Question: 1. Open the general ledger accounts and

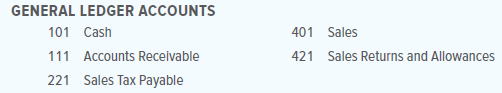

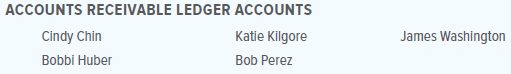

1. Open the general ledger accounts and accounts receivable ledger accounts indicated below.

2. Post the entries from the general journal in Problem 7.2A to the appropriate accounts in the general ledger and in the accounts receivable ledger.

3. Prepare a schedule of accounts receivable. Compare the balance of the Accounts Receivable control account with the total of the schedule.

Analyze: What is the amount of sales tax owed at September 30, 20X1?

> Several transactions that occurred during December 20X1, the first month of operation for Wells’ Accounting Services, follow. The company uses the general ledger accounts listed below. INSTRUCTIONS Record the transactions in the general

> In June 20X1, Chan Lee opened a photography studio that provides services to public and private schools. His firm’s financial activities for the first month of operations and the chart of accounts appear below. INSTRUCTIONS 1. Journaliz

> Accruals and deferrals can vary for each company. The adjusting entries for a service company will differ from those of a merchandising company. Brainstorm the adjusting entries’ similarities and differences for a service company and a merchandising comp

> The transactions listed below took place at Prasad Building Cleaning Service during September 20X1. This firm cleans commercial buildings for a fee. INSTRUCTIONS Analyze and record each transaction in the general journal. Choose the account names from th

> The accounts and transactions of Brian Carter, Counselor and Attorney at Law, follow. INSTRUCTIONS Analyze the transactions. Record each in the appropriate T accounts. Use plus and minus signs in front of the amounts to show the increases and decreases.

> The following transactions took place at P and W Capital Investments. INSTRUCTIONS Analyze each of the transactions. For each transaction, decide what accounts are affected and set up T accounts. Record the effects of the transaction in the T accounts. T

> The following transactions occurred at several different businesses and are not related. INSTRUCTIONS Analyze each of the transactions. For each transaction, set up T accounts. Record the effects of the transaction in the T accounts. TRANSACTIONS 1. A fi

> The accountant for the firm owned by Brian Carter prepares financial statements at the end of each month. INSTRUCTIONS Use the figures in the T accounts for Problem 3.4B to prepare a trial balance, an income state- ment, a statement of owner’s equity, an

> Carter Wilson is a painting contractor who specializes in painting commercial buildings. At the beginning of June, his firm’s financial records showed the following assets, liabilities, and owner’s equity. INSTRUCTIONS

> On July 1, Alfred Herron established Herron Commercial Appraisal Services, a firm that provides expert commercial appraisals and represents clients in commercial appraisal hearings. INSTRUCTIONS Analyze the following transactions. Record in equation form

> Obtain all data that is necessary from the worksheet prepared for Healthy Eating Foods Company in Problem 12.5A at the end of Chapter 12. Then follow the instructions to complete this problem. INSTRUCTIONS 1. Record adjusting entries in the general journ

> McCormick and Company, Inc., reported the following in its 2018 Annual Report: Analyze: 1. Based on the information presented above, which categories might require adjusting entries at the end of an operating period? 2. List the potential adjusting entri

> Obtain all data necessary from the worksheet prepared for Enoteca Fine Wines in Problem 12.6A at the end of Chapter 12. Then follow the instructions to complete this problem. INSTRUCTIONS 1. Prepare a classified income statement for the year ended Decemb

> Superior Hardwood Company distributes hardwood products to small furniture manufacturers. The adjusted trial balance data given below is from the firm’s worksheet for the year ended December 31, 20X1. INSTRUCTIONS 1. Prepare a classifie

> Enoteca Fine Wines is a retail store selling vintage wines. On December 31, 20X1, the firm’s general ledger contained the accounts and balances below. All account balances are normal. INSTRUCTIONS: 1. Prepare the Trial Balance section o

> Healthy Eating Foods Company is a distributor of nutritious snack foods such as granola bars. On December 31, 20X1, the firm’s general ledger contained the accounts and balances that follow. INSTRUCTIONS 1. Prepare the Trial Balance sec

> The Green Thumb Gardener is a retail store that sells plants, soil, and decorative pots. On December 31, 20X1, the firm’s general ledger contained the accounts and balances that appear below. INSTRUCTIONS 1. Prepare the Trial Balance se

