Question: A sample audit report is provided in

A sample audit report is provided in figure 1.3 in this chapter. A sample review engagement report is provided in figure 1.4.

Required:

a. What is the auditor’s responsibility as determined in the audit report?

b. Find the lines in the audit report that express the auditor’s opinion. Is it an unqualified or modified audit opinion?

c. Find the lines in the review report that express the auditor’s conclusion. Is it an audit opinion? Is it

a positive or negative statement?

d. Make a list of the other differences between the audit report and the review report.

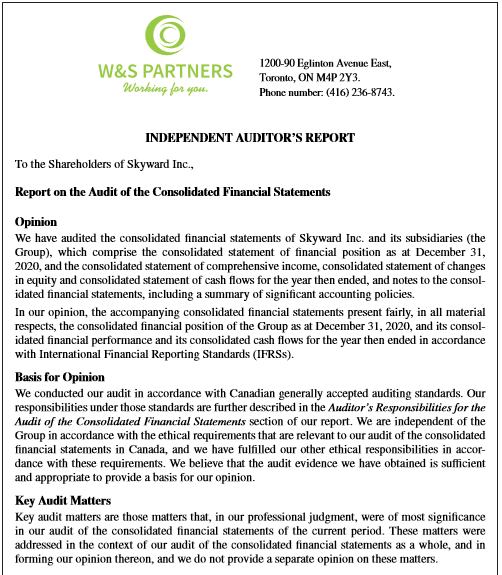

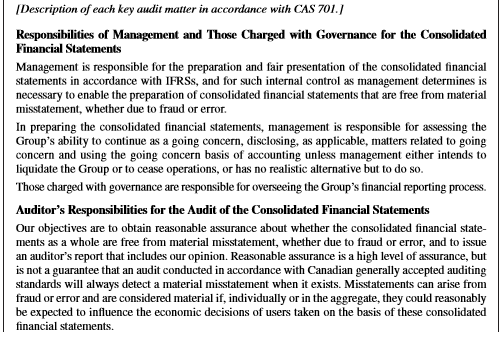

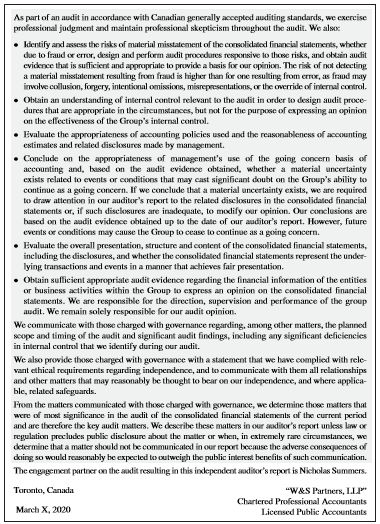

Figure 1.3:

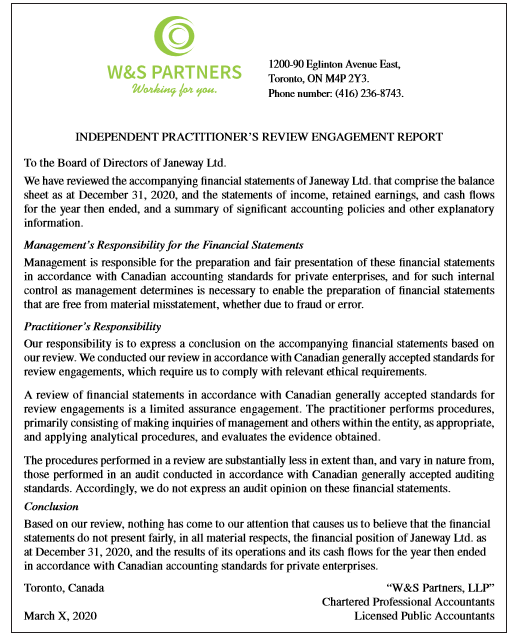

Figure 1.4:

Transcribed Image Text:

