Question: ABC Airlines carried more than 11.9

ABC Airlines carried more than 11.9 million passengers to over 160 destinations in 17 countries in 2020. ABC is the descendant of several predecessor companies, including AB Air and BC Airlines. The amalgamated company was created in 2002. In the years that followed, the world air travel industry slumped and caused many airlines to go bankrupt or suffer severe financial hardship. ABC weathered the storm by going through a significant restructuring. One of the changes as a result of the restructuring was to have ABC employees take share options as part of their remuneration. This resulted in employees investing $200 million in the company. The company is privately owned. In 2020, ABC was still suffering losses, now partly due to increased competition and falling seat prices. Losses were $187 million in 2018 and $194 million in 2019. The CEO announced a new restructuring plan that would hopefully put an end to the continuing losses. The plan focused on three areas: improved network profitability, decreased overhead costs, and decreased labour costs. For the latter, employees were asked to accept reduced wages over a four-year period. Just like most companies, ABC is now concerned with increasing market share and maintaining customer loyalty. On the company's website, the following advertisement appears: “Fly 5, Fly Free—Fly five times with ABC Airlines and its worldwide partners and earn a free trip. The more you fly, the more the world is within reach.†Free flights are also offered by ABC through its well-publicized frequent flyer program. Under the program, customers earn points for flying with ABC and, once they accumulate enough points, they can then use them to take free flights. In the notes to its financial statements, ABC states that the incremental costs of frequent flyer points are accrued as the entitlements to free flights are earned. The accrual is included as part of accrued liabilities.

Instructions

Adopt the role of company management and discuss the treatment of the “Fly 5, Fly Free†program for financial reporting purposes. The company is interested in understanding how the program would be accounted for under both IFRS and ASPE.

Transcribed Image Text:

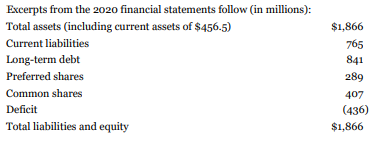

Excerpts from the 2020 financial statements follow (in millions): Total assets (including current assets of $456.5) $1,866 Current liabilities 765 Long-term debt 841 Preferred shares 289 Common shares 407 Deficit (436) Total liabilities and equity $1,866

> Assume that the bonds in BE14.11 were issued at 98. Assume also that Grenier Limited follows ASPE and records the amortization using the straight-line method. Prepare the journal entries related to the bonds for a. January 1, b. July 1, and c. Decembe

> Grenier Limited issued $300,000 of 10% bonds on January 1, 2020. The bonds are due on January 1, 2025, with interest payable each July 1 and January 1. The bonds are issued at face value. Grenier uses the effective interest method. Prepare the company's

> Takemoto Inc. borrowed $60,000 on November 1, 2020, by signing a $61,350, three-month, zero-interest-bearing note. a. Using a financial calculator or Excel, calculate the effective interest charged on the note. b. Prepare Takemoto's November 1, 2020 en

> Refer to the information for Upland Limited in BE13.4. Assume that Upland uses reversing entries. Prepare the 2021 journal entry(ies) for Upland. From BE13.4: Upland Limited borrowed $40,000 on November 1, 2020, by signing a $40,000, three-month, 9% not

> Upland Limited borrowed $40,000 on November 1, 2020, by signing a $40,000, three-month, 9% note. Prepare Upland's November 1, 2020 entry; the December 31, 2020 annual adjusting entry; and the February 1, 2021 entry. Round amounts to the nearest dollar.

> Jupiter Corp. provides at no extra charge a two-year warranty with one of its products, which was first sold in 2020. In that year, Jupiter sold products for $2.5 million and spent $68,000 servicing warranty claims. At year end, Jupiter estimates that an

> Sport Pro Magazine sold 12,000 annual subscriptions on August 1, 2020, for $18 each. Prepare Sport Pro's August 1, 2020 journal entry and the December 31, 2020 annual adjusting entry, assuming the magazines are published and delivered monthly.

