Question: Ameer purchased a business that buys and

Ameer purchased a business that buys and sells electrical household goods. When taking over the business, Ameer realised that the existing inventory was obsolete. He therefore decided to have a clearance sale of the existing inventory and replace it with a new, up-to-date inventory.

The following information is available for July:

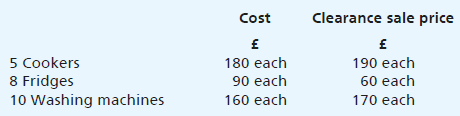

1. Inventory on 1 July

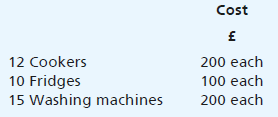

2. Purchases of new inventory during July

Ameer will ‘mark-up’ all new inventory for resale by 20%.

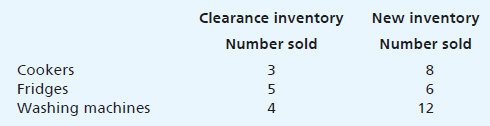

3. Sales for July

Required:

(a) Explain the following as they relate to inventory:

i) Net realizable value

ii) The accounting concept of historic cost

iii) The accounting concept of realization.

(b) Calculate the value of the inventory on 1 July.

(c) Calculate the total value of the inventory on 31 July.

(d) Calculate the gross profit for the month ended 31 July.

(e) Evaluate the use of accounting concepts and conventions in the preparation of financial statements.

> You have extracted a trial balance and drawn up accounts for the year ended 31 December 2017. There was a shortage of £78 on the credit side of the trial balance, a suspense account being opened for that amount. During 2018 the following errors made in 2

> Journalise the matters arising from the following items in the books of B. Danby, including the narrative in each case. Note that for this purpose cash and bank items may be journalized. In the case of those items which gave rise to a difference in the t

> Waban prepared draft financial statements for the year ended 31 March 2024, which showed a draft profit for the year of £43,750. His draft financial statements were prepared by a Trainee Accountant. The trial balance failed to agree and contained ledger

> Chi Knitwear Ltd is an old-fashioned business with a handwritten set of books. A trial balance is extracted at the end of each month, and an income statement and a balance sheet are computed. This month, however, the trial balance will not balance, the c

> Lee Crosby has just completed his first year of trading selling cookery equipment. He attempted to prepare a balance sheet from his trial balance before seeking expert help as he was having difficulty getting the balance sheet totals to agree. The trial

> Show the journal entries needed to correct the following errors: (a) Purchases £1,410 on credit from A. Ray had been entered in B. Roy’s account. (b) A cheque of £94 paid for printing had been entered in the cash column of the cash book instead of in the

> Thomas Smith, a retail trader, has very limited accounting knowledge. In the absence of his accounting technician, he extracted the following trial balance as at 31 March 2018 from his business’s accounting records: Required: (a) Prepa

> Journal entries to correct the following are required, but the narratives can be omitted. (a) Rent Received £430 has been credited to the Commissions Received account. (b) Bank charges £34 have been debited to the Business Rates account. (c) Completely o

> Draw up a bank reconciliation statement, after writing the cash book up to date, ascertaining the balance on the bank statement, from the following as on 31 March 2024: Cash at bank as per bank column of the cash book (Dr) …………………………………………… 3,028£ Deposi

> Prepare the double entries (not the T accounts) for the following transactions using the format: July 1 Started in business with £5,000 in the bank and £1,000 cash. 2 Bought stationery by cheque £75. 3 Bought goods

> The following is the cash book (bank columns) of F. King for December 2020: The bank statement for the month is: You are required to: (a) Write the cash book up to date to take the necessary items into account, and (b) Draw up a bank reconciliation sta

> In the draft accounts for the year ended 31 October 2019 of Thomas P. Lee, garage proprietor, the balance at bank according to the cash book was £894.68 in hand. Subsequently the following discoveries were made: (1) Cheque number 176276 dated 3 September

> The bank columns in the cash book for June 2024 and the bank statement for that month for D. Hogan are as follows:

> The details below have been taken from the books of Sue Sprung’s business in connection with the quarter ended 30 June 2020: Trade payables as at 1/4/2020 …………………………………………………………….. 48,261£ Trade receivables as at 1/4/2020 …………………………………………………………… 80,436 C

