Question: Agency Costs Fountain Corporation’s economists

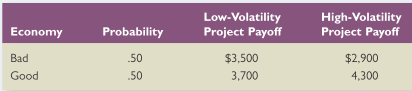

Agency Costs Fountain Corporation’s economists estimate that a good business environment and a bad business environment are equally likely for the coming year. The managers of the company must choose between two mutually exclusive projects. Assume that the project the company chooses will be the firm’s only activity and that the firm will close one year from today. The company is obligated to make a $3,500 payment to bondholders at the end of the year. The projects have the same systematic risk but different volatilities. Consider the following information pertaining to the two projects:

a. What is the expected value of the company if the low-volatility project is undertaken? What if the high-volatility project is undertaken? Which of the two strategies maximizes the expected value of the firm?

b. What is the expected value of the company’s equity if the low-volatility project is undertaken? What is it if the high-volatility project is undertaken?

c. Which project would the company’s stockholders prefer? Explain.

d. Suppose bondholders are fully aware that stockholders might choose to maximize equity value rather than total firm value and opt for the high-volatility project. To minimize this agency cost, the firm’s bondholders decide to use a bond covenant to stipulate that the bondholders can demand a higher payment if the company chooses to take on the high-volatility project. What payment to bondholders would make stockholders indifferent between the two projects?

Transcribed Image Text:

Low-Volatility Project Payoff High-Volatility Project Payoff Economy Probability Bad .50 $3,500 $2,900 Good .50 3,700 4,300

> Ren-Stimpy International is planning to raise fresh equity capital by selling a large new issue of common stock. Ren-Stimpy is currently a publicly traded corporation, and it is trying to choose between an underwritten cash offer and a rights offering (n

> What are the advantages of using the SML approach to finding the cost of equity capital? What are the disadvantages? What are the specific pieces of information needed to use this method? Are all of these variables observable, or do they need to be estim

> Why is the use of debt financing referred to as financial “leverage”?

> Do you think preferred stock is more like debt or equity? Why?

> Critically evaluate the following statements: Playing the stock market is like gambling. Such speculative investing has no social value other than the pleasure people get from this form of gambling.

> How can the return on a portfolio be expressed in terms of a factor model?

> Suppose the following two independent investment opportunities are available to Relax, Inc. The appropriate discount rate is 8.5 percent. a. Compute the profitability index for each of the two projects. b. Which project(s) should the company accept bas

> Good Time Company is a regional chain department store. It will remain in business for one more year. The probability of a boom year is 60 percent and the probability of a recession is 40 percent. It is projected that the company will generate a total ca

> Star, Inc., a prominent consumer products firm, is debating whether or not to convert its all-equity capital structure to one that is 35 percent debt. Currently there are 6,000 shares outstanding and the price per share is $58. EBIT is expected to remain

> KIC, Inc., plans to issue $5 million of bonds with a coupon rate of 8 percent and 30 years to maturity. The current market interest rates on these bonds are 7 percent. In one year, the interest rate on the bonds will be either 10 percent or 6 percent wit

> If you can borrow all the money you need for a project at 6 percent, doesn’t it follow that 6 percent is your cost of capital for the project?

> Filer Manufacturing has 8.3 million shares of common stock outstanding. The current share price is $53, and the book value per share is $4. The company also has two bond issues outstanding. The first bond issue has a face value of $70 million and a coupo

> The Starr Co. just paid a dividend of $1.95 per share on its stock. The dividends are expected to grow at a constant rate of 4.5 percent per year, indefinitely. If investors require a return of 11 percent on the stock, what is the current price? What wil

> There are two stock markets, each driven by the same common force, F, with an expected value of zero and standard deviation of 10 percent. There are many securities in each market; thus, you can invest in as many stocks as you wish. Due to restrictions,

> Consider the following information: a. What is the expected return on an equally weighted portfolio of these three stocks? b. What is the variance of a portfolio invested 20 percent each in A and B, and 60Â percent in C? State of Rate of

> Refer to Table 10.1(given below) in the text and look at the period from 1973 through 1978. a. Calculate the arithmetic average returns for large-company stocks and T-bills over this period. b. Calculate the standard deviation of the returns for large-

> B&B has a new baby powder ready to market. If the firm goes directly to the market with the product, there is only a 55 percent chance of success. However, the firm can conduct customer segment research, which will take a year and cost $950,000. By going

> An asset used in a four-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of $8,300,000 and will be sold for $1,700,000 at the end of the project. If the tax rate is 35 percent, what is the aftertax salva

