Question: a. Enter the following headings for the

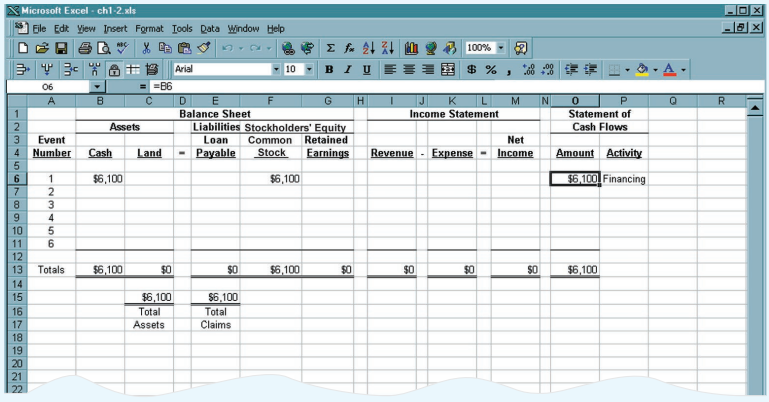

a. Enter the following headings for the horizontal statements model onto a blank spreadsheet.

b. Under the appropriate headings, record the effects of each of the following accounting events for the first month of operations. The first event has been recorded as an example.

(1) Acquired $6,100 from the issue of common stock.

(2) Paid $4,400 to purchase land.

(3) Borrowed $3,000 cash.

(4) Provided services to customers and received $700 in cash.

(5) Paid $300 for expenses.

(6) Paid a $100 dividend to the stockholders.

Note: The amounts on the statement of cash flows can be referenced to the Cash account on the balance sheet. In other words, recording the cash amounts twice is not necessary. Instead, enter formulas in the Statement of Cash Flows column equating those cell addresses to the respective cell in the Cash column. Notice that the formula in cell O6 (statement of cash flows) is set equal to cell B6 (cash on the balance sheet). Once the formula is completed for cell O6, it can be easily copied to cells O7 through O11.

c. Using formulas, sum each of the quantitative columns to arrive at the end-of-month amounts reported on the financial statements.

Spreadsheet Tips:

(1) Center the heading Balance Sheet across columns by entering the entire heading in cell B1. Position the cursor on B1 until a fat cross appears. Click and drag the cursor across B1 through G1. Click on the Merge and Center icon (it is highlighted in the screen in the toolbar).

(2) Enter arithmetic signs as headings by placing an apostrophe in front of the sign. For example, to enter the equal sign in cell D4, enter ‘=.

(3) Copy cells by positioning the cursor in the bottom right corner of the cell to copy from (such as cell O6) until a thin cross appears. Click and drag the cursor down through the desired locations to copy to (through cell O11).

(4) To enter the dollar sign, choose Format, Cells, and Currency.

> Complete requirement a of Problem 11-22A using an Excel spreadsheet. Data from Problem 11-22A: Cascade Company was started on January 1, Year 1, when it acquired $60,000 cash from the owners. During Year 2, the company earned cash revenues of $35,000 an

> Obtain Target Corporation’s annual report for its 2019 fiscal year (year ended February 1, 2020) at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. What is the par value per share of Targ

> Interest rates in the United States were at historic lows for much of the period from 2013 through 2019. The economy was slowly recovering from the recession of 2008 and 2009, and the Federal Reserve kept interest rates low to encourage this recovery. Be

> FedEx Corporation provides a broad range of transportation, e-commerce and business services. The following data were taken from the company’s 2019 annual report. All dollar amounts are in millions. Required: a. Calculate the EBIT for e

> American Airlines, Inc. “. . . our airline operates an average of nearly 6,700 flights per day to nearly 350 destinations in more than 50 countries through hubs and gateways in Charlotte, Chicago, Dallas/Fort Worth, London Heathrow, Los

> Wise Company was started on January 1, Year 1, when it issued 20-year, 10 percent, $200,000 face-value bonds at a price of 90. Interest is payable annually at December 31 of each year. Wise immediately purchased land with the proceeds (cash received) fro

> Obtain Target Corporation’s annual report for its 2019 fiscal year (year ended February 1, 2020) at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. What was the average interest rate on T

> The following cash transactions occurred in five real-world companies. 1. During the third quarter of 2019 (July 1 through September 30), Snap, Inc. the company that produces Snapchat, borrowed $1.3 billion using notes payable. 2. In August, 2019, Occide

