Question: A year out of college, you have $

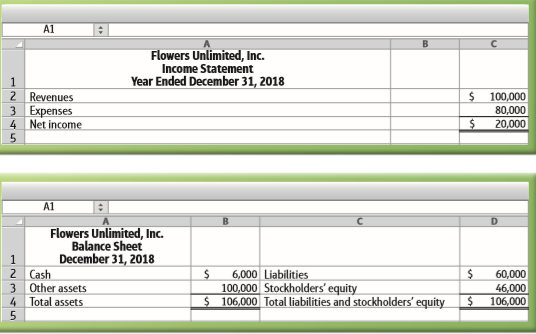

A year out of college, you have $10,000 to invest. A friend has started Flowers Unlimited, Inc., and he asks you to invest in his company. You obtain the company’s financial statements, which are summarized at the end of the first year as follows:

Visits with your friend turn up the following facts: a. Flowers Unlimited delivered $140,000 of services to customers during 2018 and collected $100,000 from customers for those services. b. Flowers Unlimited recorded a $50,000 cash payment for software as an asset. This cost should have been an expense. c. To get the business started, your friend borrowed $10,000 from his parents at the end of 2017. The proceeds of the loan were used to pay salaries for the first month of 2018. Because the loan was from his parents, your friend did not reflect the loan or the salaries in the accounting records.

Requirements :

1. Prepare corrected financial statements.

2. Use your corrected statements to evaluate Flowers Unlimited’s results of operations and financial position. (Challenge) 3. Will you invest in Flowers Unlimited? Give your reason. (Challenge)

> What amount does WestJet, in Appendix II, report as the current portion of long-term debt as at December 31, 2017? In what accounting period will this amount be paid?

> What are the three important questions concerning the certainty of liabilities?

> What is the difference between a current and a non- current liability?

> In the chapter-opening vignette, YVR refers to several capital initiatives that are underway. What types of construction costs can YVR capitalize for self-constructed assets such as the development of a new runway for the international terminal?

> Refer to the balance sheet for WestJet. What amount did it report as goodwill at December 31, 2017?

> When is the only time a business can record goodwill?

> Refer to the balance sheet for WestJet. What amount did it report as intangible assets at December 31, 2017?

> On August 26, 2015, Race World International purchased a piece of equipment for a total of $426,000. The PPE subledger shows the following information regarding the equipment: Early in 2020, it was determined that the useful life of the metal frame shoul

> What are two types of intangible assets?

> What are the characteristics of an intangible asset?

> What are some of the events that might lead to disposal of PPE?

> Refer to the statements of cash flows for Spin Master. What was the amount of depreciation and amortization for 2016 and 2017? Where will you look to find the explanation of the increase?

> What accounting principle justifies charging the $75 cost of PPE immediately to an expense account?

> What is the difference in profit between a repairs and maintenance expense and a betterment, and how is each recorded?

> Does the balance of the Accumulated Depreciation, Machinery account represent funds accumulated to replace the machinery when it wears out?

> Which two terms are used to describe the difference between current assets and current liabilities?

> Which two short-term liquidity ratios measure how frequently a company collects its accounts?

> Which assets are included in calculating the quick ratio?

> RangeStar Telecommunications recently acquired a patent regarding a new telecommunications application. Additional equipment and a computer were purchased to begin making the application available to consumers. Details of the assets follow: The company&a

> Suggest several reasons why a 2 to 1 current ratio may not be adequate for a particular company.

> What are three factors that would influence your decision as to whether a company’s current ratio is good or bad?

> Why is working capital given special attention in the process of analyzing balance sheets?

> Which items are usually assigned a value of 100% on a common-size comparative balance sheet and a common size comparative income statement?