> There is a European put option on a stock that expires in two months. The stock price is $82, and the standard deviation of the stock returns is 70 percent. The option has a strike price of $90, and the risk-free interest rate is a 5 percent annual perce

> Quartz Corporation is a relatively new firm. Quartz has experienced enough losses during its early years to provide it with at least eight years of tax loss carryforwards. Thus, Quartz’s effective tax rate is zero. Quartz plans to lease equipment from Ne

> Raggio, Inc., has 145,000 shares of stock outstanding. Each share is worth $75, so the company’s market value of equity is $10,875,000. Suppose the firm issues 30,000 new shares at the following prices: $75, $70, and $65. What will the effect be of each

> The company with the common equity accounts shown here has declared a stock dividend of 15 percent when the market value of its stock is $57 per share. What effects on the equity accounts will the distribution of the stock dividend have? Common stoc

> Given that RadNet was up by about 411 per cent for 2014, why didn’t all investors hold RadNet?

> Given the choice, would a firm prefer to use MACRS depreciation or straight-line depreciation? Why?

> National Electric Company (NEC) is considering a $68 million project in its power systems division. Tom Edison, the company’s chief financial officer, has evaluated the project and determined that the project’s unlevered cash flows will be $4.4 million p

> Ayden, Inc., has an issue of preferred stock outstanding that pays a $4.50 dividend every year, in perpetuity. If this issue currently sells for $87 per share, what is the required return?

> Why might a firm choose to engage in a sale and leaseback transaction? Give two reasons.

> The DRK Corporation has recently developed a dividend reinvestment plan, or DRIP. The plan allows investors to reinvest cash dividends automatically in DRK in exchange for new shares of stock. Over time, investors in DRK will be able to build their holdi

> As mentioned in the text, some firms have filed for bankruptcy because of actual or likely litigation-related losses. Is this a proper use of the bankruptcy process?

> Under what circumstances would it be appropriate for a firm to use different costs of capital for its different operating divisions? If the overall firm WACC was used as the hurdle rate for all divisions, would the riskier divisions or the more conservat

> Consider the following quotation from a leading investment manager: “The shares of Southern Co. have traded close to $12 for most of the past three years. Since Southern’s stock has demonstrated very little price movement, the stock has a low beta. Texas

> Two years ago, the Lake Minerals and Small Town Furniture stock prices were the same. The average annual return for both stocks over the past two years was 10 percent. Lake Minerals’ stock price increased 10 percent each year. Small Town Furniture’s stoc

> U.S. Treasury bonds are not rated. Why? Often, junk bonds are not rated. Why?

> “When evaluating projects, we’re only concerned with the relevant incremental aftertax cash flows. Therefore, because depreciation is a noncash expense, we should ignore its effects when evaluating projects.” Critically evaluate this statement.

> Referring to the previous questions, under what circumstances might a company choose not to pay dividends?

> Is it true that a U.S. Treasury security is risk-free?

> Are the capital budgeting criteria we discussed applicable to not-for-profit corporations? How should such entities make capital budgeting decisions? What about the U.S. government? Should it evaluate spending proposals using these techniques?

> In the context of the dividend growth model, is it true that the growth rate in dividends and the growth rate in the price of the stock are identical?

> Companies pay rating agencies such as Moody’s and S&P to rate their bonds, and the costs can be substantial. However, companies are not required to have their bonds rated in the first place; doing so is strictly voluntary. Why do you think they do it?

> True or false: The unsystematic risk of a share of stock is irrelevant for valuing the stock because it can be diversified away; therefore, it is also irrelevant for valuing a call option on the stock. Explain.

> Zipcar, the car sharing company, went public in April 2011. Assisted by the investment bank Goldman Sachs, Zipcar sold 9.68 million shares at $18 each, thereby raising a total of $174.24 million. By the end of the first day of trading, the stock had zipp

> Last month, Central Virginia Power Company, which had been having trouble with cost overruns on a nuclear power plant that it had been building, announced that it was “temporarily suspending dividend payments due to the cash flow crunch associated with i

> What is a proxy?

> What are the implications of the efficient market hypothesis for investors who buy and sell stocks in an attempt to “beat the market”?

> What is the relationship between the one-factor model and the CAPM?

> A coworker claims that looking at so much marginal this and incremental that is just a bunch of nonsense, and states, “Listen, if our average revenue doesn’t exceed our average cost, then we will have a negative cash flow, and we will go broke!” How do y

> Bill plans to open a self-serve grooming center in a storefront. The grooming equipment will cost $265,000, to be paid immediately. Bill expects aftertax cash inflows of $59,000 annually for seven years, after which he plans to scrap the equipment and re

> What is forecasting risk? In general, would the degree of forecasting risk be greater for a new product or a cost-cutting proposal? Why?

