Definition of Present Value Of An Annuity

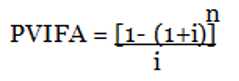

Present value of an annuity is the present value of periodic cash flows calculated by multiplying the amount of annuity with the present value interest factor of the annuity. An annuity is a periodic amount with a similar amount of cash flows after similar time intervals. PVIFA is the discount factor for a number of periods at a given discount rate.

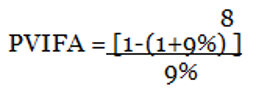

Assume a project that generates $5000 per year for 8 years. The interest rate is 9%. The present value interest factor of the annuity will be calculated using this formula:

View More General Investment Definitions

Related Questions of Present Value Of An Annuity

For each of the following cases, indicate (a) to

The internal rate of return method is used by Leach Construction Co

Ambrose Co. has the option of purchasing a new delivery truck

Suppose the interest rate is 8% APR with monthly compounding.

Using the bond details in QS 14-2, confirm that

What is the present value of an annuity of $6,

As stated in the chapter, annuity payments are assumed to come

Keith Riggins expects an investment of $82,014 to return

Park City Mountain Resort, a Utah ski resort, recently announced

A municipality expects to use a landfill evenly throughout the 25 years

Show All