> On July 31, 20X1, after one month of operation, the general ledger of Michael Mendoza, CPA, contained the accounts and balances given below. INSTRUCTIONS 1. Prepare a partial worksheet with the following sections: Trial Balance, Adjustments, and Adjusted

> Based on the information below, record the adjusting journal entries that must be made for Kisling Distributors on June 30, 20X1. The company has a June 30 fiscal year-end. Use 18 as the page number for the general journal. a.–b. Merchandise Inventory,

> The president of Tower Copper Company has told you to go out to the factory and count merchandise inventory. He said the stockholders were coming for a meeting next week and he wanted to put on a good show. He asked you to make the inventory a bit heavie

> 1. Complete Form 940, the Employer’s Annual Federal Unemployment Tax Return. Assume that all wages have been paid and that all quarterly payments have been submitted to the state as required. The payroll information for 20X1 appears bel

> Certain transactions and procedures relating to federal and state unemployment taxes follow for Robin’s Nest LLC, a retail store owned by Robin Roberts. The firm’s address is 2007 Lovely Lane, Dallas, TX 75268-0967. Th

> Metro Media Company pays its employees monthly. Payments made by the company on October 31 follow. Cumulative amounts for the year paid to the persons prior to the October 31 payroll are also given. 1. Tori Parker, president, gross monthly salary of $20,

> Alex Wilson operates On-Time Courier Service. The company has four employees who are paid on an hourly basis. During the workweek beginning December 15 and ending December 21, 20X1, employees worked the number of hours shown below. Information about thei

> On August 1, 20X1, the accountant for Midwest Imports downloaded the company’s July 31, 20X1, bank statement from the bank’s website. The balance shown on the bank statement was $28,750. The July 31, 20X1, balance in the Cash account in the general ledge

> Wages and payroll tax expense are the largest costs that a company incurs. At times, a company has a problem paying wages and cash deposits for payroll taxes. Your company has a cash flow problem. In a group of four employees, brainstorm ways to cut the

> On August 31, 20X1, the balance in the checkbook and the Cash account of the Sonoma Creek Bed and Breakfast was $13,031. The balance shown on the bank statement on the same date was $13,997. NOTES a. The firm’s records indicate that a $1,600 deposit date

> On May 2, 20X1, HPF Vacations received its April bank statement from First City Bank and Trust. Enclosed with the bank statement, which appears below, was a debit memorandum for $160 that covered an NSF check issued by Doris Fisher, a credit customer. Th

> Florence’s Florals, a retail business, started a $350 petty cash fund on June 1. Below are descriptions of the transactions to establish the petty cash fund, disburse petty cash during June, and replenish the petty cash fund on June 30.

> Candy’s Cupcakes, a retail business, started business on June 25, 20X1. It keeps a $300 change fund in its cash register. The cash receipts for the period from June 25 to June 30, 20X1, are below. INSTRUCTIONS 1. Open the general ledger

> Bennington Company (buyer) and Sanchez, Inc. (seller), engaged in the following transactions during January 20X1: INSTRUCTIONS 1. Open the accounts payable ledger account and accounts receivable ledger account indicated below for both Bennington Company

> 1. Open the general ledger accounts and accounts payable ledger accounts indicated below. Enter the balances as of June 1, 20X1. 2. Post the transactions in Problem 8.4A to the appropriate accounts in the general ledger and the accounts payable subsidiar

> NewTech Medical Devices is a medical devices wholesaler that commenced business on June 1, 20X1. The company purchases merchandise for cash and on open account. In June 20X1, NewTech Medical Devices engaged in the following purchasing and cash payment ac

> 1. Open the general ledger accounts and accounts payable ledger accounts indicated below. Enter the balance of Cash as of September 1, 20X1. 2. Post the entries in Problem 8.2A from the general journal to the appropriate accounts in the general ledger an

> The Home Depot, Inc., reported the following data in its Form 10-K filing (for the fiscal year ended February 3, 2019): Analyze: Assume all employees receive contributions to their retirement plan. What was the average retirement plan contribution made b

> High Country Ski Shop is a retail store that sells ski equipment and clothing. High Country Ski Shop commenced business on September 1, 20X1. The firm purchases merchandise on open account. The firm’s purchases, purchase returns and all

> Lens Queen Photo Shop is a retail store that sells cameras and photography supplies. The company began operations April 1, 20X1. The firm purchases its merchandise for cash and on open account. During April, the company engaged in the following transacti

