Definition of Return On Equity

Return on equity or ROE is a measure of profitability that assesses how much return the equity holders of the company are earning on their investment. It is calculated by dividing net profit or earnings after taxes by total stockholders’ equity. This is an easy measure that is calculated in percentage and can be used by various users especially by investors to make investment decisions. The higher the ROE the happier the investors are and will be willing to invest in a company.

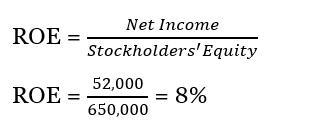

Assume that a company has a net income of $52,000 and a total stockholder’ equity of $650,000. The ROE will be calculated as follows:

View More Corporate Finance Definitions

Related Questions of Return On Equity

Following are the auditor's calculations of several key ratios for Cragston Star

Happy Times, Inc., wants to expand its party stores into

A stock analyst wants to determine whether there is a difference in

The Corrigan Corporation’s 2007 and 2008 financial statements follow, along with

Y3K, Inc., has sales of $6,183, total assets of $2,974,

Juggernaut Satellite Corporation earned $18 million for the fiscal year ending

Air Tampa has just been incorporated, and its board of directors

Rugged Sports Enterprises LP is organized as a limited partnership consisting of

Gardial & Son has an ROA of 12%, a 5%

D’Leon Inc., a regional snack foods producer, after an expansion

Show All