Question: 16. Which of the following is correct? (

16. Which of the following is correct?

(a) Contribution = sales − variable costs

(b) Contribution = gross margin − fixed costs

(c) Gross margin = sales − variable costs

(c) Gross margin = contribution − variable costs

17. Danzig plc sells a product for which data are given below:

Selling price per unit = 10

Variable cost per unit = 6

Fixed cost per unit = 2

The fixed costs are based on a budgeted level of activity of 5,000 units for the period.

What is the break-even point in units?

(a) 2,500

(b) 5,000

(c) 25,000

(d) 50,000

18. Danzig plc sells a product for which data are given below:

Selling price per unit = 10

Variable cost per unit = 6

Fixed cost per unit = 2

The fixed costs are based on a budgeted level of activity of 5,000 units for the period.

How many units must be sold if Danzig wishes to earn a profit of £6,000 for the period?

(a) 2,000

(b) 4,000

(c) 6,000

(d) 8,000

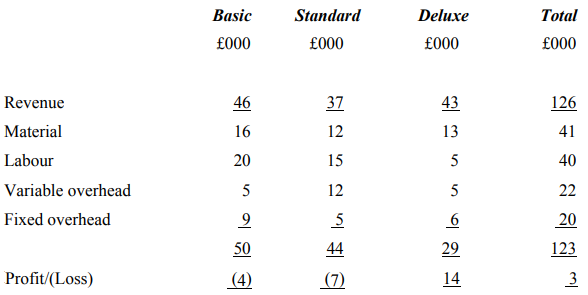

19. Arbroath Glass Products Limited manufactures three ranges of high-quality paperweights – Basic, Standard and Deluxe. Its accountant has prepared a draft budget for Year 7:

Fixed overheads are allocated to each product line on the basis of direct labour hours.

The directors are concerned about the viability of the company and are currently considering the cessation of both Basic and Standard ranges since both are apparently losing money.

If the directors close down only the manufacture of Basic paperweights, what is the effect on total profit?

(a) Profit increases by £4,000

(b) Profit decreases by £5,000

(c) Profit increases by £9,000

(d) Profit increases by £13,000

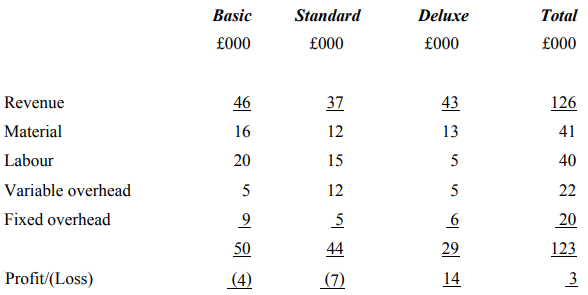

20. Arbroath Glass Products Limited manufactures three ranges of high-quality paperweights – Basic, Standard and Deluxe. Its accountant has prepared a draft budget for Year 7:

Fixed overheads are allocated to each product line on the basis of direct labour hours.

The directors are concerned about the viability of the company and are currently considering the cessation of both Basic and Standard ranges since both are apparently losing money.

If the directors close down only the manufacture of Standard paperweights, what is the effect on total profit?

(a) Profit increases by £2,000

(b) Profit decreases by £5,000

(c) Profit increases by £7,000

(d) Profit increases by £12,000

21. Which of the following is the best description of the break-even point?

(a) The level of activity at which variable cost per unit is minimised.

(b) The level of activity at which fixed costs are lowest.

(c) The level of activity at which the business makes neither a profit nor a loss.

(d) The level of activity at which the business operates most economically.

22. When a business is faced with a limiting factor (i.e. one which limits the activity of an entity) and there is a choice to be made between options to follow, which of the following statements describes the optimal course of action?

(a) Choose the option which gives the highest contribution per unit of limiting factor.

(b) Aim to achieve a balance of activities covering all of the options.

(c) Choose the option which gives the highest unit contribution.

(d) Choose the option which gives the highest unit profit.

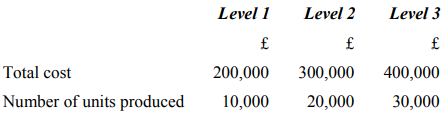

23. LMN Ltd has the following alternative planned activity levels:

The fixed overhead remains constant over the activity range shown. What is the fixed overhead cost?

