Question: A major shareholder of Systems Unlimited Inc.,

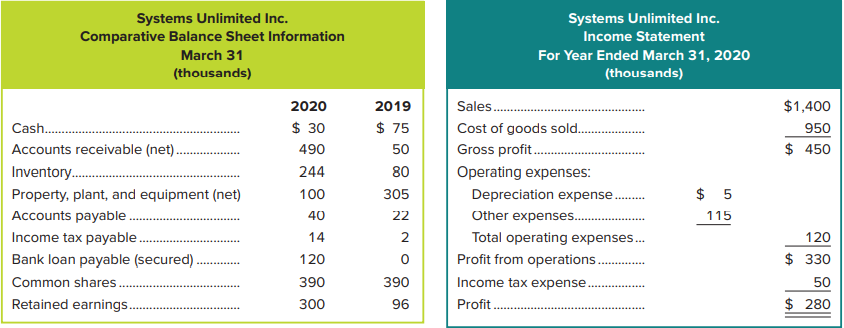

A major shareholder of Systems Unlimited Inc., Phil Wang, is perplexed. The 2020 income statement showed a healthy profit of $280 thousand. Yet, when Linda Lewis, the bank manager and a friend of Phil’s, called to let him know that the bank had just reviewed the March 31, 2020, statements, she had said, “Phil, I just wanted to give you a heads-up. We’re extremely concerned about the message your 2020 statement of cash flows is sending. We may have to call in the secured loan unless the new company manager, Martha Shewart, has some reasonable explanations. I’m phoning her next.â€

When asked, Martha Shewart says, “That’s correct, Linda. We sold some of the unsecured manufacturing equipment. It cost $245 thousand and we got $150 thousand. No, it didn’t go for book value; we incurred a loss of $50 thousand ... where on the income statement? It’s in Other expenses. Don’t worry, Linda, a friend of mine, Ronald Trump, is going to sell us cheaper equipment. It’s on order. I signed the contract and it will be delivered in April.†After the conversation, Martha Shewart slams the phone down and thinks, “I own 20% of the shares in this company; how dare anybody question my actions?!â€

Required

1. Prepare a statement of cash flows (applying the indirect or direct method)* for the year ended March 31, 2020.

2. Using the elements of critical thinking described on the inside front cover, identify and discuss the problem, goal, facts, and conclusion, while keeping in mind that it is best not to jump to conclusions.

> Mercedes Boats borrowed $220,000 on September 15, 2020, for 45 days at 7% interest by signing a note. 1. On what date will this note mature? 2. How much interest expense is created by this note? 3. Prepare the journal entries for September 15, 2020, and

> Snowbot Snow Removal Company of Halifax purchased some snowplow equipment on March 10, 2020, that had a cost of $150,000 (ignore GST/PST). Show the journal entries that would record this purchase and payment under these three separate situations: a. The

> Assume Pebble Inc. on October 15 purchased $2,500 of merchandise on credit. The next day, it recorded sales of $1,700; cost of sales was $1,200. Record the October 15 and October 16 entries assuming each of the geographical areas noted in Exhibit 10.6. A

> The following items appear on the balance sheet of Crunched Auto Body Repair Shop, which has a 12-month operating cycle. Identify the proper classification of each item. In the space beside each item write a C if it is a current liability, an L if it is

> On July 1, 2019, Alleya Amrick and Breanne Balas formed a partnership to make crafts and sell them online. Net Income during the year was $410,000 and was in the Income Summary account. On July 1, 2020 Calla Cameron invested $123,000 and was admitted to

> Nova Scotia Telecom Company had a truck that was purchased on July 7, 2018, for $36,000. The PPE subledger shows the following information regarding the truck: A customized tool carrier was constructed and permanently fitted to the truck on July 3, 2020,

> Jessica Grewal decided to open a food truck business, the Samosa Shack. She encountered the following transactions in managing her equipment over the first 2 years of her business. Record all the entries for the 2 years that Jessica owned the truck, incl

> Montalvo Bionics showed the following alphabetized unadjusted trial balance at April 30, 2020: Other information: a. All accounts have normal balances. b. The furniture was depreciated using the straight-line method and had a useful life of five years an

> Huang Resources showed the following alphabetized adjusted trial balance at October 31, 2020: Other information: a. All accounts have normal balances. b. $38,000 of the note payable is due after October 31, 2021. Required: Prepare a classified balance sh

> On September 5, 2020, Nelson Lumber purchased timber rights in Northern Quebec for $432,000, paying $96,000 cash and the balance by issuing a non-current note. Logging the area is expected to take three years, and the timber rights will have no value aft