> In the chapter-opening vignette, it was mentioned that Roots Canada had a significant increase in year over year EPS for 2017. Why should investors be evaluating profitability ratios such as EPS and gross profit margin? What information does EPS and gros

> Interior Design Company specializes in home staging consulting services and sells furniture built by European craftsmen. The following six-column table contains the company’s unadjusted trial balance as of December 31, 2020. The followi

> The following adjusted trial balance information (with accounts in alphabetical order) for Willis Tour Co. Inc. as at December 31, 2020, was made available after its second year of operations: Required: The dividends declared by Willis in the amount of $

> Fargo Inc. showed the following profit statement information for its first three years of operations: Partial information regarding Fargo’s equity for the past three years follo Required 1. Calculate Gross Profit, Operating Profit, Prof

> Jake, Sacha, and Brianne own a tour company called Adventure Sports. The partners share profit and losses in a 1:3:4 ratio. After lengthy disagreements among the partners and several unprofitable periods, the friends decided to liquidate the partnership.

> Keith Scott and David Dawson agreed to share the annual profit or losses of their corporate law partnership as follows: If the partnership earned a profit, the first $60,000 would be allocated 40% to Scott and 60% to Dawson to reflect the time devoted to

> On February 3, 2020, Secure Software Group purchased the patent for a new software for cash of $220,800. The company expects the software to be sold over the next five years and uses the straight-line method to amortize intangibles. Required 1. Prepare e

> At April 30, 2020, Hackney Building Products’ year-end, the balance sheet showed PPE information as detailed in the schedule below. The company calculates depreciation for partial periods using the half-year convention. Required: Comple

> Perform the following accounting for the receivables of Andrews and Johnson, a law firm, at December 31, 2018. Requirements: 1. Set up T-accounts and start with the beginning balances for these T-accounts: Accounts Receivable, $100,000 Allowance for U

> Antique Interiors reported the following transactions in October: Requirements 1. Record the foregoing transactions in the journal of Antique Interiors using the gross method. (You do not need to make the cost of sales journal entries; assume that thes

> Main Street Tours provides historical guided tours of several U.S. cities. The company charges $250 per person for the eight-hour tour. For groups of four or more, a group discount of $50 per person is offered. Here is a selection of transactions during

> Use the data from Exercise 4-27B to make the journal entries that McCall should record on February 28 to update his Cash account. Include an explanation for each entry. Data from 4-27b: Harry McCall operates a roller skating center, McCall Rinks. He has

> Harry McCall operates a roller skating center, McCall Rinks. He has just received the company’s monthly bank statement at February 28 from Ridgeway National Bank, and the statement shows an ending balance of $755. Listed on the statement are an EFT rent

> Suppose Easton, Inc., reported net receivables of $2,582 million and $2,260 million at January 31, 2019, and 2018, respectively, after subtracting allowances of $72 million and $67 million at these respective dates. Easton earned total revenue of $43,333

> Patterson Shirt Company sells on credit and manages its own receivables. Average experience for the past three years has been the following: The owner of Patterson is considering whether to accept credit cards (VISA and MasterCard) instead of granting cr

> Crystal Detailing Company provides mobile auto detailing to its customers. The Income Statement for the month ended January 31, 2019, the Balance Sheet for December 31, 2018, and details of postings to the Cash account in the general ledger for the month

> The accounts of Huntley Digital Services Company prior to the year-end adjustments follow: Adjusting data at the end of the year include the following: a. Unearned service revenue that has been earned, $1,620 b. Accrued service revenue, $31,600 c. Sup

> Saginaw Corporation reported the following current accounts at December 31, 2018 (amounts in thousands): During January 2019, Saginaw completed these selected transactions: Sold services on account, $9,400 Depreciation expense, $200 Paid for expenses,

> Orman Consulting performed services for a client who could not pay immediately. Orman expected to collect the $4,600 the following month. A month later, Orman received $2,100 cash from the client. 1. Record the two transactions on the books of Orman Con

> The balance sheet of Aqua, Inc., a world leader in the design and sale of telescopic equipment, reported the following information on its balance sheets for 2018 and 2017 (figures are in thousands): In 2018, Aqua recorded $15,700 (gross) in sales (all on

> Two businesses, Queens Service Corp. and Insley Sales Co., have sought business loans from you. To decide whether to make the loans, you have requested their balance sheets. Requirement : 1. Using only these balance sheets, to which entity would you be