(a) £400,000

(b) £300,000

(c) £200,000

(d) £100,000

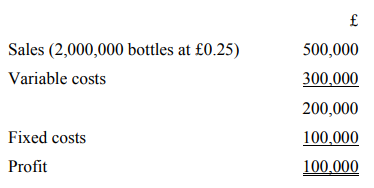

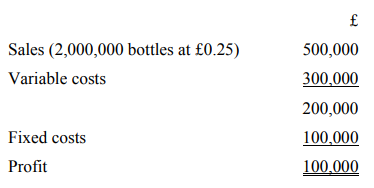

24. The Carbon Ink Company’s profit statement for the preceding year is presented below. Except as noted, the cost and sales relationship for the coming year is expected to follow the same pattern as in the preceding year. Sales and production are always equal.

What is the break-even point in units?

(a) 250,000 units

(b) 500,000 units

(c) 750,000 units

(d) 1,000,000 units

25. The Carbon Ink Company’s profit statement for the preceding year is presented below. Except as noted, the cost and sales relationship for the coming year is expected to follow the same pattern as in the preceding year. Sales and production are always equal.

An extension to the factory will add £50,000 to the fixed costs. How many bottles would have to be sold after the extension to break even?

(a) 1,000,000 units

(b) 1,250,000 units

(c) 1,500,000 units

(d) 1,750,000 units

26. If the factory produces 3,200,000 units after the extension and fixed costs become £150,000, what profit will be earned?

(a) £150,000

(b) £160,000

(c) £170,000

(d) £180,000

> A vehicle costing £20m and having accumulated depreciation of £12m was sold for £5m. How will this information be reported in the statement of cash flows?

> Calculate ratios for Ed’s Enterprises and evaluate by comparison with the ratios calculated for Andrew Hunt plc.

> Calculate ratios for Andrew Hunt plc and evaluate by comparison with the industry average. Dividend proposed for the year is £150,000 or 10 pence per share. Industry average ratios Price /earnings: 15 Dividend yield: 4.3% Return on shareho

> The following financial statements relate to Charity plc: Required (a) Calculate ratios which measure: (i) liquidity and the use of working capital; (ii) management performance; and (iii) gearing. (b) Explain how each ratio would help in understanding th

> Suppose the block of offices was to be valued by a professional expert at £640,000. What effect would this information have on the reported financial statements?

> City Centre plc has owned a block of offices for many years. The building is recorded in the statement of financial position (balance sheet) at £750,000, the historical cost being £900,000 less accumulated depreciation of £150,000. The recent report of a

> Prepare a statement of financial position (balance sheet) from the following list of assets and liabilities using the accounting equation to deduce the ownership interest as the missing item.

> The following is a summarized statement of financial position (balance sheet) of West plc: The company is considering three possible changes to its capital structure: (a) Issue for cash 80 million additional ordinary shares of nominal value, 50 pence ea

> Home Bakeries Ltd receives a training grant to cover staff training costs that will be incurred evenly over the next 2 years. Explain the accounting treatment.

> Peter (Television) Ltd gives a 2-year labour and parts warranty on all television sets that it sells. The company has the following revenue for its first 2 years of trading: Based on the level of faults normal in the industry, managers make a provision o

> Metals Ltd has begun to employ an office-cleaning company on 1 January. The charge for 4 months’ worth of cleaning services is £1,200. The office-cleaning firm sends an invoice every 4 months, on 30 April, 31 August and 31 December. Metals Ltd always pay

> Black Ltd commenced trading on 1 September Year 3 and is preparing its accounts for the year ended 31 August Year 4. During its first year of trading, the company pays total telephone company invoices of £4,300. The 3-month invoice paid in July Year 4 in

> The Table Company continues trading during Year 4. The customers who were doubtful at the end of Year 3 respond to enquiries and pay the amounts due. No adjustment is made to the provision for doubtful debts at that point. At the end of Year 4, the state

> At the end of Year 3, the Table Company has a statement of financial position (balance sheet) comprising £4,000 receivables (debtors), £9,000 other assets and £13,000 ownership interest, consisting of £5,000 ownership interest at the start of the period

> A company has an inventory (stock of goods) consisting of four different groups of items. The cost and net realizable value of each group is shown in the table below. Required: Calculate the amount to be shown as the value of the companyâ€

> During its first month of operations, a business made purchases and sales as shown in the table below: All sales were made at £4 each. Required: Calculate the profit for the month and the inventory (stock) value held at the end of the mont

