Question: Actuary and trustee reports indicate the following

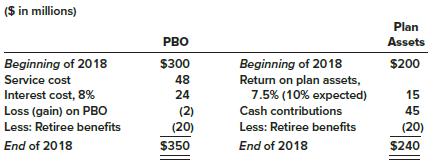

Actuary and trustee reports indicate the following changes in the PBO and plan assets of Lakeside Cable during 2018:

Prior service cost at Jan. 1, 2018, from plan amendment at the beginning of 2016 (amortization: $4 million per year) ………………………………………………………………………………………………….. $32 million

Net loss-pensions at Jan.1, 2018 (previous losses exceeded previous gains) ………………. $40 million

Average remaining service life of the active employee group 10 years Actuary’s discount rate ….. 8%

Required:

1. Determine Lakeside’s pension expense for 2018, and prepare the appropriate journal entries to record the expense as well as the cash contribution to plan assets and payment of benefits to retirees.

2. Determine the new gains and/or losses in 2018 and prepare the appropriate journal entry(s) to record them.

3. Prepare a pension spreadsheet to assist you in determining end of 2018 balances in the PBO, plan assets, prior service cost—AOCI, the net loss—AOCI, and the pension liability.

4. Assume the following actuary and trustee reports indicating changes in the PBO and plan assets of Lakeside Cable during 2019 ($ in millions):

Determine Lakeside’s pension expense for 2019, and prepare the appropriate journal entries to record the expense, the cash funding of plan assets, and payment of benefits to retirees.

5. Determine the new gains and/or losses in 2019, and prepare the appropriate journal entry(s) to record them.

6. Using T-accounts, determine the balances at December 31, 2019, in the net loss–AOCI and prior service cost–AOCI.

7. Confirm the balances determined in Requirement 6 by preparing a pension spreadsheet.

Transcribed Image Text:

($ in millions) Plan PBO Assets $300 Beginning of 2018 Return on plan assets, 7.5% (10% expected) Beginning of 2018 $200 Service cost 48 Interest cost, 8% 24 15 Loss (gain) on PBo (2) (20) Cash contributions 45 Less: Retiree benefits Less: Retiree benefits (20) End of 2018 $350 End of 2018 $240

> Indicate by letter whether each of the transactions listed below increases (I), decreases (D), or has no effect (N) on retained earnings. Assume the shareholders’ equity of the transacting company includes only common stock, paid-in capital—excess of par

> The shareholders’ equity of Kramer Industries includes the data shown below. During 2019, cash dividends of $150 million were declared. Dividends were not declared in 2017 or 2018. ???????______________________________($ in millions) Common stock …………………

> During its first year of operations, Cupola Fan Corporation issued 30,000 of $1 par Class B shares for $385,000 on June 30, 2018. Share issue costs were $1,500. One year from the issue date (July 1, 2019), the corporation retired 10% of the shares for $3

> The following is a portion of the Statement of Shareholders’ Equity from Cisco Systems’ January 23, 2016, quarterly report. Required: 1. What is the purpose of the statement of shareholders’ equity?

> Hanmi Financial Corporation is the parent company of Hanmi Bank. The company’s stock split was announced in the following wire: LOS ANGELES Jan. 20 BUSINESS WIRE —Hanmi Financial Corporation (Nasdaq), announced that the Board of Directors has approved a

> Indicate by letter whether each of the items listed below most likely is reported in the income statement as Net Income (NI) or in the statement of comprehensive income as Other Comprehensive Income (OCI). __________________Items____________________ ____

> Suppose the error described in the previous question is not discovered until six years later. What action will the discovery of this error require? In the previous question What action is required when it is discovered that a five-year insurance premium

> The FASB Accounting Standards Codification represents the single source of authoritative U.S. generally accepted accounting principles. Required: 1. Obtain the relevant authoritative literature on stock compensation using the FASB Accounting Standards C

> Comparative statements of shareholders’ equity for Anaconda International Corporation were reported as follows for the fiscal years ending December 31, 2018, 2019, and 2020. Required: 1. Infer from the statements the events and transa

> Listed below are the transactions that affected the shareholders’ equity of Branch-Rickie Corporation during the period 2018–2020. At December 31, 2017, the corporation’s accounts included: ____________________________________($ in thousands) Common stoc

> Target Corporation prepares its financial statements according to U.S. GAAP. Target’s financial statements and disclosure notes for the year ended January 30, 2016, are available in Connect. This material is also available under the Investor Relations li

