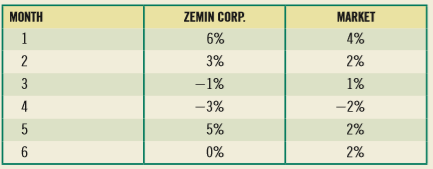

Question: a. Given the holding-period returns shown

a. Given the holding-period returns shown here, compute the average returns and the standard deviations for the Zemin Corporation and for the market.

b. If Zemin’s beta is 1.54 and the risk-free rate is 4 percent, what would be an appropriate required return for an investor owning Zemin? (Note: Because the returns of Zemin Corporation are based on monthly data, you will need to annualize the returns to make them compatible with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.)

c. How does Zemin’s historical average return compare with the return you believe to be an appropriate, given the firm’s systematic risk?

Transcribed Image Text:

MONTH ZEMIN CORP. MARKET 1 6% 4% 2 3% 2% 3 -1% 1% 4 -3% -2% 5 5% 2% 0% 2%

> Saddle River Operating Company (SROC) is a Dallas-based independent oil and gas firm. In the past, the firm’s managers have used a single firm-wide cost of capital of 11 percent to evaluate new investments. However, the firm has long recognized that its

> In May of this year Newcastle Mfg. Company’s capital investment review committee received two major investment proposals. One of the proposals was issued by the firm’s domestic manufacturing division, and the other came from the firm’s distribution compa

> Compute the cost of the following: a. A bond that has $1,000 par value (face value) and a contract or coupon interest rate of 9 percent. A new issue would have a flotation cost of 5 percent of the $1,100 market value. The bonds mature in 10 years. The fi

> LPT Inc. is an integrated oil company headquartered in Dallas, Texas. The company has three operating divisions: oil exploration and production (commonly referred to as E&P), pipelines, and refining. Historically, LPT did not spend a great deal of time t

> Newcomb Vending Company manages soft drink dispensing machines in western Tennessee for several of the major bottling companies in the area. When a machine malfunctions, the company sends out a repair technician; if he cannot repair it on the spot, he pu

> ABBC, Inc. operates a very successful chain of yogurt and coffee shops spread across the southwestern part of the United States and needs to raise funds for its planned expansion into the Northwest. The firm’s balance sheet at the close

> The capital structure for the Carion Corporation is provided here. The company plans to maintain its debt structure in the future. If the firm has a 5.5 percent after-tax cost of debt, a 13.5 percent cost of preferred stock, and an 18 percent cost of com

> Crawford Enterprises is a publicly held company located in Arnold, Kansas. The firm began as a small tool and die shop but grew over its 35-year life to become a leading supplier of metal fabrication equipment used in the farm tractor industry. At the cl

> Wingate Metal Products, Inc. sells materials to contractors who construct metal warehouses, storage buildings, and other structures. The firm has estimated its weighted average cost of capital to be 9.0 percent based on the fact that its after-tax cost o

> a. Rework Problem 9-12 as follows: Assume an 8 percent coupon rate. What effect does changing the coupon rate have on the firm’s after-tax cost of capital? b. Why is there a change? Data from Problem 9-12: Sincere Stationery Corporation needs to raise $

> Explain what a dividend’s declaration date, date of record, and ex-dividend date are.

> Compute the costs for the following sources of financing: a. A $1,000 par value bond with a market price of $970 and a coupon interest rate of 10 percent. Flotation costs for a new issue would be approximately 5 percent of market price. The bonds mature

> In March of this past year, Manchester Electric (an electrical supply company operating throughout the southeastern United States and a publicly held company) was evaluating the cost of equity capital for the firm. The firm’s shares are selling for $45.0

> Match the following terms with their definitions: TERMS DEFINITIONS Opportunity cost The target mix of sources of funds that the firm uses when raising new money to invest in the firm. Financial policy A weighted average of the required rates of r

> Haney, Inc.’s preferred stock is selling for $33 per share in the market and pays a $3.60 annual dividend. a. What is the expected rate of return on the stock? b. If an investor’s required rate of return is 10 percent, what is the value of the stock for

> Ziercher executives anticipate a growth rate of 12 percent for the company’s common stock. The stock is currently selling for $42.65 per share and pays an end-of-year dividend of $1.45. What is your expected rate of return if you purchase the stock for i

> If you purchased 125 shares of common stock that pays an end-of-year dividend of $3, what is your expected rate of return if you purchased the stock for $30 per share? Assume the stock is expected to have a constant growth rate of 7 percent.

