Question: Aeropostale, Inc. (ARO) is a specialty fashion

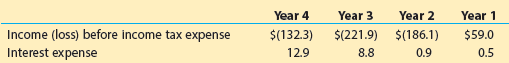

Aeropostale, Inc. (ARO) is a specialty fashion retailer targeting young adults. The income before income tax expense and interest expense for four recent years follow (in millions):

a. Compute the times interest earned ratio for each year. Round to one decimal place.

b. Plot the four points on a graph with the year numbers on the horizontal axis, beginning with Year 1.

c. Interpret the trend in the ratio from your graph.

d. What happened to interest expense in Year 4? What might be the cause?

Transcribed Image Text:

Year 4 Year 3 Year 2 Year 1 Income (loss) before income tax expense $(132.3) $(221.9) $(186.1) $59.0 Interest expense 12.9 8.8 0.9 0.5

> The following selected accounts appear in the ledger of Parks Construction Inc. at the beginning of the current year: Preferred 2% Stock, $100 par (100,000 shares authorized, 80,000 shares issued) …$ 8,000,000 Paid-In Capital in Excess of Par—Preferred

> Campbell, Inc. produces and sells outdoor equipment. On July 1, 20Y1. Campbell issued $30,000,000 of 10-year, 10% bonds at a market (effective) interest rate of 9%, receiving cash of $31,951,110. Interest on the bonds is payable semiannually on December

> An accountant prepared the following post-closing trial balance: Prepare a corrected post-closing trial balance. Assume that all accounts have normal balances and that the amounts shown are correct. Security Services Co. Post-Closing Trlal Balance

> On July 1, 20Y1, Danzer Industries Inc. issued $40,000,000 of 10-year, 7% bonds at a market (effective) interest rate of 8%, receiving cash of $37,282,062. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the c

> Campbell Inc. produces and sells outdoor equipment. On July 1, 20Y1, Campbell issued $30,000,000 of 10-year, 10% bonds at a market (effective) interest rate of 9%, receiving cash of $31,951,110. Interest on the bonds is payable semiannually on December 3

> On July 1, 20Y1, Danzer Industries Inc. issued $50,000,000 of 10-year, 8% bonds at a market (effective) interest rate of 10%, receiving cash of $43,768,920. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the

> The following information about the payroll for the week ended December 30 was obtained from the records of Boltz Co.: Tax rates assumed: Instructions: 1. Assuming that the payroll for the last week of the year is to be paid on December 31, journaliz

> The following items were selected from among the transactions completed by Sherwood Co. during the current year: Instructions: 1. Journalize the transactions. 2. Journalize the adjusting entry for each of the following accrued expenses at the end of th

> The following transactions and adjusting entries were completed by Legacy Furniture Co. during a three-year period. All are related to the use of delivery equipment. The double-declining balance method of depreciation is used. Instructions: Journalize

> Water Closet Co. wholesales bathroom fixtures. During the current year ending December 31, Water Closet received the following notes: Instructions: 1. Determine for each note (a) the due date and (b) the amount of interest due at maturity, identifying

> Call Systems Company, a telephone service and supply company, has just completed its fourth year of operations. The direct write-off method of recording bad debt expense has been used during the entire period. Because of substantial increases in sales vo

> The following transactions were completed by Irvine Company during the current fiscal year ended December 31: Instructions: 1. Record the January 1 credit balance of $26,000 in a T account for Allowance for Doubtful Accounts. 2. Journalize the transact

> Selected data on inventory, purchases, and sales for Celebrity Tan Co. and Ranchworks Co. are as follows: Instructions: 1. Determine the estimated cost of the inventory of Celebrity Tan Co. on August 31 by the retail method, presenting details of the c

> (a). What is the difference between liquidity and solvency? (b). What is the difference between working capital and the current ratio?