> Air France–KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF’s financial statements and disclosure notes for the year ended December 31, 2015, are provided in Connect. This ma

> Locate the 2015 financial statements and related disclosure notes of FedEx Corporation. You can locate the report online at www.fedex.com. Required: 1. From the information provided in the statement of cash flows, explain what allows FedEx Corporation t

> You are a loan officer for First Benevolent Bank. You have an uneasy feeling as you examine a loan application from Daring Corporation. The application included the following financial statements. DARING CORPORATION Income Statement For the Year Ended D

> “Why can’t we pay our shareholders a dividend?” shouted your new boss. “This income statement you prepared for me says we earned $5 million in our first half-year!” You were hired last month as the chief accountant for Enigma Corporation, which was organ

> Companies are required to transfer “other comprehensive income” each period to shareholders’ equity. The FASB Accounting Standards Codification represents the single source of authoritative U.S. generally accepted accounting principles. Required: 1. Obt

> Given sales revenue of $200,000, how can it be determined whether or not $200,000 cash was received from customers?

> What is the purpose of the “changes” columns of a spreadsheet to prepare a statement of cash flows?

> Perhaps the most noteworthy item reported on an income statement is net income—the amount by which revenues exceed expenses. The most noteworthy item reported on a statement of cash flows is not the amount of net cash flows. Explain.

> The shareholders’ equity of Core Technologies Company on June 30, 2017, included the following: Common stock, $1 par; authorized, 8 million shares; issued and outstanding, 3 million shares ???…………………………………………………………………………………………………………….. $ 3,000,000 Paid-i

> Magnetic-Optical Corporation offers a variety of share-based compensation plans to employees. Under its restricted stock unit plan, the company on January 1, 2018, granted restricted stock units (RSUs) representing 4 million of its $1 par common shares t

> Borner Communications’ articles of incorporation authorized the issuance of 130 million common shares. The transactions described below effected changes in Borner’s outstanding shares. Prior to the transactions, Borner’s shareholders’ equity included the

> The following is from the 2018 annual report of Kaufman Chemicals, Inc.: Kaufman reports accumulated other comprehensive income in its balance sheet as a component of shareholders’ equity as follows: Required: 1. What is comprehensi

> Refer to the financial statements and related disclosure notes of Microsoft Corporation (www.microsoft.com). Required: 1. What type of pension plan does Microsoft sponsor for its employees? Explain. 2. Who bears the “risk” of factors that might reduce r

> LGD Consulting is a medium-sized provider of environmental engineering services. The corporation sponsors a noncontributory, defined benefit pension plan. Alan Barlow, a new employee and participant in the pension plan, obtained a copy of the 2018 financ

> I only get one shot at this?” you wonder aloud. Mrs. Montgomery, human resources manager at Covington State University, has just explained that newly hired assistant professors must choose between two retirement plan options. â

> Macy’s, Inc., operates about 840 Macy’s and Bloomingdale’s department stores and furniture galleries in 45 states and U.S. territories as well as Bloomingdale’s Outlet stores, macys.com, and bloomingdales.com. Refer to the financial statements for the ye

> While doing some online research concerning a possible investment you come across an article that mentions in passing that a representative of Morgan Stanley had indicated that a company’s pension plan had benefited its reported earnings. Curiosity pique

> A partially completed pension spreadsheet showing the relationships among the elements that constitute Carney, Inc., defined benefit pension plan follows. Six years earlier, Carney revised its pension formula and recalculated benefits earned by employees

> Pension plan assets were $100 million at the beginning of the year and $104 million at the end of the year. At the end of the year, retiree benefits paid by the trustee were $6 million and cash invested in the pension fund was $7 million. What was the pe

> Herring Wholesale Company has a defined benefit pension plan. On January 1, 2018, the following pension-related data were available: ________________________________________________($ in thousands) Net gain—AOCI …………………………………………………………………………………………………….…..

> J-Matt, Inc., had pretax accounting income of $291,000 and taxable income of $300,000 in 2018. The only difference between accounting and taxable income is estimated product warranty costs for sales this year. Warranty payments are expected to be in equa

> Charles Rubin is a 30-year employee of Amalgamated Motors. Charles was pleased with recent negotiations between his employer and the United Auto Workers. Among other favorable provisions of the new agreement, the pact also includes a 14% increase in pens

> Refer to the 2015 financial statements and related disclosure notes of FedEx Corporation. The financial statements can be found at the company’s website (www.fedex.com). Required: 1. What pension and other postretirement benefit plans does FedEx sponsor

> What are the components that might be included in the calculation of net pension cost recognized for a period by an employer sponsoring a defined benefit pension plan?

