Question: a. Consider the five generic elements of

a. Consider the five generic elements of most accounting information systems. For each element, suggest one way it could be compromised via computer crime.

b. Read “Protect Small Business†by Joseph T. Wells in the March 2003 issue of Journal of Accountancy; consider the case presented in the opening paragraphs of the article (Denise, a bookkeeper for a small trucking firm). Work with a group of students and/or interview a forensic accountant/certified fraud examiner to suggest a series of steps you could use to investigate the fraud. Document your steps using one of the techniques described in Part Two of the text.

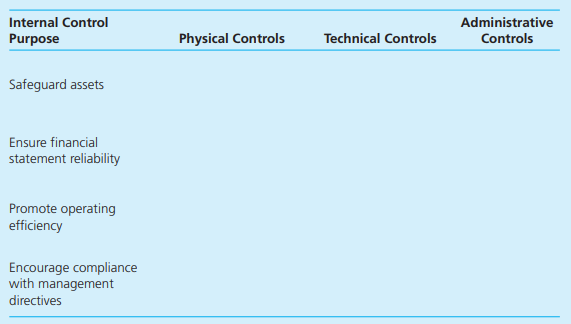

c. This chapter provided a three-part taxonomy for IT controls; earlier in the text, you learned that internal controls have four broad purposes. Fill in the table below with appropriate examples; be prepared to explain your reasoning.

Transcribed Image Text:

Internal Control Administrative Purpose Physical Controls Technical Controls Controls Safeguard assets Ensure financial statement reliability Promote operating efficiency Encourage compliance with management directives

> a. What is information overload? What causes it? What are its effects? How can decision makers deal with information overload in their professional lives? b. Explain the idea of knowledge management. Why is it important? What are some techniques you can

> This exercise will show you one way to generate a random sample using Excel. a. Consult the 3 February 2014 post on my AIS blog; download the Chapter 15 data file you’ll find there. b. In Column B of the data file, use Excelâ€

> a. This chapter outlined seven steps for creating a knowledge management system, using Netflix as an example. Think about the steps in the broader context of a functionally organized corporation; who should complete each of the steps for creating the sys

> Indicate whether each of the following statements is (i) always true, (ii) sometimes true, or (iii) never true. For those that are (ii) sometimes true, explain when the statement is true. a. An organizational culture comprises three parts: assumptions, p

> a. Viola completed her accounting degree in 2000; she has had three professional positions since that time. She summarized information about each position as indicated below. Organize the information into a knowledge management system. Dewey, Cheatam and

> a. Critter Sitters (www.stlouiscrittersitters.com/) is an in-home pet care company based in St. Louis, Missouri. Their Web site lists several services available to pet owners, including midday dog walking, puppy care, and in-home dog training. Suppose C

> Consider the list of current and classic issues in accounting presented below (or others specified by your instructor). With your instructor’s help and guidance, form a team of students to investigate one of the issues. Use the Steps for Better Thinking

> Look up the following references online or in your school’s library. Using the criteria and specific questions from the UMUC Web site referenced in the chapter, evaluate and discuss the quality of each reference. (Note: To do a thorough evaluation of the

> Throughout the text so far, we’ve examined the following companies in the various chapter openers: Starbucks, Amazon, Papa John’s, Google, Barnes & Noble, Microsoft, and Target. Choose one of those companies as the

> a. What is the basic purpose of each business process discussed in this chapter (conversion, financing, human resources)? b. What are the similarities and differences between job costing and process costing systems? How is each system reflected in the or

> RVO Corporation makes and sells decorative picture frames and scenic photographs. Each unit is sold for $32 and incurs $17 variable cost per unit. RVO’s total fixed costs are $18,000 annually. a. Use the preceding data to create a cost-

> a. You read a bit about Porter’s value chain at the beginning of Chapter 12. The value chain links together most, if not all, of the business processes we’ve examined in the last three chapters. To illustrate how, point your Web browser to www.heatercraf

> Indicate whether each statement below is (i) always true, (ii) sometimes true, or (iii) never true. For statements that are (ii) sometimes true, explain when the statement is true. a. All five business processes discussed in the text are required to crea

