Question: Amazon.com, Inc. (AMZN) is the largest

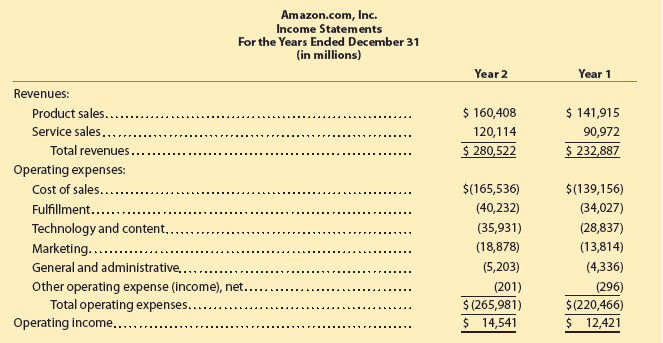

Amazon.com, Inc. (AMZN) is the largest Internet retailer in the United States. Amazon’s income statements for two recent years follow:

a. Prepare a horizontal analysis of the income statements. Round percentages to one decimal place.

b. Interpret the results of the horizontal analysis.

> In Exhibit 15, Kelly Consulting reported accrual net income of $18,300. Under the cash basis of accounting, Kelly Consulting would have reported net income of $15,000. a. Why are the accrual- and cash-basis net incomes different? b. Provide an example of

> Journalize the payment of dividends on May 20 for $75,000.

> Net solutions reported December accrual net income of $4,055 in Exhibit 20, while under the cash basis of accounting , it would have reported a net loss of $(935). a. Why are the accrual- and cash-basis net incomes different? b. From the December transa

> After the accounts have been adjusted at June 30, the end of the fiscal year, the following balances were taken from the ledger of Classic Landscaping Co.: Retained Earnings $1,100,000 Dividends 30,000 Fees Earned 975,000 Wages Expense 580,000 Rent Expen

> Brenda Tooley owns and operates Speedy Delivery Services. On January 1, 20Y7, Common Stock had a balance of $75,000, and Retained Earnings had a balance of $615,700. During the year, $15,000 of additional common stock was issued, and $6,000 of dividends

> In teams, select a public company that interests you. Obtain the company’s most recent annual report on Form 10-K. The Form 10-K is a company’s annually required filing with the Securities and Exchange Commission (SEC). It includes the company’s financia

> Reece Financial Services Co., which specializes in appliance repair services, is owned and operated by Joni Reece. Reece Financial Services’ accounting clerk prepared the following unadjusted trial balance at July 31, 20Y9: The data n

> Martin Editing Company is a small editorial services company owned and operated by Andrew Martin. On August 31, 20Y1, the end of the current year, Martin Editing Company’s accounting clerk prepared the following unadjusted trial balance

> Reliable Repairs & Service, an electronics repair store, prepared the following unadjusted trial balance on November 30, 20Y3: For preparing the adjusting entries, the following data were assembled: • Fees earned but unbilled on N

> On October 31, the following data were accumulated to assist the accountant in preparing the Adjusting entries for bickle Realty: • The supplies account balance on October 31 is $8,125. The supplies on hand on October 31 are $1,150. • The unearned rent a

> Amazon.com, Inc. (AMZN) is the largest Internet retailer in the United States. Amazon’s income statements through operating income for two recent years are as follows (in millions): a. Prepare a vertical analysis of the two income sta

> The following income statement data for AT&T Inc. (T) and Verizon Communications Inc. (VZ) were taken from their recent annual reports (in millions): a. Prepare a vertical analysis of the income statement for AT&T. Round to one decimal place. b

> Journalize the entry on October 19 for cash received for services rendered, $8,774.

> Chipotle Mexican Grill, Inc. (CMG) is a quick-service restaurant providing a focused menu of burritos, tacos, and salads. Chipotle’s income statements through operating income for two recent years are as follows (in thousands): a. Pre

> World Wrestling Entertainment, Inc. (WWE) is a sports media and entertainment company primarily focused on professional wrestling. WWE’s income statements through operating income for two recent years are as follows (in thousands): a.