> Stanley-Morgan Industries adopted a defined benefit pension plan on April 12, 2018. The provisions of the plan were not made retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assets to earn a 10% rate of retur

> Sachs Brands defined benefit pension plan specifies annual retirement benefits equal to: 1.6% × service year’s × final year’s salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2004 and is expected to retire

> Sachs Brands defined benefit pension plan specifies annual retirement benefits equal to: 1.6% × service year’s × final year’s salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2004 and is expected to retire

> Sachs Brands defined benefit pension plan specifies annual retirement benefits equal to: 1.6% × service year’s × final year’s salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2004 and is expected to retire

> Sachs Brands defined benefit pension plan specifies annual retirement benefits equal to: 1.6% × service year’s × final year’s salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2004 and is expected to retire

> Sachs Brands defined benefit pension plan specifies annual retirement benefits equal to: 1.6% × service year’s × final year’s salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2004 and is expected to retire

> Office Depot, Inc. is a leading global provider of products, services, and solutions for workplaces. The following is an excerpt from a disclosure note in the company’s annual report for the fiscal year ended December 31, 2015: Requir

> The information below pertains to the retiree health care plan of Thompson Technologies: Thompson began funding the plan in 2018 with a contribution of $127,000 to the benefit fund at the end of the year. Retirees were paid $52,000. The actuaryâ&

> Pension plan assets were $80 million at the beginning of the year and $83 million at the end of the year. The return on plan assets was 5%. At the end of the year, cash invested in the pension fund was $7 million. What was the amount of the retiree benef

> Air France–KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Reporting Standards. AF’s financial statements and disclosure notes for the year ended December 31, 2015, are available in Connect. This m

> Stockton Labeling Company has a retiree health care plan. Employees become fully eligible for benefits after working for the company eight years. Stockton hired Misty Newburn on January 1, 2018. As of the end of 2018, the actuary estimates the total net

> Century-Fox Corporation’s employees are eligible for postretirement health care benefits after both being employed at the end of the year in which age 60 is attained and having worked 20 years. Jason Snyder was hired at the end of 1995

> Shannon Polymers uses straight-line depreciation for financial reporting purposes for equipment costing $800,000 and with an expected useful life of four years and no residual value. For tax purposes, the deduction is 40%, 30%, 20%, and 10% in those year

> Reproduced below are the journal entries related to Illustration 17–12 in this chapter that Global Communications used to record its pension expense and funding in 2018 and the new gain and loss that occurred that year. To focus on the

> The following pension-related data pertain to Metro Recreation’s noncontributory, defined benefit pension plan for 2018 ($ in thousands): Required: Prepare a pension spreadsheet that shows the relationships among the various pension b

> The funded status of Hilton Paneling Inc.’s defined benefit pension plan and the balances in prior service cost and the net gain–pensions, are given below ($ in thousands): Retirees were paid $270,000, and the employ

> Lewis Industries adopted a defined benefit pension plan on January 1, 2018. By making the provisions of the plan retroactive to prior years, Lewis incurred a prior service cost of $2 million. The prior service cost was funded immediately by a $2 million

> The Kollar Company has a defined benefit pension plan. Pension information concerning the fiscal years 2018 and 2019 are presented below ($ in millions): Information Provided by Pension Plan Actuary: a. Projected benefit obligation as of December 31, 201

> Refer to the situation described in P 17–10. Assume Electronic Distribution prepares its financial statements according to International Financial Reporting Standards (IFRS). Also assume that 10% is the current interest rate on high-quality corporate bon

> Target Corporation prepares its financial statements according to U.S. GAAP. Target’s financial statements and disclosure notes for the year ended January 30, 2016, are available in Connect. This material also is available under the Investor Relations li

> Pension plan assets were $80 million at the beginning of the year. The return on plan assets was 5%. At the end of the year, retiree benefits paid by the trustee were $6 million and cash invested in the pension fund was $7 million. What was the amount of

> Electronic Distribution has a defined benefit pension plan. Characteristics of the plan during 2018 are as follows: __________________________________ ($ in millions) PBO balance, January 1 …………………………………………………… $480 Plan assets balance, January 1 …………………