> Jazzy Antiques purchased the copyright on a watercolour painting for $177,480 on January 1, 2020. The copyright legally protects its owner for 19 more years. However, Jazzy plans to market and sell prints of the original for the next 12 years only. Prepa

> On January 2, 2020, Direct Shoes Inc. disposed of a machine that cost $96,000 and had been depreciated $50,450. Present the journal entries to record the disposal under each of the following unrelated assumptions: a. The machine was sold for $44,500 cash

> On November 3, 2020, Gamez 2 Go Media exchanged an old computer for a new computer that had a list price of $190,000. The original cost of the old computer was $150,000 and related accumulated depreciation was $65,000 up to the date of the exchange. Game

> On October 6, 2020, Western Farms Co. traded in an old tractor for a new one, receiving a $68,000 trade-in allowance and paying the remaining $170,000 in cash. The old tractor cost $202,000, and straight-line depreciation of $111,000 had been recorded as

> Candy Craze purchased and installed a machine on January 1, 2020, at a total cost of $296,800. Straight-line depreciation was taken each year for four years, based on the assumption of a seven year life and no residual value. The machine was disposed of

> Conway, Kip, and Zack are partners of Force, a local cross-fit training facility with capital balances as follows: Conway, $367,200; Kip, $122,400; and Zack, $244,800. The partners share profit and losses in a 1:2:1 ratio. Young is admitted to the partne

> Macho Taco sold a food truck on March 1, 2020. The accounts showed adjusted balances on February 28, 2020, as follows: Food Truck $42,000 Accumulated Depreciation, Food Truck 21,850 Required Record the sale of the food truck assuming the cash proceeds we

> Kane Biotech was preparing the annual financial statements and, as part of the year-end procedures, assessed the assets and prepared the following alphabetized schedule based on adjusted values at December 31, 2020: Required 1. Record any impairment los

> At its December 31, 2019, year-end, Athletic Apparel had a warehouse with an adjusted book value of $292,500 and an estimated remaining useful life of 15 years and residual value of $90,000. Because of pick-up and delivery issues at the warehouse, a cont

> On April 3, 2020, David’s Chocolates purchased a machine for $71,200. It was assumed that the machine would have a five-year life and a $15,200 trade-in value. Early in January 2023, it was determined that the machine would have a seven-year useful life

> The Hilton Skating Club used straight-line depreciation for a used Zamboni ice-resurfacing machine that cost $43,500, under the assumption it would have a four-year life and a $5,000 trade-in value. After two years, the club determined that the Zamboni s

> On April 1, 2020, Ice Drilling Co. purchased a trencher for $125,000. The machine was expected to last five years and have a residual value of $12,500. Required: Calculate depreciation expense for 2020 and 2021 to the nearest month, using (a) the straigh

> Design Pro purchased on October 1, 2019, $110,000 of furniture that was put into service on November 10, 2019. The furniture will be used for five years and then donated to a charity. Complete the schedule below by calculating annual depreciation for 201

> VanHoutte Foods bought machinery on September 10, 2018, for $168,000. It was determined that the machinery would be used for six years or until it produced 260,000 units and then would be sold for about $27,600. Complete the schedule below by calculating

> Kenartha Oil recently paid $483,900 for equipment that will last five years and have a residual value of $114,000. By using the machine in its operations for five years, the company expects to earn $180,000 annually, after deducting all expenses except d

> Refer to Exercise 9-10. Assume that the only other assets at December 31, 2019, were total current assets of $338,000. Prepare the asset section of Dynamic Exploration’s classified balance sheet at December 31, 2019. Data from Exercise

> Jobs, Alford, and Norris formed the JAN Partnership to provide landscape design services in Edmonton, by making capital contributions of $150,000, $100,000, and $250,000, respectively, on January 7, 2020. They anticipate annual profit of $240,000 and are

> At December 31, 2019, Dynamic Exploration’s balance sheet showed total PPE assets of $802,000 and total accumulated depreciation of $339,980 as detailed in the PPE subledger below. Dynamic calculates depreciation to the nearest whole mo

> On January 1, 2020, Creative Calligraphy Inc. purchased land, building, equipment, and tools for a total of $2,520,000. An appraisal identified the fair values to be $700,000 (land), $1,120,000 (building), $210,000 (equipment), and $70,000 (tools). The e

> On January 3, 2020, Xenex Innovations purchased computer equipment for $125,250. The equipment will be used in research and development activities for five years or a total of 8,500 hours and then sold for about $19,000. Prepare a schedule with headings

> Jackal Energy purchased a transport truck on January 1, 2020, for $305,200 cash. Its estimated useful life is five years or 320,000 kilometres with an estimated residual value of $52,400. Required Calculate depreciation expense for the year ended Decembe

> On January 2, 2018, Archer Company, a skateboard manufacturer, installed a computerized machine in its factory at a cost of $150,200. The machine’s useful life was estimated at four years or a total of 186,000 units with a $20,000 trade

> On January 1, 2020, Land’s End Construction purchased a used truck for $52,500. A new motor had to be installed to get the truck in good working order; the costs were $21,000 for the motor and $7,500 for the labour. The truck was also painted for $6,000.