> Netflix, Inc. (NFLX) provides Internet streaming services featuring TV series, documentaries, and films throughout the world. Netflix’s income statements through operating income for two recent years are as follows (in thousands):

> The wages payable and wages expense accounts at February 28, after adjusting entries have been posted at the end of the first month of operations, are shown in the following T accounts: Determine the amount of wages paid during the month.

> Stenberg Realty Co. pays weekly salaries of $18,500 on Friday for a five-day workweek ending on that day. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends (a) on Monday and (b) on Thursday.

> At the end of the current year, $17,950 of fees has been earned but has not been billed to clients. a. Journalize the adjusting entry to record the accrued fees. b. If the cash basis rather than the accrual basis had been used, would an adjusting entry h

> The accountant for Eva’s Laundry prepared the following unadjusted and adjusted trial balances. Assume that all balances in the unadjusted trial balance and the amounts of the adjustments are correct. Identify the errors in the accountant’s adjusting ent

> For a recent year, the balance sheet for The Campbell Soup Company (CPB) includes accrued expenses of $609 million. The income before taxes for Campbell for the year was $979 million. a. Assume the adjusting entry for $609 million of accrued expenses was

> For a recent period, the balance sheet for Costco Wholesale Corporation (COST) reported accrued expenses of $3,176 million. For the same period, Costco reported income before income taxes of $4,737 million. Assume that the adjusting entry for $3,176 mill

> On a recent balance sheet, Microsoft Corporation (MSFT) reported Property, Plant, and Equipment of $71,807 million and Accumulated Depreciation of $35,330 million. a. What was the book value of the fixed assets? b. Would the book value of Microsoft’s fix

> Journalize the entry for the purchase of office supplies on February 13 for $3,175, paying $1,000 cash and the remainder on account.

> The estimated amount of depreciation on equipment for the current year is $66,290. Journalize the adjusting entry to record the depreciation.

> The balance in the prepaid insurance account, before adjustment at the end of the year, is $22,500. Journalize the adjusting entry required under each of the following alternatives for determining the amount of the adjustment: (a) the amount of insurance

> The balance in the supplies account, before adjustment at the end of the year, is $5,175. Journalize the adjusting entry required if the amount of supplies on hand at the end of the year is $615.

> The balance in the unearned fees account, before adjustment at the end of the year, is $18,000. Journalize the adjusting entry required if the amount of unearned fees at the end of the year is $3,600.

> When preparing the financial statements for the year ended December 31, 20Y5, accrued salaries owed to employees for December 30 and 31 were overlooked. The accrued salaries were included in the first salary payment on January 6, 20Y6. Indicate which ite

> Accrued salaries owed to employees for August 30 and 31 are not considered in preparing the financial statements for the year ended August 31. Indicate which items will be erroneously stated, because of the error, on (a) the income statement for the year

> Classify the following items as (1) accrued revenue, (2) accrued expense, (3) unearned revenue, or (4) prepaid expense: a. Cash paid for rent of office space b. Fees received for services to be performed c. Wages owed but not yet paid d. Services ren

> Indicate with a Yes or No whether or not each of the following accounts normally requires an adjusting entry: a. Building b. Cash c. Common Stock d. Land e. Prepaid Rent f. Wages Expense

> Two income statements for Cornea Company follow: a. Prepare a vertical analysis of Cornea Company’s income statements. b. Does the vertical analysis indicate a favorable or an unfavorable trend?

> For the year ending June 30, O’Keefe Medical Services Co. mistakenly omitted adjusting entries for (1) $2,000 of supplies that were used, (2) unearned revenue of $7,500 that was earned, and (3) insurance of $11,300 that expired. Indicate the combined eff

> The following errors took place in journalizing and posting transactions: a. The receipt of $10,700 for services rendered was recorded as a debit to Accounts Receivable and a credit to Fees Earned. b. The purchase of supplies of $4,300 on account was rec

> The prepaid insurance account had a beginning balance of $6,000 and was debited for $12,500 of premiums paid during the year. Journalize the adjusting entry required at the end of the year, assuming the amount of unexpired insurance related to future per

> On June 1, 20Y2, Monarch Co. received $9,000 for the rent of land for 12 months. Journalize the adjusting entry required for unearned rent on December 31, 20Y2.