> Royal Gift Shop sells cards, supplies, and various holiday greeting cards. Sales to retail customers are subject to an 8 percent sales tax. The firm sells its merchandise for cash; to customers using bank credit cards, such as MasterCard and Visa; and to

> 1. Open the general ledger accounts and accounts receivable ledger accounts shown below. Enter the balances as of April 1, 20X1. 2. Post the entries from the general journal in Problem 7.4A to the appropriate accounts in the general ledger and in the acc

> Incredible Sounds is a wholesale business that sells musical instruments. Transactions involving sales and cash receipts for the firm during April 20X1 follow. The firm sells its merchandise for cash and on open account. During April, Incredible Sounds e

> Precision Electronics began operations September 1, 20X1. The firm sells its merchandise for cash and on open account. Sales are subject to a 7 percent sales tax. The terms for all sales on credit are net 30. During September, Precision Electronics engag

> Cozy Kitchens began operations March 1, 20X1. The firm sells its merchandise for cash and on open account. Sales are subject to a 6 percent sales tax. The terms for all sales on credit are net 30. During March, Cozy Kitchens engaged in the following tran

> Nicky Norton owns a boutique dress shop that has been very successful. He employs 3 sales associates who get paid $10 per hour for a 40-hour week. He decides to open up another dress shop on the other side of town. He hires three more sales associates wi

> Restful Sleep Mattress company is planning to expand into selling bedroom furniture. This expansion will require a loan from the bank. The bank has requested financial information. In a group, discuss the information the bank would require. What informat

> A completed worksheet for The Best Group is shown below. INSTRUCTIONS 1. Record balances as of December 31, 20X1, in the ledger accounts. 2. Journalize (use 3 as the page number) and post the adjusting entries. Use account number 131 for Prepaid Advertis

> The completed worksheet for Chavarria Corporation as of December 31, 20X1, after the company had completed the first month of operation, appears below. INSTRUCTIONS 1. Prepare an income statement. 2. Prepare a statement of owner’s equity. The owner made

> The trial balance of Ortiz Company as of January 31, 20X1, after the company completed the first month of operations, is shown in the partial worksheet below. INSTRUCTIONS Complete the worksheet by making the following adjustments: supplies on hand at th

> Four transactions for Airline Maintenance and Repair Shop that took place in November 20X1 appear below, along with the general ledger accounts used by the company. INSTRUCTIONS Record the transactions in the general journal and post them to the appropri

> The following journal entries were prepared by an employee of International Marketing Company who does not have an adequate knowledge of accounting. INSTRUCTIONS Examine the journal entries carefully to locate the errors. Prepare journal entries to corre

> On October 1, 20X1, Helen Kennedy opened an advertising agency. She plans to use the chart of accounts listed below. INSTRUCTIONS 1. Journalize the transactions. Number the journal page 1, write the year at the top of the Date column, and include a descr

> The transactions that follow took place at the Cedar Hill Recreation and Sports Arena during September 20X1. This firm has indoor courts where customers can play tennis for a fee. It also rents equipment and offers tennis lessons. INSTRUCTIONS Record eac

> 1. Carolina Customs recently discovered that a payroll clerk had issued checks to nonexistent employees for several years and cashed the checks himself. The company does not have any internal control procedures for its payroll operations. What specific c

> The following accounts and transactions are for Vincent Sutton, Landscape Consultant. INSTRUCTIONS Analyze the transactions. Record each in the appropriate T accounts. Identify each entry in the T accounts by writing the letter of the transaction next to

> The following occurred during June at Brown Financial Planning. INSTRUCTIONS Analyze each transaction. Use T accounts to record these transactions and be sure to put the name of the account on the top of each account. Record the effects of the transactio

> The following transactions took place at Willis Counseling Services, a business established by Raymond Willis. INSTRUCTIONS For each transaction, set up T accounts from this list: Cash; Office Furniture; Office Equipment; Automobile; Accounts Payable; Ra

> The following transactions occurred at several different businesses and are not related. INSTRUCTIONS Analyze each of the transactions. For each, decide what accounts are affected and set up T accounts. Record the effects of the transaction in the T acco

> The accountant for the firm owned by Vincent Sutton prepares financial statements at the end of each month. INSTRUCTIONS Use the figures in the T accounts for Problem 3.4A to prepare a trial balance, an income statement, a statement of owner’s equity, an