W&S PARTNERS Working for you. 1200-90 Eglinton Avenue East, Toronto, ON M4P 2Y3. Phone number: (416) 236-8743. INDEPENDENT AUDITOR'S REPORT To the Shareholders of Skyward Inc., Report on the Audit of the Consolidated Financial Statements Opinion We have audited the consolidated financial statements of Skyward Inc. and its subsidiaries (the Group), which comprise the consolidated statement of financial position as at December 31, 2020, and the consolidated statement of comprehensive income, consolidated statement of changes in equity and consolidated statement of cash flows for the year then ended, and notes to the consol- idated financial statements, including a summary of significant accounting policies. In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Group as at December 31, 2020, and its consol- idated financial performance and its consolidated cash flows for the year then ended in accordance with International Financial Reporting Standards (IFRSS). Basis for Opinion We conducted our audit in accordance with Canadian generally accepted auditing standards. Our responsibilities under those standards are further described in the Auditor's Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are independent of the Group in accordance with the ethical requirements that are relevant to our audit of the consolidated financial statements in Canada, and we have fulfilled our other ethical responsibilities in accor- dance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. Key Audit Matters Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the consolidated financial statements of the current period. These matters were addressed in the context of our audit of the consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters. (Description of each key audit matter in accordance with CAS 701.J Responsibilities of Management and Those Charged with Governance for the Consolidated Financial Statements Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with IFRSs, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. In preparing the consolidated financial statements, management is responsible for assessing the Group's ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Group or to cease operations, or has no realistic alternative but to do so. Those charged with governance are responsible for overseeing the Group's financial reporting process. Auditor's Responsibilities for the Audit of the Consolidated Financial Statements Our objectives are to obtain reasonable assurance about whether the consolidated financial state- ments as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Canadian generally accepted auditing standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated financial statements. As part of an audit in accordance with Canadian generally accepted auditing standards, we exercise professional judgment and maintain professional skepticism throughout the audit. We also • kdentify and assess the risks of malerial misstatement of the consolidated financial statements, whether due to fraud or error, design and perform audit procedures respoNIsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a hasis for our opinion. The risk of not detecting a material misstalement resulting from frand is higher than for one resulting from error, as frand may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. • Obtain an understanding of internal control relevant to the audit in order to design audit proce- dures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Group's internal control. • Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management. • Conclude on the appropriateness of management's use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Group's ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor's report to the related disclosures in the consolidated financial statements or, if such disckosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor's report. However, future events or conditions may cause the Group to cease to continue as a going concern. • Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether the consolidated financial statements represent the under- lying transactions and events in a manner that achieves fair presentation. • Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Group to express an opinion on the consolidated financial statements. We are responsible for the direction, supervision and performance of the group audit. We remain solely responsible for our audit opinion. We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit. We also provide those charged with governance with a statement that we have complied with rele- vant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applica- ble, related safeguards. From the matters communicated with those charged with governance, we determine those matters that were of most significance in the audit af the consolidated financial statements of the current pericxd and are therefore the key audit matters. We describe these matters in our anditor's report unkess law or regulation precludes public disclasure about the matter ar when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of dking so woukd reasonably be expected to cutwcigh the public interest benefits of such communication. The engagement partner on the audit resulting in this independent anditor's report is Nicholas Summers. Taronto, Canada "W&S Partners, LLP" Charlered Professional Accountants March X, 2020 Licensed Public Accountants W&S PARTNERS Working for you. 1200-90 Eglinton Avenue East, Toronto, ON M4P 2Y3. Phone number: (416) 236-8743. INDEPENDENT PRACTITIONER'S REVIEW ENGAGEMENT REPORT To the Board of Directors of Janeway Ltd. We have reviewed the accompanying financial statements of Janeway Ltd. that comprise the balance sheet as at December 31, 2020, and the statements of income, retained earnings, and cash flows for the year then ended, and a summary of significant accounting policies and other explanatory information. Management's Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with Canadian accounting standards for private enterprises, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. Practitioner's Responsibility Our responsibility is to express a conclusion on the accompanying financial statements based on our review. We conducted our review in accordance with Canadian generally accepted standards for review engagements, which require us to comply with relevant ethical requirements. A review of financial statements in accordance with Canadian generally accepted standards for review engagements is a limited assurance engagement. The practitioner performs procedures, primarily consisting of making inquiries of management and others within the entity, as appropriate, and applying analytical procedures, and evaluates the evidence obtained. The procedures performed in a review are substantially less in extent than, and vary in nature from, those performed in an audit conducted in accordance with Canadian generally accepted auditing standards. Accordingly, we do not express an audit opinion on these financial statements. Conclusion Based on our review, nothing has come to our attention that causes us to believe that the financial statements do not present fairly, in all material respects, the financial position of Janeway Ltd. as at December 31, 2020, and the results of its operations and its cash flows for the year then ended in accordance with Canadian accounting standards for private enterprises. Toronto, Canada "W&S Partners, LLP" Chartered Professional Accountants March X, 2020 Licensed Public Accountants

