Question: After the success of the company’s

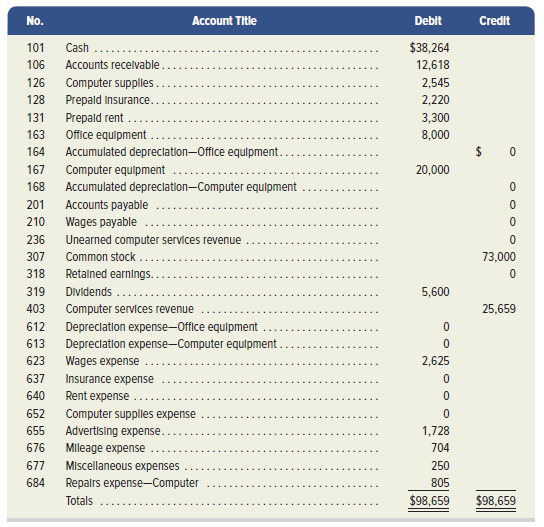

After the success of the company’s first two months, Santana Rey continues to operate Business Solutions. (Transactions for the first two months are described in the Chapter 2 serial problem.) The November 30, 2020, unadjusted trial balance of Business Solutions (reflecting its transactions for October and November of 2020) follows.

Business Solutions had the following transactions and events in December 2020.

Dec. 2 Paid $1,025 cash to Hillside Mall for Business Solutions’s share of mall advertising costs.

3 Paid $500 cash for minor repairs to the company’s computer.

4 Received $3,950 cash from Alex’s Engineering Co. for the receivable from November.

10 Paid cash to Lyn Addie for six days of work at the rate of $125 per day.

14 Notified by Alex’s Engineering Co. that Business Solutions’ bid of $7,000 on a proposed project has been accepted. Alex’s paid a $1,500 cash advance to Business Solutions.

15 Purchased $1,100 of computer supplies on credit from Harris Office Products.

16 Sent a reminder to Gomez Co. to pay the fee for services recorded on November 8.

20 Completed a project for Liu Corporation and received $5,625 cash. 22–26 Took the week off for the holidays.

28 Received $3,000 cash from Gomez Co. on its receivable.

29 Reimbursed S. Rey for business automobile mileage (600 miles at $0.32 per mile).

31 The company paid $1,500 cash in dividends.

The following additional facts are collected for use in making adjusting entries prior to preparing financial statements for the company’s first three months.

a. The December 31 inventory count of computer supplies shows $580 still available.

b. Three months have expired since the 12-month insurance premium was paid in advance.

c. As of December 31, Lyn Addie has not been paid for four days of work at $125 per day.

d. The computer system, acquired on October 1, is expected to have a four-year life with no salvage value.

e. The office equipment, acquired on October 1, is expected to have a five-year life with no salvage value.

f. Three of the four months’ prepaid rent has expired.

Required

1. Prepare journal entries to record each of the December transactions and events for Business Solutions. Post those entries to the accounts in the ledger.

2. Prepare adjusting entries to reflect a through f. Post those entries to the accounts in the ledger.

3. Prepare an adjusted trial balance as of December 31, 2020.

4. Prepare an income statement for the three months ended December 31, 2020.

5. Prepare a statement of retained earnings for the three months ended December 31, 2020.

6. Prepare a balance sheet as of December 31, 2020.

7. Record and post the necessary closing entries as of December 31, 2020.

8. Prepare a post-closing trial balance as of December 31, 2020.

> In the current year, Randa Merchandising, Inc., sold its interest in a chain of wholesale outlets, taking the company completely out of the wholesaling business. The company still operates its retail outlets. A listing of the major sections of an income

> Roak Company and Clay Company are similar firms that operate in the same industry. Clay began operations two years ago and Roak started five years ago. In the current year, both companies pay 6% interest on their debt to creditors. The following addition

> Following is an incomplete current-year income statement. Determine amounts a, b, and c. Additional information follows: Return on total assets is 16% (average total assets is $68,750). Inventory turnover is 5 (average inventory is $6,000). Accounts re

> Following are data for BioBeans and GreenKale, which sell organic produce and are of similar size. 1. Compute the profit margin and the return on total assets for both companies. 2. Based on analysis of these two measures, which company is the preferred

> Nintendo Company, Ltd., recently reported the following financial information (amounts in millions). Compute Nintendo’s current ratio and profit margin. Round to two decimals.