> Refer to the information for Lu Corp. in BE13.20 and BE13.21. Assume that the increase in the asset retirement obligation in 2020 related to the production of oil in 2020 was $61,942. Prepare any necessary entries to record the increase in the asset reti

> Refer to the information for Lu Corp. in BE13.20. Prepare any necessary adjusting entries that are associated with the asset retirement obligation and related expenses at December 31, 2020, assuming that Lu follows a. IFRS, and b. ASPE. Ignore product

> Molson Coors Brewing Company has a December 31-year end. Access the company's 2017 annual report from the company website (www.molsoncoors.com). Instructions a. What types of earnings per share information does the company provide? b. Does the compan

> Primeau Inc. pays its officers bonuses based on income. For 2020, the bonuses total $350,000 and are paid on February 15, 2021. Prepare Primeau's December 31, 2020 adjusting entry and the February 15, 2021 entry. For the payment entry, ignore withholding

> Laurin Corporation offers parental benefits to its staff as a top-up on EI benefits so that employees end up receiving 100% of their salary for a maximum of 12 months of parental leave. Ruzbeh Awad, who earns $74,000 per year, announced that he will be t

> At December 31, 2020, 30 employees of Kasten Inc. have each earned one week of vacation time. The employees' average salary is $1,000 per week. Prepare Kasten's December 31, 2020 adjusting entry.

> Refer to the information for Whirled Inc. in BE13.15. Assume now that the employer is required to match every dollar of the CPP contributions of its employees and to contribute 1.4 times the EI withholdings. a. Prepare the journal entry to record Whirle

> Whirled Inc.'s weekly payroll of $23,000 included employee income taxes withheld of $3,426, Canada Pension Plan (CPP) withheld of $990, and Employment Insurance (EI) withheld of $420. Prepare the journal entry to record Whirled's weekly payroll.

> At December 31, 2020, Burr Corporation owes $500,000 on a note payable due February 15, 2021. Assume that Burr follows IFRS and that the financial statements are completed and released on February 20, 2021. a. If Burr refinances the obligation by issuin

> At December 31, 2020, Parew Corporation has a long-term debt of $700,000 owing to its bank. The existing debt agreement imposes several covenants related to Parew's liquidity and solvency. At December 31, 2020, Parew was not in compliance with the covena

> Refer to the information about Clausius Ltd. in BE13.11. Assume instead that the tax return indicated 2020 income tax of $10,200. a. Prepare the adjusting year-end entry to recognize the 2020 income tax. b. Identify any year-end SFP amount that is rela

> Yuen Corporation shows the following financial position and results for the three years ended December 31, 2020, 2021, and 2022 (in thousands): For each year, calculate the current ratio, quick ratio, and for 2021 and 2022, calculate the days payables

> Clausius Ltd. made four quarterly payments of $3,200 each to the Receiver General for Canada during 2020 as instalment payments on its estimated 2020 corporate tax liability. At year end, Clausius's controller completed the company's 2020 tax return, whi

> Sky plc, formerly British Sky Broadcasting Group plc, is a pan-European pay television giant and multimedia content company whose common shares trade on the London Stock Exchange. The company produces financial statements in accordance with IFRS. Access

> At December 31, 2020, Lawton & Border Inc. (L&B) is involved in a lawsuit. Under existing standards in IAS 37, a. prepare the December 31 entry assuming it is probable (and very likely) that L&B will be liable for $700,000 as a result of this suit. b.

> Wynn Corp. offers a set of building blocks to customers who send in three codes from Wynn cereal, along with $1. Wynn purchased 100,000 building block sets in 2020 for $2.50 each, and paid for them by cash. During 2020, Wynn sold one million boxes of cer

> On July 10, 2020, Nguyen Ltd. sold $1.7 million worth of compressors to retailers on account. Nguyen had paid $960,000 for these compressors. Nguyen grants the right to return compressors that do not sell in three months following delivery. Past experien

> Henry Corporation sells home entertainment systems. The corporation also offers to sell its customers a two-year warranty contract as a separate service. During 2020, Henry sold 20,000 warranty contracts at $99 each. The corporation spent $180,000 servic

