Question: 2.1. In Figure 22.5, suppose

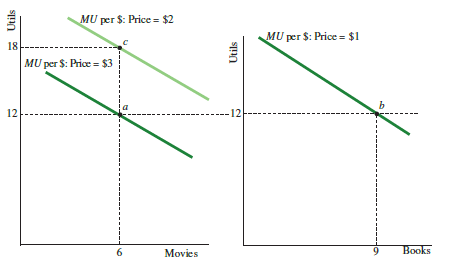

2.1. In Figure 22.5, suppose the price of movies increases from $3 to $6. The increase in price shifts the benefit curve (marginal utility per dollar) for movies (upward/downward). For the initial quantity of six movies, the marginal utility per dollar becomes utils, which is (greater/ less) than the marginal utility per dollar of books.

Figure 22.5:

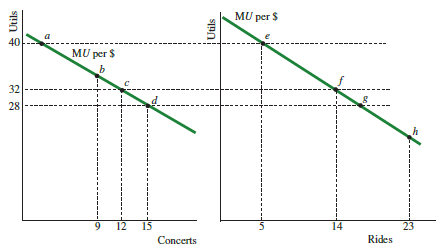

2.2. Suppose a consumer has a budget of $100 to spend on concerts (price = $6) and carnival rides (price = $2). For each of the following pairs of points in the figure below, indicate whether the pair (i) satisfies the budget constraint, (ii) satisfies the equimarginal rule, or (iii) is the best affordable bundle.

a. Points a and e.

b. Points b and h.

c. Points c and f.

d. Points d and g.

e. Points d and e.

2.3. A change in the quantity consumed that is caused by a change in the relative price of a good, holding real income constant, refers to the .

2.4. Arrow up or down: The substitution effect is that a decrease in the price of movies the relative price of movies and the consumption of movies.

2.5. To show the substitution effect of a decrease in price, we (increase/decrease) a consumer’s nominal income so the consumer can just afford .

2.6. Suppose Maxine initially watches six movies at a price of $3 each and buys nine books at a price of $1 each, and then the price of movies increases to $5. To make Maxine’s original bundle just affordable, her income must (increase/decrease) by . Her utility-maximizing consumption of movies will (increase/decrease) because at the original bundle, is now less than .

2.7. Claudia spends her income on two goods, DVD rentals and chewing gum. She considers both goods to be normal goods. If Claudia’s income increases and the prices of the two goods remain constant, she will rent (more/less) DVDs and purchase (more/less) chewing gum.

2.8. Response to the Gas Tax. Petrov initially pays $2,200 in income taxes and consumes 600 gallons of gasoline per year at a price of $3 per gallon. The price of the other good is $1. For Petrov’s initial product bundle, the marginal utility of gas is 30 utils and the marginal utility of the other good is 10 utils.

a. For his initial bundle, the marginal utility per dollar on gasoline is utils.

b. Suppose the government imposes a new gasoline tax that increases the price of gas to $5. To make his initial consumer bundle just affordable, Petrov’s income must (increase/decrease) by .

c. Suppose the government cuts Petrov’s income tax by the amount computed in (b). Given the new gas tax and the income tax cut, at his initial bundle, the marginal utility per dollar of gasoline is utils, compared to for the other good. To satisfy the marginal principle, Petrov will (increase/decrease) his gasoline consumption.

2.9. Shipping the Good Apples Out? Suppose apples come in two quality levels, low and high. At a store in the apple-growing region, the price of low-quality apples is $1 per pound, and the price of high-quality apples is $4 per pound. Johnny lives in the apple-growing region and buys 8 pounds of each type. His marginal utility of apples is 3 utils for low-quality apples and 12 utils for high-quality apples.

a. Is Johnny maximizing his utility?

b. Suppose Johnny moves to an area outside the apple growing region. Shipping the apples to his new area adds $2 to the price of a pound of apples, for both low-quality and high-quality apples. To simplify matters, assume Johnny’s income increases by an amount large enough to fully offset the higher prices of apples. In other words, he can still afford the original bundle of 8 pounds of each type of apples. If he continues to buy 8 pounds of apples of each type, is he maximizing his utility? If not, how should he change his mix of high- and low-quality apples?

c. What are the implications for the mix of high-quality and low-quality apples in apple-growing areas and other regions?

