Definition of Straight Line Depreciation

Straight-line depreciation is a method of charging depreciation expense evenly over the useful life of the assets. Since the depreciation expense is related to assets that were in use for generating revenues, the straight-line depreciation method is suitable when it can be reasonably estimated that the pattern of cash flows to the entity are also evenly distributed over the useful life of the asset.

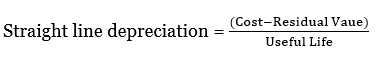

The straight-line depreciation is calculated using this formula.

Example of Straight Line Depreciation:

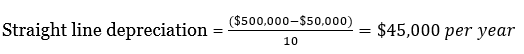

A plant has a cost of $500,000 and a useful life of 10 years. At the end of 10 years, the plant can be sold for $50,000. The straight-line depreciation will be:

View More Corporate Finance Definitions

Related Questions of Straight Line Depreciation

Lanco Corporation, an accrual-method corporation, reported taxable income

On January 1, 2018, Poultry Processing Company purchased a freezer

One measure of the effective tax rate is the difference between the

Macon Vitamins sells a variety of vitamins and herbal supplements to small

The Johnson Company bought a truck costing $24,000 two

The board of education for the Blue Ridge School District is considering

Preston Plastics is about to wrap up its capital budgeting cycle,

Melissa Corporation is domiciled in Germany and is listed on both the

Eastern Educational Services is considering the following proposal to sell its teaching

The following footnote was disclosed at the beginning of 2016 (January

Show All