> The beginning inventory for Midnight Supplies and data on purchases and sales for a three month period are shown in Problem 6-1A. Problem 6-1A: The beginning inventory at Midnight Supplies and data on purchases and sales for a three-month period ending

> The beginning inventory for Midnight Supplies and data on purchases and sales for a three month period are shown in Problem 6-1A. Problem 6-1A: The beginning inventory at Midnight Supplies and data on purchases and sales for a three-month period ending

> Selected transactions during August between Summit Company and Beartooth Co. are listed in Problem 5-4A. Problem 5-4A: The following selected transactions were completed during August between Summit Company and Beartooth Co.: Instructions: Journaliz

> Selected transactions for Babcock Company during November of the current year are listed in Problem 5-3A. Problem 5-3A: The following were selected from among the transactions completed by Babcock Company during November of the current year: Instruct

> Selected transactions for Betz Company during July of the current year are listed in Problem 5-1A. Problem 5-1A.: The following selected transactions were completed by Betz Company during July of the current year: Instructions: Journalize the entries

> The following selected transactions were completed during August between Summit Company and Beartooth Co.: Instructions: Journalize the August transactions for (1) Summit Company and (2) Beartooth Co. Aug. 1. Summit Company sold merchandise on acc

> The following selected transactions were completed by Betz Company during July of the current year: Instructions: Journalize the entries to record the transactions of Betz Company for July. July 1. Purchased merchandise from Sabol Imports Co., $20,

> Foxy Investigative Services is an investigative services firm that is owned and operated by Shirley Vickers. On November 30, 20Y8, the end of the fiscal year, the accountant for Foxy Investigative Services prepared an end-of-period spreadsheet, a part of

> Good Note Company specializes in the repair of music equipment and is owned and operated by Robin Stahl. On June 30, 20Y6, the end of the current year, the accountant for Good Note prepared the following trial balances: Instructions: Journalize the sev

> Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 20Y3, follows: The following business transactions were completed by Elite Realty during April 20Y3: Enter the following tr

> The dividend yield of Suburban Propane Partners, L.P. (SPH) was 7.7% in a recent year, and the dividend yield of Alphabet Inc. (GOOG) was 0% in the same year. What might explain the difference between these ratios?

> The financial statements at the end of Wolverine Realty’s first month of operations are as follows: Instructions: By analyzing the interrelationships among the four financial statements, determine the proper amounts for (a) through

> The Lexington Group has the following unadjusted trial balance as of May 31, 20Y6: The debit and credit totals are not equal as a result of the following errors: a. The cash entered on the trial balance was overstated by $7,000. b. A cash receipt of $8

> On August 1, 20Y9, Brooke Kline established Western Realty. Brooke completed the following transactions during the month of August: a. Opened a business bank account with a deposit of $35,000 in exchange for common stock. b. Purchased supplies on accoun

> Trident Repairs & Service, an electronics repair store, prepared the following unadjusted trial balance at the end of its first year of operations: For preparing the adjusting entries, the following data were assembled: • Fees ear

> Marjorie Knaus, an architect, organized Knaus Architects on January 1, 20Y4. During the month, Knaus Architects completed the following transactions: a. Issued common stock to Marjorie Knaus in exchange for $30,000. b. Paid January rent for office and wo

> On April 1 of the current year, Morgan Jones established a business to manage rental property. She completed the following transactions during April: a. Opened a business bank account with a deposit of $60,000 in exchange for common stock. b. Purchased

> Marriott International, Inc. (MAR), and Hyatt Hotels Corporation (H) are two major owners and managers of lodging and resort properties in the United States. Abstracted income statement information for the two companies is as follows for a recent year (i

> Deere & Company (DE) manufactures and distributes farm and construction machinery that it sells around the world. In addition to its manufacturing operations, Deere’s credit division loans money to customers to finance the purchase

> The following table shows the stock price, earnings per share, and dividends per share for Alphabet Inc. (GOOG), PepsiCo, Inc. (PEP), and Caterpillar Inc. (CAT) for a recent year: 1. For each company, determine the: a. Price-earnings ratio. Round to th

> The condensed income statements through operating income for Amazon.com, Inc. (AMZN), Best Buy Co., Inc. (BBY), and Wal-Mart Stores, Inc. (WMT), for a recent fiscal year follow (in millions): 1. Prepare comparative common-sized income statements for ea

> Installment notes require equal periodic payments. a. What is included in each periodic payment? b. Does the periodic interest expense on an installment note increase or decrease over the life of the note?