Transcribed Image Text:

MU per $: Price = $2 MU per $: Price = $1 18 MU per $: Price = $3 b 12 ---12 6 Movies 9. Books o Utils Utils MU per $ 40 MU per $ 32 28 12 15 14 23 Concerts Rides lo Utils

> Leiker Corporation has these accounts at December 31: Common Stock, $10 par, 5,000 shares issued, $50,000; Paid-in Capital in Excess of Par Value $22,000; Retained Earnings $42,000; and Treasury Stock, 500 shares, $11,000. Prepare the stockholders’ equit

> Goins Corporation issued a $50,000, 10%, 10-year installment note payable on January 1, 2014. Payments of $8,137 are made each January 1, beginning January 1, 2015. Instructions: (a) What amounts should be reported under current liabilities related to t

> Nance Co. receives $280,000 when it issues a $280,000, 6%, mortgage note payable to finance the construction of a building at December 31, 2014. The terms provide for semiannual installment payments of $14,285 on June 30 and December 31. Instructions: P

> Gomez Company issued $380,000, 7%, 10-year bonds on January 1, 2014, for $407,968. This price resulted in an effective-interest rate of 6% on the bonds. Interest is payable annually on January 1. Gomez uses the effective-interest method to amortize bond

> Cole Corporation issued $400,000, 7%, 20-year bonds on January 1, 2014, for $360,727. This price resulted in an effective-interest rate of 8% on the bonds. Interest is payable annually on January 1. Cole uses the effective-interest method to amortize bon

> Canyon Company issued $600,000, 10-year, 6% bonds at 103. Instructions: (a) Prepare the journal entry to record the sale of these bonds on January 1, 2014. (b) Suppose the remaining Premium on Bonds Payable was $10,800 on December 31, 2017. Show the bal

> Prophet Company issued $500,000, 6%, 30-year bonds on January 1, 2014, at 103. Interest is payable annually on January 1. Prophet uses straight-line amortization for bond premium or discount. Instructions: Prepare the journal entries to record the follo

> Suppose 3M Company reported the following financial data for 2014 and 2013 (in millions). Instructions: (a) Calculate the current ratio for Sedgewick Boutique for 2014 and 2013. (b) Suppose that at the end of 2014, Sedgewick Boutique used $1.5 million

> Suppose McDonald’s 2014 financial statements contain the following selected data (in millions). Instructions: (a) Compute the following values and provide a brief interpretation of each. (1) Working capital. (2) Current ratio. (3) D

> Santana, Inc. reports the following liabilities (in thousands) on its January 31, 2014, balance sheet and notes to the financial statements. Instructions: (a) Identify which of the above liabilities are likely current and which are likely long-term. Li

> The situations presented here are independent of each other. Instructions: For each situation, prepare the appropriate journal entry for the redemption of the bonds. (a) Pelfer Corporation redeemed $140,000 face value, 9% bonds on April 30, 2014, at 101

> Mike Haden, president of Haden Corporation, believes that it is a good practice for a company to maintain a constant payout of dividends relative to its earnings. Last year, net income was $600,000, and the corporation paid $120,000 in dividends. This ye

> Explain how IFRS defines a provision and give an example.

> 5.1. A pollution tax on automobiles provides an incentive to buy , maintain , drive , and use alternative . 5.2. Arrows up or down: A gasoline tax will shift the supply curve for gasoline , causing the equ

> 3.1. Consider a market with two firms managed by Harry and Vera. Under a cartel (both firms pick the high price), each firm earns a profit of $80. Under a duopoly (both firms pick the low price), each firm earns a profit of $60. If the two firms pick dif

> 6.1. The short-run supply curve is steeper than the long-run supply curve because of the principle of . 6.2. Arrows up or down: Suppose the demand for shirts increases. In the short run, the price by a relatively large amount. As firms enter

> 2.1. The relationship between the quantity of output produced and the quantity of inputs used to produce it is called the __________. 2.2. Which of the following would be counted as part of the stock of capital? a. copy machines in a photocopying shop b.