> Alyward & Bram’s common stock currently sells for $23 per share. The company’s executives anticipate a constant growth rate of 10.5 percent and an end-of-year dividend of $2.50. a. What is your expected rate of return? b. If you require a 17 percent retu

> You are planning to purchase 100 shares of preferred stock and must choose between stock in the Jackson Corporation and stock in the Fields Corporation. Your required rate of return is 9 percent. If the stock in Jackson pays a dividend of $2 and is selli

> You own 200 shares of Shapard Resources’ preferred stock, which currently sells for $40 per share and pays annual dividends of $3.40 per share. a. What is your expected return? b. If you require an 8 percent return, given the current price, should you se

> You are planning to purchase 100 shares of preferred stock and must choose between Stock A and Stock B. Stock A pays an annual dividend of $4.50 and is currently selling for $35. Stock B pays an annual dividend of $4.25 and is selling for $36. If your re

> In the introduction to the chapter we learned that Apple Computer (AAPL) recently reinstated the payment of cash dividends, which had been suspended since the 1990s. What are some reasons that might have influenced the firm’s decision to begin paying div

> You own 250 shares of Dalton Resources’ preferred stock, which currently sells for $38.50 per share and pays annual dividends of $3.25 per share. a. What is your expected return? b. If you require an 8 percent return, given the current price, should you

> The common stock of NCP paid $1.32 in dividends last year. Dividends are expected to grow at an 8 percent annual rate for an indefinite number of years. a. If NCP’s current market price is $23.50 per share, what is the stock’s expected rate of return? b.

> Dalton Inc., has an 11.5 percent return on equity and retains 55 percent of its earnings for reinvestment purposes. It recently paid a dividend of $3.25 and the stock is currently selling for $40. a. What is the growth rate for Dalton, Inc.? b. What is t

> National Steel’s 15-year, $1,000 par value bonds pay 5.5 percent interest annually. The market price of the bonds is $1,085, and your required rate of return is 7 percent. a. Compute the bond’s expected rate of return. b. Determine the value of the bond

> Mason, Inc. has two bond issues outstanding, called Series A and Series B both paying the same annual interest of $55. Series A has a maturity of 12 years, whereas Series B has a maturity of 1 year. a. What would be the value of each of these bonds when

> Hamilton, Inc. bonds have a 6 percent coupon rate. The interest is paid semiannually, and the bonds mature in 8 years. Their par value is $1,000. If your required rate of return is 4 percent, what is the value of the bond? What is the value if the intere

> You own a 20-year, $1,000 par value bond paying 7 percent interest annually. The market price of the bond is $875, and your required rate of return is 10 percent. a. Compute the bond’s expected rate of return. b. Determine the value of the bond to you, g

> Flora Co.’s bonds, maturing in 7 years, pay 4 percent interest on a $1,000 face value. However, interest is paid semiannually. If your required rate of return is 5 percent, what is the value of the bond? How would your answer change if the interest were

> Sakara Co. bonds are selling in the market for $1,045. These 15-year bonds pay 7 percent interest annually on a $1,000 par value. If they are purchased at the market price, what is the expected rate of return?

> Xerox issued bonds that pay $67.50 in interest each year and will mature in 5 years. You are thinking about purchasing the bonds. You have decided that you would need to receive a 5 percent return on your investment. What is the value of the bond to you,

> The common stockholders receive two types of return from their investment. What are they?

> Bank of America has bonds that pay a 6.5 percent coupon interest rate and mature in 5 years. If an investor has a 4.3 percent required rate of return, what should she be willing to pay for the bond? What happens if she pays more or less than this amount?