> The following equation shows the transactions of Cotton Cleaning Service during May. The business is owned by Taylor Cotton. INSTRUCTIONS Analyze each transaction carefully. Prepare an income statement and a statement of owner’s equity

> Oil Field Equipment Repair Service is owned by Jack Phillips. INSTRUCTIONS Use the following figures to prepare a balance sheet dated February 28, 20X1. (You will need to compute the owner’s equity.) Analyze: What is the net worth, or o

> The Fashion Rack is a retail merchandising business that sells brand-name clothing at discount prices. The firm is owned and managed by Teresa Lojay, who started the business on April 1, 20X1. This project will give you an opportunity to put your knowled

> This project will give you an opportunity to apply your knowledge of accounting principles and procedures by handling all the accounting work of Eli’s Consulting Services for the month of January 2020. Assume that you are the chief acco

> Indicate the impact of each of the transactions below on the fundamental accounting equation (Assets = Liabilities + Owner’s Equity) by placing an “I” to indicate an increase and a “

> There are many approvals needed to create a paycheck for an employee. Divide into groups of five to identify the jobs necessary to create a paycheck for an employee. Describe the function and, if necessary, the journal entry for each job.

> The fundamental accounting equations for several businesses follow. Supply the missing amounts.

> Just before Henderson Laboratories opened for business, Eugene Henderson, the owner, had the following assets and liabilities. Determine the totals that would appear in the firm’s fundamental accounting equation (Assets = Liabilities +

> The following selected accounts were taken from the financial records of Sonoma Valley Distributors at December 31, 20X1. All accounts have normal balances. Accounts Receivable at December 31, 20X0, was $52,550. Merchandise Inventory at December 31, 20X0

> The Adjusted Trial Balance section of the worksheet for Hendricks Janitorial Supplies follows. The owner made no additional investments during the year. Prepare a postclosing trial balance for the firm on December 31, 20X1. ACCOUNTS

> Examine the following adjusting entries and determine which ones should be reversed. Show the reversing entries that should be recorded in the general journal as of January 1, 20X2. Include appropriate descriptions.

> On December 31, 20X1, the Income Statement columns of the worksheet for The Sax Shop contained the following information. Give the entries that should be made in the general journal to close the revenue, cost of goods sold, expense, and other temporary a

> The worksheet of Lantz’s Office Supplies contains the following asset and liability accounts. The balance of the Notes Payable account consists of notes that are due within a year. Prepare a balance sheet dated December 31, 20X1. Obtain

> The worksheet of Lantz’s Office Supplies contains the following owner’s equity accounts. Use this data and the net income determined in Exercise 13.3 to prepare a statement of owner’s equity for the y

> The worksheet of Lantz’s Office Supplies contains the following revenue, cost, and expense accounts. Prepare a classified income statement for this firm for the year ended December 31, 20X1. The merchandise inventory amounted to $59,775

> The Home Depot, Inc., reported the following data in its FY 2018 10-K (for the fiscal year ended February 3, 2019): Analyze: 1. What percentage of total current liabilities is made up of accrued salaries and related expenses at February 3, 2019? 2. By wh

> Selected accounts and other information from the records of Calderone Company for the year ended December 31 follow: 1. Compute the following items that would appear on a classified income statement. The company combines both selling and general and admi

> Tsang Company reports the following in its most recent year of operations: ■ Net sales, $2,000,000 (all on account) ■ Cost of goods sold, $977,500 ■ Gross profit, $1,022,500 ■ Accounts receivable, beginning of year, $220,000 ■ Accounts receivable, end of

> The accounts listed below appear on the worksheet of Commonwealth Crafts. Indicate the section of the classified income statement in which each account will be reported. SECTIONS OF CLASSIFIED INCOME STATEMENT a. Operating Revenue b. Cost of Goods Sold c

> For each of the following independent situations, prepare the adjusting entry that must be made at December 31, 20X1. Omit descriptions. a. On December 31, 20X1, the Notes Receivable account at Sufen Materials Corporation had a balance of $25,000, which

> On December 31, 20X1, the Notes Payable account at Cherie’s Boutique Shop had a balance of $72,000. This amount represented funds borrowed on a six-month, 6 percent note from the firm’s bank on December 1. Prepare the adjusting journal entry for interest

> On December 1, 20X1, Jenny’s Java Joint borrowed $50,000 from its bank in order to expand its operations. The firm issued a four-month, 9 percent note for $50,000 to the bank and received $48,500 in cash because the bank deducted the interest for the ent