> U.S. Metallurgical Inc. reported the following balances in its financial statements and disclosure notes at December 31, 2017. Plan assets ……………………………………………. $400,000 Projected benefit obligation ……………………... 320,000 U.S.M.’s actuary determined that 2018

> Pension data for Barry Financial Services Inc. include the following: ____________________________($ in thousands) Discount rate, 7% Expected return on plan assets, 10% Actual return on plan assets, 9% Service cost, 2018 ………………………………………………………….. $ 310 Ja

> IFRS and U.S. GAAP follow similar approaches to accounting for taxation. Nevertheless, differences in reported amounts for deferred taxes are among the most frequent between IFRS and U.S. GAAP. Why?

> Abbott and Abbott has a noncontributory, defined benefit pension plan. At December 31, 2018, Abbott and Abbott received the following information: Projected Benefit Obligation ______($ in millions) Balance, January 1 ……………………………………………. $120 Service cost

> Refer to the situation described in E 17–8. In E 17–8 Pension data for Sterling Properties include the following: _____________________________________($ in thousands) Service cost, 2018 ………………………………………………………………………………. $112 Projected benefit obligation,

> Pension data for Sterling Properties include the following: _____________________________________($ in thousands) Service cost, 2018 ………………………………………………………………………………. $112 Projected benefit obligation, January 1, 2018 ………………………………………… 850 Plan assets (fair

> Pension data for Fahy Transportation Inc. include the following: ______________________________________($ in millions) Discount rate, 7% Expected return on plan assets, 10% Actual return on plan assets, 11% Projected benefit obligation, January 1 …………………

> Pension data for Millington Enterprises include the following: _________________________________________($ in millions) Discount rate, 10% Projected benefit obligation, January 1 ………………………………………………….. $360 Projected benefit obligation, December 31 ………………

> Kroger Co. is one of the largest retail food companies in the United States as measured by total annual sales. The Kroger Co. operates supermarkets, convenience stores, and manufactures and processes food that its supermarkets sell. Using EDGAR (www.sec.

> The following data relate to Voltaire Company’s defined benefit pension plan: _______________________________________($ in millions) Plan assets at fair value, January 1 …………………………………………………… $600 Expected return on plan assets ……………………………………………………………. 60

> The projected benefit obligation was $80 million at the beginning of the year and $85 million at the end of the year. Service cost for the year was $10 million. At the end of the year, pension benefits paid by the trustee were $6 million. The actuary’s d

> Harrison Forklift’s pension expense includes a service cost of $10 million. Harrison began the year with a pension liability of $28 million (underfunded pension plan). Required: Prepare the appropriate general journal entries to record Harrison’s pensio

> Indicate by letter whether each of the events listed below increases (I), decreases (D), or has no effect (N) on an employer’s periodic pension expense in the year the event occurs. Events _____ 1. Interest cost _____ 2. Amortization of prior service cos

> On January 1, 2018, Burleson Corporation’s projected benefit obligation was $30 million. During 2018, pension benefits paid by the trustee were $4 million. Service cost for 2018 is $12 million. Pension plan assets (at fair value) increased during 2018 by

> Indicate by letter whether each of the events listed below increases (I), decreases (D), or has no effect (N) on an employer’s projected benefit obligation. Events _____ 1. Interest cost _____ 2. Amortization of prior service cost _____ 3. A decrease in

> What is intraperiod tax allocation?

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Determine the specific citation for accounting for each of the following items: 1. The disclosure required in the notes to the financial statements for pension plan ass

> When a company sponsors a postretirement benefit plan other than a pension plan, benefits typically are not earned by employees on the basis of a formula, so assigning the service cost to specific periods is more difficult. The FASB Accounting Standards

> Frazier Refrigeration amended its defined benefit pension plan on December 31, 2018, to increase retirement benefits earned with each service year. The consulting actuary estimated the prior service cost incurred by making the amendment retroactive to pr

> Access the 2015 financial statements and related disclosure notes of Ford Motor Company from its website at corporate.ford.com. Required: 1. In Note 21, find Ford’s net deferred tax asset or liability. What is that number? 2. Does Ford show a valuation

> Southeast Technology provides postretirement health care benefits to employees. On January 1, 2018, the following plan-related data were available: _______________________________________________($ in thousands) Prior service cost—originated in 2013 …………

> Gorky-Park Corporation provides postretirement health care benefits to employees who provide at least 12 years of service and reach age 62 while in service. On January 1, 2018, the following plan-related data were available: _____________________________

> Differentiate between the accumulated benefit obligation and the projected benefit obligation.

