Definition of Price To Book Ratio

Price to book ratio is a ratio of the market price of a share divided by the book value per share.

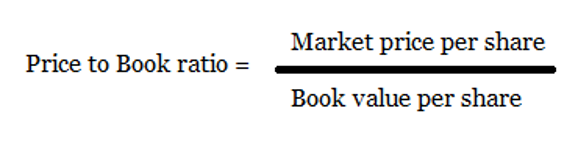

The formula for price to book value per share is as follows.

The investors use the price to book ratio to assess that a stock is undervalued or over-valued. Assume that a company has total equity of $50,000 and 2000 shares outstanding. The current market price is $23.

The price to book ratio will be as follows.

Book value per share = Equity / Number of shares

Book value per share = $50000 / $2000 = $25 per share

Price to book value ratio = $23 / $25 = 0.92

View More Personal Finance Definitions

Related Questions of Personal Finance

1. Using Your Personal Financial Plan Sheet 22, compare the

1. Jamie Lee is considering a used vehicle, but cannot

Newlyweds Jamie Lee and Ross have had several milestones in the past

Troy has a credit card that charges 18% on outstanding balances

Nick and Nora are married and have three children in college.

Gene and Dixie, husband and wife (ages 35 and 32

How is the market for a stock created? How do brokerage

Ted Riley owns a 2012 Lexus worth $40,000.

1. What is the benefit to Jamie Lee and Ross investing

Julie wants to open a bank account with $75. Julie

Show All