> Analyze basic financial statement information (Learning Objectives 3, 4) Note: This mini-case is the first part of The Cheesecake Factory serial case contained in every chapter in this textbook. The Cheesecake Factory Incorporated (NASDAQ: CAKE) was star

> This and similar cases in each chapter are based on the 2016 consolidated financial statements of Under Armour, Inc. You can retrieve the 2016 Under Armour financial statements at www.sec.gov by clicking on Filings and then searching for “Under Armour” u

> The net income of Summit Photography Company decreased sharply during 2018. Anette Summit, the owner of the company, anticipates the need for a bank loan in 2019. Late in 2018, Summit instructed Tim Loftus, the company’s controller, to record a $15,000 s

> This and similar cases in succeeding chapters are based on the consolidated financial statements of Apple Inc. shown in Appendix A and online in the filings section of www.sec.gov. Requirements: 1. Go online and do some research on Apple Inc. and its

> Blue Vistas Energy Co. is in its third year of operations, and the company has grown. To expand the business, Blue Vistas borrowed $15 million from Bank of Forest Lake. As a condition for making this loan, the bank required that Blue Vistas maintain a cu

> Teresa Gardner has owned and operated Gardner Advertising, Inc., since it began ten years ago. Recently, Gardner mentioned that she would consider selling the company for the right price. Assume that you are interested in buying this business. You obtain

> The Cheesecake Factory Incorporated (NASDAQ: CAKE) is publicly held and uses U.S. Generally Accepted Accounting Principles (GAAP) to prepare its financial statements. Its fiscal year-end is the 52- or 53-week period ending on the Tuesday closest to Decem

> Consultant Mary Gervais purchased supplies on account for $4,300. Later Gervais paid $3,450 on account. 1. Journalize the two transactions on the books of Mary Gervais, Consultant. Include an explanation for each transaction. 2. Open a T-account for Ac

> On October 1, 2018, Elise Pulito opened Tree City Cafe, Inc. Pulito is now at a crossroads. The October financial statements paint a glowing picture of the business, and Pulito has asked you whether she should expand the business. To expand the business,

> The Cheesecake Factory Incorporated (NASDAQ: CAKE) operates two bakeries in the United States where it makes over 70 desserts for its own restaurants. In addition, the Cheesecake Factory bakeries sell selected desserts to a variety of foodservice operato

> The unadjusted trial balance of Stone Park Services, Inc., at January 31, 2019, does not balance. The list of accounts and their balances follows. The trial balance needs to be prepared and adjusted before the financial statements at January 31, 2019, ca

> Shabby Fitch is the president and principal stockholder of Shabby’s Bar & Grill, Inc. To expand, the business is applying for a $350,000 bank loan. To get the loan, Fitch is considering two options for beefing up the stockholders’ equity of the business:

> Strasburg Loan Company is in the consumer loan business. Strasburg borrows from banks and loans out the money at higher interest rates. Strasburg’s bank requires Strasburg to submit quarterly financial statements to keep its line of credit. Strasburg’s m

> Suppose you work in the loan department of Third National Bank. Byron Blakely, the owner of Byron’s Beauty Solutions, has come to you seeking a loan for $500,000 to expand operations. He proposes to use accounts receivable as collateral

> A fire during 2018 destroyed most of the accounting records of Lyons Entertainment, Inc. The only accounting data for 2018 that Lyons can come up with are the following balances at December 31, 2018. The general manager also knows that uncollectible-acco

> Joe Ferritto opened an Italian restaurant. Business has been good, and Ferritto is considering expanding the restaurant. Ferritto, who knows little accounting, produced the following financial statements for Romano Castle, Inc., at December 31, 2018, the

> A friend named Lance Barton has asked what effect certain transactions will have on his company, Blast Networks, Inc. Time is short, so you cannot apply the detailed procedures of journalizing and posting. Instead, you must analyze the transactions witho

> Note: This mini-case is part of The Cheesecake Factory serial case contained in every chapter in this textbook. The Cheesecake Factory Incorporated (NASDAQ: CAKE) owns and operates over 200 restaurants, including The Cheesecake Factory, the Grad Lux Cafe