> City Realty Co. pays weekly salaries of $34,500 on Monday for a six-day workweek ending the preceding Saturday. Journalize the necessary adjusting entry at the end of the accounting period, assuming that the period ends on Friday.

> At the end of the current year, $6,750 of fees have been earned but have not been billed to clients. Journalize the adjusting entry to record the accrued fees.

> On June 1 of the current year, Chris Bates established a business to manage rental property. The following transactions were completed during June: a. Opened a business bank account with a deposit of $75,000 in exchange for common stock. b. Purchased off

> Erin Murdoch, an architect, organized Modern Architects on January 1, 20Y4. During the month, Modern Architects completed the following transactions: a. Issued common stock to Erin Murdoch in exchange for $50,000. b. Paid January rent for office and work

> The assets and liabilities of Adventure Travel Agency on December 31, 20Y5, and its revenue and expenses for the year are as follows: Common stock was $250,000 and retained earnings were $1,160,400 as of January 1, 20Y5. During the year, additional com

> Target Corporation (TGT) is one of the largest retailers in the United States. Target operates over 1,800 stores that sell a wide assortment of merchandise, including a variety of grocery items. Target recently reported the following end-of-year balance

> Amazon.com, Inc. (AMZN) is one of the largest Internet retailers in the world. We will use Amazon as a continuing company exercise to reinforce the various tools and techniques for analyzing financial statements. We will begin with the ratio of liabiliti

> The following data (in millions) are taken from the financial statements of Walmart Inc. (WMT): a. For Walmart, determine the amount of change in millions and the percent of change rounded to one decimal place from Year 1 to Year 2 for: 1. Revenue 2.

> A summary of cash flows for A-One Travel Service for the year ended August 31, 20Y6, follows: The cash balance as of September 1, 20Y5, was $59,500. Prepare a statement of cash flows for A-One Travel Service for the year ended August 31, 20Y6.

> The following data (in millions) are taken from the financial statements of Target Corporation (TGT), the owner of Target stores: a. For Target, determine the amount of change in millions and the percent of change rounded to one decimal place from Year

> Vera Bradley, Inc. (VRA) is a leading designer, producer, and retailer of fashion handbags, accessories, and travel items for women. Income statements for two recent years for Vera Bradley is as follows: a. Prepare a horizontal analysis of the two inco

> Chipotle Mexican Grill, Inc. (CMG) is a quick-service restaurant providing a focused menu of burritos, tacos, and salads. Chipotle’s income statements for the end of two recent years are as follows: a. Prepare a horizontal analysis of

> Based upon MAD 2-4 and MAD 2-5, compare the two-year change in operating results between Target (TGT) and Walmart (WMT).

> The following total liabilities and stockholders’ equity information (in millions) is provided for The Wendy’s Company (WEN) and Chipotle Mexican Grill, Inc. (CMG) at the end of a recent year: Wendy’

> Using your answers for Target Corporation (TGT) in MAD 1-2 and Walmart Inc. (WMT) in MAD 1-3, compare and interpret Target’s ratio of liabilities to stockholders’ equity to that of Walmart.

> Walmart Inc. (WMT), a major competitor to Target Corporation (TGT) in the retail business, operates over 11,000 stores. Walmart recently reported the following end-of-year balance sheet data (in millions): a. Compute the ratio of liabilities to stockho

> Determine the missing amount for each of the following:

> Using the income statement for A-One Travel Service from Basic Exercise 1-4, prepare a statement of stockholders’ equity for the year ended August 31, 20Y6. Kate Duffner invested an additional $15,000 in the business in exchange for common stock, and $50

> Speedy Delivery Service is owned and operated by Kris Meyers. The following selected transactions were completed by Speedy Delivery during March: 1. Received cash in exchange for common stock, $30,000. 2. Paid advertising expense, $3,500. 3. Purchased su

> Inspiring U is a motivational consulting business. At the end of its accounting period, December 31, 20Y2, Inspiring U has assets of $690,000 and liabilities of $375,000. Using the accounting equation, determine the following amounts: a. Stockholders’ eq