> You are examining three bonds with a par value of $1,000 (you receive $1,000 at maturity) and are concerned with what would happen to their market value if interest rates (or the market discount rate) changed. The three bonds are Bond A—a bond with 3 yea

> Kyser Public Utilities issued a bond with a $1,000 par value that pays $30 in annual interest. It matures in 20 years. Your required rate of return is 4 percent. a. Calculate the value of the bond. b. How does the value change if your required rate of re

> You own a bond that pays $70 in annual interest, with a $1,000 par value. It matures in 15 years. Your required rate of return is 7 percent. a. Calculate the value of the bond. b. How does the value change if your required rate of return (1) increases t

> Bellingham bonds have an annual coupon rate of 8 percent and a par value of $1,000 and will mature in 20 years. If you require a return of 7 percent, what price would you be willing to pay for the bond? What happens if you pay more for the bond? What hap

> From the price data that follow, compute the holding period returns for periods 2 through 4. PERIOD ……………………. STOCK PRICE 1 ………………………………………………. $10 2 …………………………………………………. 13 3 …………………………………………………. 11 4 ………………………………………………… 15

> Given the following probabilities and returns for Mik’s Corporation, find the standard deviation. PROBABILITY …………………. RETURNS 0.40 …………………………………………. 7% 0.25 …………………………………………. 4% 0.15 …………………………………………. 18% 0.20 ………………………………………… 10%

> Summerville, Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better based on the risk (as measured by the standard deviation) and return of each? СОMMON STOCK A COMMON STOCK B PR

> Carter, Inc. is evaluating a security. Calculate the investment’s expected return and its standard deviation. PROBABILITY………………RETURN 0.15……………………………………..6% 0.30…………………………………….9% 0.40…………………………………...10% 0.15…………………………………….15%

> You own a portfolio consisting of the stocks below: The risk-free rate is 3 percent. Also, the expected return on the market portfolio is 11 percent. a. Calculate the expected return of your portfolio. b. Calculate the portfolio beta. c. Given the fore

> How can management’s desire to maintain ownership control constrain the growth of a firm?

> The expected return for the general market is 12.8 percent, and the risk premium in the market is 9.3 percent. Tasaco, LBM, and Exxos have betas of 0.864, 0.693, and 0.575, respectively. What are the corresponding required rates of return for the three s

> Given the holding-period returns shown here, calculate the average returns and the standard deviations for the Kaifu Corporation and for the market. MONTH KAIFU CORP. MARKET 1 4% 2% 2 6% 3% 0% 1% 4 2% -1%

> a. Determine the expected return and beta for the following portfolio: b. Given the foregoing information, draw the security market line and show where the securities and portfolio fit on the graph. Assume that the risk free rate is 2 percent and that

> Below you have been provided the prices for Citigroup and the S&P 500 Index. a. Calculate the monthly holding-period returns for Citigroup and the S&P 500 Index. b. What are the average monthly returns and standard deviations for each? c. Gra

> The following are the end-of-month prices for both the Standard & Poor’s 500 Index and Nike’s common stock. a. Using the data here, calculate the holding-period returns for each of the months. b. Calculate the

> a. From the price data here, compute the holding-period returns for Jazman and Solomon for periods 2 through 4. b. How would you interpret the meaning of a holding-period return? PERIOD JAZMAN SOLOMON 1 $9 $27 2 11 28 3 10 32 13 29

> Universal Corporation is planning to invest in a security that has several possible rates of return. Given the following probability distribution of returns, what is the expected rate of return on the investment? Also compute the standard deviations of t

> Giancarlo Stanton hit 37 home runs in 2014. If his home-run output grew at a rate of 12 percent per year, what would it have been over the following 5 years?

> Sales of a new finance book were 15,000 copies this year and were expected to increase by 20 percent per year. What are expected sales during each of the next 3 years? Graph this sales trend and explain.

> What legal restrictions may limit the amount of dividends to be paid?

> Stanford Simmons, who recently sold his Porsche, placed $10,000 in a savings account paying annual compound interest of 6 percent. a. Calculate the amount of money that will have accrued if he leaves the money in the bank for 1, 5, and 15 years. b. If he

> Jesse Pinkman is thinking about trading cars. He estimates he will still have to borrow $25,000 to pay for his new car. How large will Jesse’s monthly car loan payment be if he can get a 5-year (60 equal monthly payments) car loan from the university’s c

> To buy a new house you take out a 25-year mortgage for $300,000. What will your monthly payments be if the interest rate on your mortgage is an APR of 8 percent compounded monthly? Use a spreadsheet to calculate your answer. Now, calculate the portion of

> About how many years would it take for your investment to grow fourfold if it were invested at an APR of 16 percent compounded semiannually?

