Definition of Pvifa

Present value interest factor of annuity or PVIFA is a discount factor that is used to calculate the present value of the annuity. An annuity is a stream of exact cash flows equally spread over a timeline. The present value interest factor of an annuity is the sum of all the discount factors used to discount the cash flow of each period.

For example, the 6 years annuity factor at 8% will be as follows:

|

Year |

Discount factor @ 8% |

|

|

1 |

(1+8%)-1 |

0.925926 |

|

2 |

(1+8%)-2 |

0.857339 |

|

3 |

(1+8%)-3 |

0.793832 |

|

4 |

(1+8%)-4 |

0.73503 |

|

5 |

(1+8%)-5 |

0.680583 |

|

6 |

(1+8%)-6 |

0.63017 |

|

PVIFA |

4.62288 |

|

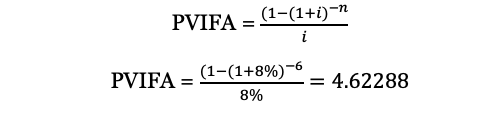

The total of 4.62288 is a short form that is calculated using the following formula:

View More Financial Management Definitions

Related Questions of Financial Management

An oil drilling company must choose between two mutually exclusive extraction projects

Executive salaries have been shown to be more closely correlated to the

Lloyd Corporation’s 14% coupon rate, semiannual payment, $1

Your division is considering two projects. Its WACC is 10%,

Suppose a new and more liberal Congress and administration are elected.

Crissie just won the lottery, and she must choose between three

TIE RATIO AEI Incorporated has $5 billion in assets, and

A company’s 5-year bonds are yielding 7.75%

Lloyd Inc. has sales of $200,000, a

Gamma Medical’s stock trades at $90 a share. The company

Show All