> The Priceline Group Inc. (PCLN) is a leading provider of online travel reservation services, including brand names Priceline, KAYAK, and Open Table. Selected cash flow information from the statement of cash flows for three recent years is as follows (in

> AT&T Inc. (T) is a leading global provider of telecommunication services. Facebook, Inc. (FB) is a major worldwide social media company. AT&T has a lengthy history and was founded by Alexander Graham Bell. Facebook has a short history and was fou

> Aeropostale, Inc. (AROPQ) is a specialty retailer of casual apparel and accessories for teens. Recently, the company declared bankruptcy to provide financial protection while attempting to reorganize its operations. Annual report information for the thre

> Financial information for Apple Inc. (AAPL), The Coca-Cola Company (KO), and Verizon Communications (VZ) follows (in millions): a. Compute the free cash flow for each company. b. Compute the ratio of free cash flow to sales for each company. Round to o

> Amazon.com, Inc. (AMZN) is one of the largest Internet retailers in the world. Best Buy Co., Inc. (BBY) is a leading retailer of consumer electronics and media products in the United States, while Wal-Mart Stores, Inc. (WMT) is the leading retailer in th

> BB&T Corporation (BBT) and Regions Financial Corporation (RF) are large regional banking companies. The net income and average common shares outstanding for both companies were reported in recent financial reports as follows (in millions): a. Deter

> Caterpillar Inc. (CAT) is the world’s leading manufacturer of construction and mining equipment. In addition, Birinyi Associates identified Caterpillar as one of the top five companies to repurchase its own shares in a recent year.12 Th

> Pacific Gas and Electric Company (PCG) is a large gas and electric utility operating in northern and central California. Three recent years of financial data for Pacific Gas and Electric are as follows (in millions): a. Determine the earnings per share

> Bank of America Corporation (BAC) and Wells Fargo & Company (WFC) are two large financial services companies. The following data (in millions) were taken from a recent year’s financial statements for both companies: a. Compute the

> Amazon.com, Inc. (AMZN) is one of the largest Internet retailers in the world. Wal-Mart (WMT) is the largest retailer in the United States. Amazon and Wal-Mart compete in similar markets; however, Wal-Mart sells through both traditional retail stores and

> What is the nature of (a) a credit memo issued by the seller of merchandise, (b) a debit memo issued by the buyer of merchandise?

> Selected transactions completed by Kornett Company during its first fiscal year ended December 31, 20Y5, were as follows: Unemployment tax rates: State unemployment …………&a

> Hilton Worldwide Holdings, Inc. (HLT) and Marriott International, Inc. (MAR) are two of the largest hotel operators in the world. Selected financial information from recent income statements for both companies follows (in millions): a. Compute the time

> The Clorox Company (CLX) and The Procter & Gamble Company (PG) produce and sell packaged consumer products around the world. Income and interest expense information from financial statements for a recent year follows (in millions): a. Compute the t

> Stores, Inc. (WMT) is the largest retailer in the United States. Amazon and Wal-Mart compete in similar markets; however, Wal-Mart sells through both traditional retail stores and the internet, while Amazon sells only through the internet. Interest expen

> Cabela’s Incorporated (CAB) is a leading specialty retailer of outdoor sports merchandise. Dick’s Sporting Goods, Inc. (DKS) is a leading full-line retailer of sporting equipment and apparel. The current assets and cur

> Neiman Marcus Group (NMG) is one of the largest luxury fashion retailers in the world. Kohl’s Corporation (KSS) sells moderately priced private and national branded products through more than 1,100 department stores located throughout t

> The Hershey Company (HSY) is the largest producer of chocolate in North America under the Hershey’s and Reese’s brand names. The following balance sheet information is provided at the end of three recent years (in thou

> Abercrombie & Fitch Co. (ANF) and The Gap, Inc. (GPS) are two U.S. apparel retailers. The current assets and current liabilities for each company from recent balance sheets are as follows (in thousands): a. Compute the working capital for each comp

> Amazon.com, Inc. (AMZN) is one of the largest Internet retailers in the world. Best Buy, Co. Inc. (BBY) is a leading retailer of consumer electronics and media products in the United States. Amazon and Best Buy compete in similar markets; however, Best B

> The following table shows the sales and average book value of fixed assets for three different companies from three different industries for a recent year: a. For each company, determine the fixed asset turnover ratio. Round to one decimal place. b. Ex

> Briefly explain the difference between liquidity, solvency, and profitability analysis.