> Explain how compliance with the fundamental principles in the code of professional conduct contributes to the ability of the auditor to discharge their duty to act in the public interest.

> Explain the system of reviewing the quality of audits performed by listed company auditors.

> Describe the audit expectation gap. What causes the gap?

> What are the auditor’s responsibilities?

> What is an emphasis of matter paragraph? When do you think an auditor would use it?

> What does reasonable assurance mean?

> Are internal auditors independent? Which internal auditor would be more independent: an internal auditor who reports to the chief financial officer (CFO) of the company, or an internal auditor who reports to the audit committee?

> Who would request a performance audit? Why?

> Identify and discuss any professional conduct issues in the following independent scenarios. a. Adnan Hussein is a CPA working for a national firm. He is at his desk when he overhears his colleague Joan having a phone conversation. She is telling the per

> What are the limitations of an audit?

> Compare the financial statement users and their needs for a large listed public company with those of a sports team (for example, a football team).

> The global financial crisis led to increasing legal action against auditors as company managers searched for scapegoats and potential places to recover their losses. The tough economic times also likely caused companies that would otherwise have survived

> The audit of short-term investments can be a high-risk area for auditors. A case in Australia (AWA Ltd v. Daniels t/a Deloitte Haskins & Sells & Ors (1992) 10 ACLC 933) found the auditors negligent for failing to report weaknesses in the foreign exchange

> Consider the following statement: The audit of inventory is one of the riskiest areas of the audit. Management can manipulate the value of inventory through a variety of methods, such as through varying the provision for obsolescence or the method of val

> A generally accepted definition of earnings management is the planned timing of revenues, expenses, gains, and losses to smooth out earnings over a number of accounting periods. Generally speaking, earnings management is used to increase income in the cur

> In the early 2000s, several large corporations such as Enron, WorldCom, and Nortel collapsed because of corporate greed, bad business practices, and accounting irregularities. Others, such as Bristol-Myers Squibb, Xerox, and Harris Scarfe, were forced to

> The financial statements for public companies are available through the website SEDAR (www.sedar.com). This is the official site that provides access to information filed by public companies and investment funds with the CSA. The statutory objective in m

> Bernard Madoff was convicted in 2009 of running a Ponzi scheme, the biggest in U.S. history. A Ponzi scheme is essentially the process of taking money from new investors on a regular basis and using the cash to pay promised returns to existing investors.

> One way of getting accounting expertise onto audit committees is to recruit ex-audit firm partners and/or employees onto the board of directors. However, appointing former audit firm partners to boards and audit committees raises independence concerns, a

> You are a recently designated accountant. As a result of having your designation, you have been hired as the controller at a national manufacturing company. Due to a recent economic slowdown, the company has been struggling to meet earnings targets. Thes

> Required: Access the CPA Canada Handbook and locate the following: a. What number is the CAS for audit documentation? b. How many sections are there to each CAS? c. What is the name of CSAE 3000? d. What numbers relate to review engagements? e. Where spe