> The following information is available for Lumberton Co. for the week ending June 28, Year 1. All employees are paid time and one-half for all hours over 40. Each employee has a cumulative salary of over $7,000, but less than $110,000. Assume the Social

> Scott Putman owns and operates a lawn care company. Like most companies in the lawn care business, his company experiences a high level of employee turnover. However, he finds it relatively easy to replace employees because he pays above-market wages. He

> Nancy, who graduated from State University in June Year 1, has just landed her first real job. She is excited because her salary is $4,000 per month. Nancy is single and has been planning all month about how she will spend her $4,000. When she received h

> Advanced Micro Devices, Inc. (AMD) is “a global semiconductor company with facilities around the world.” AMD began operations in 1969. Texas Instruments, Inc. is the company that invented the integrated circuit over 50

> Stanley Black & Decker, Inc. (SBD) was founded in 1843. Its 2018 annual report states that “the Company is a diversified global provider of hand tools, power tools and related accessories, engineered fastening systems and products,

> In the liabilities section of its 2018 balance sheet, Bank of America reported “noninterest-bearing deposits” in U.S. offices of over $412 billion. Bank of America is a very large banking company. In the liabilities section of its 2018 balance sheet, New

> Refer to Exercise 9-17A. Complete Requirements a, b, c, and d using an Excel spreadsheet. Refer to Chapter 1, Problem ATC 1-8, for ideas on how to structure the spreadsheet. Data from Exercise 9-17A: Sheldon Jones borrowed money by issuing two notes on

> Obtain Target Corporation’s annual report for its 2019 fiscal year (year ended February 1, 2020) at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. What was Target’s current ratio for its

> Crist Company operates a lawn-mowing service. Crist has chosen to depreciate its equipment for financial statement purposes using the straight-line method. However, to save cash in the short run, Crist has elected to use the MACRS method for income tax r

> Electronic Arts, Inc. better known to consumers as EA Sports, is in the digital interactive entertainment business. Its products include Madden NFL and The Sims. Union Pacific Corporation is one of the largest railway networks in the nation. The followin

> Verizon Communications, Inc. is one of the world’s largest providers of communication services. The following information, taken from the company’s annual reports, is available for the years 2018, 2017, and 2016. Dolla

> The following ratios are for four companies in different industries. Some of these ratios have been discussed in the textbook, others have not, but their names explain how the ratio was computed. These data are for the companies’ 2018 f

> Short Company purchased a computer on January 1, Year 1, for $5,000. An additional $100 was paid for delivery charges. The computer was estimated to have a life of five years or 10,000 hours. Salvage value was estimated at $300. During the five years, th

> AutoZone, Inc. claims to be the nation’s leading auto parts retailer. It sells replacement auto parts directly to the consumer. BorgWarner, Inc. has over 30,000 employees and produces automobile parts, such as transmissions and cooling

> The following data were taken from The Hershey Company’s 2018 annual report. All dollar amounts are in millions. Required: a. Compute Hershey’s accounts receivable turnover ratios for 2018 and 2017. b. Compute Hershey&

> Presented here are the average days to collect accounts receivable for four companies in different industries. The data are for 2018. Required: Write a brief memorandum that provides possible answers to each of the following questions: a. Why would a com

> Anyone who has shopped at Target Corporation knows that many of its customers use a credit card to pay for their purchases. There is even a Target brand credit card. However, Target did not report any accounts receivables or credit card receivables on it

> The accounting firm of Brooke & Doggett, CPAs, recently completed the audits of three separate companies. During these audits, the following events were discovered, and Brooke & Doggett is trying to decide if each event is material. If an item is materia

> The following excerpt was taken from Alphabet, Inc.’s 10-K report for its 2019 fiscal year. Alphabet, Inc. is the parent company of Google, Inc. CONTROLS AND PROCEDURES Evaluation of Disclosure Controls and Procedures Our management, with the participati

> Obtain Target Corporation’s annual report for its 2019 fiscal year (year ended February 1, 2020) at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. Who are the independent auditors for Ta

> Domino’s Pizza, Inc. had 5,486 franchised restaurants in the United States and 85 in international markets as of December 30, 2018. Signet Jewelers Limited claims to be the world’s largest retailer of diamond jewelry.

