shares will be ($5 x 15000 / $6) =12500.

The basic and diluted EPS will be as follows:

View More Managerial Finance Definitions

Related Questions of Diluted Eps

Niles Company granted 9 million of its no par common shares to

PHN Foods granted 18 million of its no par common shares to

Anderson Steel Company began 2018 with 600,000 shares of common

Refer to the salesforce.com financial statement excerpts given below to

On 1 January 2016, G plc issued £2 million of

Riggs Corporation has the following balance sheet information at December 31,

Listed below are several terms and phrases associated with earnings per share

Selected data for The Hershey Company for Year 1 through Year 3

The Shareholders’ Equity section of Holiday Roads Company’s balance sheet shows:

In its December 31, 2016, balance sheet, Castle,

Show All