> Chong and Pflugrath conducted a study of different audit report formats and their effects on the audit expectation gap. They investigated whether report length (long or short), the location of the audit opinion (at the start or the end), and plain langua

> For each of the following statements identify the audit assertion to which it relates: a. All cash transfers are recorded in the correct period. b. All investment gains are recorded in the correct amount. c. All cash inflows are recorded. d. The line of c

> Your firm of accountants is the auditor of Oxford Ltd., a reporting entity. Oxford’s consolidated financial statements incorporate the financial statements of its four subsidiaries. Three subsidiaries are incorporated in Canada and audited by your firm. The

> You are performing the audit of Toledo Ltd. for the financial year ended December 31, 2020. Under the terms of a major loan contract, Toledo is required to maintain certain financial ratios. If the ratios are breached, then the loan is immediately due for

> Ingrid Shalansky, an audit senior, was given the task of auditing Crabapple Ltd., an investment company. Her firm had not performed the audit before; however, from a discussion with the previous year’s auditors, she found out that the following transactio

> Your firm is the auditor of Zhao’s Charity for Pensioners. The charity was formed many years ago from a large gift by the Zhao family, the income from which is used to pay pensions to needy people. The original gift has been invested in

> Your firm is the auditor of Trojan Trading Ltd. The audited financial statements for the year ended December 31, 2020, show the company’s revenue was $5 million and the profit before tax was $320,000. The part of the working papers that records audit work o

> Mathias Co. sells cars, car parts, and gasoline from 25 different locations in one country. Each branch has up to 20 staff working there, although most of the accounting systems are designed and implemented from the company’s head office. All accounting syst

> You have been asked by the financial controller, Walid Hossain, of Potter Ltd. to carry out an investigation of a suspected fraud by the company’s cashier. The cashier, Alfred Blyton, has left the firm without notice. Potter is a small company, and there w

> IndaCar Inc. (IC) operates a high-end car rental agency that specializes in the rental of unique vehicles and is located next to Lester B. Pearson International Airport in Toronto. IC is a private Canadian company that is wholly owned by Jake Bouvier. Da

> Your firm is the auditor of Thai Textiles Ltd. and you are auditing the financial statements for the year ended June 30, 2020. The company has sales of $2.5 million and a before-tax profit of $150,000. The company has supplied you with the following bank re

> Shiny Happy Windows Co. (SHW) is a window cleaning company. Customers’ windows are cleaned monthly and the window cleaner then posts a stamped addressed envelope for payment through the customer’s front door. SHW has a large number of receivable balances

> You have spent two years working as an auditor. In that time, you have come across a number of errors in performing bank reconciliations. Outlined below are some of them: 1. An un reconciled item of $340 was on the client’s final bank reconciliation and w

> You are an audit senior performing the audit of Stella’s Stars Ltd., a talent agency. In performing the audit, Stella informs you of the following: 1. She does not want you to send the bank a confirmation because she objects to the cost and feels that the

> In 2002 the audit firm Arthur Andersen collapsed following charges brought against it in the United States relating to the failure of its client, Enron. Some other clients announced that they would be dismissing Arthur Andersen as their auditor before it

> Bravo Bags is a luggage retailer that operates out of a shopping mall. As required by the landlord, Bravo Bags has hired Brad Pope, CPA, to provide a report to the landlord as to whether Bravo Bags has met the requirements of its lease agreement in terms

> You are the audit manager of Currant & Co and you are planning the audit of Orange Financials Co (Orange), who specialize in providing loans and financial advice to individuals and companies. Currant & Co has audited Orange for many years. The directors

> Required: a. Identify and explain the potential type of threat to Fellowes and Associates’ independence in situations (1) and (2) above. b. What action should Fellowes and Associates take to eliminate the potential threats to independence in situations (

> Explain why Tania Fellowes should have reservations about accepting the HCHG engagement to provide an opinion with respect to the laser machines. Make appropriate reference to fundamental ethical principles in your answer.