> Suppose you are analyzing the financial statements of Corley, Inc. Identify each item with its appropriate financial statement, using the following abbreviations: Income statement (I), Statement of retained earnings (R), Balance sheet (B), and Statement

> Backline Advertising creates, plans, and handles advertising campaigns in a three-state area. Recently, Backline had to replace an inexperienced office worker in charge of bookkeeping because of some serious mistakes that had been uncovered in the accoun

> This question concerns the items and the amounts that two entities, Marion Co. and Ashland Hospital, should report in their financial statements. During November, Ashland provided Marion with medical exams for Marion employees and sent a bill for $48,000

> The trial balance of Jubilee, Inc., at October 31, 2018, does not balance. Requirements: 1. Prepare a trial balance for the ledger accounts of Jubilee, Inc., as of October 31, 2018. 2. Determine the out-of-balance amount. The error lies in the Account

> The manager of West Industries Furniture needs to compute the following amounts: a. Total cash paid during December. b. Cash collections from credit customers during December. Analyze Accounts Receivable. c. Cash paid on a note payable during December

> Prepare the closing entries from the following selected accounts from the records of North Pole Enterprises at December 31, 2018: How much net income did North Pole Enterprises earn during 2018? Prepare a T-account for Retained Earnings to show the Decem

> The adjusted trial balances of Patterson Corporation at August 31, 2018, and August 31, 2017, include these amounts (in millions): Patterson Corporation completed these transactions (in millions) during the year ended August 31, 2018. Calculate the amoun

> The adjusted trial balance of Pearl Industries, Inc., follows. Requirement: 1. Prepare Pearl Industries, Inc.’s single-step income statement and statement of retained earnings for the year ended December 31, 2018, and its balance shee

> Dizzy Toys prepaid three years’ rent ($36,000) on January 1, 2018. At December 31, 2018, Dizzy prepared a trial balance and then made the necessary adjusting entry at the end of the year. Dizzy adjusts its accounts once each year—on December 31. What amo

> Jenkins Rentals Company faced the following situations. Journalize the adjusting entry needed at December 31, 2020, for each situation. Consider each fact separately. a. The business has interest expense of $3,100 that it must pay early in January 2021.

> Greenville Corporation experienced four situations for its supplies. Calculate the amounts that have been left blank for each situation. For situations 1 and 2, journalize the needed transaction. Consider each situation separately.

> Baer, MD, opened a medical practice. The business completed the following transactions: After these transactions, how much cash does the business have to work with? Use a T-account to show your answer.

> An accountant made the following adjustments at December 31, the end of the accounting period: a. Prepaid insurance, beginning, $500. Payments for insurance during the period, $2,000. Prepaid insurance, ending, $400. b. Interest revenue accrued, $2,500

> During 2018, Able Network, Inc., which designs network servers, earned revenues of $820 million. Expenses totaled $520 million. Able collected all but $20 million of the revenues and paid $610 million on its expenses. a. Under accrual accounting, what a

> Assume that All Towne Company reported the following summarized data at September 30, 2018. Accounts appear in no particular order; dollar amounts are in millions. Requirements : 1. Solve for Cash. 2. Prepare the trial balance of All Towne at September

> The trial balance of St. James, Inc., at September 30, 2018, does not balance. The accounting records hold the following errors: a. Recorded a $400 cash revenue transaction by debiting Accounts Receivable. The credit entry was correct. b. Posted a $4,000

> The accounts of Specialty Deck Service, Inc., follow with their normal balances at April 30, 2018. The accounts are listed in no particular order. Requirements: 1. Prepare the company’s trial balance at April 30, 2018, listing account

> The first seven transactions of Gallagher Advertising, Inc., have been posted to the company’s accounts: Requirement : 1. Prepare the journal entries that served as the sources for the seven transactions. Include an explanation for eac

> Refer to Exercises 2-30B and 2-31B. Requirements: 1. Post the entries to the ledger, using T-accounts. Key transactions by date. Determine the ending balance in each account. 2. Prepare the trial balance of Dr. Char Morin, P.C., at July 31, 2018. 3. F