> In each of the following independent cases, indicate primary and foreign keys in the usual way. a. Consider the Dreambox Creations case presented in the preceding problem. Create specifications for the following tables: employee, report hours. Suggest at

> In each of the following independent cases, document the system using whatever technique(s) your instructor specifies. a. Dreambox Creations (www.dreamboxcreations.com/) in Diamond Bar, California, partners with Automatic Data Processing Inc. (ADP) for i

> In each independent situation below, identify and describe at least three risks. For each risk, suggest two internal controls to address it. a. (CMA adapted, June 1992) Midwest Electronics Corp. manufactures computers. Recently, its products have met sti

> Explain what is happening in each transaction presented in the previous exercise. For example, in transaction (a) , the company is paying its share of payroll taxes.

> Indicate whether each of the following types of businesses would be more likely to use a job or process costing system. Justify your choices. f. Landscaper g. Magazine publisher h. Management consultant a. Architect b. Attorney c. Dentist d. Heavy-e

> On 10 January 20x4, TPL Corporation purchased equipment for use in its operations. TPL made a down payment on the equipment of $25,000 and financed the remainder of its $65,000 total cost with a 6 percent, one-year note payable. TPL expects to use the e

> a. What is the basic purpose of the acquisition/payment process? b. What steps do companies commonly complete as part of the acquisition/payment process? c. How are the generic elements of the AIS exemplified in the acquisition/payment process? d. What r

> Consider the data array below (also available in the 3 February 2014 post in my AIS blog): a. Use Excel’s “Sum Product” function to calculate the total cost of all units purchased in Transactions 1

> In many business processes, resources and agents have no relationship outside the context of a specific event. For example, a customer has no relationship with an inventory item unless the customer buys the item. A REA model of that scenario appears belo

> a. Point your Web browser to www.download.com, and search for inventory management software packages, such as in Flow Inventory Software and Inventoria Stock Manager. Choose two or three such packages, and use the weighted rating technique discussed in C

> Indicate whether each statement below is (i) always true, (ii) sometimes true, or (iii) never true. For any statements that are (ii) sometimes true, explain when the statement is true. a. A bill of lading is required in the acquisition/payment process. b

> LCK Corporation manufactures small tools such as hammers and screwdrivers. Many of LCK’s employees pocket some of the firm’s manufactured tools for their personal use. Since the quantities taken by any one employee were typically immaterial, the individu

> Brock Company is a manufacturer of children’s toys and games. The company has been experiencing declining profit margins and is looking for ways to increase operating income. Because of the competitive nature of the industry, Brock is unable to raise its

> As of 30 April 2011, PLR Corporation’s accounts payable subsidiary ledger included the following information: PLR completed the following transactions in May 2011: a . Record the May transactions in general journal format. b . Prepa

> a. The library at Big State University routes all purchase requests through its requisitions department. Faculty, staff, and students can suggest titles for books, periodicals, electronic media, and other items via e-mail or by using a paper form sent to

> Consider the following short case: FMD Corporation is a multinational corporation, with corporate headquarters in Colorado. The corporate headquarters comprises the following divisions: marketing, finance, operations, information systems, and human reso

> Determine whether each of the following statements is (i) always true, (ii) sometimes true, or (iii) never true. For those that are (ii) sometimes true, explain when the statement is true. a. Bookkeeping and accounting are two ways of referring to the sa

> The chapter discussed how the acquisition/payment process functions for inventory, but it can also apply to virtually any asset on an organization’s balance sheet. In responding to the following questions, consider KKD’s capital assets, such as buildings

> Rob, Teri, Kirk, and Peggy are students in the accounting program at Big State University. They have worked together on several projects throughout their classes and are considering starting a business together when they graduate. Their preliminary idea

> Krispy Kreme Doughnuts offers several ways community groups can use its products for fundraising; one such way is via fundraising certificates. Charitable groups fill out a fundraising application on KKD’s Web site; the application is evaluated by a stor

> a. What activities are accounted for in the sales/collection process? b. What are the steps in the sales/collection process? c. How are the five generic elements of the AIS exemplified in the sales/collection process? d. What recordable transactions are