> What is the present value of the following future amounts? a. $800 to be received 10 years from now discounted back to the present at 10 percent b. $300 to be received 5 years from now discounted back to the present at 5 percent c. $1,000 to be received

> After examining the various personal loan rates available to you, you find that you can borrow funds from a finance company at an APR of 12 percent compounded monthly or from a bank at an APR of 13 percent compounded annually. Which alternative is more a

> a. Calculate the future sum of $5,000, given that it will be held in the bank for 5 years at an annual interest rate of 6 percent. b. Recalculate part (a) assuming the interest rates is (1) an APR of 6 percent compounded semiannually and (2) an APR of

> Imagine that Homer Simpson actually invested $100,000 5 years ago at a 7.5 percent annual interest rate. If he invests an additional $1,500 a year at the beginning of each year for 20 years at the same 7.5 percent annual rate, how much money will Homer h

> Springfield mogul Montgomery Burns, age 80, wants to retire at age 100 in order to steal candy from babies full time. Once Mr. Burns retires, he wants to withdraw $1 billion at the beginning of each year for 10 years from a special offshore account that

> In 20 years you’d like to have $250,000 to buy a vacation home, but you have only $30,000. At what rate must your $30,000 be compounded annually for it to grow to $250,000 in 20 years? Use a spreadsheet to calculate your answer.

> Compare valuing preferred stock and common stock.

> If you invest $900 in a bank in which it will earn 8 percent compounded annually, how much will your investment be worth at the end of 7 years? Use a spreadsheet to do your calculations.

> At what annual rate would the following have to be invested? a. $500 to grow to $1,948.00 in 12 years b. $300 to grow to $422.10 in 7 years c. $50 to grow to $280.20 in 20 years d. $200 to grow to $497.60 in 5 years

> Nicki Johnson, a sophomore mechanical engineering student, receives a call from an insurance agent, who believes that Nicki is an older woman ready to retire from teaching. He talks to her about several annuities that she could buy that would guarantee h

> What is the present value of each of the following annuities? a. $2,500 a year for 10 years discounted back to the present at 7 percent b. $70 a year for 3 years discounted back to the present at 3 percent c. $280 a year for 7 years discounted back to th

> What is the accumulated sum of each of the following streams of payments? a. $500 a year for 10 years compounded annually at 5 percent b. $100 a year for 5 years compounded annually at 10 percent c. $35 a year for 7 years compounded annually at 7 percent

> How many years will the following take? a. $500 to grow to $1,039.50 if invested at 5 percent compounded annually b. $35 to grow to $53.87 if invested at 9 percent compounded annually c. $100 to grow to $298.60 if invested at 20 percent compounded annual

> Selma and Patty Bouvier are twins, and both work at the Springfield DMV. They decide to save for retirement, which is 35 years away. They’ll both receive an 8 percent annual return on their investment over the next 35 years. Selma invests $2,000 per year

> In 2016 Bill Gates was worth about $82 billion. Let’s see what Bill Gates can do with his money in the following problems. a. I’ll take Manhattan? Manhattan’s native tribe sold Manhattan Island to Peter Minuit for $24 in 1626. Now, 390 years later in 201

> Roger Sterling has decided to buy an ad agency and is going to finance the purchase with seller financing—that is, a loan from the current owners of the agency. The loan will be for $2 million financed at an APR of 7 percent compounded monthly. This loan

> Don Draper has signed a contract that will pay him $80,000 at the beginning of each year for the next 6 years, plus an additional $100,000 at the end of year 6. If 8 percent is the appropriate discount rate, what is the present value of this contract?

> Why is preferred stock frequently convertible? Why is it callable?

> This Mini Case is available in My Finance Lab. Below are the financial statements for two firms, Time Warner and Walt Disney, for 2012 and 2013. a. How did Time Warner’s profit margins change from 2012 to 2013? To what would you attribu

> Don Draper has signed a contract that will pay him $80,000 at the end of each year for the next 6 years, plus an additional $100,000 at the end of year 6. If 8 percent is the appropriate discount rate, what is the present value of this contract?