> 2.1. A fire extinguisher is an example of a (n) good with a (n) benefit. 2.2. Education generates three types of external benefits: , , and . 2.3. The external benefit of transforming a high school

> 1.1. Suppose 2,000 people would each get a benefit of $60 from a bridge. Building the bridge is socially efficient if its cost is less than $ . If the cost is $80,000, a tax of $ per person would generate unanimous support for the bridge. 1

> 5.1. The reservation price is the price at which the consumer is about additional search, meaning that the of search equals the . 5.2. If a consumer knows that TVs are available at BestBuy at a price as low as $200,

> 2.1. Consider a thin used-car market. Someone just developed a device that can instantly identify the nearest plum in a used-car lot. The device works only once. The maximum amount that a consumer would be willing to pay for the device equals

> 4.1. In the market for insurance, the moral-hazard problem is that encourages . 4.2. While shopping for office equipment, an office manager sees a display of fire extinguishers. After making a single phone call, the manager decides not to buy

> 3.1. Suppose the average annual penalty is $10,000 for reckless drivers and $1,000 for careful drivers. If half of an insurance company’s insured drivers are reckless, the company will earn zero economic profit if the price of insurance is $ .

> 1.1. There is asymmetric information in the used-car market because (buyers/sellers) cannot distinguish between lemons and plums but (buyers/sellers) can. 1.2. The supply curve for high-quality used cars lies (above

> 1.1. Arrows up or down: At a natural monopolist’s current level of output, marginal cost exceeds marginal revenue. The firm should its output and its price. 1.2. The entry of a second firm shifts the demand curve of

> 2.1. The purpose of antitrust policy is to promote , which leads to lower . 2.2. There are three types of antitrust policies: (1) , (2) , and (3) . 2.3. In the Staples case discussed in this chapt

> 4.1. Otto has a monopoly on limousine service, and Carla is thinking about entering the market. The outcome of the entry-deterrence game represented by the game tree on the following page is that Otto picks the quantity and Carla the

> 3.1. Robert Solow added ____________ to the conventional production function to account for technological change. 3.2. ____________ is a method used to determine the contribution to economic growth from increased capital, labor, and technological progre

> 5.1. The advertisers’ dilemma is that both firms would be better if advertises, but each has an incentive to . 5.2. The advertisers’ dilemma shown in Figure 27.10 on page 618 occurs when advertisi

> 2.1. For firms with a low-price guarantee, the promise of matching a lower price is a(n) promise because all firms will charge the same price. 2.2. Suppose that Jack and Jill use a tit-for-tat scheme to encourage cartel pricing. Jill chooses

> 1.1. A market is considered “unconcentrated” if the Herfindahl– Hirschman Index (HHI) is below and is “highly” concentrated if the HHI is at least . 1.2.

> 3.1. The trade-off with entry is that an increase in the number of firms leads to higher but greater. 3.2. When products are differentiated by location, the entry of firms generates benefits for consumers in the form of. 3.3. A perfectly competitive fir

> 1.1. Monopolistic competition describes a market served by firms that sell products. 1.2. Arrows up or down: At a firm’s current level of output, marginal revenue exceeds the marginal cost. The firm should its output and its price. 1.3. The marginal pr

> 2.1. Monopolistic competition refers to a market in which old boys act naturally as they transport tight slacks in the back of Dodge Ram pickup trucks. (True/False) 2.2. Perfectly competitive firms sell a product, while monopolistically competitive firm

> 4.1. Advertising for eyeglasses (increases/ decreases) the price of eyeglasses because advertising promotes . 4.2. An advertisement that succeeds in getting consumers to try the product will be sensible only if the number of

> 2.1. A monopoly is inefficient solely because the monopolist gets a profit at the expense of consumers. (True/False) 2.2. To show the deadweight loss from monopoly, we compare the monopoly outcome to what would happen under .

> 1.1. For a monopolist, marginal revenue is (greater/less) than price. 1.2. A monopoly that cuts its price gains revenue from its customers but loses revenue from its customers. 1.3. At a price of $18 per CD, a firm sells 60 CDs. If the slope of the dem

> 4.1. A price-discriminating firm will charge a higher price to consumers with a relatively (elastic/ inelastic) demand and a lower price to consumers with a relatively (elastic/inelastic) demand. 4.2. The aspirin sold in airports is more expensive than a

> 1.1. To gauge living standards across countries with populations of different sizes, economists use ____________. 1.2. In poor countries, the relative prices for nontraded goods (such as household services) to traded goods (such as jewelry) are ________

> 5.1. An increasing-cost industry is one in which the average cost of production as the total output of the industry . 5.2. Arrows up or down: Costs with output in an increasing-cost industry because input prices i

