Definition of Times Interest Earned

Time interest earned is a ratio that assesses the business’s ability to pay interest cost on interest-bearing debt out of its operating profits before interest and taxes also called EBIT. The time interest earned ratio is a very important ratio from an audit perspective because it determines the liquidity of the company and assesses the level of financial leverage.

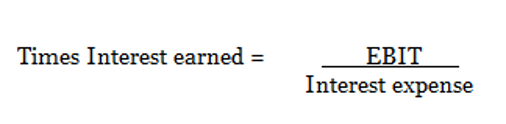

The time interest earned ratio is calculated as follows.

If the time interest earned is less than 2.0 it is alarming for a company and its shareholders because there will be not much left after payment of interest and taxes for distribution of profits after taxes.

View More General Accounting Definitions

Related Questions of Times Interest Earned

Following are the auditor's calculations of several key ratios for Cragston Star

The balance sheet for Garcon Inc. at the end of the

The 2018 balance sheet for Hallbrook Industries, Inc., is shown

Hasbro, Inc. and Mattel, Inc. are the two

Best Buy Co, Inc., is a leading retailer specializing in

Target Corporation prepares its financial statements according to U.S.

Refer to the financial statements for Castile Products, Inc., in

Answer the following multiple-choice questions: a. Which

Find the following financial ratios for Smolira Golf Corp. (use

Realtor Inc. is a company that owns five large office buildings

Show All