> The following information relates to the business of Amit Juneja for the year ended 31 December 2019: Amounts paid to credit suppliers ………………………………………………………… 223,990£ Bad debts written-off ……………………………………………………………………………….. 7,220 Cheques and bank transfers

> Prepare a sales ledger control account from the following information for May, carrying down the balance at 31 May: May 1 Sales ledger balances ………………………………. 39,953£ Totals for May: Sales day book ……………………………………….… 28,487 Bad debts written off …………………………

> You are required to prepare a purchases ledger control account from the following information for the month of July: July 1 Purchases ledger balances ……………………. 31,278£ Totals for July: Purchases day book ……………………………….. 22,451 Returns outwards day book ……

> (a) Angela’s business pays for its lighting and heating usage in arrears. The business’s books showed an accrual in connection with lighting & heating expenses of £840 as at 1 January 2020 and an accru

> On 1 January 2019 the following balances, among others, stood in the books of B. Baxter: (a) Lighting and heating, (Dr) £192. (b) Insurance, (Dr) £1,410. During the year ended 31 December 2019 the information related to these tw

> W. Hope’s year ended on 30 June 2020. Write up the ledger accounts, showing the transfers to the financial statements and the balances carried down to the next year for the following:

> Danielle is starting a business. Before starting to sell anything, she bought fixtures for £4,100, a van for £5,950 and an inventory of goods for £3,620. Although she has paid in full for the fixtures and the van, she still owes £1,670 for some of the in

> The following trial balance has been extracted from the ledger of Mr Yousef, a sole trader. The following additional information as at 31 May 2019 is available: (a) Rent is accrued by £210. (b) Rates have been prepaid by £880.

> Danielle is a sole proprietor and you are given the following information relating to her business: Additional information: Required: Prepare an income statement for Danielle’s business for the year ended 30 April 2024 as well as a ba

> The owner of a small business selling and repairing cars which you patronise has just received a copy of his financial statements for the current year. He is rather baffled by some of the items and as he regards you as a financial expert, he has asked yo

> Fast Response is a business delivering goods to customers. The following information is available: (1) Extract from the Balance Sheet at 31 December 2024. Non-current assets (2) History of delivery vehicle purchases and sales. (3) Fast Response has the

> Vinny purchased some new equipment on 28 February 2016 for £240,000. Vinny’s policy is to depreciate equipment at 30% per year using the reducing balance method. He calculates a full year’s charge in the year of acquisition and none in the year of dispos

> A bus is bought for £60,000. It will be used for four years, and then sold back to the supplier for £15,000. Show the depreciation calculations for each year using (a) The reducing balance method at 30% per year; and (b) The straight-line method.

> A piece of equipment originally cost £80,000. It is expected to be used for five years and then sold for £800. Show your calculations of the amount of depreciation each year using (a) The reducing balance method at 60% per year; and (b) The straight-line

> A photocopier was bought for £32,000. It is predicted to be used for four years, and then traded in for £10,000. Show the calculations of the figures for depreciation for each year using (a) The straight-line method; and (b) The reducing balance method a

> Richard runs a small publishing business. He buys a new XP27 printing machine on 1 January 2021 for £100,000 which he expects to use for five years. He predicts that the machine will then have a residual value of £10,000. Richard expects to print a total

> A company maintains its non-current assets at cost. Separate accumulated depreciation accounts are kept for each class of asset. At 31 December 2018 the position was as follows: The following transactions were made in the year ended 31 December 2019: (a

> Enter the following transactions in T-accounts: May 1 Started in business with £18,000 in the bank. 2 Bought goods on time from B. Hind £1,455. 3 Bought goods on time from G. Smart £472. 5 Sold goods for cash £210. 6 We returned goods to B. Hind £82. 8 B

> On 31 March 2019, Dixie’s business traded-in a machine (a Z-15 model) which it had originally purchased on 1 April 2016 for £19,000. Dixie had depreciated the Z-15 at 10 per cent per annum using the straight-line method. Dixie part-exchanged the Z-15 for

> Contractors Ltd was formed on 1 January 2019 and the following purchases and sales of machinery were made during the first 3 years of operations. Each machine was estimated to last 10 years and to have a residual value of 5 per cent of its cost price. D

> (a) Jack’s business has a financial year end of 31 May. He bought an item of plant for £225,000 on 1 June 2022 and estimated its useful life to be six years and its residual value to be £45,000. He believed that the straight-line method of depreciation w