> 3.1. A firm will not shut down in the long run as long as its revenue is (larger/smaller) than the firm’s variable cost. 3.2. Your firm has a total revenue of $500, a total cost of $700, and a variable cost of $600. You

> 2.1. Economic profit equals minus . 2.2. Economic cost equals cost plus cost. 2.3. For a perfectly competitive firm, marginal revenue equals , and to maximize profit, the firm produces the quantity at

> 4.1. A firm’s short-run supply curve shows the relationship between on the horizontal axis and on the vertical axis. 4.2. The part of a firm’s marginal cost curve that is above the minim

> 3.1. The presence of explains the negatively sloped portion of a long-run average-cost curve, and the notion of explains the horizontal portion of the curve. 3.2. Consider the information provided in Figure 23.6. Suppose the output of a large aluminum f

> 1.1. The computation of economic cost is based on the principle of . 1.2. A firm’s implicit cost is defined as the cost of nonpurchased inputs, such as the entrepreneur’s and . 1.3. Economic profit equals minus . 1.4. Fill with “ec

> 4.1. The average cost of electricity (increases/ decreases) as the size of the wind turbine increases. 4.2. For information goods such as a music video distributed online, the cost of producing the first copy is very , but the marginal

> 2.1. The short-run marginal cost curve is shaped like the letter _________ and the short-run average cost curve is shaped like the letter _________. 2.2. The negatively sloped portion of the short-run marginal-cost curve is explained by _________ and th

> 1.1. Based on Figure 22.1, fill in the blanks in the following table to identify different points on the consumer’s budget line. Figure 22.1: 1.2. In Figure 22.1 (above), suppose the price of movies increases to $9. Draw a new budge

> 2.1. In an economy with no government sector or foreign sector, saving must equal investment because a. total demand is equal to consumption and investment. b. total income is equal to consumption and saving. c. total income is equal to total demand.

> 4.1. The introduction of cognition into a consumer’s choice between healthy and unhealthy food shifts the curve downward, causing the marginal utility per dollar of to be less than the marginal utility per dollar of . 4.2. C

> 5.1. The 1990 tax on yachts and other luxury goods was shifted forward to and backward to . 5.2. A tax paid in legal terms by producers will be partly shifted forward onto and partly shifted backward onto

> 2.1. You are willing to pay $3,000 to have your windows covered, and Tom’s marginal cost of covering windows is $2,500. If you agree to split the difference, the price is , your consumer surplus is , and Tom&a

> 4.1. In Figure 21.6, the taxi medallion policy prevents mutually beneficial transactions for consumers on the demand curve between points and and producers on the supply curve between points and . Figure 21.6: 4.2. In Figur

> 3.1. Arrow up or down: In Figure 21.5, rent control the quantity of apartments , producer surplus, consumer surplus , and the total market surplus . Figure 21.5: 3.2. In Figure 21.5 (

> 1.1. Consumer surplus equals minus . 1.2. Producer surplus equals minus . 1.3. In Figure 21.1, Tupak’s consumer surplus is , compared to for Thurl. Figure 21.1: 1.4. In Figure 2

> 2.1. Recall the example “Beer Prices and Highway Deaths” from the chapter. A doubling of the tax on beer will reduce the number of highway deaths among young adults by _________ percent. 2.2. Recall the example â

> 6.1. Assume that the elasticity of demand for chewing tobacco is 0.70 and the elasticity of supply is 2.30. Suppose an antichewing campaign decreases the demand for chewing tobacco by 18 percent. The equilibrium price of chewing tobacco will _________ (d

> 5.1. When the price of paper increases from $100 to $104 per ton, the quantity supplied increases from 200 to 220 tons per day. The price elasticity of supply is _________. 5.2. Suppose that in a month the price of movie rentals increases from $2 to $2.