> Consider the data below and on the next page for DSC Corporation’s recent sales. (The file is available on my AIS blog in the 3 February 2014 post.) a. Use appropriate formulas to calculate the following amounts in the columns indica

> Consider the following short case as you respond to the requirements for this problem: The Institute for Computer Enthusiasts (ICE) sponsors four computer seminars each year: Access, Excel, PowerPoint, and QuickBooks. Participants can sign up for any or

> Indicate whether each of the following statements is (i) always true, (ii) sometimes true, or (iii) never true. For those that are (ii) sometimes true, explain when the statement is true. a. A junction table would be required in a relational database for

> Bonnie makes and sells her own jewelry over the Internet. A customer browses Bonnie’s catalog online and fills out a sales order. The sales order is transmitted electronically to Bonnie, who checks her inventory for each item ordered. If the item is on h

> The flowchart below depicts the sales/collection process for Richards Furniture Company, a mid-sized retailer of living room and bedroom furniture. a. Identify and describe at least three weaknesses in the flowchart itself. For example, it does not hav

> Abid and Company manufactures a variety of pumps and valves that it distributes through several thousand plumbing supply houses as well as 100 manufacturer’s representatives. As a result of the lessthan-favorable business conditions tha

> Making choices and exercising judgment. As you read in the chapter, AIS is all about making choices and evaluating their costs and benefits. These questions and exercises are designed to help you develop those skills. When I give exercises like these to

> Several potential problems in the sales/collection process are listed below. Indicate at least two internal controls that would address the problem. Also identify which of the four purposes of internal control it addresses. a. A burglar takes cash while

> BRN Corporation sells on credit with terms of 2/10, n/30. Freight charges are always paid by the customer when the goods are delivered by a common carrier. During the month of April 2011, BRN completed the following transactions: a. Record the transact

> In each of the following independent cases, use a systems documentation technique specified by your instructor to model the process. a. Dave’s Pool Service is based in Upland, California; the firm offers a variety of pool- and spa-related services, inclu

> Consider the material in Chapter 11 on computer crime and information technology security. a. Which business risks/threats impact Big Marker? Explain your response. b. How does the narrative presented at the end of Part One demonstrate one or more of CoB

> Consider the following list of transactions Big Marker might record in its AIS. Indicate the journal entry required for each transaction, then use XBRL’s Global Ledger taxonomy to find the correct tags for any five of the indicated acco

> a. What four common classifications are often associated with computer crime? b. What computer crime–related risks and threats are associated with information systems? c. What categories are commonly associated with computer criminals? Describe each cate

> Consider the following data set (available for download in the 3 February 2014 post on my AIS blog): a. Use Excel’s regression function to analyze the data. Use “Fraud dollar amount” as

> This problem is structured in three main parts. The first two parts require less critical thinking, as they ask you simply to recall elements of the CoBIT 5 framework. The second part requires more critical thinking, as it asks you to apply those element

> Indicate whether each of the following statements is (i) always true, (ii) sometimes true, or (iii) never true. For those that are (ii) sometimes true, explain when the statement is true. a. A specific instance of computer crime can involve multiple cate

> Every chapter in this edition has an Excel application problem; I’ve included them based on feedback from other AIS faculty and my own approach to teaching AIS. As you complete each problem, ensure that your spreadsheet is logically lai

> a. In your own words, explain the similarities and differences between accounting and bookkeeping. b. What systems do accountants use to create and modify a chart of accounts? c. What internal controls are common in the accounting cycle? d. How is human

> In year 1, Firm A paid $50,000 cash to purchase a tangible business asset. In year 1 and year 2, it deducted $3,140 and $7,200 depreciation with respect to the asset. Firm A’s marginal tax rate in both years was 21 percent. a. Compute Firm A’s net cash f

> Jonson Corporation incurred $150,000 in capitalized acquisition costs to develop an oil well. The corporation’s geologists estimated that there were 200,000 barrels of oil in the well at the beginning of the year. Jonson produced and sold 20,000 barrels