> Charles is at a neighborhood party with several of his roommates. Over a few beers, Charles gets into a conversation with a neighbor, William, about mutual acquaintances. Charles is a senior auditor with a large accounting firm (although he tells William

> Auto Care Ltd. (ACL) is a federally incorporated public company formed in 2014 to manufacture and sell specialty auto products such as paint protection and rust proofing. By 2018, ACL’s board of directors felt that the companyâ

> Salt & Pepper & Co is a firm of Chartered Professional Accountants that has seen its revenue decline steadily over the past few years. The firm is looking to increase its revenue and client base and so has developed a new advertising strategy. It is guar

> Roy Dussault is a CPA who started a sports equipment importing business. The business became very successful and he sold it to his neighbour. As part of the sale agreement, Roy agreed to perform an audit of the financial statements for the first year at

> HHH Corporation manufactures automobile engines. In 2018, the treasurer at HHH decided to invest the company’s surplus funds in the commodities market. She intended for it to be a short-term investment, as the company had $1 million in extra funds that w

> Ahmad & Partners is a public accounting firm in eastern Canada. Last year, it audited Chan Corporation, a publicly traded company that manufactures automobile component parts. Although the company has been profitable for many years, Ahmad & Partners was

> Legal implications of client acceptance Moderate LO 4, 5 Godwin, Key & Associates is a small but rapidly growing audit fi rm. Its success is largely due to the growth of several clients that have been with the firm for more than five years. One of these

> Theobald Ltd. has an internal audit department that primarily focuses on audits of the efficiency and effectiveness of its production departments. The other main role of the internal audit department is auditing compliance with various government regulat

> You have recently graduated from university and have started work with an audit firm. You meet an old school friend, Kim, for dinner—you haven’t seen each other for several years. Kim is surprised that you are now working as an auditor, because your chil

> Certek Technologies Inc. is a biotechnology company whose stock traded on a major Canadian stock exchange. Over the 22 months following its initial public offering in May 2009, Certek’s stock rose an astounding 1,350 percent. In mid-March 2000, Certek’s

> Securimax Limited has been an audit client of KFP Partners for the past 15 years Securimax is based in Waterloo, where it manufactures high-tech armour-plated personnel carriers. Securimax often has to go through a competitive market tender process to w

> Cool Look Limited (CLL) is a high-end clothing design and manufacturing company that has been in business in Canada since 1964. CLL started as an owner-managed enterprise created and run by Hector Gauthier. Its ownership has stayed within the family, and

> The accounting firm of Aschari and Di Tomaso was engaged to perform an audit of the financial statements of Pammenter Inc. During the audit, Pammenter’s senior managers refused to give the auditors the information they needed to confirm any of the accoun

> Linda is the managing partner of Osuji and Associates, a small audit firm. Linda’s role includes managing the business affairs of the firm, and she is very worried about the amount of fees outstanding from audit clients. One client, Dreamers Ltd., has no

> DDD Motor Sales Inc. is privately owned. It wants to expand its business and has approached its bank for a loan. DDD wants the funds to purchase additional inventory and will be able to provide excellent security to the bank. The bank has agreed that, si

> Fellowes and Associates Chartered Professional Accountants is a successful national accounting firm with a large range of clients across Canada. In 2020, Fellowes and Associates gained a new client, Health Care Holdings Group (HCHG), which owns 100 perce

> Required: Discuss the expectation gap that could exist for the audit of Securimax. Consider the existence of any special interests of the users of Securimax’s financial statements.

> What is a review engagement? Why would a review be appropriate for a set of financial statements for Securimax?