> Refer to Simon Company’s financial information in Exercises 13-6 and 13-9. Additional information about the company follows. For both the current year and one year ago, compute the following ratios: (1) return on common stockholders&aci

> In the current year, Aveeno reported net income of $50,400, which was a 12% increase over prior year net income. Compute prior year net income.

> Refer to Simon Company’s financial information in Exercises 13-6 and 13-9. For both the current year and one year ago, compute the following ratios: (1) profit margin ratio—percent rounded to one decimal; did profit margin improve or worsen in the curren

> Spiller Corp. plans to issue 10%, 15-year, $500,000 par value bonds payable that pay interest semiannually on June 30 and December 31. The bonds are dated December 31, 2021, and are issued on that date. If the market rate of interest for the bonds is 8%

> Refer to the Simon Company information in Exercises 13-6 and 13-9. For both the current year and one year ago, compute the following ratios: (1) debt ratio and equity ratio—percent rounded to one decimal, (2) debt-to-equity ratio—rounded to two decimals;

> Refer to the Simon Company information in Exercise 13-6. The company’s income statements for the cur- rent year and one year ago follow. Assume that all sales are on credit and then compute (1) days’ sales uncollected,

> On January 1, 5G Co. reported current assets of $72,000 and current liabilities of $60,000. Compute total current assets, total current liabilities, and the current ratio at January 1 and after each of the following transactions. Jan. 5 Purchased equipme

> Refer to Simon Company’s balance sheets in Exercise 13-6. (1) Compute the current ratio for each of the three years. Did the current ratio improve or worsen over the three-year period? (2) Compute the acid-test ratio for each of the three years. Did the

> Simon Company’s year-end balance sheets follow. (1) Express the balance sheets in common-size per- cents. Round percents to one decimal. (2) Assuming annual sales have not changed in the last three years, is the change in accounts recei

> Common-size and trend percents for Roxi Company’s sales, cost of goods sold, and expenses follow. Determine whether net income increased, decreased, or remained unchanged in this three-year period.

> Compute common-size percents for the following comparative income statements (round percents to one decimal). Using the common-size percents, which item is most responsible for the decline in net income?

> Compute trend percents for the following accounts using 2016 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favorable or unfavorable.

> Identify which of the following six metrics a through f best completes questions 1 through 3. a. Days’ sales uncollected b. Accounts receivable turnover c. Working capital d. Return on total assets e. Total asset turnover f. Profit margin 1. Which two r

> Identify which standard of comparison, (a) intracompany, (b) competitor, (c) industry, or (d) guidelines, best describes each of the following examples. 1. Compare Ford’s return on assets to GM’s return on assets. 2. Compare a company’s acid-test ratio t

> Otto Co. borrows money on April 30, 2021, by promising to make four payments of $13,000 each on November 1, 2021; May 1, 2022; November 1, 2022; and May 1, 2023. 1. How much money is Otto able to borrow if the interest rate is 8%, compounded semiannually

> Match the ratio to the building block of financial statement analysis to which it best relates. A. Liquidity and efficiency B. Solvency C. Profitability D. Market prospects 1. Equity ratio 2. Return on total assets 3. Dividend yield 4. Days’ sa

> Wipfli Co. provides auditing services and consulting services. Wipfli sells the consulting services segment for a gain of $75,000 (net of tax). Income from consulting services during the year is $20,000 (net of tax). Wipfli reports income from continuing

> Which of the following gains or losses would Organic Foods account for as unusual and/or infrequent? a. A hurricane destroys rainwater tanks that result in a loss for Organic Foods. b. The used vehicle market is weak and Organic Foods is forced to sell i

> Following is information for Morgan Company and Parker Company, which are similar firms operating in the same industry. 1. Based on current ratio and acid-test ratio, which company appears better positioned to pay current liabilities? 2. Based on account

> For each ratio listed, identify whether the change in ratio value from the prior year to the current year is usually regarded as favorable or unfavorable.