> For each of the following independent situations, prepare the adjusting entry that must be made on December 31, 20X1. Omit descriptions. a. On December 31, 20X1, the Notes Payable account at Tsang Manufacturing Company had a balance of $18,000. This bala

> For each of the following independent situations, prepare the adjusting entry that must be made at December 31, 20X1. Omit descriptions. a. During the year 20X1, Alenikov Company had net credit sales of $2,020,000. Past experience shows that 1.5 percent

> The Income Statement section of the Johnson Company worksheet for the year ended December 31, 20X1, has $201,000 recorded in the Debit column and $216,250 in the Credit column on the line for the Income Summary account. What were the beginning and ending

> The beginning inventory of SoCal Wholesalers was $121,000, and the ending inventory is $116,500. What entries are needed at the end of the fiscal period to adjust Merchandise Inventory?

> Susie’s Sweater Factory employs two managers for the factory. These managers work 12 hours per day at $16 per hour. After eight hours, they receive overtime pay. Management is trying to cut costs. They have decided to promote the managers to a salary pos

> Meri Medical Supplies estimates that its office employees will earn $175,000 next year and its factory employees will earn $600,000. The firm pays the following rates for workers’ compensation insurance: $0.60 per $100 of wages for the office employees a

> On January 31, AC Gourmet Shop prepared its Employer’s Annual Federal Unemployment Tax Return, Form 940. During the previous year, the business paid total wages of $462,150 to its 14 employees. Of this amount, $98,000 was subject to FUTA tax. Using a rat

> On April 30, Quality Furniture Company prepared its state unemployment tax return for the first quarter of the year. The firm had taxable wages of $85,000. Because of a favorable experience rating, Quality pays SUTA tax at a rate of 1.4 percent. How much

> At the end of the weekly payroll period on June 30, the payroll register of Known Consultants showed employee earnings of $50,000. Determine the firm’s payroll taxes for the period. Use a social security rate of 6.2 percent, Medicare rate of 1.45 percent

> Given the following scenario, choose the best answer. At the end of the quarter, the business owed $2,000 in total payroll taxes. The amount due must be deposited: a. on the last business day of the quarter. b. on the last day of the quarter. c. on the d

> On July 31, the payroll register for Red Company showed the following totals for the month: gross earnings, $38,950; social security tax, $2,414.90; Medicare tax, $564.78; income tax, $5,842.00; and net amount due, $30,128.32. Of the total earnings, $30,

> Private Investigations has two office employees. A summary of their earnings and the related taxes withheld from their pay for the week ending June 7, 20X1, follows. 1. Prepare the general journal entry to record the company’s payroll f

> 1. Why should managers check the amount spent for overtime? 2. The new controller for CAR Company, a manufacturing firm, has suggested to management that the business change from paying the factory employees in cash to paying them by check. What reasons

> Data about the marital status, withholding allowances, and weekly salaries of the four office workers at Ollie’s Office Supply Company follow. Use the tax tables in Figure 10.2 to find the amount of federal income tax to be deducted fro

> Using the earnings data given in Exercise 10.3, determine the amount of Medicare tax to be withheld from each employee’s gross pay for December. Assume a 1.45 percent Medicare tax rate and that all salaries and wages are subject to the tax.

> During one week, four production employees of Morgan Manufacturing Company worked the hours shown below. All these employees receive overtime pay at one and one-half times their regular hourly rate for any hours worked beyond 40 in a week. Determine the

> The hourly rates of four employees of European Enterprises follow, along with the hours that these employees worked during one week. Determine the gross earnings of each employee.

> After returning from a three-day business trip, the accountant for Southeast Sales, Johanna Estrada, checked bank activity in the company’s checking account online. The activity for the last three days follows. After matching these tran

> Flores Company received a bank statement showing a balance of $13,000 on November 30, 20X1. During the bank reconciliation process, Flores Company’s accountant noted the following bank errors: 1. A check for $153 issued by Flora, Inc., was mistakenly cha

> Venturi Office Supplies received a bank statement showing a balance of $73,047 as of March 31, 20X1. The firm’s records showed a book balance of $72,987 on March 31. The difference between the two balances was caused by the following items. Prepare a ban

> At Pleasonton Delivery and Courier Service, the following items were found to cause a difference between the bank statement and the firm’s records. Indicate whether each item will affect the bank balance or the book balance when the bank reconciliation s