Question: Adams Corporation uses a periodic inventory system

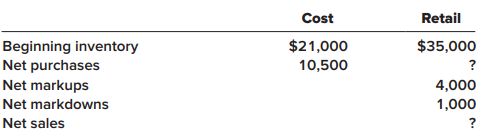

Adams Corporation uses a periodic inventory system and the retail inventory method to estimate ending inventory and cost of goods sold. The following data are available for the month of September 2021:

The company used the average cost flow method and estimated inventory at the end of September to be $17,437.50. If the company had used the LIFO cost flow method, the cost-to-retail percentage would have been 50%.

Required:

Compute net purchases at retail and net sales for the month of September using the information provided.

> Howarth Manufacturing Company purchased equipment on June 30, 2017, at a cost of $800,000. The residual value of the equipment was estimated to be $50,000 at the end of a five-year life. The equipment was sold on March 31, 2021, for $170,000. Howarth use

> On July 1, 2016, Farm Fresh Industries purchased a specialized delivery truck for $126,000. At the time, Farm Fresh estimated the truck to have a useful life of eight years and a residual value of $30,000. On March 1, 2021, the truck was sold for $58,000

> Mercury Inc. purchased equipment in 2019 at a cost of $400,000. The equipment was expected to produce 700,000 units over the next five years and have a residual value of $50,000. The equipment was sold for $210,000 part way through 2021. Actual productio

> On January 1, 2021, the Excel Delivery Company purchased a delivery van for $33,000. At the end of its five-year service life, it is estimated that the van will be worth $3,000. During the five-year period, the company expects to drive the van 100,000 mi

> On March 31, 2021, Wolfson Corporation acquired all of the outstanding common stock of Barney Corporation for $17,000,000 in cash. The book values and fair values of Barney’s assets and liabilities were as follows: Required: Calculate t

> In 2021, Bratten Fitness Company made the following cash purchases: 1. The exclusive right to manufacture and sell the X-Core workout equipment from Symmetry Corporation for $200,000. Symmetry created the unique design for the equipment. Bratten also pai

> Jackpot Mining Company operates a copper mine in central Montana. The company paid $1,000,000 in 2021 for the mining site and spent an additional $600,000 to prepare the mine for extraction of the copper. After the copper is extracted in approximately fo

> The Manguino Oil Company incurred exploration costs in 2021 searching and drilling for oil as follows: It was determined that Wells 104–108 were dry holes and were abandoned. Wells 101, 102, and 103 were determined to have sufficient oi

> Freitas Corporation was organized early in 2021. The following expenditures were made during the first few months of the year: Required: Prepare a summary journal entry to record the $107,000 in cash expenditures.

> On September 30, 2021, Athens Software began developing a software program to shield personal computers from malware and spyware. Technological feasibility was established on February 28, 2022, and the program was available for release on April 30, 2022.

> King Supply maintains its internal inventory records using perpetual FIFO, but for financial reporting purposes, reports ending inventory and cost of goods sold using periodic LIFO. At the beginning of the year, the company had a balance of $60,000 in it

> Early in 2021, the Excalibur Company began developing a new software package to be marketed. The project was completed in December 2021 at a cost of $6 million. Of this amount, $4 million was spent before technological feasibility was established. Excali

> NXS Semiconductor prepares its financial statements according to International Financial Reporting Standards. The company incurred the following expenditures during 2021 related to the development of a chip to be used in mobile devices: Salaries and wage

> Janson Pharmaceuticals incurred the following costs in 2021 related to a new cancer drug: The development costs were incurred after technological and commercial feasibility was established and after the future economic benefits were deemed probable. The

> Delaware Company incurred the following research and development costs during 2021: The equipment has a seven-year life and will be used for a number of research projects. Depreciation for 2021 is $120,000. Required: Calculate the amount of research and

> In 2021, Space Technology Company modified its model Z2 satellite to incorporate a new communication device. The company made the following expenditures: The equipment will be used on this and other research projects. Depreciation on the equipment for 20

> Thornton Industries began construction of a warehouse on July 1, 2021. The project was completed on March 31, 2022. No new loans were required to fund construction. Thornton does have the following two interest-bearing liabilities that were outstanding t

> On January 1, 2021, the Highlands Company began construction on a new manufacturing facility for its own use. The building was completed in 2022. The company borrowed $1,500,000 at 8% on January 1 to help finance the construction. In addition to the cons