> Franklin Co. reported the following year-end data: net income of $220,000; annual cash dividends per share of $3; market price per (common) share of $150; and earnings per share of $10. Compute the a. Price-earnings ratio and b. dividend yield.

> Edison Co. reported the following for the current year: net sales of $80,000; cost of goods sold of $56,000; net income of $16,000; beginning balance of total assets of $60,000; and ending balance of total assets of $68,000. Compute (a) profit margin and

> Paddy’s Pub reported the following year-end data: income before interest expense and income tax expense of $30,000; cost of goods sold of $17,000; interest expense of $1,500; total assets of $70,000; total liabilities of $20,000; and total equity of $50,

> Dundee Co. reported the following for the current year: net sales of $80,000; cost of goods sold of $60,000; beginning balance of total assets of $115,000; and ending balance of total assets of $85,000. Compute total asset turnover. Round to one decimal.

> SCC Co. reported the following for the current year: net sales of $48,000; cost of goods sold of $40,000; beginning balance in inventory of $2,000; and ending balance in inventory of $8,000. Compute (a) inventory turnover and (b) days’ sales in inventory

> Analyze Rowan’s entries (1 through 3) from QS C-16 by showing each entry’s effect on the accounting equation—specifically, identify the accounts and amounts (including + or −) for each.

> Identify whether each of the following items are included as part of general-purpose financial statements. a. Income statement b. Balance sheet c. Shareholders’ meetings d. Financial statement notes e. Company news releases f. Statement of cash flows g.

> Use the following adjusted trial balance of Sierra Company to prepare its (1) income statement and (2) Statement of retained earnings for the year ended December 31. The Retained Earnings account balance was $5,500 on December 31 of the prior year.

> Common categories of a classified balance sheet include Current Assets, Long-Term Investments, Plant Assets, Intangible Assets, Current Liabilities, and Long-Term Liabilities. For each of the following items, identify the balance sheet category where the

> Following are unadjusted balances along with year-end adjustments for Quinlan Company. Complete the adjusted trial balance by entering the adjusted balance for each of the following accounts.

> For the entries below, identify the account to be debited and the account to be credited. Indicate which of the accounts the income statement account is and which the balance sheet account is. a. Entry to record services revenue earned that was previousl

> Molly Mocha employs one college student every summer in her coffee shop. The student works the five weekdays and is paid on the following Monday. (For example, a student who works Monday through Fri- day, June 1 through June 5, is paid for that work on M

> Select a company that you can visit in person or interview on the telephone. Call ahead to the company to arrange a time when you can interview an employee (preferably an accountant) who helps prepare the annual financial statements. Inquire about the fo

> Review this chapter’s opening feature involving Evan and Bobby and Snapchat. 1. Explain how a classified balance sheet can help Evan and Bobby know what bills are due when and whether they have the resources to pay those bills. 2. Why is it important for

> a. Tao Co. receives $10,000 cash in advance for four months of evenly planned legal services beginning on October 1. Tao records it by debiting Cash and crediting Unearned Revenue both for $10,000. It is now December 31, and Tao has provided legal servic

> Access EDGAR online (SEC.gov) and locate the 10-K report of The Gap, Inc. (ticker: GPS), filed on March 20, 2017. Review its financial statements reported for the year ended January 28, 2017, to answer the following questions. Required 1. What are Gap’s