> Suitcases Ltd is a small company manufacturing holiday luggage. A list of balances extracted at 31 December Year 2 showed the following information: Further investigation revealed the following matters requiring action: 1. No depreciation has been charg

> (a) Prepare a spreadsheet containing a trial balance, adjustment and resulting figures for income statement (profit and loss account) and statement of financial position (balance sheet) items. (b) Present the income statement (profit and loss account) fo

> Cheesecake Ltd is a small company selling ready-to-eat cakes. A list of balances extracted at 31 December Year 2 showed the following information: Further investigation revealed the following matters requiring action: 1. No depreciation has been charged

> Keyboards Ltd is a small company manufacturing electronic musical instruments. A list of balances extracted at 31 December Year 2 showed the following information: Further investigation revealed the following matters requiring action: 1. No depreciation

> Prepare ledger accounts to report the transactions and events of questions C8.1 and C8.2. Data from C8.1: The Biscuit Manufacturing Company commenced business on 1 January Year 1 with capital of £22,000 contributed by the owner. It immediately paid cash

> Prepare ledger accounts for the transactions of Peter Gold, furniture supplier, listed in question B6.2. Data from Question B6.2: The following list of transactions relates to the business of Peter Gold, furniture supplier, during the month of April. An

> Which of the following errors would be detected at the point of listing a trial balance? (a) The bookkeeper enters a cash sale as a debit of £49 in the cash book and as a credit of £94 in the sales account. (b) The bookkeeper omits a cash sale of £23 fro

> Prepare ledger accounts for the transactions of Jane Gate’s dental practice.

> Prepare bookkeeping records for the information in question B11.2. Data from Question B11.2: General Engineering Ltd receives a government grant for £60,000 towards employee training costs to be incurred evenly over the next three years. Explain how thi

> On 1 December Year 1 a company paid £2,400 as an insurance premium to give accident cover for the 12 months ahead. The accounting year-end is 31 December. Required Prepare an accounting equation spreadsheet to show the effect of the prepayment in the yea

> On 1 January Year 1, Angela’s Employment Agency was formed. The owner contributed £300,000 in cash which was immediately used to purchase a building. It is estimated to have a 20-year life and a residual value of £200,000. During Year 1 the agency collec

> Prepare bookkeeping records for the information in question B11.1. Data from Question B11.1: The Washing Machine Repair Company gives a warranty of no-cost rectification of unsatisfactory repairs. It has revenue from repair contracts recorded as: Based

> Prepare bookkeeping records for the information in question C10.1. Data from Question C10.1: The following file of papers was found in a cupboard of the general office of Green Ltd at the end of the accounting year. Explain how each would be treated in

> Prepare bookkeeping records for the information in question B10.3. Data from Question B10.1: The accountant of Brown Ltd has calculated that the company should report in its profit and loss account a tax charge of £8,000 based on the taxable profit of t

> Prepare bookkeeping records for the information in question B10.2. Data from Question B10.1: Plastics Ltd pays rent for a warehouse used for storage. The quarterly charge for security guard services is £800. The security firm sends an invoice on 31 Marc

> Prepare bookkeeping records for the information in question B10.1. Data from Question B10.1: White Ltd commenced trading on 1 July Year 3 and draws up its accounts for the year ended 30 June Year 4. During its first year of trading the company pays tota

> Record the transactions of question B9.5 in ledger accounts for L6 Expense of insurance and L7 Prepayment. Data from Question B9.5: On 1 December Year 1 a company paid £2,400 as an insurance premium to give accident cover for the 12 months ahead. The ac

> Record the transactions of question B9.4 in ledger accounts for L1 Receivables (debtors), L2 Provision for doubtful debts, L3 Cash and L4 Profit and loss account. Data from Question B9.4: The Bed Company continues trading during Year 4. The statement of

> Record the transactions of question B9.3 in ledger accounts for L1 Receivables (debtors), L2 Provision for doubtful debts, L3 Cash and L4 Profit and loss account. Data from Question B9.3: At the end of Year 3 the Bed Company has a statement of financial

> 7. Which of the following entities is required to apply the accounting requirements of the Companies Act? (a) Partnership (b) Sole trader (c) Limited company (d) A museum owned by a local government authority 8. Consider the following comments regar