> On January 1, 2021, the Shagri Company began construction on a new manufacturing facility for its own use. The building was completed in 2022. The only interest-bearing debt the company had outstanding during 2021 was long-term bonds with a book value of

> On January 1, 2021, the Marjlee Company began construction of an office building to be used as its corporate headquarters. The building was completed early in 2022. Construction expenditures for 2021, which were incurred evenly throughout the year, total

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Determine the specific eight-digit Codification citation (XXX-XX-XX-X) that describes each of the following items: 1. The disclosure requirements in the notes to the fi

> Refer to the situation described in BE 8–8. Assuming an income tax rate of 25%, what is LIFO liquidation profit or loss that the company would report in a disclosure note accompanying its financial statements? Data from BE 8-8: Esquire Inc. uses the LIF

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Determine the specific eight-digit Codification citation (XXX-XX-XX-X) that describes each of the following items: 1. The basic principle for recording nonmonetary tran

> Nvidia Corporation, a global technology company located in Santa Clara, California, reported the following information in its 2017 financial statements ($ in millions): Required: 1. Calculate the company’s 2017 fixed-asset turnover rati

> Cranston LTD. prepares its financial statements according to International Financial Reporting Standards. In October 2021, the company received a $2 million government grant. The grant represents 20% of the total cost of equipment that will be used to im

> On February 1, 2021, the Xilon Corporation issued 50,000 shares of its no-par common stock in exchange for five acres of land located in the city of Monrovia. On the date of the acquisition, Xilon’s common stock had a fair value of $18 per share. An offi

> On March 1, 2021, Beldon Corporation purchased land as a factory site for $60,000. An old building on the property was demolished, and construction began on a new building that was completed on December 15, 2021. Costs incurred during this period are lis

> On November 21, 2021, a fire at Hodge Company’s warehouse caused severe damage to its entire inventory of Product Tex. Hodge estimates that all usable damaged goods can be sold for $12,000. The following information was available from the records of Hodg

> On September 22, 2021, a flood destroyed the entire merchandise inventory on hand in a warehouse owned by the Rocklin Sporting Goods Company. The following information is available from the records of the company’s periodic inventory system: Inventory, J

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Determine each of the following: 1. The specific seven-digit Codification citation (XXX-XX-XX) that contains discussion of the measurement of ending inventory using the

> Tatum Company has four products in its inventory. Information about the December 31, 2021, inventory is as follows: The normal profit is 25% of total cost. Required: 1. Determine the carrying value of inventory at December 31, 2021, assuming the lower of

> The inventory of Royal Decking consisted of five products. Information about the December 31, 2021, inventory is as follows: Selling costs consist of a sales commission equal to 10% of selling price and shipping costs equal to 5% of cost. The normal prof

> At the end of the first year of operations, Gaur Manufacturing had gross accounts receivable of $300,000. Gaur’s management estimates that 6% of the accounts will prove uncollectible. What journal entry should Gaur record to establish an allowance for un

> On January 1, 2021, the general ledger of Big Blast Fireworks included the following account balances: The $30,000 beginning balance of inventory consists of 300 units, each costing $100. During January 2021, Big Blast Fireworks had the following invento

> In March 2021, the Phillips Tool Company signed two purchase commitments. The first commitment requires Phillips to purchase inventory for $100,000 by June 15, 2021. The second commitment requires the company to purchase inventory for $150,000 by August

> On October 6, 2021, the Elgin Corporation signed a purchase commitment to purchase inventory for $60,000 on or before March 31, 2022. The company’s fiscal year-end is December 31. The contract was exercised on March 21, 2022, and the inventory was purcha

> Tatum Company has four products in its inventory. Information about the December 31, 2021, inventory is as follows: Required: 1. Determine the carrying value of inventory at December 31, 2021, assuming the lower of cost or net realizable value (LCNRV) ru

> In 2021, the controller of Sytec Corporation discovered that $42,000 of inventory purchases were incorrectly charged to advertising expense in 2020. In addition, the 2020 year-end inventory count failed to include $30,000 of company merchandise held on c

> In 2021, the internal auditors of Development Technologies, Inc., discovered that a $4 million purchase of merchandise in 2021 was recorded in 2020 instead. The physical inventory count at the end of 2020 was correct. Required: Prepare the journal entry

> For each of the following inventory errors occurring in 2021, determine the effect of the error on 2021’s cost of goods sold, net income, and retained earnings. Assume that the error is not discovered until 2022 and that a periodic inve