> FedEx Corporation (FDX) and United Parcel Service, Inc. (UPS) compete in the package delivery business. The major fixed assets for each business include aircraft, sorting and handling facilities, delivery vehicles, and information technology. The sales a

> Verizon Communications Inc. (VZ) is a major telecommunications company in the United States. Two recent balance sheets for Verizon disclosed the following information regarding fixed assets: Verizon’s revenue for the year was $125,980

> Alaska Air Group (ALK), Delta Air Lines (DAL), and Southwest Airlines (LUV) reported the following financial information (in millions) in a recent year: a. Determine the fixed asset turnover ratio for each airline. Round to one decimal place. b. Based

> Amazon.com, Inc. (AMZN) is the world’s leading Internet retailer of merchandise and media. Amazon also designs and sells electronic products, such as e-readers. Netflix, Inc. (NFLX) is one of the world’s leading Intern

> Use the data in MAD 8-2 and MAD 8-3 to analyze the accounts receivable turnover ratios of Ralph Lauren Corporation and L Brands, Inc. MAD 8-2: Ralph Lauren Corporation (RL) designs, markets, and distributes a variety of apparel, home décor

> L Brands, Inc. (LB) sells women’s clothing and personal health care products through specialty retail stores including Victoria’s Secret and Bath & Body Works stores. L Brands reported the following (in millions) f

> Ralph Lauren Corporation (RL) designs, markets, and distributes a variety of apparel, home décor, accessory, and fragrance products. The company’s products include such brands as Ralph Lauren, Polo by Ralph Lauren, and Chap

> Amazon.com, Inc. (AMZN) is one of the largest Internet retailers in the world. Best Buy, Inc. (BBY) is a leading retailer of consumer electronics and media products in the United States. Amazon and Best Buy compete in similar markets; however, Best Buy s

> Three companies that compete in the athletic and activewear market segment are Nike, Inc. (NKE), lululemon athletica inc. (LULU), and Under Armour, Inc. (UAA). Nike is the largest designer and seller of athletic footwear and apparel in the world. Lululem

> Krispy Kreme Doughnuts, Inc. (KKD) is a leading retailer and wholesaler of doughnuts. Krispy Kreme owns or franchises more than 1,100 stores where the “hot” light tells you if doughnuts are cooking. Dunkinâ€

> The unadjusted trial balance of PS Music as of July 31, 20Y5, along with the adjustment data for the two months ended July 31, 20Y5, are shown in Chapter 3. Based upon the adjustment data, the following adjusted trial balance was prepared: Instructions

> Apache Corporation (APA) is an independent energy company that explores, develops, and produces oil and gas products. Apache operates worldwide, including in the United States, Canada, and the North Sea. The profitability of the oil and gas business is h

> Amazon.com, Inc. (AMZN) is one of the largest Internet retailers in the world. Netflix, Inc. (NFLX) provides digital streaming and DVD rentals in the United States. Amazon and Netflix compete in streaming and digital services; however, Amazon also sells

> Monster Beverage Corporation (MNST) develops, markets, and sells energy and other alternative beverage brands. Brown-Forman Corporation (BF.B) manufactures and sells a wide variety of spirit and wine beverages, such as Jack Daniel’s&Aci

> The general merchandise retail industry has a number of segments represented by the following companies: Company Name Merchandise Concept Costco Wholesale Corporation (COST) ………â

> Darden Restaurants, Inc. (DRI) is the largest full-service restaurant company in the world. It operates over 2,200 restaurants under a variety of brand names, including Olive Garden, Bahama Breeze, and Long Horn Steakhouse. Panera Bread Company (PNRA) op

> Amazon.com, Inc. (AMZN) is one of the largest Internet retailers in the world. Target Corporation (TGT) is one of the largest value-priced general merchandisers operating in the United States. Target sells through nearly 1,800 brick-and-mortar stores and

> J. C. Penney Company, Inc. (JCP) is a large general merchandise retailer in the United States. The following data (in millions) were obtained from its financial statements for four recent years: a. Compute the asset turnover ratio for each year. Round

> The Kroger Company (KR), a national supermarket chain, reported the following data (in millions) in its financial statements for a recent year: Total sales ………………………………………………………………. $115,337 Total assets: Beginning of year ……………………………………………………….. 33,897

> The Home Depot (HD) reported the following data (in millions) in its recent financial statements: a. Determine the asset turnover ratio for Home Depot for Year 2 and Year 1. Round to two decimal places. b. What conclusions can be drawn from these ratio

> CSX Corporation (CSX) and Union Pacific Corporation (UNP) are major railroads, operating primarily in the eastern and western portion of the United States, respectively. YRC Worldwide Inc. (YRCW) is one of the largest trucking companies in the United Sta

> The unadjusted trial balance that you prepared for PS Music at the end of Chapter 2 should appear as follows: The data needed to determine adjustments are as follows: • During July, PS Music provided guest disc jockeys for KXMD for a