> 1. What is the ethical issue in this situation? 2. What are the alternatives? 3. Who are the stakeholders? What are the possible consequences to each? Analyze from the following standpoints: (a) economic, (b) legal, and (c) ethical. 4. Place yourself

> Augusta Construction, headquartered in Topeka, Kansas, built a motel in Kansas City. The construction foreman, Pete Garcia, hired the workers for the project. Garcia had his workers fill out the necessary tax forms and sent the employment documents to th

> Nashville Motels, Inc., has poor internal controls. Recently, Rick Colby, the manager, has suspected the bookkeeper of stealing. Details of the company’s cash position at September 30 follow. a. The Cash account shows a balance of $10,

> Fourth Investments, Inc., began by issuing common stock for cash of $200,000. The company immediately purchased computer equipment on account for $56,000. 1. Set up the following T-accounts of Fourth Investments, Inc.: Cash, Computer Equipment, Accounts

> The Cheesecake Factory must implement and enforce an effective internal control system to both comply with financial reporting regulations and protect its assets. Let’s look at a description of a typical day for a server at a Cheesecake Factory restauran

> Assume that Old Center Company reported the following summarized data at September 30, 2018. Accounts appear in no particular order; dollar amounts are in millions. Requirements: 1. Solve for Cash. 2. Prepare the trial balance of Old Center at Septemb

> The trial balance of Addison, Inc., at September 30, 2018, does not balance: The accounting records hold the following errors: a. Recorded a $700 cash revenue transaction by debiting Accounts Receivable. The credit entry was correct. b. Posted a $1,000

> The accounts of Deluxe Patio Service, Inc., follow with their normal balances at April 30, 2018. The accounts are listed in no particular order. Requirements : 1. Prepare the company’s trial balance at April 30, 2018, listing accounts

> The first seven transactions of Frontier Advertising, Inc., have been posted to the company’s accounts: Requirement: 1. Prepare the journal entries that served as the sources for the seven transactions. Include an explanation for each

> Refer to Exercises 2-20A and 2-21A. Requirements: 1. After journalizing the transactions of Exercise 2-20A, post the entries to the ledger, using T-accounts. Key transactions by date. Determine the ending balance in each account. 2. Prepare the trial

> Refer to Exercise 2-20A. Requirement: 1. Record the transactions in the journal of Dr. Helen Samoa, P.C. List the transactions by date and give an explanation for each transaction.

> Dr. Helen Samoa opened a medical practice specializing in physical therapy. During the first month of operation (December), the business, titled Dr. Helen Samoa, Professional Corporation (P.C.), experienced the following events: Requirements: 1. Analyz

> During 2018, Brewster Company earned revenues of $146 million. Brewster incurred, during that same year, salary expense of $28 million, rent expense of $23 million, and utilities expense of $19 million. Brewster declared and paid dividends of $15 million

> This exercise should be used in conjunction with Exercises 1-39B through 1-41B. The owner of Island Coffee Roasters Corporation now seeks your advice as to whether she should cease operations or continue the business. Complete the report giving her your

> Classify the following items as an asset (A), a liability (L), or stockholders’ equity (S) for Target Corporation, a large retailer: a. Land b. Accrued expenses payable c. Supplies d. Equipment e. Notes payable f. Long-term debt g. Retained earnings

> Refer to the data in Exercises 1-39B and 1-40B. Requirement: 1. Prepare the statement of cash flows of Island Coffee Roasters Corporation for the month ended August 31, 2019. Using Exhibit 1-11 as a model, show with arrows the relationships among the i

> Refer to the data in Exercise 1-39B. Requirement: 1. Prepare the balance sheet of Island Coffee Roasters Corporation at August 31, 2019.

> Assume Island Coffee Roasters Corporation ended the month of August 2019 with these data: Requirement: 1. Prepare the income statement and the statement of retained earnings for Island Coffee Roasters Corporation for the month ended August 31, 2019.

> This exercise should be used with Exercise 1-37B. Requirements: 1. Prepare the income statement of Mary Burke Realty Company for the year ended March 31, 2018. 2. What amount of dividends did Mary Burke Realty Company declare during the year ended Mar