Definition of Effective Annual Rate

The effective annual rate or EAR is the rate that a compound interest rate offers in annual terms. Effective annual rate is used for comparing investments offering different compounding factors. For example, a bank offers three different investments; monthly, quarterly, and semi-annually at 10% per annum.

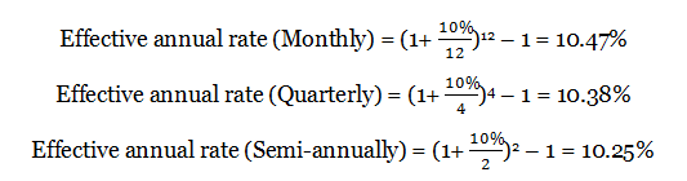

The effective annual rate will be calculated as follows:

In the above example, the monthly investment plan computes interest on principal at a monthly compounding rate i.e. (10% / 12 =0. 833%) and then reinvested at the same rate for each month. The quarterly investment plan computes interest on principal at a quarterly compounding rate i.e. (10% / 4 = 2.5%) and then reinvested at the same rate for each quarter and for semiannual the half-yearly rate is used i.e. (10% / 2 = 5%). Effectively the monthly, quarterly, and semi-annual investments plans are offering 10.47%, 10.38%, and 10.25% respectively.

View More Managerial Finance Definitions

Related Questions of Effective Annual Rate

You are looking at an investment that has an effective

Bruner Aeronautics has perpetual preferred stock outstanding with a par value of

The Rasputin Brewery is considering using a public warehouse loan as part

The Ohio Valley Steel Corporation has borrowed $5 million for one

Veggie Burgers, Inc., would like to maintain their cash account

You have applied for a job with a local bank. As

The Signet Corporation has issued four-month commercial paper with a

The Treadwater Bank wants to raise $1 million using three-

The Needy Corporation borrowed $10,000 from Bank Ease.

Magna Corporation has an issue of commercial paper with a face value

Show All