> During 2021, WMC Corporation discovered that its ending inventories reported in its financial statements were misstated by the following material amounts: 2019: understated by $120,000 2020: overstated by 150,000 WMC uses a periodic inventory system and

> Goddard Company has used the FIFO method of inventory valuation since it began operations in 2018. Goddard decided to change to the average cost method for determining inventory costs at the beginning of 2021. The following schedule shows year-end invent

> In 2021, CPS Company changed its method of valuing inventory from the FIFO method to the average cost method. At December 31, 2020, CPS’s inventories were $32 million (FIFO). CPS’s records indicated that the inventories would have totaled $23.8 million a

> Refer to the situation described in BE 7–6. Prepare the year-end adjusting journal entries to account for anticipated sales returns, assuming that all sales are made on credit and all accounts receivable are outstanding. Data from BE 7-6: During 2021, i

> Bosco Company adopted the dollar-value LIFO retail method at the beginning of 2021. Information for 2021 and 2022 is as follows, with certain data intentionally omitted: Required: Determine the missing data.

> Lance-Hefner Specialty Shoppes decided to use the dollar-value LIFO retail method to value its inventory. Accounting records provide the following information: Related retail price indexes are as follows: January 1, 2021 = 1.00 December 31, 2021 = 1.10 R

> Canova Corporation adopted the dollar-value LIFO retail method on January 1, 2021. On that date, the cost of the inventory on hand was $15,000 and its retail value was $18,750. Information for 2021 and 2022 is as follows: Required: 1. What is the cost-to

> The inventory of Royal Decking consisted of five products. Information about the December 31, 2021, inventory is as follows: Costs to sell consist of a sales commission equal to 10% of selling price and shipping costs equal to 5% of cost. Required: What

> On January 1, 2021, the Brunswick Hat Company adopted the dollar-value LIFO retail method. The following data are available for 2021: Required: Calculate the estimated ending inventory and cost of goods sold for 2021 using the information provided.

> LeMay Department Store uses the retail inventory method to estimate ending inventory for its monthly financial statements. The following data pertain to one of its largest departments for the month of March 2021: Sales are recorded net of employee discou

> Almaden Valley Variety Store uses the retail inventory method to estimate ending inventory and cost of goods sold. Data for 2021 are as follows: Required: Estimate the ending inventory and cost of goods sold for 2021, applying the conventional retail met

> Crosby Company owns a chain of hardware stores throughout the state. The company uses a periodic inventory system and the retail inventory method to estimate ending inventory and cost of goods sold. The following data are available for the three months e

> Campbell Corporation uses the retail method to value its inventory. The following information is available for the year 2021: Required: Determine the December 31, 2021, inventory by applying the conventional retail method using the information provided.

> During 2021, its first year of operations, Hollis Industries recorded sales of $10,600,000 and experienced returns of $720,000. Cost of goods sold totaled $6,360,000 (60% of sales). The company estimates that 8% of all sales will be returned. Prepare the

> San Lorenzo General Store uses a periodic inventory system and the retail inventory method to estimate ending inventory and cost of goods sold. The following data are available for the month of October 2021: Required: Estimate the average cost of ending

> National Distributing Company uses a periodic inventory system to track its merchandise inventory and the gross profit method to estimate ending inventory and cost of goods sold for interim periods. Net purchases for the month of August were $31,000. The

> A fire destroyed a warehouse of the Goren Group, Inc., on May 4, 2021. Accounting records on that date indicated the following: Merchandise inventory, January 1, 2021 = $1,900,000 Purchases to date = 5,800,000 Freight-in = 400,000 Sales to date = 8,200,0

> On July 15, 2021, the Nixon Car Company purchased 1,000 tires from the Harwell Company for $50 each. The terms of the sale were 2/10, n/30. Nixon uses a perpetual inventory system and the gross method of accounting for purchase discounts. Required: 1. Pr

> The Phoenix Corporation’s fiscal year ends on December 31. Phoenix determines inventory quantity by a physical count of inventory on hand at the close of business on December 31. The company’s controller has asked for your help in deciding if the followi

> The December 31, 2021, year-end inventory balance of the Raymond Corporation is $210,000. You have been asked to review the following transactions to determine if they have been correctly recorded. 1. Goods shipped to Raymond f.o.b. destination on Decemb

> The Kwok Company’s inventory balance on December 31, 2021, was $165,000 (based on a 12/31/2021 physical count) before considering the following transactions: 1. Goods shipped to Kwok f.o.b. destination on December 20, 2021, were received on January 4, 20

> The Playa Company has the following information in its records. Certain data have been intentionally omitted ($ in thousands). Required: Determine the missing numbers. Show computations where appropriate.