> Refer to the information for Jupiter Corp. in BE13.25. a. Prepare entries for the warranty that recognize the sale as a multiple deliverable with the warranty as a separate service that Jupiter bundled with the selling price of the product. Ignore any c

> Yuen Corporation shows the following financial position and results for the three years ended December 31, 2022, 2021, and 2020 (in thousands): Calculate the current ratio, quick ratio for each year, and the days payables outstanding ratio for 2021 and

> Referring to the research study mentioned in this chapter (in the section “Limitations of Financial Statement Analysis”), discuss some limitations of the financial statement analysis done in BE23.22. Include in your answer some of the general limitations

> Condensed data from the comparative statement of financial position (SFP) of Legros Inc. follow: a. Using vertical (common-size) analysis, calculate the various SFP categories as a percentage of total assets for Legros Inc. for each of 2018, 2019, and 2

> The income statements of Dwayne Corporation show the following amounts: Using vertical (common-size) analysis, analyze Dwayne Corporation's declining profit before tax. Round answers to zero decimal places. 2020 2019 2018 Net sales $800 $770 $720 Co

> On January 1, 2020, Animation Ltd., which uses ASPE, sold a truck to Letourneau Finance Corp. for $65,000 and immediately leased it back. The truck was carried on Animation’s books at $53,000, net of $26,000 of accumulated depreciation. The term of the l

> City Goods Limited (CG) is a sports clothing and equipment retailer that has a chain of 10 stores across Canada. You have just been hired as the new controller for the company. You are currently meeting with the CFO to discuss some accounting-related top

> On January 1, 2020, Clark Inc. sold a piece of equipment to Daye Ltd. for $200,000, and immediately leased the equipment back. At the time, the equipment was carried on Clark’s books at a cost of $300,000, less accumulated depreciation of $120,000. The l

> Use the information for Regina Corporation from BE20.16. Assume instead that the residual value is not guaranteed. Prepare Regina’s May 29, 2020 journal entries. Round to the nearest dollar. From BE20.16: Regina Corporation, which uses ASPE, manufacture

> Use the information for Merrill Corporation from BE20.11. Assume that for Moxey Corporation, the lessor, collectibility is reasonably predictable, there are no important uncertainties concerning costs, and the equipment’s carrying amount is $121,000. Pre

> Tonoma Inc., a company that follows IFRS, is preparing its December 31, 2020 financial statements. The following two events occurred after December 31, 2020: 1. A flood loss of $80,000 occurred on March 1, 2021. 2. A liability, estimated and accrued at

> In 2020, Oswald Corporation reported a net loss of $56,000. Oswald's only net income adjustments were depreciation expense of $67,000 and an increase in accounts receivable of $8,100. Calculate Oswald's net cash provided (used) by operating activities us

> October Corporation reported net income of $46,000 in 2020. Depreciation expense was $17,000 and unrealized losses on FV-NI investments were $3,000. The following accounts changed as indicated in 2020: Calculate the net cash provided by operating activi

> Lupasco Ltd. had the following 2020 income statement data: In 2020, Lupasco had the following activity in selected accounts: Prepare Lupasco's cash flows from operating activities section of the statement of cash flows using a. the direct method, and

> Kamsky Inc., which follows IFRS, had the following balances and amounts on its comparative financial statements at year end: a. Calculate income taxes paid in 2020 and discuss the related disclosure requirements under IFRS, if any. b. If Kamsky followe

> Ciao Corporation had January 1 and December 31 balances as follows: For 2020, the cost of goods sold was $550,000. Calculate Ciao's 2020 cash paid to suppliers of inventory 1/1/20 12/31/20 Inventory $90,000 $113,000 Accounts payable 61,000 69,000

> At January 1, 2020, Apex Inc., a private company following ASPE, had accounts receivable of $72,000. At December 31, 2020, the accounts receivable balance was $59,000. Sales revenue for 2020 was $420,000. Sales returns and allowances for the year were $1

> Locate and review the statement of changes in shareholders' equity for the Hudson's Bay Company (HBC) in its financial statements for the 53 weeks ended February 3, 2018 (fiscal 2017) and the 52 weeks ended January 28, 2017 (fiscal 2016), at the end of V

