Definition of Inverted Yield Curve

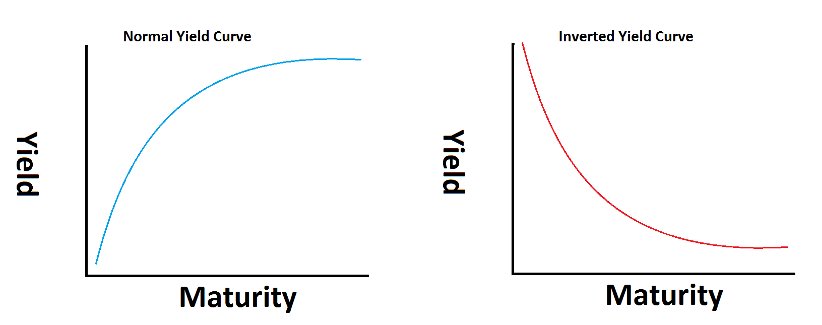

An inverted yield curve shows that the long term investments are showing lower rates than short term investment yield curves. A yield curve represents the perception of the investor in a market and under normal economic conditions, the yield curves are upward slopping for long term investments and comparatively lower for short term investments.

Under recession, the returns on investments with longer maturity are showing a downward trend and the curve is inverted. The inverted yield curve shows that the investors’ expectations are not good and it appears as a sharp indicator that an economy is in recession.

View More Managerial Finance Definitions

Related Questions of Managerial Finance

Harte Systems Inc., a maker of electronic surveillance equipment, is

Miller Corporation is considering replacing a machine. The replacement will reduce

Matt Peters wishes to evaluate the risk and return behaviors associated with

Bluestone Metals Inc. is a metal fabrication firm that manufactures prefabricated

Lincoln Industries has a line of credit at Bank Two that requires

Samuels Manufacturing is considering the purchase of a new machine to replace

Bristol’s Bistro, Inc., has declared a dividend of $1

Gabrielle just won $2.5 million in the state lottery

Gina Vitale has just contracted to sell a small parcel of land

You have been made treasurer for a day at AIMCO, which

Show All