> Ignoring taxes in Problem 6, what is the price per share of equity under Plan I? Plan II? What principle is illustrated by your answers?

> Harrison, Inc., has the following book value balance sheet: a. What is the debt–equity ratio based on book values? b. Suppose the market value of the company’s debt is $225 million and the market value of equity is $

> Fama’s Llamas has a weighted average cost of capital of 9.8 percent. The company’s cost of equity is 13 percent, and its cost of debt is 6.5 percent. The tax rate is 35 percent. What is Fama’s debt–equity ratio?

> You are forming an equally weighted portfolio of stocks. Many stocks have the same beta of .84 for Factor 1 and the same beta of 1.69 for Factor 2. All stocks also have the same expected return of 11 percent. Assume a two-factor model describes the retur

> A portfolio is invested 20 percent in Stock G, 55 percent in Stock J, and 25 percent in Stock K. The expected returns on these stocks are 9 percent, 11 percent, and 14 percent, respectively. What is the portfolio’s expected return? How do you interpret y

> Using the following returns, calculate the average returns, the variances, and the standard deviations for X and Y: Returns Year Y 9% 12% 2 21 27 3 -27 -32 4 15 14 5 23 36

> You find a zero coupon bond with a par value of $10,000 and 17 years to maturity. If the yield to maturity on this bond is 4.9 percent, what is the dollar price of the bond? Assume semiannual compounding periods.

> Suppose you are evaluating a callable, convertible bond. If the stock price volatility increases, how will this affect the price of the bond?

> The manager for a growing firm is considering the launch of a new product. If the product goes directly to market, there is a 50 percent chance of success. For $125,000 the manager can conduct a focus group that will increase the product’s chance of succ

> Dog Up! Franks is looking at a new sausage system with an installed cost of $345,000. This cost will be depreciated straight-line to zero over the project’s five-year life, at the end of which the sausage system can be scrapped for $25,000. The sausage s

> Maxwell Software, Inc., has the following mutually exclusive projects. a. Suppose the company’s payback period cutoff is two years. Which of these two projects should be chosen? b. Suppose the company uses the NPV rule to rank these t

> Sportime Fitness Center, Inc., issued convertible bonds with a conversion price of $49. The bonds are available for immediate conversion. The current price of the company’s common stock is $43 per share. The current market price of the convertible bonds

> Wet for the Summer, Inc., manufactures filters for swimming pools. The company is deciding whether to implement a new technology in its pool filters. One year from now the company will know whether the new technology is accepted in the market. If the dem

> Super Sonics Entertainment is considering buying a machine that costs $480,000. The machine will be depreciated over five years by the straight-line method and will be worthless at that time. The company can lease the machine with year-end payments of $1

> The Green Hills Co. has just gone public. Under a firm commitment agreement, Green Hills received $29.96 for each of the 7.5 million shares sold. The initial offering price was $32 per share, and the stock rose to $34.56 per share in the first few minute

> The market value balance sheet for Outbox Manufacturing is shown here. Outbox has declared a stock dividend of 25 percent. The stock goes ex dividend tomorrow (the chronology for a stock dividend is similar to that for a cash dividend). There are 22,000

> Watson, Inc., is an all-equity firm. The cost of the company’s equity is currently 11.9 percent, and the risk-free rate is 3.5 percent. The company is currently considering a project that will cost $10.6 million and last six years. The project will gener

> Why do firms issue convertible bonds and bonds with warrants?

> Why does a strict NPV calculation typically understate the value of a company or project?

> You are discussing real options with a colleague. During the discussion, the colleague states, “Real option analysis makes no sense because it says that a real option on a risky venture is worth more than a real option on a safe venture.’’ How should you

> What is meant by the term off–balance sheet financing? When do leases provide such financing, and what are the accounting and economic consequences of such activity?

> Refer to the observed capital structures given in Table 17.3 of the text. What do you notice about the types of industries with respect to their average debt–equity ratios? Are certain types of industries more likely to be highly levera

> Chanelle, Inc., is proposing a rights offering. Presently, there are 625,000 shares outstanding at $87 each. There will be 85,000 new shares offered at $78 each. a. What is the new market value of the company? b. How many rights are associated with one o

> Is there an easily identifiable debt–equity ratio that will maximize the value of a firm? Why or why not?

> Both Dow Chemical Company, a large natural gas user, and Superior Oil, a major natural gas producer, are thinking of investing in natural gas wells near Houston. Both are all-equity financed companies. Dow and Superior are looking at identical projects.