> 8. Which of the following is equal to ownership interest if it is assumed that there are no long-term liabilities? (a) Current Cassets + current liabilities (b) Non-current (fixed) assets + current assets (c) Non-current (fixed) assets + current liabi

> The Bed Company continues trading during Year 4. The statement of financial position (balance sheet) at the end of Year 4, in its first draft, showed receivables (debtors) as £4,850 and the provision for doubtful debts unchanged from Year 3 at £450. Enqu

> 23. Which of the following is a correct statement of the accounting equation? (a) Assets plus liabilities equals ownership interest. (b) Assets minus liabilities equals ownership interest. (c) Assets equals liabilities minus ownership interest. (d) A

> 19. Which of the following statements about users of accounting information is correct? (i) Most of the investment in shares through the Stock Exchange in the United Kingdom is carried out by individual investors. (ii) Lenders are primarily interested

> 9. Which of the following entities has an ownership interest that is divided into individual shares and profits, distributed to owners by means of the payment of dividends? (a) A school in state ownership (b) A partnership (c) A limited company (d) A

> 21. Three general types of capital budgeting models are: (a) Net present value declining balance and accounting rate of return (b) Payback, internal rate of return and units of production (c) Accounting rate of return, discounted cash flow and units o

> 19. Which of the following is the best definition of feedforward control? (a) Feedforward control means that managers are asked to put forward their plans for controlling the activity of their departments. (b) Feedforward control means making predictio

> 24. Calculation of direct labour variances shows a favourable labour rate variance of £5,000 and an adverse labour efficiency variance of £100. Which of the following sentences is the best interpretation of this result? (a) The

> 14. Durham Prints Ltd manufactures a single product that has the following standard cost specifications (per unit). During June, the following actual data have been recorded in the production of 2,000 units: Direct materials: 21,000 square metres at &Ac

> 19. Which of the following is not an essential feature of a budget? (a) There is a clearly defined budget period. (b) It is a combination of financial and non-financial data set with reference to key budget assumptions. (c) It permits managers flexibi

> 37. If the factory produces 3,200,000 boxes of USBs after the extension and fixed costs become £7m in total, what profit will be earned? (a) £2m (b) £3.2m (c) £5.8m (d) £12.8m 38. Scal

> 27. A business division manufacturing table lamps plans for sales of 1,000 lamps at a selling price of £12 each. The variable cost is £8 per lamp. Fixed costs for the reporting period are £2,800. Which of the follow

> At the end of Year 3 the Bed Company has a statement of financial position (balance sheet) comprising £3,000 receivables (debtors), £8,000 other assets and £11,000 ownership interest, consisting of £2,000 ownership interest at the start of the period and

> 26. Selling price per unit is £12. Variable cost per unit is £10. Fixed costs of the period are £800. Using absorption costing, the profit of period 2 is: (a) 2,940 (b) 1,460 (c) 1,260 (d) 1,180 27. Selling p

> 16. Which of the following items will appear in a job cost record? (a) A budget plan for the job (b) An organisation chart for the job (c) Cost of direct materials for the job (d) A working capital plan for the job 17. Which of the following defines

> 29. Which of the following types of cost would not form part of the prime cost of a product? (a) The factory overhead costs (b) The direct labour costs (c) The direct expense costs (d) The direct material costs 30. For Week 1, the budgeted labour ho

> 19. In most companies, direct labour is treated as: (a) product cost (b) period cost (c) fixed cost (d) sunk cost 20. Which of the following is a direct labour cost? (a) The wages of an operative paid on the basis of output achieved (b) A bonus pa

> 13. Which of the following describes a fixed cost? (a) Any overhead cost that is incurred in the factory of a manufacturing company (b) Any selling, general or administrative cost incurred in a manufacturing company (c) A total cost that remains const

> 11. Which of the following indicates an outward focus of management accounting? (a) Management accounting focuses on the business entity alone. (b) Management accounting directs attention to effective linkages that will improve competitive positions.

