Question:

“A dollar of gross margin per briefcase? That’s ridiculous!†roared Art Dejans, president of CarryAll, Inc. “Why do we go on producing those standard briefcases when we’re able to make over $15 per unit on our specialty items? Maybe it’s time to get out of the standard line and focus the whole plant on specialty work.â€

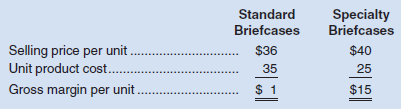

Mr. Dejans was referring to a summary of unit costs and revenues that he had just received from the company’s Accounting Department:

CarryAll produces briefcases from leather, fabric, and synthetic materials in a single plant. The basic product is a standard briefcase that is made from leather lined with fabric. The standard briefcase is a high quality item and has sold well for many years.

Last year, the company decided to expand its product line and produce specialty briefcases for special orders. These briefcases differ from the standard in that they vary in size, they contain the finest leather and synthetic materials, and they are imprinted with the buyer’s name. To reduce labor costs on the specialty briefcases, automated machines do most of the cutting and stitching. These machines are used to a much lesser degree in the production of standard briefcases.

“I agree that the specialty business is looking better and better,†replied Sally Henrie, the company’s marketing manager. “And there seems to be plenty of specialty work out there, particularly because the competition hasn’t been able to touch our price. Did you know that Armor Company, our biggest competitor, charges over $50 a unit for its specialty items? Now that’s what I call gouging the customer!â€

A breakdown of the manufacturing cost for each of CarryAll’s product lines is given below:

Manufacturing overhead is applied to products on the basis of direct labor-hours. The rate of $18 per direct labor-hour is determined by dividing the total manufacturing overhead cost for a month by the direct labor-hours:

Predetermined overhead rate = Manufacturing overhead / Direct labor-hours

= $101,250 / 5,625 DLHs = $18 per DLH

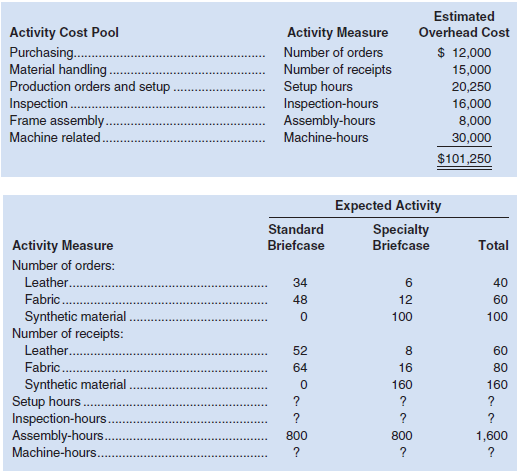

The following additional information is available about the company and its products:

a. Standard briefcases are produced in batches of 200 units, and specialty briefcases are produced in batches of 25 units. Thus, the company does 50 setups for the standard items each month and 100 setups for the specialty items. A setup for the standard items requires one hour, whereas a setup for the specialty items requires two hours.

b. All briefcases are inspected to ensure that quality standards are met. A total of 300 hours of inspection time is spent on the standard briefcases and 500 hours of inspection time is spent on the specialty briefcases each month.

c. A standard briefcase requires 0.5 hours of machine time, and a specialty briefcase requires 2 hours of machine time.

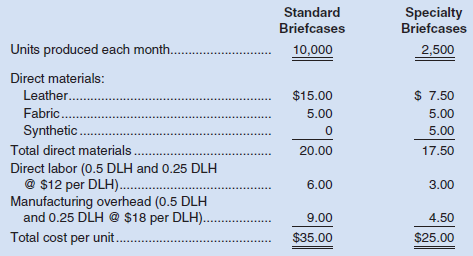

d. The company is considering the use of activity-based costing as an alternative to its traditional costing system for computing unit product costs. Since these unit product costs will be used for external financial reporting, all manufacturing overhead costs are to be allocated to products and nonmanufacturing costs are to be excluded from product costs. The activity-based costing system has already been designed and costs allocated to the activity cost pools. The activity cost pools and activity measures are detailed below:

Required:

1. Using activity-based costing, determine the amount of manufacturing overhead cost that would be applied to each standard briefcase and each specialty briefcase.

2. Using the data computed in part (1) above and other data from the case as needed, determine the unit product cost of each product line from the perspective of the activity-based costing system.

