Definition of Yield To Maturity

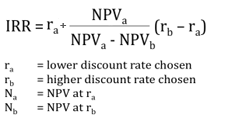

Yield to maturity or YTM is a rate at which the present value of all cash inflows related to a bond or debt security is exactly equal to the market value of the bond. It is also referred to as the internal rate of return or the IRR of a bond.

Example of Yield to Maturity:

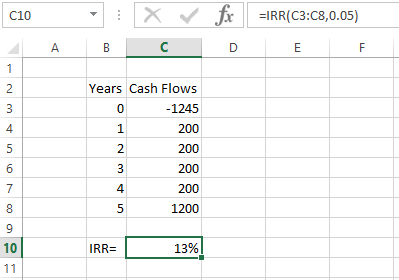

A bond that is currently trading at $1,245 has a coupon rate of 20% and will mature in 5 years at par value i.e. $1,000. To find out the YTM you can use the IRR formula in excel.

View More Corporate Finance Definitions

Related Questions of Yield To Maturity

In February 2015 Treasury 4¾s of 2041 offered a semi

Suppose you purchase a 30-year, zero-coupon bond

Suppose you purchase a ten-year bond with 6% annual

Clifford Clark is a recent retiree who is interested in investing some

Your company has two divisions: One division sells software and the

Even though most corporate bonds in the United States make coupon payments

a. An 8%, five-year bond yields 6%.

Daniel B. Butler and Freida C. Butler, husband and

Last year Clark Company issued a 10-year, 12%

Your company wants to raise $10 million by issuing 20-

Show All