> 31. The reported net profit of a company for the year is £20m after charging depreciation of £5m. During the year, there was an increase of £6m in stocks. Trade debtors and trade creditors remained constant. What is the net cash inflow from operating act

> 20. Which of the following is the best explanation of why depreciation is added back to operating profit while calculating the cash flow from operations? (a) Depreciation is a subjective amount in the profit calculation, and so must be taken out to leav

> 28. Which of the following is a correct statement about the strategic report? (a) A forward-looking aspect is not permitted. (b) A forward-looking aspect is encouraged. (c) The content of the strategic report is prescribed by an international financia

> On 1 September Year 1, a company paid £1,800 as an insurance premium to give accident cover for the 12 months ahead. The accounting year-end is 31 December. Required: Prepare an accounting equation spreadsheet to show the effect of the prepayment in th

> 9. Which of the following is the most accurate definition of return on shareholders’ equity? (a) Profit after tax as a percentage of share capital (b) Profit after tax as a percentage of share capital and reserves (c) Sales (revenue)

> 13. Which of the following items is/are likely to be found in a company’s statement of changes in equity? (i) Dividends paid (ii) Surplus on revaluation of non-current (fixed) assets (iii) Premium on the issue of shares Is it (a) (

> 10. Which of the following will not normally be found under the heading ‘Liabilities due after 1 year’? (a) Deferred taxation (b) Unsecured loan (c) Bank overdraft (d) Provision for reorganization costs 11. Which of the following most accurately des

> 12. Which of the following is/are normally treated as a contingent liability? (i) The corporation tax liability for the reporting period (ii) Claim for damages by a customer, where the reporting company believes the customer will be unsuccessful (iii)

> 24. On 1 April Year 1, a company paid £2,800 in advance for 1 year’s fire insurance. On the financial statement date of 31 December, what is the correct accounting treatment for this information? (a) Insurance expense of £700: current liability of £2,10

> 14. Which of the following would be included in a statement of financial position (balance sheet) under the heading ‘inventory’ (‘stock’)? (i) Raw materials (ii) Bank deposits (ii

> 28. The following is a list of non-current (fixed) assets: (i) Plant and equipment (ii) Patents (iii) Shares in subsidiary companies (iv) Trade marks Which of the above are classed as intangible assets? (a) (i) and (ii) (b) (ii) and (iii) (c) (ii

> 18. JK Builders Co purchases a new excavator costing £40,000. Its expected useful life is 10 years, at which point it is anticipated that the excavator will have a residual value of £6,000. If the straight-line method of depreciation is used, what is the

> 20. Which of the following is the best description of convergence of accounting in Europe? (a) From 2005, all accounting standards in the European Union are prepared by the European Commission. (b) From 2005, all listed companies in the European Union

> 16. A manufacturing company has carried out the following business transactions: • 500 kg of raw materials has been purchased for cash at a price of £3 per kg. • 300 kg of the raw materials has been put into production process. • 1 kg of raw material

> On 1 January Year 1, Company A purchased a bus costing £70,000. It was estimated to have a useful life of three years and a residual value of £4,000. It was sold for £8,000 on the last day of Year 3. On 1 January Year 1, Company B purchased a bus also co

> 6. Which of the following reflects the effect of the delivery of finished goods to customers on the accounting equation? (a) Assets decrease: ownership interest decreases (b) Assets decrease: ownership interest increases (c) Assets increase: ownership

> 6. Which of the following reflects the effects of a payment to creditors on the accounting equation? (a) Assets decrease: ownership interest decreases. (b) Assets decrease: ownership interest increases. (c) Assets increase: liabilities decrease. (d)

> 17. Which of the following statement is/are correct? (a) All pages of the annual report of a typical public company are heavily regulated by the company law. (b) The auditors are responsible for preparing a company’s annual financial statements. (c) T

> J Sainsbury plc: annual report of a service business We want to be a place where people love to work and shop. That means harnessing the talent, creativity and diversity of our colleagues to ensure that customers receive great service every time they sho

> Scope and quality of audits needs reform, say City chiefs Auditors have had their “heads in the sand” and must provide a far more rounded view of companies’ health than the current statutory “truth and fairness” opinions if they are to win back public tr

> Whitbread plc: main points from financial statements Extracts from the Annual Report Whitbread is the UK’s leading hospitality company We have built two of the UK’s most successful hospitality brands, Premier Inn and C

> The Financial Reporting Council (FRC) in the UK has set out an accounting standard for micro entities, which are the very smallest companies. Typically they have fewer than 10 employees. One permitted outline for a statement of financial position (balanc

> Oxfam Great Britain’s purpose is to help create lasting solutions to the injustice of poverty. As stated in its Memorandum of Association, the objects for which Oxfam is established for the public benefit are: • to prevent and relieve poverty and to prot

