Definition of Terminal Value

Terminal value refers to the present value of perpetual free cash flows assuming a constant growth forever at a given rate of return. It is used while assessing the viability of a project that involves perpetual cash flows after a certain period.

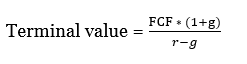

The formula for terminal value is

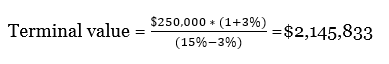

Example of Terminal Value:

A project that has initial cash outflow of $5 million, offers $250,000 for fist 20 years and after that, the cash flows are expected to grow at 3% per year and the required cost of capital is 15%. The terminal value, in this case, will be

View More Corporate Finance Definitions

Related Questions of Terminal Value

Happy Times, Inc., wants to expand its party stores into

Answer the following questions about the discounted free cash flow model illustrated

Eberhart Manufacturing has projected sales of $145 million next year.

The fair value hierarchy establishes three levels of input, with level

RxDelivery Systems is an R&D venture specializing in the development

Why do net income and cash flow in the numerical examples in

Suppose that in the case application in the chapter the APV for

Fincher Manufacturing has projected sales of $135 million next year.

Gemco Jewelers earned $5 million in after-tax operating income

Using the market data in Exhibit 7.6, show the

Show All