Definition of Loan Amortization Schedule

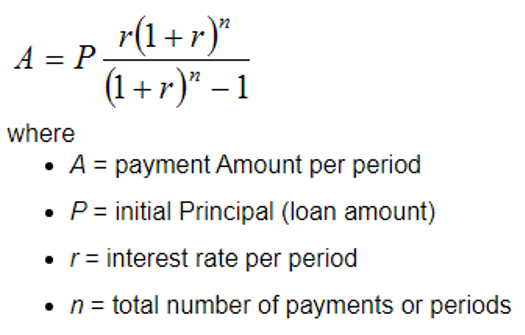

When a person takes a loan for buying a house the bank offers the borrower a payment plan that lays all the upcoming payments of the loan that includes principal and interest amounts. The monthly installment is calculated using the following formula.

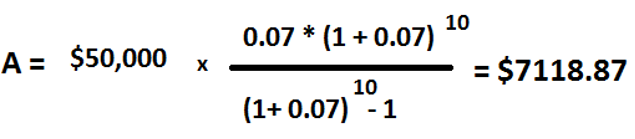

Assume a house is worth currently $50,000 the yearly installment will be as follows.

The amortization schedule for this will be as follow:

|

Period |

Installment |

Interest (7%) |

Principal Paid |

Principal Remaining |

|

0 |

- |

- |

- |

50,000.00 |

|

1 |

7,118.87 |

3,500.00 |

3,618.87 |

46,381.13 |

|

2 |

7,118.87 |

3,246.68 |

3,872.19 |

42,508.94 |

|

3 |

7,118.87 |

2,975.63 |

4,143.24 |

38,365.69 |

|

4 |

7,118.87 |

2,685.60 |

4,433.27 |

33,932.42 |

|

5 |

7,118.87 |

2,375.27 |

4,743.60 |

29,188.82 |

|

6 |

7,118.87 |

2,043.22 |

5,075.65 |

24,113.17 |

|

7 |

7,118.87 |

1,687.92 |

5,430.95 |

18,682.22 |

|

8 |

7,118.87 |

1,307.76 |

5,811.11 |

12,871.11 |

|

9 |

7,118.87 |

900.98 |

6,217.89 |

6,653.22 |

|

10 |

7,118.87 |

465.73 |

6,653.22 |

0.00 |

View More Financial Management Definitions

Related Questions of Loan Amortization Schedule

Construct a loan amortization schedule for a 3-year, 11

The James Company has been offered a 4-year loan from

Joan Messineo borrowed $45,000 at a 4% annual

Determine the annual payment on a $15,000 loan that

What does a loan amortization schedule do?

Show All