> Obtain Target Corporation’s annual report for its 2019 fiscal year (year ended February 1, 2020) at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. What was Target’s net income for 2019 (

> Costco Wholesale Corporation operated 787 stores as of September 1, 2019. The following data were taken from the company’s annual report. All dollar amounts are in millions. Required: a. Compute Costco’s inventory turn

> The following data were extracted from the 2018 financial statements of Penske Automotive Group, Inc. This company operates automobile dealerships, mostly in the United States, Canada, and Western Europe, and commercial truck dealerships in Australia, Ne

> The accounting records of Blue Bird Co. showed the following balances at January 1, Year 2. Transactions for Year 2 were as follows. Required a. Organize the class into three sections, and divide each section into groups of three to five students. Assign

> Complete ATC 5-5 using an Excel spreadsheet Data from ATC 5-5: Domino’s Pizza, Inc. had 5,486 franchised restaurants in the United States and 85 in international markets as of December 30, 2018. Signet Jewelers Limited claims to be the

> Obtain Target Corporation’s annual report for its 2019 fiscal year (year ended February 1, 2020) at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. What was Target’s inventory turnover ra

> The following accounts, balances, and other financial information are drawn from the records of Vong Company for Year 2. The Cash account revealed the following cash flows. Required: Build an Excel spreadsheet to construct a multistep income statement, s

> The Kroger Co. was founded in 1883 and is one of the largest retailers in the world, based on annual sales. Publix Super Markets, Inc. operates 1,167 grocery stores throughout the southeastern and mid-Atlantic United States. It is employee owned, and its

> Bloomin’ Brands, Inc. is the corporation behind five restaurant chains: Outback Steakhouse, Carrabba’s Italian Grill, Bonefish Grill, Fleming’s Prime Steakhouse and Wine Bar, and Roy’

> Presented here is selected information from the 2018 fiscal-year 10-K reports of four companies. The four companies, in alphabetical order, are: Advance Micro Devices, a global semiconductor company; AT&T, Inc., a company that provides communications

> At the end of Year 1, the following information is available for Short and Wise Companies. Required: a. Set up the spreadsheet shown here. Complete the income statements by using Excel formulas. b. Prepare a common size income statement for each company

> What is the difference between a multistep income statement and a single-step income statement?

> Obtain Target Corporation’s annual report for its 2019 fiscal year (year ended February 1, 2020) at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. What was Target’s gross margin percenta

> The following data were taken from the 2018 annual reports of Biogen, Inc. and Amgen Inc. Both companies are leaders in biotechnology. All dollar amounts are in millions. Required: a. For each company, compute the debt-to-assets ratio, return-on-assets r

> The following data were taken from Netflix, Inc.’s 2018 annual report. All dollar amounts are in millions. Required: a. For each year, compute Netflix’s debt-to-assets ratio, return-on-assets ratio, and return-on-equit

> Consider the following brief descriptions of four companies from different industries. Michaels Companies, the parent company of Michaels craft stores, claims to be the largest arts and crafts specialty retailer in North America. It operates over 1,250 r

> At the end of the accounting period, Adams Company’s general ledger contained the following adjusted balances. Required: 1. Set up the preceding spreadsheet format. 2. Record the closing entries in the Closing Entries column of the spre

> Obtain Target Corporation’s annual report for its 2019 fiscal year (year ended February 1, 2020) at http://investors.target.com using the instructions in Appendix B, and use it to answer the following questions: a. What was Target’s debt-to-assets ratio

> a. Use an Excel spreadsheet to construct the required financial statements. To complete Requirement b, use formulas where normal arithmetic calculations are made within the financial statements (in particular the statement of changes in stockholders&acir

> The following data are based on information in the 2018 annual report of YUM! Brands, Inc. YUM! Brands is the parent company of KFC, Pizza Hut, and Taco Bell. As of December 31, 2018, the parent company owned or franchised over 48,000 restaurants in 140

> The following data are based on information in the 2019 annual report of Cracker Barrel Old Country Store. As of August 2, 2019, Cracker Barrel operated 660 restaurants and gift shops in 45 states. Dollar amounts are in millions. Required: a. Calculate t

> How is net sales determined?

> Is it easier to reach agreement on international standards on auditing than on international accounting standards? If so, why?

> Is there a single best method of currency translation?

> Are gains on unsettled foreign currency balances realized? When should they be recognized as income?

> Discuss how different attitudes to prudence can affect foreign currency translation policies.

> Does accounting translation exposure matter? Explain your reasoning.