> Rowan Co. purchases 100 common shares (40%) of JBI Corp. as a long-term investment for $500,000 cash on July 1. JBI paid $5,000 in total cash dividends on November 1 and reported net income of $100,000 for the year. Prepare Rowan’s entries to record (1)

> One of your classmates’ states that a company’s books should be ongoing and therefore not closed until that business is terminated. Write a half-page memo to this classmate explaining the concept of the closing process by drawing analogies between (1) a

> On January 20, Tamira Nelson, the accountant for Picton Enterprises, is feeling pressure to complete the annual December 31 year-end financial statements. The company president has said he needs up-to-date financial statements to share with the bank on J

> Refer to Apple’s most recent balance sheet in Appendix A. What three main noncurrent asset categories are used on its classified balance sheet?

> Refer to Google’s most recent balance sheet in Appendix A. Identify the accounts listed as current liabilities.

> Key comparative figures for Samsung, Apple, and Google follow. Required 1. Compute profit margin for Samsung, Apple, and Google. 2. Which company has the highest profit margin?

> Key figures for the recent two years of both Apple and Google follow. Required 1. Compute profit margins for (a) Apple and (b) Google for the two years of data reported above. 2. In the current year, which company is more successful on the basis of prof

> Use Apple’s financial statements in Appendix A to answer the following. 1. Compute Apple’s profit margin for fiscal years ended (a) September 29, 2018, and (b) September 30, 2017. 2. Is the change in Apple’s profit margin favorable or unfavorable? 3. In

> Common categories of a classified balance sheet include Current Assets, Long-Term Investments, Plant Assets, Intangible Assets, Current Liabilities, Long-Term Liabilities, and Equity. For each of the following items, identify the balance sheet category w

> a. Barga Company purchases $20,000 of equipment on January 1. The equipment is expected to last five years and be worth $2,000 at the end of that time. Prepare the entry to record one year’s depreciation expense of $3,600 for the equipment as of December

> On January 1, Aivah Co. purchased 2,000 common shares (25%) of Maywood Corp. as a long-term investment for $200,000. Later in the year, Maywood paid $16,000 in total cash dividends on December 15 and reported net income of $60,000 for the year ended Dece

> For journal entries 1 through 12, indicate the explanation that most closely describes it. You can use explanations more than once. A. To record payment of a prepaid expense. B. To record this period’s use of a prepaid expense. C. To re

> Common categories of a classified balance sheet include Current Assets, Long-Term Investments, Plant Assets, Intangible Assets, Current Liabilities, Long-Term Liabilities, and Equity. For each of the following items, identify the balance sheet category w

> For journal entries 1 through 12, indicate the explanation that most closely describes it. You can use explanations more than once. A. To record receipt of unearned revenue. B. To record this period’s earning of prior unearned revenue.

> The following data are taken from the unadjusted trial balance of the Westcott Company at December 31. Each account carries a normal balance. Set up a 10-column work sheet to answer the requirements. 1. Enter the accounts in proper order and enter their

> Use the information in the adjusted trial balance reported in Exercise 3-17 to prepare Wilson Trucking Company’s classified balance sheet as of December 31.

> Use the adjusted trial balance accounts for Stark Company from Exercise 3-13 to prepare closing entries.

> Use the table of adjusted trial balance accounts for Stark Company from Exercise 3-13 to prepare the (1) Income statement and (2) Statement of retained earnings for the year ended December 31 and (3) balance sheet at December 31. The Retained Earnings a

> Stark Company has the following adjusted accounts with normal balances at its December 31 year-end. Prepare an adjusted trial balance for Stark Company at December 31.

> For each of the separate cases in Exercise 3-10, determine the financial statement impact of each required year-end adjusting entry. Fill in the table below by indicating the amount and direction (+ or −) of the effect.