> Using the information from BE22.9 for Azure Ltd., (a) prepare the cash flows from operating activities section of Azure's 2020 statement of cash flows using the indirect method and following IFRS. (b) How would the disclosure requirements differ under AS

> Azure Ltd. had the following 2020 income statement data: The following accounts increased during 2020 by the amounts shown: Accounts Receivable, $17,000; Inventory, $11,000; Accounts Payable (relating to inventory), $13,000; Taxes Payable, $2,000; and M

> Papadopoulos Limited (PL) sells retail merchandise in Canada. The company was incorporated last year and is now in its second year of operations. PL is owned and operated by the Papadopoulos family, and Iris Papadopoulos, the company president, has decid

> Delmar Manufacturing Inc. is a manufacturer of electronics. It has been in operation for over 25 years under ownership of the same two private shareholders. It has always offered its employees a very generous defined benefit (DB) pension plan as part of

> Baker Company Limited (BCL) was founded in 2018. Its first year of operations turned out to be a good one, as start-up years go, because the company not only broke even but actually showed a very small profit. Just as the company was getting established

> Air Canada is Canada's largest domestic and international airline, providing scheduled and charter air transportation for passengers and cargo. The airline industry has suffered many difficulties and financial setbacks in recent years. The high costs ass

> CopMin Inc. is a private enterprise that is involved in copper mining operations. The company currently owns two operating mines. It is January 1, 2020, and CopMin has recently entered into two types of contracts. For its Papula Mine, it has entered into

> The executive officers of Coach Corporation have a performance-based compensation plan that links performance criteria to growth in earnings per share. When annual earnings per share (EPS) growth is 12%, the Coach executives earn 100% of a predetermined

> In June 2021, the board of directors for Holtzman Enterprises Inc. authorized the sale of $10 million of corporate bonds. Michelle Collins, treasurer for Holtzman Enterprises Inc., is concerned about the date when the bonds are issued. The company really

> Access the financial statements of Brookfield Asset Management for the year ended December 31, 2017. The full set of its annual financial statements can be found on SEDAR at www.sedar.com or on the company's website. Paragraph 1 of IFRS 7 Financial Instr

> Each of the following items must be considered in preparing a statement of cash flows (indirect method) for Bastille Inc., which follows IFRS, for the year ended December 31, 2020. 1. Equipment that cost $40,000 six years before and was being depreciate

> MacAskill Mills Limited follows IFRS, has a calendar year end, and adopted the policy of classifying interest paid as financing activities. It engaged in the following transactions in 2020. 1. The Land account increased by $58,000 over the year: Land th

> The following accounts appear in the ledger of Tanaka Limited, which uses IFRS, and has adopted the policy of classifying dividends paid as operating activities: Instructions Show how the information posted in the accounts is reported on a statement of

> Guas Inc., a major retailer of bicycles and accessories, operates several stores and is a publicly traded company. The company is currently preparing its statement of cash flows. The comparative statement of financial position and income statement for Gu

> Since incorporation in 2018, Ning Construction Inc. has accounted for its income from long-term construction contracts using the completed-contract method because this method is allowed by the Canada Revenue Agency. The completed-contract method allowed

> Corbeil Limited, a private company following ASPE, disposed of some assets during the fiscal year ended December 31, 2020. Based on the research done by the assistant controller, journal entries were made and the following first draft of the income state

> Malouin Corp.'s income statement for the year ended December 31, 2020, had the following condensed information: There were no purchases or sales of trading (FV-NI) investments during 2020. Malouin's statement of financial position included the followin

> Golden Properties Corporation purchased a parcel of land in March 2019 for $1 million with the intent to construct a building on the property in the near future. At the time of purchase, Golden applied the cost model and measured and reported the land at

> Linden Corporation started operations on January 1, 2012, and has used the FIFO cost formula since its inception. In 2021, it decides to switch to the weighted average cost formula. You are provided with the following information. Instructions Answer

> Merrick Inc. follows IFRS and is adjusting and correcting its books at the end of 2020. In reviewing its records, the following information has been compiled: 1. In 2020, the depreciation method on plant assets should be changed from sum-of-the-years'-d