> Briefly explain why the covariance of a security with the rest of a well-diversified portfolio is a more appropriate measure of the risk of the security than the security’s variance.

> Two years ago, General Materials’ and Standard Fixtures’ stock prices were the same. During the first year, General Materials’ stock price increased by 10 percent while Standard Fixtures’ stock price decreased by 10 percent. During the second year, Gener

> The Mango Republic has just liberalized its markets and is now permitting foreign investors. Tesla Manufacturing has analyzed starting a project in the country and has determined that the project has a negative NPV. Why might the company go ahead with th

> When is EAC analysis appropriate for comparing two or more projects? Why is this method used? Are there any implicit assumptions required by this method that you find troubling? Explain.

> Why do noninvestment-grade bonds have much higher direct costs than investment-grade issues?

> Based on the dividend growth model, what are the two components of the total return on a share of stock? Which do you think is typically larger?

> If a market is semistrong form efficient, is it also weak form efficient? Explain.

> What is wrong with the simple view that it is cheaper to issue a bond with a warrant or a convertible feature because the required coupon is lower?

> If the risk of a stock increases, what is likely to happen to the price of call options on the stock? To the price of put options? Why?

> Zoso is a rental car company that is trying to determine whether to add 25 cars to its fleet. The company fully depreciates all its rental cars over five years using the straight-line method. The new cars are expected to generate $215,000 per year in ear

> Zipcar, the car sharing company, went public in April 2011. Assisted by the investment bank Goldman Sachs, Zipcar sold 9.68 million shares at $18 each, thereby raising a total of $174.24 million. By the end of the first day of trading, the stock had zipp

> If increases in dividends tend to be followed by (immediate) increases in share prices, how can it be said that dividend policy is irrelevant?

> Compute the internal rate of return for the cash flows of the following two projects: Cash Flows ($) Year Project A Project B -$5,700 -$3,450 2,750 1,380 2 2,800 1,800 1,600 1,200

> An analyst has recently informed you that at the issuance of a company’s convertible bonds, one of the two following sets of relationships existed: Assume the bonds are available for immediate conversion. Which of the two scenarios do

> Sardano and Sons is a large, publicly held company that is considering leasing a warehouse. One of the company’s divisions specializes in manufacturing steel, and this particular warehouse is the only facility in the area that suits the firm’s operations

> You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common practice with expensive, high-tech equipment). The scanner costs $5,800,000, and it would be depreciated straight-line to zero over four ye

> You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common practice with expensive, high-tech equipment). The scanner costs $5,800,000, and it would be depreciated straight-line to zero over four ye

> In the previous problem, if the SEC filing fee and associated administrative expenses of the offering are $1,900,000, how many shares need to be sold?

> In the previous problem, suppose the company has announced it is going to repurchase $22,400 worth of stock. What effect will this transaction have on the equity of the company? How many shares will be outstanding? What will the price per share be after

> Daniel Kaffe, CFO of Kendrick Enterprises, is evaluating a 10-year, 7.5 percent loan with gross proceeds of $4,450,000. The interest payments on the loan will be made annually. Flotation costs are estimated to be 2.5 percent of gross proceeds and will be

> Steinberg Corporation and Dietrich Corporation are identical firms except that Dietrich is more levered. Both companies will remain in business for one more year. The companies’ economists agree that the probability of the continuation of the current exp

> Janetta Corp. has EBIT of $850,000 per year that is expected to continue in perpetuity. The unlevered cost of equity for the company is 14 percent, and the corporate tax rate is 35 percent. The company also has a perpetual bond issue outstanding with a m

> Kolby Corp. is comparing two different capital structures. Plan I would result in 1,300 shares of stock and $80,640 in debt. Plan II would result in 2,900 shares of stock and $19,200 in debt. The interest rate on the debt is 10 percent. a. Ignoring taxes

> Frusciante, Inc., has 290,000 bonds outstanding. The bonds have a par value of $1,000, a coupon rate of 7 percent paid semiannually, and 8 years to maturity. The current YTM on the bonds is 7.5 percent. The company also has 10 million shares of stock out

> The following three stocks are available in the market: Assume the market model is valid. a. Write the market model equation for each stock. b. What is the return on a portfolio with weights of 30 percent Stock A, 45 percent Stock B, and 25 percent Sto

> Based on the following information, calculate the expected return and standard deviation: Probability of State of Economy State of Rate of Return Economy if State Occurs Depression .15 -105 Recession .30 .059 Normal .45 .130 Вoom 10 .211

> What is the main difference between the FTE approach and the other two approaches?