> For each of the following separate cases, prepare the required December 31 year-end adjusting entries. a. Depreciation on the company’s wind turbine equipment for the year is $5,000. b. The Prepaid Insurance account for the solar panels had a $2,000 debi

> Indicate where each of the following items is reported on financial statements. Choose from the following categories: (a) current assets, (b) long-term investments, (c) current liabilities, (d) long-term liabilities, (e) other revenues and gains, ( f )

> a. On July 1, Lopez Company paid $1,200 for six months of insurance coverage. No adjustments have been made to the Prepaid Insurance account, and it is now December 31. Prepare the year-end adjust- ing entry to reflect expiration of the insurance as of D

> Analyze each adjusting entry in Exercise 3-8 by showing its effects on the accounting equation— specifically, identify the accounts and amounts (including + or −) for each transaction or event.

> Prepare year-end adjusting journal entries for M&R Company as of December 31 for each of the following separate cases. Entries can draw from the following partial chart of accounts: Cash; Accounts Receivable; Interest Receivable; Equipment; Wages Payable

> Analyze each adjusting entry in Exercise 3-6 by showing its effects on the accounting equation— specifically, identify the accounts and amounts (including + or ) for each transaction or event.

> For each of the following separate cases, prepare adjusting entries required of financial statements for the year ended December 31. Entries can draw from the following partial chart of accounts: Cash; Interest Receivable; Supplies; Prepaid Insurance; Eq

> Pablo Management has five employees, each of whom earns $250 per day. They are paid on Fridays for work completed Monday through Friday of the same week. Near year-end, the five employees worked Monday, December 31, and Wednesday through Friday, January

> For each of the following separate situations, determine the amount of expense each company should recognize in December (using accrual basis accounting). a. Chipotle has monthly wages expense of $3,200 that has been incurred but not paid as of December

> For each of the following separate situations, determine how much revenue is recognized in December (using accrual basis accounting). a. On December 7, Oklahoma City Thunder sold a $90 ticket to a basketball game to be played in March. b. Tesla sold and

> On December 31, Yates Co. prepared an adjusting entry for $12,000 of earned but unrecorded consulting revenue. On January 16, Yates received $26,700 cash as payment in full for consulting work it provided that began on December 18 and ended on January 16

> Garcia Company had the following selected transactions during the year. Jan. 1 The company paid $6,000 cash for 12 months of insurance coverage beginning immediately. Aug. 1 The company received $2,400 cash in advance for 6 months of contracted servi

> On May 20, Montero Co. paid $150,000 to acquire 30 shares (4%) of ORD Corp. as a long-term investment. On August 5, Montero sold one-tenth of the ORD shares for $18,000. 1. Prepare entries to record both (a) the acquisition and (b) the sale of these shar

> Use the information in the adjusted trial balance reported in QS 3-22 to prepare Sierra Company’s classified balance sheet as of December 31.

> At the end of its annual accounting period, the company must make three adjusting entries. For each of these adjusting entries, indicate the account to be debited and the account to be credited. a. Accrue salaries expense. b. Adjust the Unearned Revenue

> SP 2 On October 1, 2020, Santana Rey launched a computer services company called Business Solutions, which provides consulting services, computer system installations, and custom program development. The company’s initial chart of accou

> Victoria Rivera owns and manages a consulting firm called Prisek, which began operations on July 1. On July 31, the company’s records show the following selected accounts and amounts for the month of July. Required 1. Prepare a July inc

> Roshaun Gould started a web consulting firm called Gould Solutions. He began operations and completed seven transactions in April that resulted in the following accounts, which all have normal balances. Required 1. Prepare a trial balance for this busine

> The accounting records of Tama Co. show the following assets and liabilities as of December 31 for Year 1 and for Year 2. Required 1. Prepare balance sheets for the business as of December 31 for Year 1 and Year 2. Hint: Report only total equity on the

> Angela Lopez owns and manages a consulting firm called Metrix, which began operations on December 1. On December 31, Metrix shows the following selected accounts and amounts for the month of December. Required 1. Prepare a December income statement for t

> Yi Min started an engineering firm called Min Engineering. He began operations and completed seven transactions in May, which included his initial investment of $18,000 cash. After those seven transactions, the ledger included the following accounts with

> a. Compute the debt ratio for each of the three companies. b. Which company has the most financial leverage?