3. Within the limitations of the data that have been provided, evaluate the president’s concern about the profitability of the two product lines. Would you recommend that the company shift its resources entirely to production of specialty briefcases? Explain.

4. Sally Henrie stated that “the competition hasn’t been able to touch our price†on specialty business. Why do you suppose the competition hasn’t been able to touch CarryAll’s price?

Transcribed Image Text:

Standard Specialty Briefcases Briefcases Selling price per unit Unit product cost. $36 $40 35 25 Gross margin per unit.. $ 1 $15 Specialty Briefcases Standard Briefcases Units produced each month.. 10,000 2,500 Direct materials: Leather. $15.00 $ 7.50 Fabric. 5.00 5.00 Synthetic. 5.00 Total direct materials 20.00 17.50 Direct labor (0.5 DLH and 0.25 DLH @ $12 per DLH) . Manufacturing overhead (0.5 DLH and 0.25 DLH @ $18 per DLH).. 6.00 3.00 9.00 4.50 Total cost per unit. $35.00 $25.00 Estimated Activity Cost Pool Activity Measure Overhead Cost $ 12,000 Purchasing. Material handling Production orders and setup Inspection Frame assembly. Number of orders Number of receipts Setup hours Inspection-hours Assembly-hours Machine-hours 15,000 20,250 16,000 8,000 Machine related. 30,000 $101,250 Expected Activity Standard Specialty Briefcase Activity Measure Briefcase Total Number of orders: Leather.. 34 6 40 Fabric. Synthetic material Number of receipts: 48 12 60 100 100 Leather.. 52 60 Fabric.. Synthetic material Setup hours. Inspection-hours. Assembly-hours. 64 16 80 160 160 ? ? ? ? ? ? 800 800 1,600 Machine-hours.. ? ? ?

> Assume that a company has two processing departments—Mixing and Firing. Prepare a journal entry to show a transfer of work in process from the Mixing Department to the Firing Department.

> Why is activity-based costing described as a “two-stage” costing method?

> Logistics Solutions provides order fulfillment services for dot-com merchants. The company maintains warehouses that stock items carried by its dot-com clients. When a client receives an order from a customer, the order is forwarded to Logistics Solution

> What is meant by the term break-even point?

> Magic Realm, Inc., has developed a new fantasy board game. The company sold 15,000 games last year at a selling price of $20 per game. Fixed costs associated with the game total $182,000 per year, and variable costs are $6 per game. Production of the gam

> Data for Hermann Corporation are shown below: Required: 1. The marketing manager argues that a $5,000 increase in the monthly advertising budget would increase monthly sales by $9,000. Should the advertising budget be increased? 2. Refer to the origina

> What is a segment of an organization? Give several examples of segments.

> Why are separate price and quantity variances computed?

> What are the four hierarchical levels of activity discussed in the chapter?

> How many Work in Process accounts are maintained in a company that uses process costing

> What are the three major elements of product costs in a manufacturing company?

> What is meant by the term operating leverage?

> Due to erratic sales of its sole product—a high-capacity battery for laptop computers—PEM, Inc., has been experiencing difficulty for some time. The company’s contribution format income statement for the most recent month is given below: Sales (19,500 u

> SkyChefs, Inc., prepares in-flight meals for a number of major airlines. One of the company’s products is grilled salmon in dill sauce with baby new potatoes and spring vegetables. During the most recent week, the company prepared 4,000 of these meals us

> Fill in the missing amounts in each of the eight case situations below. Each case is independent of the others. a. Assume that only one product is being sold in each of the four following case situations: b. Assume that more than one product is being s

> Last month when Holiday Creations, Inc., sold 50,000 units, total sales were $200,000, total variable expenses were $120,000, and fixed expenses were $65,000. Required: 1. What is the company’s contribution margin (CM) ratio? 2. Estimate the change in

> Distinguish between a cost center, a profit center, and an investment center.

> What is meant by the term management by exception?

> What are the major differences between financial and managerial accounting?

> In all respects, Company A and Company B are identical except that Company A’s costs are mostly variable, whereas Company B’s costs are mostly fixed. When sales increase, which company will tend to realize the greatest increase in profits? Explain.

> The Fashion Shoe Company operates a chain of women’s shoe shops around the country. The shops carry many styles of shoes that are all sold at the same price. Sales personnel in the shops are paid a substantial commission on each pair of

> Jaffre Enterprises distributes a single product whose selling price is $16 and whose variable expense is $11 per unit. The company’s fixed expense is $16,000 per month. Required: 1. Prepare a profit graph for the company up to a sales level of 4,000 uni

> Why is cost accumulation simpler in a process costing system than it is in a job-order costing system?