> Distance Limited owned three lorries at 1 April 2019: Lorry A: purchased on 21 May 2015 for £31,200 Lorry B: purchased on 20 June 2017 for £19,600 Lorry C: purchased on 1 January 2019 for £48,800 Depreciation is charged annually at 20 per cent of cost on

> A company maintains its non-current assets at cost. A separate accumulated depreciation account is used for each type of asset. Machinery is to be depreciated at the rate of 15% per annum, and fixtures depreciated at the rate of 5% per annum, using the r

> X Co constructed a new factory for itself. The costs incurred on the construction project were as follows: £’000 Architect’s fees (including £75,000 for an initial design that was rejected and discarded by X Co) 415 Costs of applying for and obtaining pl

> The data which follows was extracted from the books of account of H. Kassab, an engineer, on 31 March 2024, his financial year end. (a) Purchase of extra milling machine (includes £300 for repair of an old machine) 2,900 £ (b) Rent 750 (c) Electrical exp

> On what principles would you distinguish between capital and revenue expenditure? Illustrate your answer by reference to the following: (a) The cost of repairs and an extension to the premises. (b) Installation of a gas central heating boiler in place of

> Indicate which of the following would be revenue items and which would be capital items in a wholesale bakery: (a) Purchase of a new van. (b) Purchase of replacement engine for existing van. (c) Cost of altering the interior of the new van to increase ca

> On 18 August 2024, J. Barton purchased a new machine from DelFalco Ltd. Barton paid the following amounts in relation to this acquisition: List price of machine ………………………………………………. 195,000£ Costs of preparing the site for installation ……………………… 8,700 Ass

> Which of the following are shown under the wrong headings?

> Sema plc, a company in the heavy engineering industry, carried out an expansion programmed during its most recent financial year, in order to meet a permanent increase in contracts. The company selected a suitable site and commissioned a survey and valua

> (a) As at 31 October 2024, a balance of £12,900 on the allowance for doubtful debts account of Daisy’s business had been brought forward from the previous year end. It was then decided that specific debts totaling £14,300 were to be written off as the ca

> A business, which started trading on 1 January 2022, adjusted its allowance for doubtful debts at the end of each year on a percentage basis, but each year the percentage rate is adjusted in accordance with an analysis of the business’s

> The following balances appeared in the trial balance of Dave Bainbridge’s business as at 30 June 2024: Trade receivables ……………………………………. 117,000£ Bad debts expense ……………………………………… 18,720 Bad debts recovered ………………………………………. 690 Allowance for doubtful deb

> The balance sheet of Tyrone’s business as at 31 December 2021 included an allowance for doubtful debts of £4,010 and an allowance for prompt payment discounts of £288. Tyrone is now in the process of preparing his financial statements for the year ended

> Lohit is in business buying and selling goods on credit. The following information relates to his bad and doubtful debts for the year ended 31 August 2024. 1. Balance of Allowance for Doubtful Debts Accounts on 1 September 2023 was £1,100 2.

> (a) Tomasz’s business buys and sells various products, including Product J. The business has 100 units of J in stock at 1 February valued (using the FIFO assumption) at £4 each. Calculate the value of inventory at the end o

> Draw up trading account parts of the income statement using each of the three methods from the details in Review question 18.3A. Review Question 18.3A:

> From the following figures, calculate the closing inventory that would be shown using the (i) FIFO, (ii) LIFO, (iii) AVCO methods on a perpetual inventory basis.

> Enter the following transactions in the appropriate accounts: Aug 1 Started in business with £7,400 cash. 2 9aid £7,000 of the opening cash into the bank. 4 Bought goods on time £410 from J. Watson. 5 Bought a van by cheque £4,920. 7 Bought goods for cas

> Explain how to calculate depreciation using the reducing balance method.

> Explain why it is important to keep notes of all the workings you use in a financial calculation.