> Use the information in Exercise 2-25 to prepare a December 31 balance sheet for Help Today. Hint: The ending Retained Earnings account balance as of December 31 is $4,470.

> Prepare Tiker Company’s journal entries to record the following transactions and the adjusting entry to record the fair value of the stock investments portfolio. This is the first and only time the company purchased such securities. May 9 Purchases 200 s

> Obtain a recent copy of the most prominent newspaper distributed in your area. Research the classified section and prepare a report answering the following questions (attach relevant printouts to your report). Alternatively, you may want to search the we

> Assume that Katrina Lake of Stitch Fix plans to expand her business to accommodate more product lines. She is considering financing expansion in one of two ways: (1) contributing more of her own funds to the business or (2) borrowing the funds from a ban

> Access EDGAR online (sec.gov/edgar) and locate the 2018 10-K report of Amazon.com (ticker: AMZN) filed on February 1, 2019. Review its financial statements reported for years ended 2018, 2017, and 2016 to answer the following questions. Required 1. What

> Assume that you are a cashier and your manager requires that you immediately enter each sale when it occurs. Recently, lunch hour traffic has increased and the assistant manager asks you to avoid delays by taking customers’ cash and making change without

> Key comparative figures for Apple, Google, and Samsung follow. Required 1. Compute Samsung’s debt ratio for the current year and prior year. 2. Did Samsung’s financial leverage increase or decrease in the current year

> Key comparative figures for Apple and Google follow. 1. What is the debt ratio for Apple in the current year and for the prior year? 2. What is the debt ratio for Google in the current year and for the prior year? 3. Which of the two companies has the h

> Refer to Apple’s financial statements in Appendix A for the following questions. Required 1. What amount of total liabilities does Apple report for each of the fiscal years ended (a) September 29, 2018, and (b) September 30, 2017? 2. What amount of total

> Use the information in Exercise 2-25 to prepare a December statement of retained earnings for Help Today. The Retained Earnings account balance at December 1 was $0. Hint: Net income for December is $10,470.

> Create a table similar to Exhibit 1.9. Then use additions and subtractions to show the dollar effects of each transaction on individual items of the accounting equation. a. The company completed consulting work for a client and immediately collected $5,5

> Determine whether each of the following transactions increases or decreases equity. a. Owner invested cash in the company. b. Incurred maintenance expenses. c. Performed services for a client. d. Incurred employee wage expenses.

> Prepare Riley Company’s journal entries to record the following transactions for the current year. Apr. 18 Purchases 300 common shares of XLT Co. as a short-term investment at a cost of $42 per share. With this stock investment, Riley has an insignific

> Identify the accounting principle or assumption that best explains each situation. 1. In December of this year, Chavez Landscaping received a customer’s order and cash prepayment to install sod at a house that would not be ready for installation until Ma

> Teamwork is important in today’s business world. Successful teams schedule convenient meetings, maintain regular communications, and cooperate with and support their members. This assignment aims to establish support/learning teams, initiate discussions,

> Visit the EDGAR database at sec.gov/edgar/searchedgar/companysearch.html. Access the Form 10-K report of Rocky Mountain Chocolate Factory (ticker: RMCF) filed on May 15, 2018, covering its 2018 fiscal year. Required 1. Item 6 of the 10-K report provides

> Access the SEC EDGAR database (sec.gov/edgar) and retrieve Apple’s 2018 10-K (filed November 5, 2018). Identify its auditor. What responsibility does its independent auditor claim regarding Apple’s financial statements?