> Paul, Frank, and Basil formed Fresh, a greenhouse and garden centre business, 10 years ago, and Paul is about to retire. Paul is not experienced in financial accounting, but knows, based on the partnership agreement, that he is entitled to one-third of p

> Mike Li is a sales manager for an electric car dealership in Alberta. Mike earns a bonus each year based on revenue generated by the number of vehicles sold in the year less related warranty expenses. The quality of electric cars sold each year seems to

> Marcia Diamond is a small business owner who handles all the books for her business. Her company just finished a year in which a large amount of borrowed funds were invested into a new building addition as well as numerous equipment and fixture additions

> In your position as controller of Flashy Inc., a video production company, you are responsible for keeping the board of directors informed about the financial activities and status of the company. At the board meeting, you present the following report: A

> Bosch and Gilbert are in the process of forming a golf course equipment maintenance company. Bosch will contribute one-third time and Gilbert will work full time. They have discussed the following alternative plans for sharing profit and losses. a. In th

> Wendy Cramer is working late on a Friday night in preparation for a meeting with her banker early Monday morning. Her business is just finishing its fourth year. In Year 1, the business experienced negative cash flows from operations. In Years 2 and 3, c

> Jack Phelps is the controller for Jayhawk Corporation. Jayhawk has a corporate policy of investing idle cash in non-strategic investments. About 18 months ago, the company had significant amounts of idle cash and invested in 16%, 10-year Delta Inc. bonds

> A few years ago, politicians needed a new headquarters building for their municipal government. The price tag for the building approached $24 million. The politicians felt that the voters were unlikely to approve a bond issue to raise money for the headq

> JenStar’s management team has decided that its income statement would be more useful if depreciation were calculated using the straight-line method instead of the double-declining balance method. This change in accounting policy adds $156,000 to income

> Jack and Bill are partners in a computer software company. They developed a word processing program that is remarkably similar to a Corel product. Jack telephones Bill at home one evening and says, “We should convert our partnership into a corporation be

> Jones Inc. needs $100,000 to finance the purchase of new equipment. The finance manager is considering two options: 1. Borrowing the funds over a five-year term and paying interest at the rate of 6% per year, or 2. Issuing 6,000 shares of $1 cumulative p

> Josh and Ben Shaw are brothers. They each have $75,000 to invest in a business together: Northern Canadian Extreme Adventures. They estimate that an additional $200,000 is required to get the business operating but have yet to determine how to get this a

> Selected information taken from the December 31, 2020, financial statements for Mesa Company is shown below for the year just ended: The accountant was not sure about how to handle a few transactions and has listed the details here. Inventory Purchased $

> Two years ago, on March 1, 2018, General Recycling Management Systems purchased five used trucks and debited the Trucks account for the total cost of $180,000. The estimated useful life and residual value per truck were determined to be five years and $5

> You are the new human resources manager and are reviewing the bonus policies as part of familiarizing yourself with the payroll system. The plant superintendent’s bonus is calculated as the return on total assets ratio for the year time

> Phung, Moier, and Lister invested $130,000, $150,000, and $120,000, respectively, into an organic farm to restaurant distribution business. During its first year, the firm earned $25,000. Required: Prepare entries to close the firm’s Income Summary accou

> You are the chair of the board of CT Inc., a Canadian-based multinational corporation, which has excess cash totalling $75 million. The company is interested in investing some or all of this in Delmar Corp., one of CT’s key suppliers. T

> 5-Star Adventures Inc. financed its $1,000,000 expansion by issuing on January 1, 2020, a 5%, 10-year bond dated the same day with annual interest payments to be made each December 31. The market interest rate at the time of issue was 7%. Assume that you

> CanaCo showed the following equity on its December 31, 2020, balance sheet: The shareholders of CanaCo expressed concerns to the board of directors at the recent annual meeting that the market price of their shares has not changed significantly over the

> What is the difference in how to account for land and land improvements?

> What are some examples of items to include in the cost of a property, plant, and equipment purchase?

> What is the balance sheet classification of land held for future expansion? Why is the land not classified as property, plant, and equipment?

> What characteristics of a property, plant, and equipment item make it different from other assets, such as accounts receivable or inventory?

> Refer to the financial statements for Spin Master and calculate the percentage change in non-current liabilities from December 31, 2016 to December 31, 2017.