> Most audit firms maintain a website that explains the services offered by the firm and provides resources to their clients and other interested parties. The services offered by most firms include both audit and non-audit services. Required: a. Find the

> In connection with your examination of the financial statements of Martinson Inc. for the year ended December 31, your post–balance sheet date audit procedures disclosed the following items: 1. January 5: The funds for a $50,000 loan to the corporation ma

> Martin Rorke is reviewing the results of the review of subsequent cash receipts. There are several receipts listed from customers that were considered doubtful at the end of the year (June 30). Martin is also reviewing evidence that shows that another cu

> Brad Gokool is reviewing the results of the subsequent events audit procedures. Brad is writing a report for his audit partner based on these results and will be attending a meeting tomorrow with the partner and representatives of the company to discuss

> You are the audit senior of Ball Construction Corporation (BC), a small public company that enters into construction contracts with individuals and developers and builds to their specifications. BC is a Canadian company, but recently opened a branch in th

> Sharon Gallagher, Josh Thomas, and Jo Wadley are members of the audit firm W&S Partners. Sharon is the audit manager and Josh is the audit senior assisting the partner, Jo, evaluate the decision to accept the Cloud 9 Ltd. audit engagement for the year en

> Mitch Ziegel and Rosie Punter are discussing the audit plan for a large manufacturing company. The company has two main manufacturing plants plus several warehouse and distribution centres (one in each province). The company has a large investment in tra

> Springsteen Ltd. is a new audit client for the 2020 financial year. Springsteen’s financial statements for the 2019 year, the last with the previous auditor, were prepared on the assumption of a going concern. An unmodified audit opinion with a going concer

> Manitoba Metal Fabricators (MMF) is a company that makes steel components for the construction industry. It specializes in extreme precision manufacturing where tolerances are measured in distances of less than one millimetre. Its products are used in re

> Phil Nanere is the partner in charge of the audit for a new client, Western Wonderland (WW). The client engaged Phil’s audit firm in November 2019, in preparation for the 2020 audit. From January 30, 2020, onwards, WW has consistently paid its suppliers l

> You, a recently designated CPA, have agreed to serve on a committee that is organizing a sports adventure race as a fundraiser for Far West Camp, a camp for teenagers from all economic backgrounds. Far West Camp has obtained support from two sponsors tha

> Beautiful Shoes Inc. is a high-end ladies’ shoe store. It has recently expanded its operations and signed a long-term lease in a popular shopping centre. The owner, Beverly Hung, is concerned because the lease agreement requires that she submit to the la

> For each of the following situations, indicate what type of modification/audit report is most appropriate. a. There is a scope limitation and it is material. However, the overall financial statements are still presented fairly. b. There is a departure from

> a. Are there any going concern issues for HCHG? Explain. If so, what are the mitigating circumstances? b. How will you recommend that the issues be handled in the financial statements and the audit report?

> a. Explain your responsibilities with respect to the Shady Oaks cafeteria fire. b. How will this event be handled in the HCHG financial statements and the audit report?

> Based on your answer to question 13.13, explain what type of audit opinion you would issue. Why? Data from Question 13.13: Required: Analyze the events surrounding the sale of FH’s land and buildings. Is it a subsequent event? If so, which type?

> You are the audit senior in charge of the audit of Blackburn Ltd., and you are auditing the company’s trade creditors at December 31, 2020. A junior member of the audit team has been checking suppliers’ statements agai

> Analyze the events surrounding the sale of FH’s land and buildings. Is it a subsequent event? If so, which type?

> Steven Erasmus has had difficulties throughout the audit of Kingston Catering. The company is a long-standing client of the audit firm and there have been no problems in the past. However, four months into the start of the financial year, the company’s compu

> The staff at Nguyen and Partners have completed the necessary audit work for Manitoba Metal Fabricators. The partner responsible for the audit is now reviewing the audit file. She has come across the Schedule of Unadjusted Differences and is considering the

> Katrina Lukacs is the engagement partner of the audit of Champion Securities, an investment company. Most of Champion’s assets and liabilities are financial and their valuation is critical to the assessment of the company’s solvency and profitability. Katr

> Lucy Huang has just finished her first audit assignment. She is now assisting her audit manager, Tom Lucas, in wrapping up the engagement. He has asked Lucy to make a list of all un cleared review notes, to-do items, and audit procedures, and to note for e

> You are the auditor of John Benson Ltd, a manufacturer of a variety of paper and cardboard stationery products. Product lines range from everyday items that are low value but high volume to more expensive and specialized items that are produced for niche