> Mil house, 22, is about to begin his career as a rocket scientist for a NASA contractor. Being a rocket scientist, Mil house knows that he should begin saving for retirement immediately. Part of his inspiration came from reading an article on Social Secu

> Upon graduating from college 35 years ago, Dr. Nick Riviera was already thinking of retirement. Since then, he has made deposits into his retirement fund on a quarterly basis in the amount of $300. Nick has just completed his final payment and is at last

> The state lottery’s million-dollar payout provides for $1 million to be paid over 19 years in 20 payments of $50,000. The first $50,000 payment is made immediately, and the 19 remaining $50,000 payments occur at the end of each of the next 19 years. If 1

> You are trying to plan for retirement in 10 years, and currently you have $100,000 in a savings account and $300,000 in stocks. In addition, you plan on adding to your savings by depositing $10,000 per year in your savings account at the end of each of t

> You would like to have $50,000 in 15 years. To accumulate this amount you plan to deposit each year an equal sum in the bank, which will earn 7 percent interest compounded annually. Your first payment will be made at the end of the year. a. How much must

> How much do you have to deposit today so that beginning 11 years from now you can withdraw $10,000 a year for the next 5 years (periods 11 through 15) plus an additional amount of $20,000 in that last year (period 15)? Assume an interest rate of 6 percen

> Bart Simpson, age 10, wants to be able to buy a really cool new car when he turns 16. His really cool car costs $15,000 today, and its cost is expected to increase 3 percent annually. Bart wants to make one deposit today (he can sell his mint-condition o

> The Kumar Corporation is planning on issuing bonds that pay no interest but can be converted into $1,000 at maturity, 7 years from their purchase. To price these bonds competitively with other bonds of equal risk, it is determined that they should yield

> You are given three investment alternatives to analyze. The cash flows from these three investments are as follows: Assuming a 20 percent discount rate, find the present value of each investment. INVESTMENT END OF YEAR A B 1 $10,000 $10,000 2 10,

> Why would a preferred stockholder want the stock to have a cumulative dividend feature and protective provisions?

> You are offered $1,000 today, $10,000 in 12 years, or $25,000 in 25 years. Assuming that you can earn 11 percent on your money, which offer should you choose?

> To what amount will the following investments accumulate? a. $5,000 invested for 10 years at 10 percent compounded annually b. $8,000 invested for 7 years at 8 percent compounded annually c. $775 invested for 12 years at 12 percent compounded annually d.

> Should we have bet the kids’ college fund at the dog track? Let’s look at one specific case of a college professor (let’s call him Prof. ME) with two young children. Two years ago, Prof. ME invested $160,000 hoping to have $420,000 available 12 years lat

> Dennis Rodman has a $5,000 debt balance on his Visa card that charges an APR of 12.9 percent compounded monthly. Dennis’s current minimum monthly payment is 3 percent of his debt balance, or $150. How many months (round up) will it take Dennis to pay off

> Hank Schrader plans to invest $1,000 at the end of each quarter for 4 years into an account with an APR of 6.4 percent compounded quarterly. He will use this money as a down payment on a new home at the end of the 4 years. How large will his down payment

> Ford’s current incentives for customers looking to buy a Mustang include either financing at an APR of 4.9 percent compounded monthly for 60 months or $1,000 cash back. Let’s assume Suzie Student wants to buy the premium Mustang convertible, which costs

> Bowflex’s television ads say you can get a fitness machine that sells for $999 for $33 a month for 36 months. What APR are you paying on this Bowflex loan?

> The financial statements and industry norms are shown below for Pamplin, Inc.: a. Compute the financial ratios for Pamplin for 2014 and for 2015 to compare both against the industry norms. b. How liquid is the firm? c. Are its managers generating an ade

> The Tabor Sales Company had a gross profit margin (gross profits, sales) of 30 percent and sales of $9 million last year. Seventy-five percent of the firm’s sales are on credit, and the remainder are cash sales. Tabor’s current assets equal $1.5 million;

> The D. A. Winston Corporation earned an operating profit margin of 10 percent based on sales of $10 million and total assets of $5 million last year. a. What was Winston’s total asset turnover ratio? b. During the coming year, the company president has s

> Because preferred stock dividends in arrears must be paid before common stock dividends, should they be considered a liability and appear on the right-hand side of the balance sheet?

> The balance sheet and income statement for the A. Thiel Mfg. Company are as follows: Balance Sheet………………………………………………………. ($000) Cash …………………………………………….………………………...$ 500 Accounts receivable…………………………………………………. 2,000 Inventories ……………………………………………………………..