> 5.1. Clear property rights reduce growth in an economy because producers are not able to freely use innovations. ____________ (True/False) 5.2. Which of the following events hinder economic growth? a. Uncertain financial environment b. Reduced savings

> 4.1. The income elasticity of demand is _________ (positive/ negative) for normal goods and _________ (positive/ negative) for inferior goods. 4.2. If a 20 percent increase in income increases the quantity of iPods demanded by 30 percent, the income ela

> 3.1. Demand is _________ on the upper portion of a linear demand curve and _________ on the lower portion of a linear demand curve. 3.2. If Maria spends a fixed dollar amount per week on movie rentals regardless of changes in the price, Maria’s demand f

> 3.1. Net transfers from abroad are a (n) entry on the current account. 3.2. The current, financial, and capital accounts must sum to . 3.3. The balance of payments is divided into three major accounts,

> 2.1. The best measure of the purchasing power of one currency relative to another is the . 2.2. When the U.S. and foreign price levels remain the same but the dollar appreciates, the real exchange rate will . 2.3. The

> 5.1. When prices rose in Mexico faster than in the United States and the nominal exchange rate remained constant, the real exchange rate . 5.2. If a country borrows in dollars, a depreciation of its own currency against the dollar

> 4.1. The government foreign currency for dollars if it wants to peg the exchange rate at a higher rate than would normally prevail in the market. 4.2. If there is an excess supply of a country’s currency at the fixed exchange rate, the

> 3.1. The _________ industry argument is often given to provide a rationale for tariffs for new firms. 3.2. Knowledge gained during production is known as _________ by doing. 3.3. If only one firm can exist in a market, a government may try to subsidize

> 5.1. Price discrimination occurs when a good is sold at _________ (higher/lower/similar/different) prices to different consumers. 5.2. Under global trade rules, the United States was allowed to ban Chinese bicycles because China violated U.S. dumping ru

> 2.1. If a country bans the importation of a particular good, the market equilibrium is shown by the intersection of the _________ curve and the _________ curve. 2.2. The equilibrium price under an import quota is _________ (above/below) the price that o

> 1.1. A country has a comparative advantage if it has a lower _________ cost of producing a good. 1.2. The terms of trade is the rate at which two goods can be _________ for one another. 1.3. Suppose a country has a comparative advantage in shirts but n

> 3.1. Labor market equilibrium occurs at a real wage at which the quantity demanded for labor equals the quantity __________ of labor. 3.2. The labor __________ (demand/supply) curve is based on the decisions of __________ (firms/workers); these decision

> 4.1. The latest trade round is called the _________ round. 4.2. The _________ was formed in 1995 to oversee GATT. 4.3. NAFTA took effect in _________ and was implemented over a _________ year period between _________, Mexico, and _________. 4.4. When

> 3.1. Suppose there is a consumption tax of 20 percent. You earn $1,150, have an income tax rate of 30 percent, and save $100 after tax. Your tax will be equal to . 3.2. A sales tax that is levied at all stages of production is known as a(n) tax. 3.3. M

> 1.1. If a government runs a deficit, it will its outstanding debt. 1.2. Proponents of Ricardian equivalence believe that deficits do not really matter as long as taxes are raised in the future. (True/F

> 2.1. In recent years, many developed countries have found that inflation targeting (increased/ decreased) the autonomy of their central banks, helping them fight inflation. 2.2. In , inflation targeting was adopted in 1992,

> 2.1. If actual inflation is higher than expected inflation, the actual unemployment rate will be _________ than the natural rate. 2.2. James Tobin explained business cycles with rational expectations. _________ (True/False) 2.3. The increase in the fra

> 1.1. The expected real rate of interest is the nominal interest rate plus the expected inflation rate. _________ (True/ False) 1.2. Countries with lower rates of money growth have _________ interest rates. 1.3. If the growth rate of money increases fro

> 4.1. The velocity of money is defined as _________ income divided by the supply of money. 4.2. According to the quantity equation, the product of money supply and velocity is equal to the product of _________ and _________. 4.3. The growth version of t

> 5.1. To eliminate a budget deficit, a government can _________ (increase/decrease) taxes and/or _________ (increase/decrease) spending. 5.2. During hyperinflations the velocity of money tends to _________ sharply. 5.3. Economists call inflation “hyperi

> 3.1. An aggressive union will shift the aggregate supply curve _________, causing prices to and real GDP to _________. 3.2. In the face of an upward shift in the aggregate supply curve, the Fed can increase the supply of money. This will prevent a reces

> 3.1. As the price level increases, the demand for money _________ and interest rates _________. 3.2. If output is above full employment, we expect wages and prices to rise, money demand to increase, and interest rates to fall. _________ (True/False) 3.