> A&Z incurred $450,000 of capitalized costs to develop a uranium mine. The corporation’s geologists estimated that the mine would produce 900,000 tons of ore. During the year, 215,000 tons were extracted and sold. A&Z’s gross revenues from the sales total

> TGW, a calendar year corporation, reported $3,908,000 net income before tax on its financial statements prepared in accordance with GAAP. The corporation’s records reveal the following information: TGW’s depreciation expense per books was $448,000, and i

> SEP, a calendar year corporation, reported $918,000 net income before tax on its financial statements prepared in accordance with GAAP. The corporation’s records reveal the following information: SEP incurred $75,000 of research costs that resulted in a

> On November 13, Underhill Inc., a calendar year taxpayer, purchased a business for a $750,000 lump-sum price. The business’s balance sheet assets had the following appraised FMV. Accounts receivable ………………………………$ 38,000 Inventory ………………………………………………….77,

> On April 23, Mrs. Y purchased a taxi business from Mr. M for a $60,000 lump-sum price. The business consisted of a two-year-old taxicab worth $19,000, Mr. M’s license to operate a taxi business in Baltimore, his list of regular customers, and his registe

> MNO is a calendar year taxpayer. On March 1, MNO signed a 36month lease on 2,100 square feet of commercial office space. It paid a $3,240 fee to the real estate agent who located the space and negotiated the lease and $8,800 to install new overhead light

> Mr. Z, a calendar year taxpayer, opened a new car wash. Prior to the car wash’s grand opening on October 8, Mr. Z incurred various start-up expenditures (rent, utilities, employee salaries, supplies, and so on). In each of the following cases, compute Mr

> Mr. and Mrs. FB, a retired couple, decided to open a family restaurant. During March and April, they incurred the following expenses. Mr. and Mrs. FB served their first meal to a customer on May 1. Determine the tax treatment of the given expenses on t

> Company N will receive $100,000 of taxable revenue from a client. Compute the NPV of the $100,000 in each of the following cases: a. Company N will receive $50,000 now (year 0) and $50,000 in year 1. The company’s marginal tax rate is 30 percent, and it

> Ajax Inc. was formed on April 25 and elected a calendar year for tax purposes. Ajax paid $11,200 to the attorney who drew up the articles of incorporation and $5,100 to the CPA who advised the corporation concerning the accounting and tax implications of

> In April 2018, Lenape Corporation completed security, fire, and heating system improvements to existing nonresidential real property with a total cost of $1,275,000. Assuming these improvements are 39year recovery property and qualify for the Section 179

> At the beginning of its 2018 tax year, Hiram owned the following business assets. On July 8, Hiram sold its equipment. On August 18, it purchased and placed in service new tools costing $589,000; these tools are threeyear recovery property. These were

> Loni Company paid $527,000 for tangible personality in 2017 and elected to expense $510,000 of the cost (the limited dollar amount for 2017). Loni’s taxable income before a Section 179 deduction was $394,100. Loni paid $23,700 for tangible personality in

> In 2017, Company W elected under Section 179 to expense $19,300 of the cost of qualifying property. However, it could deduct only $15,000 of the expense because of the taxable income limitation. In 2018, Company W’s taxable income before any Section 179

> In 2018, Firm L purchased machinery costing $21,300 and elected to expense the entire cost under Section 179. How much of the expense can Firm L deduct in each of the following cases? a. Its taxable income before the deduction was $58,000. b. Its taxable

> Find the website for the U.S. Treasury Department and report its URL. Who is the current secretary of the Treasury? Find the equivalent of the U.S. Treasury Department for one of the following countries: Western Australia, Germany, Japan, or Spain. Repor

> Find the IRS website and locate the following items: a. Find the IRS publication dealing with moving expenses. What is its publication number? b. Find the IRS publication providing tax information relevant to divorced or separated individuals. What is it

> Using an electronic library such as Checkpoint, CCH Intelli Connect, or LexisNexis, determine how many federal tax cases decided in 2017 contain the phrase step transaction.