> On January 1, 2021, the general ledger of Tripley Company included the following account balances: The $30,000 beginning balance of inventory consists of 300 units, each costing $100. During January 2021, the company had the following transactions: Jan.

> On January 1, 2021, Displays Incorporated had the following account balances: From January 1 to December 31, the following summary transactions occurred: a. Purchased inventory on account for $330,000. b. Sold inventory on account for $570,000. The cost

> Refer to the situation described in BE 7–4. Answer the questions assuming that Tristar uses the net method to account for sales discounts. Data from BE 7-4: On December 28, 2021, Tristar Communications sold 10 units of its new satellite uplink system to

> The June 30, 2021, year-end trial balance for Askew Company contained the following information: In addition, you determine that the June 30, 2021, inventory balance is $40,000. Required: Calculate the cost of goods sold for the Askew Company for the yea

> Mercury Company has only one inventory pool. On December 31, 2021, Mercury adopted the dollar-value LIFO inventory method. The inventory on that date using the dollar-value LIFO method was $200,000. Inventory data are as follows: Required: Compute the in

> On January 1, 2021, the Haskins Company adopted the dollar-value LIFO method for its one inventory pool. The pool’s value on this date was $660,000. The 2021 and 2022 ending inventory valued at year-end costs were $690,000 and $760,000, respectively. The

> The table below contains selected information from recent financial statements of The Home Depot, Inc., and Lowe’s Companies, Inc., two companies in the home improvement retail industry ($ in millions): Required: Calculate the gross pro

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Determine each of the following: 1. The specific nine-digit Codification citation (XXX-XX-XXX-X) that describes the disclosure requirements that must be made by publicl

> The Churchill Corporation uses a periodic inventory system and the LIFO inventory cost method for its one product. Beginning inventory of 20,000 units consisted of the following, listed in chronological order of acquisition: 12,000 units at a cost of $8.

> The Reuschel Company began 2021 with inventory of 10,000 units at a cost of $7 per unit. During 2021, 50,000 units were purchased for $8.50 each. Sales for the year totaled 54,000 units leaving 6,000 units on hand at the end of 2021. Reuschel uses a peri

> AmerisourceBergen is an American drug wholesale company. The company uses the LIFO inventory method for external reporting but maintains its internal records using FIFO. The following disclosure note was included in a recent quarterly report: 5. Inventor

> Tipton Processing maintains its internal inventory records using average cost under a perpetual inventory system. The following information relates to its inventory during the year: Jan. 1: Inventory on hand—80,000 units; cost $4.25 each. Feb. 14: Purcha

> John’s Specialty Store uses a periodic inventory system. The following are some inventory transactions for the month of May: 1. John’s purchased merchandise on account for $5,000. Freight charges of $300 were paid in cash. 2. John’s returned some of the

> On December 28, 2021, Tristar Communications sold 10 units of its new satellite uplink system to various customers for $25,000 each. The terms of each sale were 1/10, n/30. Tristar uses the gross method to account for sales discounts. In what year will i

> To more efficiently manage its inventory, Treynor Corporation maintains its internal inventory records using first-in, first-out (FIFO) under a perpetual inventory system. The following information relates to its merchandise inventory during the year: Ja

> Causwell Company began 2021 with 10,000 units of inventory on hand. The cost of each unit was $5.00. During 2021, an additional 30,000 units were purchased at a single unit cost, and 20,000 units remained on hand at the end of 2021 (20,000 units therefor

> The following information is taken from the inventory records of the CNB Company for the month of September: Required: 1. Assuming that CNB uses a periodic inventory system and employs the average cost method, determine cost of goods sold for September a

> Alta Ski Company’s inventory records contained the following information regarding its latest ski model. The company uses a periodic inventory system. Required: 1. Which method, FIFO or LIFO, will result in the highest cost of goods sol

> Altira Corporation provides the following information related to its merchandise inventory during the month of August 2021: Aug. 1: Inventory on hand—2,000 units; cost $5.30 each. 8: Purchased 8,000 units for $5.50 each. 14: Sold 6,000 units for $12.00 e