> Access the annual report of Canadian Tire Corporation for its year ended December 31, 2017, from the company's website or SEDAR (www.sedar.com). According to Note 1 to the financial statements, the company operates in three main segments: retail, a real

> Access the annual report, including the audited financial statements, of Thomson Reuters Corporation for the year ended December 31, 2017, from SEDAR (www.sedar.com) or from the company's website (www.thomsonreuters.com). Instructions a. What related-

> Oakridge Leasing Corporation signs an agreement on January 1, 2020, to lease equipment to LeBlanc Limited. Oakridge and LeBlanc follow ASPE. The following information relates to the agreement. 1. The term of the non-cancellable lease is five years, with

> On January 1, 2021, Xu Ltd., which uses IFRS 16, entered into an eight-year lease agreement for a conveyor machine. Annual lease payments are $28,500 at the beginning of each lease year, which ends December 31, and Xu made the first payment on January 1,

> Field Corp.'s controller was preparing the adjusting entries for the company's year ended December 31, 2020, when the V.P. Finance called him into her office. “Jean-Pierre,” she said, “I've been considering a couple of matters that may require different

> In 2019, Bergeron Construction Company Ltd. applied the completedcontract method of accounting for long-term construction contracts. However, in 2020, Bergeron discovered that the percentage-of-completion method should have been applied instead. For tax

> On January 1, 2016, Zui Corporation purchased a building and equipment that had the following useful lives, residual values, and costs: Building: 40-year estimated useful life, $50,000 residual value, $1,200,000 cost Equipment: 12-year estimated useful

> Oliver Inc. acquired the following assets in January 2017: The equipment was depreciated using the double-declining-balance method for the first three years for financial reporting purposes. In 2020, the company decided to change the method of calculati

> When the records of Hilda Corporation were reviewed at the close of 2020, the following errors were discovered. Instructions For each item, indicate by a check mark in the appropriate column whether the error resulted in an overstatement or understatem

> The before-tax income for Hawks Corp. for 2019 was $101,000; for 2020, it was $77,400. However, the accountant noted that the following errors had been made: 1. Sales for 2019 included $38,200 that had been received in cash during 2019, but for which th

> Bennett Corp., which began operations in January 2017, follows IFRS and is subject to a 30% income tax rate. In 2020, the following events took place: 1. The company switched from the zero-profit method to the percentage-of-completion method of accounti

> Neilson Tool Corporation's December 31 year-end financial statements contained the following errors: An insurance premium of $66,000 covering the years 2019, 2020, and 2021 was prepaid in 2019, with the entire amount charged to expense that year. In add

> Access the financial statements of Saskatoon-based Potash Corporation of Saskatchewan Inc. for its year ended December 31, 2017, from SEDAR (www.sedar.com). PotashCorp was a well-known Canadian global fertilizer and related industrial and feed producer.

> A partial trial balance of Lindy Corporation at December 31, 2020, follows: Additional adjusting data: 1. A physical count of supplies on hand on December 31, 2020, totalled $3,400. Through an oversight, the Salaries and Wages Payable account was not c

> Refer to the information in E19.16 and assume Opsco Corp. applies IFRS. Instructions Complete a post-retirement work sheet for 2020, and prepare all required journal entries related to the plan made by Opsco in 2020. From E19.16: Opsco Corp. provides

> Tracy Ltd. purchased a piece of equipment on January 1, 2016, for $1.2 million. At that time, it was estimated that the machine would have a 15- year life and no residual value. On December 31, 2020, Tracy's controller found that the entry for depreciati

> For the past three years, Bonafacio Holdings Ltd. has held bonds as investments, which it accounted for using the amortized cost model. The bonds were purchased at a discount and are currently classified as Bond Investment at Amortized Cost. There have b

> Matta Leasing Limited, which has a fiscal year end of October 31 and follows IFRS 16, signs an agreement on January 1, 2020, to lease equipment to Irvine Limited. The following information relates to the agreement. 1. The term of the non-cancellable lea

> Kea Limited provides a defined contribution pension plan for its employees. The plan requires the company to deduct 5% of each employee's gross pay for each payroll period as the employee contribution. The company then contributes 7% of the gross pay for