> The beginning inventory at Midnight Supplies and data on purchases and sales for a three-month period ending March 31 are as follows: Instructions 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to

> In teams, select a public company that interests you. Obtain the company’s most recent annual report on Form 10-K. The Form 10-K is a company’s annually required filing with the Securities and Exchange Commission (SEC). It includes the company’s financia

> In teams, select a public company that interests you. Obtain the company’s most recent annual report on Form 10-K. The Form 10-K is a company’s annually required filing with the Securities and Exchange Commission (SEC). It includes the company’s financia

> Obtain The Walt Disney Company’s (DIS) most recent annual report on Form 10-K. The Form 10-K is a company’s annually required filing with the Securities and Exchange Commission (SEC). It includes the company’s financial statements and accompanying notes.

> The total assets and total liabilities (in millions) of Dollar Tree Inc. (DLTR) and Target Corporation (TGT) follows: Determine the stockholders’ equity of each company.

> Use the data in MAD 8-2 and MAD 8-3 to analyze the accounts receivable turnover ratios of Ralph Lauren Corporation and L Brands, Inc. a. Compute the accounts receivable turnover ratios for Ralph Lauren and L Brands for the years shown in MAD 8-2 and MAD

> The following table shows the stock price, earnings per share, and dividends per share for Alphabet Inc. (GOOG), PepsiCo, Inc. (PEP), and Caterpillar Inc. (CAT) for a recent year: 1. For each company, determine the: a. Price-earnings ratio. Round to th

> The condensed income statements through operating income for Amazon.com, Inc. (AMZN), Best Buy Co., Inc. (BBY), and Walmart Inc. (WMT) for a recent fiscal year follows (in millions): 1. Prepare comparative common-sized income statements for each compan

> Marriott International, Inc. (MAR) and Hyatt Hotels Corporation (H) are two major owners and managers of lodging and resort properties in the United States. Abstracted income statement information for the two companies is as follows for a recent year (in

> Deere & Company (DE) manufactures and distributes farm and construction machinery that it sells around the world. In addition to its manufacturing operations, Deere’s credit division loans money to customers to finance the purchase

> The following comparative income statement (in thousands of dollars) for two recent fiscal Years was adapted from the annual report of International Speedway Corporation (ISCA), owner and operator of several major motor speedways, such as Daytona Interna

> The table that follows shows the stock price, earnings per share, and dividends per share for three companies for a recent year: a. Determine the price-earnings ratio and dividend yield for the three companies. Round ratios and percentages to one decim

> Ralph Lauren Corporation (RL) sells apparel through company-owned retail stores. Financial information for Ralph Lauren follows (in thousands): Assume the apparel industry average return on total assets is 8.0%, and the average return on stockholders&a

> Three major segments of the transportation industry are motor carriers, such as YRC Worldwide (YRCW); railroads, such as Union Pacific (UNP); and transportation logistics services, such as C.H. Robinson Worldwide, Inc. (CHRW). Financial statement informa

> Recent balance sheet information for two companies in the food industry, Mondelez International, Inc. (MDLZ) and The Hershey Company (HSY), is as follows (in thousands): a. Determine the ratio of liabilities to stockholders’ equity fo

> Hasbro, Inc. (HAS) and Mattel, Inc. (MAT) are the two largest toy companies in North America. Condensed liabilities and stockholders’ equity from a recent balance sheet are shown for each company as follows (in thousands): The operati

> The total assets and total liabilities (in millions) of The Kroger Company (KR) and the Procter & Gamble Company (PG) follow: Determine the stockholders’ equity of each company.

> PepsiCo, Inc. (PEP), the parent company of Frito-Lay snack foods and Pepsi beverages, had the following current assets and current liabilities at the end of two recent years: a. Determine the (1) current ratio and (2) quick ratio for both years. Round

> The Kroger Company (KR), a grocery store chain, recently had a price-earnings ratio of 13.2, while the average price-earnings ratio in the grocery store industry was 17.0. What might explain this difference?

> The following items are reported on a company’s balance sheet: Determine (a) the current ratio and (b) the quick ratio. Round to one decimal place.