> Discuss the view that the individual company financial statements in Germany are useful only for tax purposes.

> Compare the influence of tax law on financial reporting in the United Kingdom with its influence in Germany.

> Using the numerical reconciliation shown in this chapter and the information in Chapter 2, comment on the adjustments necessary when moving from German accounting to US or IFRS accounting.

> ‘German accounting rules for individual companies are ideal for domestic companies with no international connections.’ Discuss.

> The formats in the appendices to this chapter, relating to three EU countries, all comply with the EU Fourth Directive. Comment on the differences between them.

> Explain how international differences in the ownership and financing of companies could lead to differences in financial reporting.

> Why are leased assets accounted for differently in individual company financial statements in the United Kingdom and France?

> Is it useful to regulate, as for example in France, the keeping of accounting records, as well as the preparation of financial statements?

> Why has the FRC in the United Kingdom decided to converge (partially but not completely) UK standards for individual companies with IFRS for SMEs?

> Compare the composition and the roles of the FRC in the United Kingdom and the ANC in France.

> ‘The UK accountancy profession no longer has any influence on the accounting rules relating to individual financial statements.’ Discuss.

> What are the arguments for and against a national accounting plan?

> What effect, if any, has harmonization in the European Union had on non-member states in Europe?

> Discuss the choice of national charts of accounts in post-communist Russia and Romania.

> Compare the importance of the influences of Anglo-Saxon accounting and continental European accounting in Eastern Europe during the 1990s.

> One of the original aims of the Seventh Directive was to assist with the supervision of multinational enterprises by their host countries. Examine and discuss arguments for and against such a desire for supervision.

> Why is English the leading language of international corporate financial reporting?

> To what extent did the EU Seventh Directive harmonies consolidation accounting between Germany and the United Kingdom?

> ‘The EU Seventh Directive was a much more useful harmonizing tool than the Fourth Directive was.’ Discuss.

> Compare the importance of the influences of Anglo-Saxon accounting and continental European accounting in Eastern Europe and China in the 1990s.

> Which was more successful at harmonization until 2001: the IASC or the European Union?

> Why, and to what extent, has post-Communist Romania adopted Anglo-Saxon rather than French-style corporate financial reporting?

> Why is auditor independence a problem in Central and Eastern Europe?

> From this and earlier chapters, explain how financial reporting profit can differ from taxable income, and how this varies internationally.

> Suggest reasons for the adoption or non-adoption of IFRS for SMEs in China, France, Japan, South Africa and the United States.

> Explain how IFRS for SMEs differs from full IFRS. In your opinion, does it differ enough?

> Imagine that you are a financial analyst used to US or IFRS company statements; what difficulties would be met when assessing Japanese companies?

> Why are some EU companies listed on non-European (especially North American) stock exchanges?

> ‘Japan is unique, so Japanese accounting is unique.’ Discuss.

> Discuss the causes of differences in financial reporting and its regulation (giving relevant examples of the effects) between your own country and Japan.

> Compare and contrast the roles of the JICPA and the AICPA.

> Why did Chinese accounting develop differently from Eastern European accounting in the 1990s?

> From your knowledge of Japanese accounting, what characteristics do you think it has in terms of Gray’s (1988) model?

> Discuss the classification of Japanese accounting in Nobes’ (1998) model (see Figure 3.4). Which features give rise to this classification, and what have Japanese accounting and its environment in common with other countries in this group?

> Discuss the view that political lobbying could and should be reduced by giving preparers more say in the setting of accounting standards.

> Give examples of political lobbying of the IASC/B, explaining why and how lobbying has increased over the years.

> Why might it be expected that there would be more examples of political lobbying relating to the United States than to any other country?

> Discuss the role of a conceptual framework as a defense against political lobbying.

> Why are there more accountants per head of population in New Zealand than in France?

> Is there a connection between the amount of political lobbying in a country and the degree of independence of the standard-setter from (a) government departments and (b) the accountancy profession?

> Discuss the causes of differences in financial reporting and its regulation (giving relevant examples of the effects) between your own country and the United States.

> Which US accounting practices seem out of line with those of many other countries? What explanations are there for this?

> Would you describe the differences between IFRS and US GAAP as ‘major’? Will it be easy for the standard-setters to remove these differences?

> As pointed out in this chapter, the United States and the United Kingdom are reasonably similar with respect to the causes and nature of differences of financial reporting. Identify and discuss factors that may account for the existing differences in pra