> From the standpoint of cost control, why is the FIFO method superior to the weighted-average method?

> Bandar Industries Berhad of Malaysia manufactures sporting equipment. One of the company’s products, a football helmet for the North American market, requires a special plastic. During the quarter ending June 30, the company manufactured 35,000 helmets,

> Why do departmental overhead rates sometimes result in inaccurate product costs?

> Distinguish between ideal and practical standards?

> Why is activity-based costing growing in popularity?

> What are the four steps in the planning and control cycle?

> Often the most direct route to a business decision is an incremental analysis. What is meant by an incremental analysis?

> On the cost reconciliation part of the production report, the weighted-average method treats all units transferred out in the same way. How does this differ from the FIFO method of handling units transferred out?

> Gold Star Rice, Ltd., of Thailand exports Thai rice throughout Asia. The company grows three varieties of rice—Fragrant, White, and Loonzain. (The currency in Thailand is the baht, which is denoted by B.) Budgeted sales by product and i

> Menlo Company distributes a single product. The company’s sales and expenses for last month follow: Required: 1. What is the monthly break-even point in units sold and in sales dollars? 2. Without resorting to computations, what is th

> Karlik Enterprises distributes a single product whose selling price is $24 and whose variable expense is $18 per unit. The company’s monthly fixed expense is $24,000. Required: 1. Prepare a cost-volume-profit graph for the company up to a sales level of

> In what ways are job-order and process costing similar?

> Martin Company manufactures a powerful cleaning solvent. The main ingredient in the solvent is a raw material called Echol. Information concerning the purchase and use of Echol follows: Purchase of Echol Echol is purchased in 15-gallon containers at a co

> What is meant by the term decentralization?

> What is a quantity standard? What is a price standard?

> Describe the three major activities of a manager.

> Under what conditions would it be appropriate to use a process costing system?

> What are the three common approaches for assigning overhead costs to products?

> What is meant by a product’s contribution margin ratio? How is this ratio useful in planning business operations?

> Feather Friends, Inc., distributes a high-quality wooden birdhouse that sells for $20 per unit. Variable costs are $8 per unit, and fixed costs total $180,000 per year. Required: Answer the following independent questions: 1. What is the product’s CM rat

> Miller Company’s most recent contribution format income statement is shown below: Required: Prepare a new contribution format income statement under each of the following conditions (consider each case independently): 1. The number of

> Whirly Corporation’s most recent income statement is shown below: Required: Prepare a new contribution format income statement under each of the following conditions (consider each case independently): 1. The sales volume increases by

> The questions in this exercise are based on JetBlue Airways Corporation. To answer the questions, you will need to download JetBlue’s Form 10-K/A for the year ended December 31, 2004 at www.sec.gov/edgar/searchedgar/companysearch.html. Once at this websi

> A business executive once stated, “Depreciation is one of our biggest sources of cash.” Do you agree that depreciation is a source of cash? Explain.

> The questions in this exercise are based on Dell, Inc. To answer the questions, you will needto download Dell’s Form 10-K for the fiscal year ended January 28, 2005 by going to www.sec.gov/edgar/searchedgar/companysearch.html. Input CIK code 826083 and h

> Java Source, Inc. (JSI), is a processor and distributor of a variety of blends of coffee. The company buys coffee beans from around the world and roasts, blends, and packages them for resale. JSI offers a large variety of different coffees that it sells

> Your team should visit and closely observe the operations at a fast-food restaurant. Required: Identify activities and costs at the restaurant that fall into each of the following categories: a. Unit-level activities and costs. b. Customer-level activit

> Gary Stevens and Mary James are production managers in the Consumer Electronics Division of General Electronics Company, which has several dozen plants scattered in locations throughout the world. Mary manages the plant located in Des Moines, Iowa, while

> You often provide advice to Maria Graham, a client who is interested in diversifying her company. Maria is considering the purchase of a small manufacturing company that assembles and packages its many products by hand. She plans to automate the factory

> You and your friends go to a restaurant as a group. At the end of the meal, the issue arises of how the bill for the group should be shared. One alternative is to figure out the cost of what each individual consumed and divide up the bill accordingly. An

> “I think we goofed when we hired that new assistant controller,” said Ruth Scarpino, president of Provost Industries. “Just look at this report that he prepared for last month for the Finishing Department. I can’t make heads or tails out of it.” Finishin

> How does the computation of equivalent units under the FIFO method differ from the computation of equivalent units under the weighted-average method?