> 1.1. Economic models that assume that wages and prices adjust freely to changes in demand and supply are known as __________ models. 1.2. At full employment, there are only frictional and __________ unemployment. 1.3. According to classical economists, a

> 1.1. Wages and prices will fall when unemployment falls below its natural rate. _________ (True/False) 1.2. The short run in macroeconomics is the time period over which _________ do not adjust to economic conditions. 1.3. According to the logic of the

> 2.1. If output is less than potential output, prices _________ and the short-run aggregate supply curve shifts _________. 2.2. Output will automatically return to full employment in the long run if it deviates from full employment. _________ (True/False

> 1.1. We measure the opportunity cost of holding money with _________. 1.2. If interest rate decreases, investment spending _________ (increases/decreases) and money demand _________ (increases/decreases). 1.3. The principle of _________ suggests that t

> 5.1. _________ (Inside/Outside) lags would be longer for the European Central Bank. 5.2. Compared to fiscal policy, the outside lag for monetary policy is longer for monetary policy. _________ (True/ False) 5.3. Current and future short-term interest r

> 4.1. When the Federal Reserve buys bonds on the open market, it leads to _________ (increase/decreases) in the price of bonds. 4.2. To decrease the level of output, the Fed should conduct an open market _________ (sale/purchase) of bonds. 4.3. An open

> 2.1. To increase the supply of money, the Fed should _________ bonds. 2.2. An increase in price levels leads to _________ money demand. 2.3. Banks trade reserves with one another in the _________ market. 2.4. Banks borrow from the Fed at the _________

> 3.1. Interest rates typically rise in booms because the demand for money depends _________ on changes in real income. 3.2. If interest rates are 12 percent per year, the price of a bond that promises to pay $100 next year will be equal to _________. 3.

> 4.1. The Federal Reserve arranged for JPMorgan Chase & Co. to _________ Bear Stearns during the financial crisis in 2008. 4.2. The Federal Reserve helps finance the deficit of the U.S. government by _________ (creating/reducing) money. 4.3. A stress te

> 1.1. Money provides a convenient measuring rod when the _________ of all goods are expressed in _________ terms. 1.2. Gold is a good example of commodity money. _________ (True/False) 1.3. In the United States, currency held by the public constitutes a

> 2.1. Banks are required by law to keep a fraction of their deposits as _________. 2.2. When reserves do not pay interest, banks prefer to keep reserves rather than make loans. _________ (True/ False) 2.3. If the reserve ratio is 0.3 and a deposit of $50

> 5.1. On a graph of the labor market, show the effects of an increase in the payroll tax. 5.2. On a graph of the labor market, show the effects of a negative shock to technology on wages and employment. 5.3. Two examples of major technological innovatio

> 3.1. The Federal Reserve is the “_________ of last resort.” 3.2. The United States is divided into 12 districts, each of which has a Federal Reserve Bank. These banks do not participate in monetary policy decisions, but liaise between the Fed and other

> 3.1. If a project costs $100 and pays $105 in year 1 and $110 in year 2, the maximum interest rate at which the present value of investment exceeds its cost is _________. 3.2. As real interest rates rise, investment spending in the economy _________. 3

> 4.1. An illiquid financial asset is one that can easily be used to buy goods and services. _________ (True/False) 4.2. Creation of _________ following the Great Depression has greatly reduced the likelihood of runs on banks today. 4.3. Securitization r

> 2.1. If the interest rate is 25 percent, the present value of $500 paid 2 years from now equals _________. 2.2. If the interest rate is 10 percent, the present value of $300 paid 1 year from now equals _________. If the $300 is received in 5 years, the

> 1.1. Investment is a larger component of GDP than consumption, but it is much more volatile. _________ (True/False) 1.2. Investment spending is very _________, since it moves in conjunction with GDP. 1.3. Keynes states that optimism and pessimism relat

> 6.1. An increase in the price level will _________ GDP and thereby move the economy _________ the aggregate demand curve. 6.2. At any price level, the income-expenditure model determines the level of equilibrium output and the corresponding point on the

> 2.1. The consumption function describes the relationship between consumption expenditures and the level of _________. 2.2. A decrease in consumer confidence will shift the consumption function _________ (upward/downward). 2.3. If housing prices fall, y

> 4.1. The multiplier for taxes is greater than the multiplier for government spending. _________ (True/False) 4.2. An increase in the tax rate will _________ the government spending multiplier. 4.3. Economic fluctuations have _________ since World War I