> Associated British Foods is a diversified international food, ingredients and retail group with sales of £13.4 billion, 130,000 employees and operations in 50 countries across Europe, southern Africa, the Americas, Asia and Australia. Business strategies

> The Bristol Port Company was formed in 1991 when entrepreneurs Terence Mordaunt and David Ord purchased the Port of Bristol from Bristol City Council. Since privatisation over £475 million has been invested to create a modern, thriving business offering

> Explain how the accounting equation spreadsheet of your answer to question B8.4 would alter if the building had been sold for £250,000. Data from Question B8.4: Angela’s Employment Agency sells the building for £285,000 on the final day of December Year

> More than half a million students have lived with us during our 25-year history and we continue to grow. In 2016, we opened five new properties which means we have the privilege of housing our largest ever number of students, 49,000. As the UKâ

> At our core, we are a successful branded soft drinks business, building a diverse and differentiated portfolio of great tasting brands that people love. We make it our business to understand what our consumers want. Whether it’s our iconic IRN-BRU, launc

> The case study shows a typical announcement of budget plans where management accounting is helpful but must be read in conjunction with short-term requirements and longer term strategic plans. Read the case now but only attempt the discussion points afte

> Plymouth-based super yacht company Princess Yachts has almost doubled its order book this year as it embarks on a £100m investment program. The company said that orders following the Cannes Yachting Festival reached a record £640m – 85pc higher than at t

> How much should I charge for my cakes? I have read that a good way to price cakes is to charge for the cost of ingredients times 2 (or 3). We firmly believe that the ‘ingredients times 2 or 3’ method of pricing is arbitrary and not rooted in any kind of

> Whirlpool said Monday it swung to a profit in the fourth quarter driven by higher prices and sales in North America, though the appliance maker’s 2019 outlook disappointed investors. Stronger prices for its products and fixed cost reduction boosted Whirl

> The purpose as ever of this annual road haulage cost movement report is to assist members and their customers to understand trends in the industry. It reflects cost movements, reasons for changes, and makes predictions. Every firm has different costs and

> Chartered Institute of Management Accounting (CIMA) What is management accounting? Management accounting is the sourcing, analysis, communication and use of decision-relevant financial and non-financial information to generate and preserve value for orga

> Unless it can reduce inventory and working capital, dividends may be at risk Everyone likes a bargain, particularly investors. Hennes & Mauritz, Sweden’s purveyor of Scandi fashions worldwide, offers value on the high street. Unfortunately, fears of “pea

> Our business model is designed to generate long-term sustainable value. We focus on mission-critical and highly engineered equipment with intensive aftermarket care and comprehensive global support. This model creates positive outcomes for our customers

> Angela’s Employment Agency sells the building for £285,000 on the final day of December Year 3. Record the transactions and events of Year 3 in an accounting equation spreadsheet. Assume depreciation is calculated in full for Year 3.

> The following extracts show the different ways in which three companies report their operating profit margins (operating profit as a percentage of sales). This ratio is an indicator of the performance of the business, or segments of the business. It prov

> Thames Water is one of ten regional licensed and regulated companies providing water and wastewater services in England and Wales. With 15 million customers we serve about 25% of the population of England and Wales. Dividends The Companyâ€

> We are a global energy company with wide reach across the world’s energy system. We have operations in Europe, North and South America, Australasia, Asia and Africa. Decommissioning Liabilities for decommissioning costs are recognized when the group has

> We use our cost advantage and number one and number two network positions in strong markets to deliver low fares and operational efficiency on point-to-point routes, with our people making the difference by offering friendly service for our customers. S

> Ocado Group plc: reporting inventory Established in 2000 and listed on the London Stock Exchange in July 2010, Ocado is the world’s largest dedicated online grocery retailer, with over 580,000 active customers. Our objective is to provi

> Investment by UK companies has fallen for three consecutive quarters, in a decline that highlights how uncertainty about Brexit is prompting consumers and businesses to tighten their belts. Business investment was 2.2 per cent lower in the third quarter

> Domino’s Pizza International Franchising Inc. (‘DPIF’) is the owner of the Domino’s brand across the globe. We have two Master Franchise Agreements in place with DPIF, which gives us exclusive rights to the markets in the UK, the Republic of Ireland, Swi

> Mulberry is a vertically integrated luxury brand which was founded in 1971 in Somerset. The Group designs, develops, manufactures, markets and sells products under the Mulberry brand name. The Group has over 1,400 employees (full time equivalents), the m