> The asset turnover ratios for two recent years for Dollar Tree, Inc. (DLTR) are shown in the Analysis for Decision Making section of this chapter. Using your results from MAD 5-2, compare and interpret the asset turnover ratios for Dollar Tree and Dollar

> Dollar General Corporation (DG) is a discount retailer with more than 12,000 stores. It offers a wide range of merchandise normally for $10 or less. The following data (in millions) were taken from recent financial statements of Dollar General: a. Comp

> Amazon.com, Inc. (AMZN) is one of the largest Internet retailers in the world. Netflix, Inc. (NFLX) provides digital streaming and DVD rentals in the United States. Amazon and Netflix compete in streaming and digital services; however, Amazon also sells

> Alphabet Inc. (GOOG) and Microsoft Corporation (MSFT) design and distribute consumer and enterprise software, including overlaps in search, business productivity, and mobile operating systems. Alphabet’s primary source of revenue is fro

> Sears Holdings Corporation (SHLD) is one of the largest mall-based retailers in the United States. The following year-end data were taken from a recent Sears balance sheet (in millions): a. Compute the working capital and the current ratio as of Decemb

> The following year-end data were taken from recent balance sheets of Under Armour, Inc. (UA) (in millions): a. Compute the working capital and the current ratio as of December 31, Year 2 and Year 1. Round to one decimal place. b. What conclusions conce

> The Foot Locker, Inc. (FL) and The Finish Line, Inc. (FINL) are two retail athletic footwear chains. The current assets and current liabilities from recent balance sheets for both companies are as follows (in millions): a. Compute the working capital f

> Data (in millions) from recent financial statements of Zynga Inc. (ZNGA), Electronic Arts Inc. (EA), and Take-Two Interactive Software, Inc. (TTWO) are as follows: a. Compute the working capital for Year 2 and Year 1 for each company. b. Which company

> Amazon.com, Inc. (AMZN) is the largest internet retailer in the United States. Best Buy, Inc. (BBY) is a leading retailer of technology and media products in the United States. Amazon and Best Buy compete in similar markets; however, Best Buy sells throu

> The following income statement data for AT&T Inc. (T) and Verizon Communications Inc. (VZ) were taken from their recent annual reports (in millions): a. Prepare a vertical analysis of the income statement for AT&T. Round to one decimal place. b

> Dynamic Weight Loss Co. offers personal weight reduction consulting services to individuals. After all the accounts have been closed on June 30, 20Y7, the end of the fiscal year, the balances of selected accounts from the ledger of Dynamic Weight Loss ar

> The following data are taken from recent financial statements of Nike, Inc. (NKE) (in millions): a. Determine the amount of change (in millions) and percent of change in operating income from Year 1 to Year 2. Round to one decimal place. b. Determine t

> Chipotle Mexican Grill, Inc. (CMG) is a quick-service restaurant providing a focused menu of burritos, tacos, and salads. Chipotle’s income statements through operating income for two recent years are as follows (in thousands): a. Pre

> World Wrestling Entertainment, Inc. (WWE) is a sports media and entertainment company primarily focused on professional wrestling. WWE’s income statements through operating income for two recent years are as follows (in thousands): *$

> Pandora Media, Inc. (P) provides Internet music platform services in North America. Pandora’s income statements through operating income for two recent years are as follows (in thousands): a. Prepare a vertical analysis of the two inc

> Amazon.com, Inc. (AMZN) is the largest Internet retailer in the United States. Amazon’s income statements through operating income for two recent years are as follows (in millions): a. Prepare a vertical analysis of the two income sta

> The following data (in millions) are taken from the financial statements of Wal-Mart Stores, Inc. (WMT): a. For Walmart, determine the amount of change in millions and the percent of change rounded to one decimal place from Year 1 to Year 2 for: 1. Rev

> The following data (in millions) are taken from the financial statements of Target Corporation (TGT), the owner of Target stores: a. For Target, determine the amount of change in millions and the percent of change rounded to one decimal place from Year

> Vera Bradley, Inc. (VRA) is a leading designer, producer, and retailer of fashion handbags, accessories, and travel items for women. Income statements for two recent years for Vera Bradley are as follows: a. Prepare a horizontal analysis of the two inc

> Chipotle Mexican Grill, Inc. (CMG) is a quick-service restaurant providing a focused menu of burritos, tacos, and salads. Chipotle’s income statements for the end of two recent years are as follows: a. Prepare a horizontal analysis of