> Cahal-Michael Company has a postretirement health care benefit plan. On January 1, 2018, the following plan-related data were available: _______________________________________________($ in thousands) Net loss—AOCI …………………………………………………………………………………….………………

> Data pertaining to the postretirement health care benefit plan of Sterling Properties include the following for 2018: ______________________________________($ in thousands) Service cost ………………………………………………………………………………………. $124 Accumulated postretirement b

> Lorin Management Services has an unfunded postretirement benefit plan. On December 31, 2018, the following data were available concerning changes in the plan’s accumulated postretirement benefit obligation with respect to one of Lorin’s employees: APBO a

> The following data are available pertaining to Household Appliance Company’s retiree health care plan for 2018: Number of employees covered …………………………………………………. 2 Years employed as of January 1, 2018 ……………………………... 3 (each) Attribution period ……………………………

> Classified Electronics has an unfunded retiree health care plan. Each of the company’s three employees has been with the firm since its inception at the beginning of 2017. As of the end of 2018, the actuary estimates the total net cost of providing healt

> Accounting for uncertainty in tax positions is prescribed by GAAP in FASB ASC 740–10: Income Taxes–Overall (previously FASB Interpretation No. 48 (FIN 48)). Describe the two-step process required by GAAP.

> Indicate with the appropriate letter the nature of each adjustment described below: Type of Adjustment A. Change in principle B. Change in estimate C. Correction of an error D. Neither an accounting change nor an error _____ 1. Change in actuarial assump

> The income tax disclosure note accompanying the January 31, 2016, financial statements of Walmart is reproduced below: Required: 1. Focusing on only the first part of Note 9, relating current, deferred, and total provision for income taxes, prepare a s

> Refer to the situation described in E 17–21. In E 17–21 Lacy Construction has a noncontributory, defined benefit pension plan. At December 31, 2018, Lacy received the following information: Projected Benefit Obligation ……………… ($ in millions) Balance, Ja

> Lacy Construction has a noncontributory, defined benefit pension plan. At December 31, 2018, Lacy received the following information: Projected Benefit Obligation ……………… ($ in millions) Balance, January 1 …………………………………………………….. $360 Service cost ……………………

> Refer to the data provided in E 17–19. In E 17–19 Beale Management has a noncontributory, defined benefit pension plan. On December 31, 2018 (the end of Beale’s fiscal year), the following pension-related data were available: Projected Benefit Obligatio

> Lamont Corporation has a pension plan in which the corporation makes all contributions and employees receive benefits at retirement based on the balance in their accumulated pension fund. What type of pension plan does Lamont have?

> Beale Management has a noncontributory, defined benefit pension plan. On December 31, 2018 (the end of Beale’s fiscal year), the following pension-related data were available: Projected Benefit Obligation ____________________($ in millions) Balance, Janu

> Patel Industries has a noncontributory, defined benefit pension plan. Since the inception of the plan, the actuary has used as the discount rate the rate on high quality corporate bonds, which recently has been 7%. During 2018, changing economic conditio

> Listed below are several terms and phrases associated with pensions. Pair each item from List A with the item from List B (by letter) that is most appropriately associated with it. List A List B 1. Future compensation levels estimated 2. All funding

> Actuary and trustee reports indicate the following changes in the PBO and plan assets of Douglas-Roberts Industries during 2018: Prior service cost at Jan. 1, 2018, from plan amendment at the beginning of 2015 (amortization: $4 million per year) â&

> A partially completed pension spreadsheet showing the relationships among the elements that comprise the defined benefit pension plan of Universal Products is given below. The actuary’s discount rate is 5%. At the end of 2016, the pensi

> Warrick Boards calculated pension expense for its underfunded pension plan as follows: __________________________________________($ in millions) Service cost ………………………………………………..………………………………………….. $224 Interest cost ………………………………………………..….…………………………………………

> Suppose a tax reform bill is enacted that causes the corporate tax rate to change from 34% to 36%. How would this affect an existing deferred tax liability? How would the change be reflected in income?

> Additional disclosures are required pertaining to the income tax expense reported in the income statement. What are the needed disclosures?