> In researching a tax issue, you locate the case Stern, Sidney B. & Vera L., 77 T.C. 614, which seems relevant to your issue. However, before completing your research check the Citator for subsequent information about the case. What do you find in the Cit

> Using an electronic research database such as Checkpoint, CCH Intelli Connect, or LexisNexis, do a keyword search that includes both the phrase capital gain and the keyword livestock. Include both primary sources and editorial materials in your search. a

> Margo, a calendar year taxpayer, paid $580,000 for new machinery (seven-year recovery property) placed in service on August 1, 2017. a. Assuming that the machinery was the only tangible property placed in service during the year, compute Margo’s maximum

> Using an electronic library such as Checkpoint, CCH Intelli Connect, or LexisNexis, find a federal tax case in which the taxpayer is found guilty of tax evasion. After reading the case, list the behaviors of the taxpayer that convinced the court that the

> Explain why, in the course of tax research, it may be necessary for the researcher to gather more facts.

> If a trial court decision has been appealed and the appellate court reversed the trial court’s decision, which of the two court decisions is considered authoritative? Briefly explain your answer.

> Discuss why and how a researcher might use secondary authorities in performing tax research.

> Why is it important for a tax researcher to understand the client’s motivation in undertaking a transaction? How will this knowledge assist the tax professional in serving her client?

> Term life insurance has no investment element and no cash surrender value. As a result, a term policy represents pure insurance protection. What are the tax consequences when the owner lets a term policy lapse by discontinuing premium payments?

> Mr. and Mrs.Greer earn a combined annual salary of $150,000. What two basic economic choices do they have with respect to this income (i.e., what can they do with their money)? Now assume that Mr. and Mrs. Greer own property worth $2 million. What three

> Discuss the tax policy rationale behind the unlimited federal estate tax deduction for testamentary transfers to religious, charitable, educational, government, or other nonprofit organizations.

> Describe the differences between a defined-benefit plan and a defined-contribution plan.

> Six years ago, Corporation AT granted a stock option to an employee to purchase 1,000 shares of AT stock for $15 per share. At date of grant, AT stock was selling for $14.10 per share. Over the last six years, the market price has steadily declined to $1

> In March 2018, Jones Company purchased a Mercedes for use in its business at a cost of $73,000. Assuming no bonus depreciation or Section 179 deduction, calculate the allowable tax depreciation on this asset for 2018, 2019, and 2020.

> Describe the restrictions on tax benefits available to an individual taxpayer who is claimed as a dependent on another taxpayer’s Form 1040.

> Individuals who plan to bunch itemized deductions into one year can either postpone the payment of expenses from an earlier year or accelerate the payment of expenses from a later year. Which technique is preferable from a cash flow standpoint?

> While checking the computations on his Form 1040, Mr. Gordon realized he had misclassified a $10,800 expense as a business deduction on Schedule C. The expense should have been an itemized deduction on Schedule A. Mr. Gordon didn’t correct the error beca

> Identify the reasons why individual taxpayers benefit more from above-the-line deductions than from itemized deductions.

> Discuss possible tax policy reasons why individuals who are age 65 or older receive an additional standard deduction.

> University K is located in a small town that depends on real property taxes for revenue. Over the past decade, University K has expanded by purchasing a number of commercial buildings and personal residences and converting them to classrooms and dormitor

> Explain why AGI is considered a better measure of individual disposable income than taxable income.

> Ms. Jobe has been very ill since the beginning of the year and unable to attend to any financial matters. Her CPA advised that she request an automatic extension of time to file her prior year Form 1040. Ms. Jobe likes this idea because she believes the

> Congress enacted the earned income credit to relieve the burden of the payroll tax on low-income workers. Why didn’t Congress accomplish this goal by providing a payroll tax exemption for a base amount of annual compensation paid by an employer to an emp

> The tax law provides for both refundable and nonrefundable credits. What is the difference between the two types of credit?

> On May 12, 2018, Nelson Inc. purchased eight passenger automobiles for its business. Nelson did not make a Section 179 election to expense any portion of the cost of the automobiles, which are five year recovery property subject to the half-year conventi

> Explain why an individual’s combined standard deduction can be considered a bracket of income taxed at a zero rate.

> Discuss the extent to which adjusted gross income (AGI) is actually a net income number.

> What is the purpose of a bilateral income tax treaty between two countries?