> Robles & Co is a VAT-registered business. During the quarter just ended, it bought goods and services to the value of £51,690 excluding VAT, and its sales were £81,906 including VAT. All of the business’s sales are subject to VAT at 20%. However, only tw

> On 1 March 2020, B. Cox, Middle Road, Paisley, a VAT-registered business, sold the following goods on credit to T. Ross, 24 Peter Street, Loughborough, Order No. 9841: 20,000 Coils Sealing Tape @ £6.70 per 1,000 coils 40,000 Sheets Bank A5 @ £5.20 per 1,

> Mudgee Ltd issued the following invoices to customers in respect of credit sales made during the last week of May 2020. The amounts stated are all net of Value Added Tax. All sales made by Mudgee Ltd are subject to VAT at 15%. On 29 May Laira Brand retu

> G. Brown’s sales including VAT were £130,000 in November 2020, then £150,000 in December 2020, and £110,000 during January 2021. Suppose that the rate of VAT was 20% until 31 December 2020 and 22.5% from 1 January 2021. Exactly three-fifths of Brown’s ne

> Show the journal entries necessary to record the following items: Apr 1 Bought office furniture on credit from Durham Brothers Ltd £1,400. 4 We take goods costing £270 out of the business inventory without paying for them. 9 £90 of the goods taken by us

> A. Henriques has the following purchases and sales for May 2024: May 1 Sold to M. Marshall: brass goods £24, bronze items £36. Less 25 per cent trade discount. 7 Sold to R. Richards: tin goods £70, lead items £230. Less 331 3 per cent trade discount. 9 B

> J. Glen has the following purchases for the month of June: June 2 From J. Ring: 3 sets golf clubs at £900 each, 6 footballs at £36 each. Less 25 per cent trade discount. 11 From F. Clark: 6 cricket bats at £70 each, 8 ice skates at £40 each, 5 rugby ball

> J. Fisher, White House, Bolton, is selling the following items at the prices as shown: plastic tubing at £1 per metre, polythene sheeting at £2 per length, vinyl padding at £5 per box, foam rubber at £3 per sheet. She makes the following sales: June 1 To

> Classify the following items into liabilities and assets: (a) Computers (b) Buildings (c) Trade payables (d) Inventory (e) Trade receivables (f) Cash in bank (g) Bank overdraft (h) Loan from bank (i) Vans

> Enter up the Sales Day Book from the following details. Post the items to the relevant accounts in the Sales Ledger and then show the transfer to the sales account in the General Ledger.

> You are to enter the following items in the relevant day books, post to the personal accounts, and show the transfers to the General Ledger. 2024 July 1 Credit purchases from: K. Hill £380; M. Norman £500; N. Senior £106. 3 Credit sales to: E. Rigby £510

> Enter up the Sales Day Book and the returns inwards day book from the following details. Then post to the customers’ accounts and show the transfers to the General Ledger. 2024 June 1 Credit sales to: B. Dock £240; M. Ryan £126; G. Soul £94; F. Trip £107

> Rule up a petty cash book with analysis columns for office expenses, motor expenses, cleaning expenses and casual labour. The cash float is £450 and the amount spent is reimbursed on 30 November.

> At 1 September the financial position of Sara Young’s business was: Cash in hand ……………… 80£ Balance at bank ………….. 900 Trade receivables: AB ……………………. 200 CD ……………………. 500 EF ……………………. 300 Inventory ………… 1,000 Trade payables: GH ………………….… 600 IJ ……………………

> Enter the following in the three-column cash book of an office supply shop. Balance-off the cash book at the end of the month and show the discount accounts in the general ledger. June 1 Balances brought forward: Cash £420; Bank £4,940. 2 The following p

> Write up a two-column cash book for a second-hand bookshop from the following: Nov 1 Balance brought forward from last month: Cash £295; Bank £4,240. 2 Cash sales £310. 3 Took £200 out of the cash till and paid it into the bank. 4 F. Bell paid us by cheq

> The following questions all relate to the qualitative characteristics of useful financial information as defined by the IASB’s Conceptual Framework for Financial Reporting: (i) To which characteristic is the concept of materiality most closely related? (

> Carlos starts a business buying and selling a new type of foldaway commuter bike. In his first year of trading, he buys 100 bikes for £90 and sells 80 of them for £170 each. How should the 20 bikes in closing inventory be valued in his financial statemen

> F. Giannopoulos drew up the following trial balance as at 30 September 2020. You are to draft the income statement for the year ending 30 September 2020 and a balance sheet as at that date. Inventory at 30 September 2020 was £89,404.

> Complete the following table for a business that buys and sells cleaning products:

> The following is the trial balance of T. Agua as at 31 March 2023. Draw up a set of financial statements for the year ended 31 March 2023. Inventory at 31 March 2023 was £58,440.