> The auditor’s working paper for auditing inventory balances for the client New Millennium Eco products appears in Figure 11.3. It shows the details of the net realizable value (NRV) tests. Required: a. Why does an auditor test for NRV

> Stenton Toys Ltd. is a toy retailer with stores in each of the Canadian provinces. Stenton has a head office and a central warehouse in Mississauga, Ontario. All inventory purchases are made centrally and are held in the Mississauga warehouse; they are the

> You attended the inventory count of your client Davis Hydraulics Ltd. You observed the following during the count: 1. Warehouse staff counted specific areas of the inventory as determined by the warehouse supervisor; staff members, including the warehouse s

> Refer to Professional Application Question 11.4 regarding Lily Window Glass Co. Now assume that you are the audit senior of Daffodil & Co. and are responsible for the audit of inventory for Lily. You will be attending the year-end inventory count on Decem

> Greystone Co. is a retailer of women’s clothing and accessories. It operates in many countries around the world and has expanded steadily from its base in Canada. Its main market is 15- to 35-year-olds and its prices are mid to low range. The company’s y

> Lily Window Glass Co. (Lily) is a glass manufacturer that operates from a large production facility, where it undertakes continuous production 24 hours a day, seven days a week. Also on this site are two warehouses where the company’s raw materials and fi

> You are the auditor of Fenton Electronics Ltd., which has recently installed a computerized bar code system to record goods received, sales, and inventory quantities. The company is a retailer of electrical products. 1. When the goods are received, the r

> Key documents are used to record and maintain adequate inventory and property, plant, and equipment accounts. Required: For each of the following documents, describe its purpose and how it contributes to internal control over the related function: a. in

> Wear Wraith (WW) Co.’s main activity is the extraction and supply of building materials including sand, gravel, cement, and similar aggregates. The company’s year end is December 31 and your firm has audited WW for a n

> Your firm is the auditor of Day brook Insurance Brokers Ltd., which operates from a number of branches and provides insurance for the general public and businesses. The company obtains insurance from large insurance companies and takes a commission for it

> Pineapple Beach Hotel Co. (Pineapple) operates a hotel providing accommodation, leisure facilities, and restaurants. Its year end was April 30, 2020. You are the audit senior of Berry & Co. and are currently preparing the audit program for the year-end a

> A copy of the auditor’s working paper for auditing additions and disposals relevant to the balance of property, plant, and equipment (PPE) for the client New Millennium Eco products is presented in Figure 11.4. Required: a. What assert

> Your firm is auditing the financial statements of Newthorpe Manufacturing Ltd. for the year ended June 30, 2020. You have been assigned to the audit of the company’s property, plant, and equipment, which includes freehold land and buildings, plant and mach

> Securimax Limited has been an audit client of KFP Partners for the past 15 years. Securimax is based in Waterloo, Ontario, where it manufactures high-tech armour-plated personnel carriers. Securimax often has to go through a competitive market tender pro

> Your firm is responsible for auditing the financial statements of Hucknall Manufacturing Ltd. for the year ended November 30, 2020. The company operates from a single site. Its sales are $5 million and the profit before tax

> Blake Co. assembles specialist motor vehicles such as freight trucks, buses, and delivery trucks. The company owns four assembly plants where parts are delivered and assembled into the motor vehicles. The motor vehicles are assembled using a mix of robot

> For each of the following statements, identify the audit assertion that it relates to: a. Inventories are recorded at the lower of cost and net realizable value. b. There is no inventory on consignment. c. All asset additions during the year have been re

> You are the auditor of Sofasellers Ltd., which buys furniture from manufacturers for sale to the public. You have been asked to audit certain aspects of the computerized purchasing and accounts payable system. The company has a head office, a warehouse, an

> Lise Couture is documenting the purchasing and cash payments processes at Hardies Wholesaling. Hardies Wholesaling imports garden and landscaping items, such as pots, furniture, fountains, mirrors, and sculpture, from suppliers in Southeast Asia. All ite