> The comparative accounts payable and long-term debt balances for a company follow. Based on this information, what is the amount and percentage of increase or decrease that would be shown on a balance sheet with horizontal analysis?

> A company reports the following: a. Determine the company’s earnings per share on common stock. b. Determine the company’s price-earnings ratio. Round to one decimal place.

> A company reports the following income statement and balance sheet information for the current year: Determine the return on total assets. Round percentage to one decimal place.

> A company reports the following: Determine the asset turnover ratio. Round to one decimal place.

> A company reports the following: Determine the times interest earned. Round to one decimal place.

> The following information was taken from Charu Company’s balance sheet: Determine the company’s (a) ratio of fixed assets to long-term liabilities and (b) ratio of liabilities to stockholders’ equit

> A company reports the following: Determine (a) the accounts receivable turnover and (b) the days’ sales in receivables. Round to one decimal place.

> The following errors took place in journalizing and posting transactions: a. Cash of $7,550 received on account was recorded as a debit to Fees Earned and a credit to Cash. b. A $1,350 purchase of supplies for cash was recorded as a debit to Supplies Exp

> Obtain National Beverage Corp.’s most recent annual report on Form 10-K. The Form 10-K is a company’s annually required filing with the Securities and Exchange Commission (SEC). It includes the company’s financial statements and accompanying notes. The F

> Amazon.com, Inc. (AMZN) is one of the largest Internet retailers in the world. Best Buy Co., Inc. (BBY) is a leading retailer of consumer electronics and media products in the United States, while Walmart, Inc. (WMT) is the leading retailer in the United

> The Priceline Group Inc. (PCLN) is a leading provider of online travel reservation services, including brand names Priceline, KAYAK, and OpenTable. Selected cash flow information from the statement of cash flows for three recent years is as follows (in m

> AT&T Inc. (T) is a leading global provider of telecommunication services. Facebook, Inc. (FB) is a major worldwide social media company. AT&T has a lengthy history and was founded by Alexander Graham Bell. Facebook has a short history and was fou

> Aeropostale, Inc. (AROPQ) is a specialty retailer of casual apparel and accessories for teens. Recently, the company declared bankruptcy to provide financial protection while attempting to reorganize its operations. Annual report information for the thre

> Financial information for Apple Inc. (AAPL), The Coca-Cola Company (KO), and Verizon Communications (VZ) follows (in millions): a. Compute the free cash flow for each company. b. Compute the ratio of free cash flow to sales for each company. Round perc

> State the effect (cash receipt or cash payment and amount) of each of the following transactions, considered individually, on cash flows: a. Retired $400,000 of bonds, on which there was $3,000 of unamortized discount, for $407,000. b. Sold 20,000 shares

> In a recent year, J. C. Penney Company, Inc. (JCP) reported a net loss of $268 million from operations. However, on its statement of cash flows, it reported $428 million of net cash flows from operating activities. Explain this apparent contradiction bet

> On the basis of the details of the following fixed asset account, indicate the items to be reported on the statement of cash flows:

> An analysis of the general ledger accounts indicates that delivery equipment, which cost $75,000 and on which accumulated depreciation totaled $54,000 on the date of sale, was sold for $26,900 during the year. Using this information, indicate the items t

> The following errors took place in journalizing and posting transactions: a. Insurance of $12,000 paid for the current year was recorded as a debit to Insurance Expense and a credit to Prepaid Insurance. b. Dividends of $8,000 were recorded as a debit to

> An analysis of the general ledger accounts indicates that office equipment, which cost $280,000 and on which accumulated depreciation totaled $153,900 on the date of sale, was sold for $108,200 during the year. Using this information, indicate the items

> The net income reported on the income statement for the current year was $222,000. Depreciation recorded on equipment and a building amounted to $98,400 for the year. Balances of the current asset and current liability accounts at the beginning and end o

> The net income reported on the income statement for the current year was $106,800. Depreciation recorded on store equipment for the year amounted to $41,700. Balances of the current asset and current liability accounts at the beginning and end of the yea

> Staley Inc. reported the following data: Prepare the “Cash flows from (used for) operating activities” section of the statement of cash flows, using the indirect method.