> How do the direct and the indirect methods differ in their approach to computing the net cash provided by operating activities?

> What are the three major sections on a statement of cash flows, and what are the general rules that determine the transactions that should be included in each section?

> Assume that a company repays a $300,000 loan from its bank and then later in the same year borrows $500,000. What amount(s) would appear on the statement of cash flows?

> Why aren’t transactions involving accounts payable considered to be financing activities?

> If an asset is sold at a gain, why is the gain deducted from net income when computing the net cash provided by operating activities under the indirect method?

> Why is interest paid on amounts borrowed from banks and other lenders considered to be an operating activity while the amounts borrowed are financing activities?

> What is the difference between net cash provided by operating activities and free cash flow?

> Would a sale of equipment for cash be considered a financing activity or an investing activity? Why?

> If the Accounts Receivable balance increases during a period, how will this increase be recognized using the indirect method of computing the net cash provided by operating activities?

> What is the purpose of a statement of cash flows?

> What is the danger in allocating common fixed costs among product lines or other segments of an organization?

> Prentice Company is considering dropping one of its product lines. What costs of the product line would be relevant to this decision? Irrelevant?

> What are cash equivalents, and why are they included with cash on a statement of cash flows?

> “All future costs are relevant in decision making.” Do you agree? Why?

> “Sunk costs are easy to spot—they’re simply the fixed costs associated with a decision.” Do you agree? Explain.

> Are variable costs always relevant costs? Explain.

> How will relating product contribution margins to the amount of the constrained resource they consume help a company maximize its profits?

> What is a relevant cost?

> How can budgeting assist a company in planning its workforce staffing levels?

> “As a practical matter, planning and control mean exactly the same thing.” Do you agree? Explain.

> What is the contribution margin?

> What is the difference between ordinary least-squares regression analysis and multiple regression analysis?

> What happens to overhead rates based on direct labor when automated equipment replaces direct labor?

> “If a product line is generating a loss, then it should be discontinued.” Do you agree? Explain.

> Provide two reasons why overhead might be underapplied in a given year.

> What is the major disadvantage of the high-low method?

> What adjustment is made for underapplied overhead on the schedule of cost of goods sold? What adjustment is made for overapplied overhead?

> What is meant by the term least-squares regression?

> Give the general formula for a mixed cost. Which term represents the variable cost? The fixed cost?

> What account is credited when overhead cost is applied to Work in Process? Would you expect the amount applied for a period to equal the actual overhead costs of the period? Why or why not?

> Does the concept of the relevant range apply to fixed costs? Explain.

> If fixed manufacturing overhead costs are released from inventory under absorption costing, what does this tell you about the level of production in relation to the level of sales?

> If the units produced and unit sales are equal, which method would you expect to show the higher net operating income, variable costing or absorption costing? Why?

> Managers often assume a strictly linear relationship between cost and volume. How can this practice be defended in light of the fact that many costs are curvilinear?

> Why is the sales forecast the starting point in budgeting?

> “Variable costs and differential costs mean the same thing.” Do you agree? Explain.

> What is meant by an activity base when dealing with variable costs? Give several examples of activity bases.

> Are selling and administrative expenses treated as product costs or as period costs under variable costing?

> When would job-order costing be used instead of process costing?

> Why aren’t actual manufacturing overhead costs traced to jobs just as direct materials and direct labor costs are traced to jobs?

> The questions in this exercise are based on Netflix, Inc. To answer the questions you will need to download the Netflix Form 10-K for the year ended December 31, 2005, at www.sec.gov/edgar/searchedgar/companysearch.html. Once at this website, input CIK c

> The questions in this exercise give you an appreciation for the complexity of budgeting in a large multinational corporation. To answer the questions, you will need to download the Procter & Gamble (P&G) 2005 Annual Report at www.pg.com/investors/annualr

> The questions in this exercise are based on Toll Brothers, Inc., one of the largest home builders in the United States. To answer the questions, you will need to download Toll Brothers’ 2004 annual report (www.tollbrothers.com/homesearch/servlet/HomeSear

> You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company has done very little in the way of budgeting and at cer

> Haglund Department Store is located in the downtown area of a small city. While the store had been profitable for many years, it is facing increasing competition from large national chains that have set up stores on the outskirts of the city. Recently th