> Refer to the financial statements for Spin Master and calculate the percentage change in revenue from December 31, 2016, to December 31, 2017.

> Zest Company is a Montreal HR firm. Its condensed income statement for the year ended November 30, 2020, is shown below. The liabilities reported on the November 30, 2020, balance sheet were: Accounts payable $ 26,230 Mortgage payable 328,698 Total lia

> What is the difference between comparative financial statements and common-size comparative statements?

> Refer to the financial statements for WestJet and calculate the percentage change in sales and marketing expenses from 2016 to 2017.

> Refer to the financial statements for WestJet and calculate the percentage change in total revenues from 2016 to 2017.

> What ratios would you calculate for the purpose of evaluating management performance?

> Why would a company’s return on total assets be different from its return on common shareholders’ equity?

> Why must the ratio of pledged assets to secured liabilities be interpreted with caution?

> Why is the capital structure of a company, as measured by debt and equity ratios, of importance to financial statement analysts?

> What information does the inventory turnover provide about a company’s short-term liquidity?

> What is the significance of the inventory of days’ sales uncollected?

> What does a relatively high accounts receivable turnover indicate about a company’s short-term liquidity?

> Sask Tractor borrowed $320,000 to purchase inventory on September 17, 2020 for 60 days at 6% interest by signing a note. On December 6, 2020, Sask Tractor sold a tractor for cash of $24,000 (cost $15,400) with a two-year parts and labour warranty. Based

> Which two ratios are the basic components in measuring a company’s operating efficiency? Which ratio summarizes these two components?

> Explain the difference between financial reporting and financial statements.

> On June 3, a company borrowed $50,000 by giving its bank a 60-day, interest-bearing note. On the June 30 statement of cash flows, where should this item be reported?

> Is depreciation an outflow of cash? Explain.

> Explain why non-cash expenses and losses are added to profit in calculating cash provided by operating activities using the indirect method.

> Refer to WestJet’s statement of cash flows. a. Which method was used to calculate net cash provided by operating activities? b. WestJet has two off-balance-sheet arrangements. What are they?

> If a company reports a profit for the year, is it possible for the company to show a net cash outflow from operating activities? Explain your answer.

> Describe the indirect method of reporting cash flows from operating activities.

> Describe the direct method of reporting cash flows from operating activities.

> What are cash equivalents and why are they included with cash when preparing a statement of cash flows?

> Appleton Electronics Company purchases merchandise inventory from several suppliers. On October 1, 2020, Appleton Electronics purchased from Digital Wiring $40,000 of inventory on account. On November 10, 2020, Appleton Electronics sold inventory to Disc

> Fab-Form Industries completed the following transactions involving the purchase of delivery equipment. Required: Prepare journal entries to record the transactions.

> The chapter-opening vignette indicated that Calvin Su follows the cash flow of his business very closely. Why do you think it is imperative for business owners to strictly manage their cash resources?

> Explain how cost of goods sold is converted from an accrual basis to a cash basis for use in the direct method.

> Explain how sales are converted from an accrual basis to a cash basis for use in the direct method.

> When a statement of cash flows is prepared by the direct method, what are some examples of items reported as cash flows from operating activities?

> Refer to Spin Master’s statement of cash flows. What activity comprised the largest financing activity resulting in cash outflows for the year ended December 31, 2017?

> Refer to Spin Master’s balance sheet. First, find the Cash balances on December, 2016, and December 31, 2017, and calculate the change in Cash. Next, refer to Spin Master’s statement of cash flows and identify the change in Cash reported for the year end

> Refer to Indigo’s statement of cash flows. What activity comprised Indigo’s cash outflows from financing activities for the fiscal year ended 2017?

> What are some examples of items reported on a statement of cash flows as financing activities?

> A company purchases land for $100,000, paying $20,000 cash and borrowing the remainder on a long-term note payable. How should this transaction be reported on a statement of cash flows?

> What are some examples of items reported on a statement of cash flows as investing activities?

> Africa Safari is a tour business that operates from about April to October each year. The company has an outstanding reputation for the quality of its tours and as a result pre-books customers a full year in advance. Customers must pay 40% at the time of

> What is the purpose and importance of a statement of cash flows to business decision making?

> Using the equity method, dividends received are not recorded as profit. Explain why this is true.

> When share investments are accounted for using the equity method, when should investment income be recognized? What accounts are debited and credited?

> In accounting for common share investments, when should the equity method be used?

> When non-strategic debt investments are accounted for using the amortized cost method, when should interest income be recognized?

> When non-strategic investments are accounted for using the fair value method, when should investment income be recognized?

> Is the FVTPL category used when management plans to hold investments to maturity or if they plan to actively trade the debt investments?