> Altira Corporation provides the following information related to its merchandise inventory during the month of August 2021: Aug. 1: Inventory on hand—2,000 units; cost $5.30 each. 8: Purchased 8,000 units for $5.50 each. 14: Sold 6,000 units for $12.00 e

> Altira Corporation provides the following information related to its merchandise inventory during the month of August 2021: Aug. 1 Inventory on hand—2,000 units; cost $5.30 each. 8: Purchased 8,000 units for $5.50 each. 14: Sold 6,000 units for $12.00 ea

> Access the FASB Accounting Standards Codification at the FASB website (www.fasb.org). Determine each of the following: 1. The specific eight-digit Codification citation (XXX-XX-XX-X) that describes the meaning of cost as it applies to the initial measure

> Tracy Company, a manufacturer of air conditioners, sold 100 units to Thomas Company on November 17, 2021. The units have a list price of $500 each, but Thomas was given a 30% trade discount. The terms of the sale were 2/10, n/30. Thomas uses a perpetual

> On July 15, 2021, the Nixon Car Company purchased 1,000 tires from the Harwell Company for $50 each. The terms of the sale were 2/10, n/30. Nixon uses a perpetual inventory system and the net method of accounting for purchase discounts. Required: 1. Prep

> Thaler Inc. holds a $1 million receivable ($800,000 principal, $200,000 accrued interest) from Einhorn Industries, and agrees to settle the receivable outright for $900,000 given Einhorn’s difficult financial situation. How much gain or loss should Thale

> The FASB Accounting Standards Codification represents the single source of authoritative U.S. generally accepted accounting principles. Required: 1. Obtain the relevant authoritative literature on accounting for accounts receivable using the FASB’s Codif

> Halifax Manufacturing allows its customers to return merchandise for any reason up to 90 days after delivery and receive a credit to their accounts. All of Halifax’s sales are for credit (no cash is collected at the time of sale). The company began 2021

> Harwell Company manufactures automobile tires. On July 15, 2021, the company sold 1,000 tires to the Nixon Car Company for $50 each. The terms of the sale were 2/10, n/30. Harwell uses the net method of accounting for cash discounts. Required: 1. Prepare

> Harwell Company manufactures automobile tires. On July 15, 2021, the company sold 1,000 tires to the Nixon Car Company for $50 each. The terms of the sale were 2/10, n/30. Harwell uses the gross method of accounting for cash discounts. Required: 1. Prepa

> Tracy Company, a manufacturer of air conditioners, sold 100 units to Thomas Company on November 17, 2021. The units have a list price of $600 each, but Thomas was given a 30% trade discount. The terms of the sale were 2/10, n/30. Required: 1. Prepare the

> Parker Inc. has the following cash balances: Required: 1. Prepare the current assets and current liabilities section of Parker’s 2021 balance sheet, assuming Parker reports under U.S. GAAP. 2. Prepare the current assets and current liab

> On January 1, 2021, the general ledger of 3D Family Fireworks includes the following account balances: During January 2021, the following transactions occur: 1. January 2: Provide services to customers for cash, $35,100. 2. January 6: Provide services to

> At January 1, 2021, Clayton Hoists Inc. owed Third BancCorp $12 million, under a 10% note due December 31, 2022. Interest was paid last on December 31, 2019. Clayton was experiencing severe financial difficulties and asked Third BancCorp to modify the te

> Harrison Company maintains a checking account at the First National City Bank. The bank provides a bank statement along with canceled checks on the last day of each month. The July 2021 bank statement included the following information: The companyâ

> Jansen Company’s general ledger showed a checking account balance of $23,820 at the end of May 2021. The May 31 cash receipts of $2,340, included in the general ledger balance, were placed in the night depository at the bank on May 31 and were processed

> Shan Enterprises received a bank statement listing its May 31, 2021, bank balance as $47,582. Shan determined that as of May 31 it had cash receipts of $2,500 that were not yet deposited and checks outstanding of $7,224. Calculate Shan’s correct May 31,

> The petty cash fund of Ricco’s Automotive contained the following items at the end of September 2021: The petty cash fund was established at the beginning of September with a transfer of $150 from cash to the petty cash account. Require

> Loucks Company established a $200 petty cash fund on October 2, 2021. The fund is replenished at the end of each month. At the end of October 2021, the fund contained $37 in cash and the following receipts: Required: Prepare the necessary general journal