> The following information is available for the year ending 31 December 2024. Draw up the trading account section of the income statement of R. Marin, who started trading in that year: Inventory: 31 December 2024 ………………….. 44,860 Returns inwards ………………………

> Ms Bukoski’s business position at 1 July was as follows: During July, she: Inventory at 31 July was £6,200. Required: (a) Open ledger accounts (including capital) at 1 July. (b) Record all transactions. (c) Prepare a tri

> Return to Review question 7.3A and prepare a balance sheet as at 31 May 2020. Review Question 7.3A: From the following trial balance of F. Dover drawn-up on conclusion of his first year in business, Inventory at 31 May 2020 was £28,972.

> The following information relates to A. Trader’s business: During the year, Trader had sold some of his personal investments for £4,000 which he paid into the business bank account, and he had drawn out £200 w

> Return to Review question 7.4A and prepare a balance sheet as at 30 June 2024. Review Question 7.4A: G. Graham trial balance as at 30 June 2024 after his first year of trading was as follows: Inventory at 30 June 2024 was £29,304.

> Record the following transactions for a new small business for the month of June, balance-off all the accounts, and then extract a trial balance as at 30 June. June 1 Started in business with £10,500 cash. 2 Put £9,000 of the cash into a bank account. 3

> Record the following details relating to a carpet wholesaler for the month of November and extract a trial balance as at 30 November. Nov 1 Started in business with £15,000 in the bank. 3 Bought goods on time from J. Small £290; F. Brown £1,200; R. Charl

> Extract an income statement for the year ending 30 June 2024 for G. Graham. The trial balance as at 30 June 2024 after his first year of trading was as follows: Inventory at 30 June 2024 was £29,304.

> From the following trial balance of F. Dover drawn-up on conclusion of his first year in business, draw up an income statement for the year ending 31 May 2020. A balance sheet is not required. Inventory at 31 May 2020 was £28,972.

> Complete the gaps in the following table:

> Redraft each of the accounts given in your answer to Review question 5.6A in three-column style. Question 5.6A: May 2024 1 Credit sales F. Black £620; G. Smith £84; L. Sime £1,200; J. Teel £608. 2 Credit purchases from P. Best £190; I. Donovan £63; G. L

> Enter the following transactions in personal accounts only. Bring down the balances at the end of the month. After completing this, state which of the balances represent debtors and which represent creditors. May 2024 1 Credit sales F. Black £620; G. Smi

> The following table shows the cumulative effects of a succession of separate transactions on the assets and liabilities of a business. The first column of data gives the opening position. Required: Identify clearly and as fully as you can what transacti

> (a) The following trial balance was extracted from the books of Peter Mackie on 30 April 2024. From this, and the note below it, prepare his income statement for the year ending 30 April 2024, and a balance sheet as at that date. Note: Closing inventory

> What benefits can result through the use of ratios and what limitations should be imposed on any conclusions drawn from their use?

> Write up the asset, capital and liability accounts in the books of D. Gough to record the following transactions: June 1 Started business with £16,000 in the bank. 2 Bought van paying by cheque £6,400. 5 Bought office fixtures £900 on time from Old Ltd.

> The rate of progress in technology is so rapid that it is very difficult to predict exactly how new technology will affect accounting in the future. Can you suggest any developments in technology that could have a significant impact on accounting in the

> You may have no plans to become an accountant in the future. Why is it still important for you to study the basics of accounting, such as those covered in this book?

> Some students who want to train with an accountancy practice tend to focus exclusively on trying to get a job with one of the ‘Big Four’ (PwC, Deloitte, EY and KPMG) and ignore smaller accounting firms altogether. Required: (a) What do you think are the

> In this chapter you’ve learnt about some specific roles and areas of accountancy, such as ‘financial controller’ or ‘tax adviser’. Can you suggest any other particular areas of accounting in which you can specialise?

> For simplicity and convenience, this chapter discusses accountants as working ‘in practice’, ‘in industry’ or ‘in the public sector’. However, some organisations might not fall neatly into one of these three categories but will still require accounting s

> There is now growing disapproval from some sections of the public of the elaborate tax planning arrangements that tax advisers at some accounting firms have recommended to their clients. These arrangements may be entirely legal but are often highly compl

> There have been several high-profile scandals in accounting in recent times, which have contributed to the raised profile of ethics and integrity in accounting. The details of many of these scandals might be difficult to understand at this stage in your

> You are given summarised information about two firms in the same line of business, A and B, as follows. Required: (a) Produce a table of eight ratios calculated for both businesses. (b) Write a report briefly outlining the strengths and weaknesses of th