> On January 1, 2020, Lavery Corp., which follows ASPE, leased equipment to Flynn Ltd., which follows IFRS 16. Both Lavery and Flynn have calendar year ends. The following information concerns this lease. 1. The term of the non-cancellable lease is six ye

> Cuomo Mining Corporation, a public company whose stock trades on the Toronto Stock Exchange, uses IFRS. The vice-president of finance has asked you, the assistant controller, to prepare the company’s current accounting of a lease. The lease was signed by

> Assume the same data as in E20.6 for LeBlanc Limited except that the $7,000 residual value is guaranteed. Instructions Answer the following, rounding all numbers to the nearest dollar. a. Calculate the PV of the future minimum lease payments using any o

> A lease agreement between Hebert Corporation and Russell Corporation is described in E20.3. Instructions Provide the following for Hebert Corporation, the lessor, rounding all numbers to the nearest cent. a. Discuss the nature of the lease. b. Calcu

> Refer to the financial statements and accompanying notes of Canadian Tire Corporation Limited, for its year ended December 31, 2017. The financial statements are available on SEDAR (www.sedar.com). Instructions a. What are the issued and authorized sh

> The following facts are for a non-cancellable lease agreement between Hebert Corporation and Russell Corporation, a lessee: The collectibility of the lease payments is reasonably predictable, and there are no important uncertainties about costs that hav

> The accounting income (loss) figures for Farah Corporation are as follows: Accounting income (loss) and taxable income (loss) were the same for all years involved. Assume a 30% tax rate for 2015 and 2016, and a 25% tax rate for the remaining years. In

> Alliance Inc. reports the following incomes (losses) for both book and tax purposes (assume the carryback provision is used where possible): The tax rates listed were all enacted by the beginning of 2017. Instructions a. Prepare the journal entries f

> At the end of 2019, Valerie Corporation reported a deferred tax liability of $41,000. At the end of 2020, the company had $241,000 of temporary differences related to property, plant, and equipment. Depreciation expense on this property, plant, and equip

> Adelphi Corp. in its first year of operations has the following differences between its carrying amounts and the tax bases of its assets and liabilities at the end of 2020. It is estimated that the warranty liability will be settled in 2021. The differe

> Rancour Ltd., which uses ASPE, recently expanded its operations into an adjoining municipality, and on March 30, 2020, it signed a 15-year lease with its Municipal Industrial Commission (MIC). The property has a total fair value of $450,000 on March 30,

> On September 15, 2020, Local Camping Limited, the lessee, entered into a 20-year lease with Sullivan Corp. to rent a parcel of land at a rate of $30,000 per year. Both Local and Sullivan use ASPE. The annual rental is due in advance each September 15, be

> Instructions Refer to the data and other information provided in E20.1, but now assume that Maleki’s fiscal year end is May 31. Prepare the journal entries on Maleki Corp.’s books to reflect the signing of the lease agreement and to record payments and

> Presented below are five independent situations. All the companies involved use ASPE, unless otherwise noted. 1. On December 31, 2020, Zarle Inc. sold equipment to Orfanakos Corp. and immediately leased it back for 10 years. The equipment’s selling pric

> On January 1, 2020, Hein Corporation sold equipment to Liquidity Finance Corp. for $720,000 and immediately leased the equipment back. Both Hein and Liquidity use ASPE. Other relevant information is as follows. 1. The equipment’s carrying value on Hein’

> The Bank of Montreal and Royal Bank of Canada financial statements for their years ended October 31, 2017, can be found on SEDAR (www.sedar.com). Instructions a. What is the average carrying amount of each company's common shares? Compare these values

> Wong Inc., the lessee entered into two leases on July 1, 2020 with Pomerleau Corp. Both companies are public corporations following IFRS. The leases are for a large auger and a jackhammer that will be used on a construction site, and both parties would p

> Zdon Inc. reports accounting income of $105,000 for 2020, its first year of operations. The following items cause taxable income to be different than income reported on the financial statements. 1. Capital cost allowance (on the tax return) is greater t