Definition of Operating Income

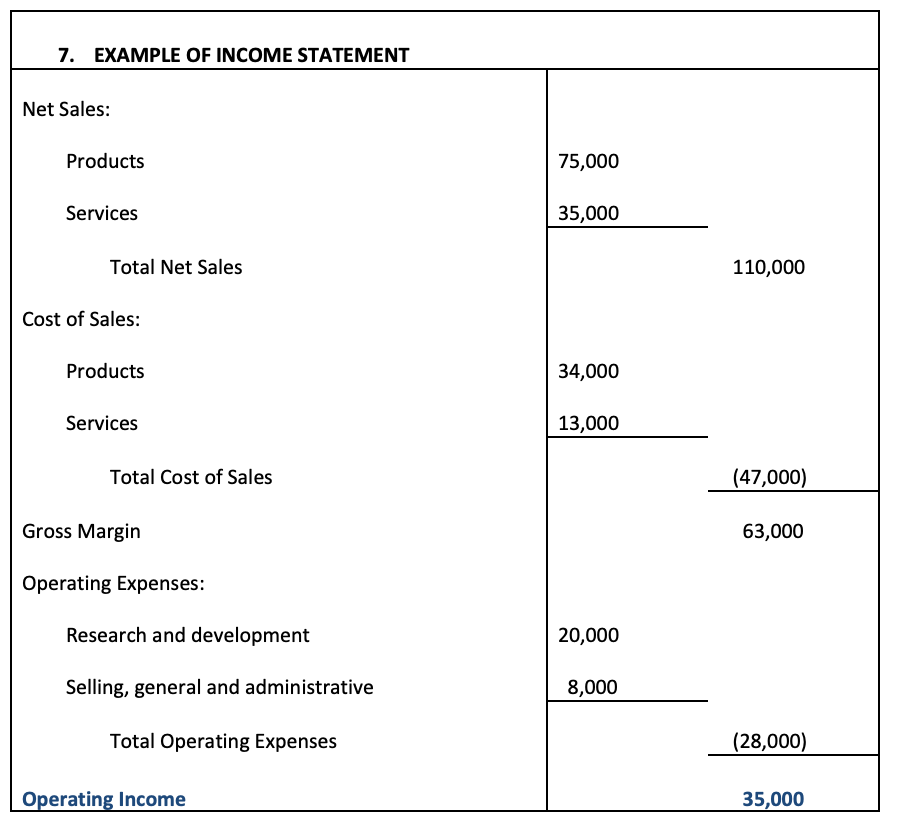

Operating income is the residual of sales revenue after deducting direct and direct expenses. The direct costs include the cost of goods sold. When we deduct the cost of goods sold from sales revenues we get gross profit or gross margin. From this, we then deduct indirect expenses like depreciation, amortization, selling, and administrative expenses and adjust them with all other operating revenues if any. Adding all these net expenses collectively are called operating expenses.

When these operating expenses are deducted from the gross profit the residual is called operating income. This is also known as EBIT as it does not take effect of any interest payments and taxation. Let’s see an income statement example to understand how the operating income is calculated.

View More Corporate Finance Definitions

Related Questions of Operating Income

Todrick Company is a merchandiser that reported the following information based on

Pittman Company is a small but growing manufacturer of telecommunications equipment.

Engberg Company installs lawn sod in home yards. The company’s most

TufStuff, Inc., sells a wide range of drums, bins

Gold Star Rice, Ltd., of Thailand exports Thai rice throughout

Outback Outfitters sells recreational equipment. One of the company’s products,

Magic Realm, Inc., has developed a new fantasy board game

“I know headquarters wants us to add that new product line

Tami Tyler opened Tami’s Creations, Inc., a small manufacturing company

Stavos Company’s Screen Division manufactures a standard screen for high-definition

Show All