Question: American Eagle Outfitters Inc. (AEO) operates

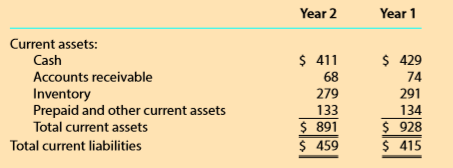

American Eagle Outfitters Inc. (AEO) operates specialty retail stores, selling clothing such as denim, sweaters, t-shirts, and fleece outerwear that targets 15 to 25-year-old men and women. that targets 15 to 25-year-old men and women. The following asset and liability data (in millions) were adapted from recent ï¬nancial statements.

1. Compute quick assets for Years 2 and 1.

2. Compute the quick ratio for Years 2 and 1. Round to two decimal places.

3. Analyze and assess any changes in liquidity for Years 2 and 1.

Transcribed Image Text:

Year 2 Year 1 Current assets: $ 411 68 $ 429 74 Cash Accounts receivable Inventory Prepaid and other current assets Total current assets 279 291 133 134 $ 891 $ 459 $ 928 $ 415 Total current liabilities

> Identify the errors in the following bank reconciliation: DAKOTA CO. Bank Reconciliation For the Month Ended June 30, 20Y3 Cash balance according to bank statement Add outstanding checks: No. 7715 $22,900 $1,450 7760 915 7764 1,850 775 4,990 $27,890

> An accounting clerk for Westwind Co. prepared the following bank reconciliation: a. From the bank reconciliation data, prepare a new bank reconciliation for Westwind Co., using the format shown in Exhibit 10. b. If a balance sheet were prepared for Wes

> Accompanying a bank statement for Nite Lighting Company is a credit memo for $26,500, representing the principal ($25,000) and interest ($1,500) on a note that had been collected by the bank. The company had been notified by the bank at the time of the co

> Lyle Steinberg has recently been hired as the manager of Laramie Coffee, a national chain of franchised coffee shops. During her first month as store manager, Lyle encountered the following internal control situations: a. Laramie Coffee has one cash regis

> Using the data presented in Exercise 5-18, record the effects on the accounts and financial statements of the company based upon the bank reconciliation. Data from Exercise 5-18: The following data were accumulated for use in reconciling the bank account

> The following data (in millions) were adapted from recent financial statements of Apple Inc (AAPL). 1. Compute the accounts receivable turnover for Years 1 and 2. Round to one decimal place. 2. Compute days’ sales in re

> The following data were accumulated for use in reconciling the bank account of Kaycee Sisters Inc. for August 20Y9: a. Cash balance according to the company’s records at August 31, $14,190. b. Cash balance according to the bank statement at August 31, $1

> Torpedo Digital Company, a communications equipment manufacturer, recently fell victim to a fraud scheme developed by one of its employees. To understand the scheme, it is necessary to review Torpedo’s procedures for the purchase of services. The purchas

> Greenleaf Co. is a small merchandising company with a manual accounting system. An investigation revealed that in spite of a sufficient bank balance, a significant amount of available cash discounts had been lost because of failure to make timely payments

> Jodi Rostad works at the drive-through window of Mamma’s Burgers. Occasionally, when a drive-through customer orders, Jodi fills the order and pockets the customer’s money. She does not ring up the order on the cash register. Identify the internal control

> Using Wikipedia (www.wikipedia.org.), look up the entry for the Sarbanes- Oxley Act. Look over the table of contents and find the section that describes Section 404. What does Section 404 require of management’s internal control report?

> After the amount due on a sale of $16,000, terms 2/10, n/eom, is received from a customer within the discount period, the seller consents to the return of the entire shipment. The cost of the merchandise returned was $10,000. (a) What is the amount of th

> Illustrate the effects on the accounts and financial statements of recording the following transactions: a. Sold merchandise for cash, $62,500. The cost of the goods sold was $30,000. b. Sold merchandise on account, $27,800. The cost of the goods sold was

> Illustrate the effects on the accounts and financial statements of the following related transactions of Bowen Inc. a. Purchased $400,000 of merchandise from Swanson Co. on account, terms 1/10, n/30. b. Paid the amount owed on the invoice within the disco

> Milan Co., a women’s clothing store, purchased $120,000 of merchandise from a supplier on account, terms FOB destination, 2/10, n/30. Milan Co. returned $16,000 of the merchandise, receiving a credit memorandum, and then paid the amount due within the di

> Identify the errors in the following income statement and prepare a corrected income statement: CARLSBAD COMPANY Income Statement For the Year Ended February 28, 20Y8 Sales...... $4,220,000 Cost of goods sold.. (2,650,000) Operating income Expenses:

> The following data (in millions) were adapted from recent financial statements of International Paper Company (IP) and Wal-Mart Stores Inc. (WMT) 1. Compute the accounts receivable turnover for International Paper and Wal-Mart. Round to one decimal pla

> Summary operating data for Loma Company during the current year ended April 30, 20Y6, are as follows: cost of goods sold, $7,500,000; administrative expenses, $750,000; interest expense, $100,000; rent revenue, $120,000; sales, $13,580,000 and selling ex

> On March 31, 20Y5, the balances of the accounts appearing in the ledger of Lange Daughters Inc. are as follows: a. Prepare a multiple-step income statement for the year ended March 31, 20Y5. b. Compare the major advantages and disadvantages of the mult

> Assume the following data for Alpine Technologies for the year ending July 31, 20Y2. Illustrate the effects of the adjustments for customer refunds and returns on the accounts and financial statements of Alpine Technologies for the year

> Intrax Inc.’s perpetual inventory records indicate that $815,400 of merchandise should be on hand on December 31, 20Y4. The physical inventory indicates that $798,300 of merchandise is actually on hand. Illustrate the effects on the accounts and financial

> Based on the data presented in Exercise 4-13, illustrate the effects on the accounts and financial statements of Butler Co. for (a) the purchase, (b) the credit for damaged merchandise, and (c) the payment of the invoice within the discount period. Data

> Steritech Co., a furniture wholesaler, sells merchandise to Butler Co. on account, $86,000, terms 2/10, n/30. The cost of the merchandise sold is $51,600. Steritech Co. issues a credit memorandum for $5,000 ($4,900 net of the 2% discount) for merchandise

> La-Z-Boy Inc. (LZB) is one of the world’s largest manufacturer of furniture and is best known for its reclining chairs. The following data (in thousands) were adapted from recent financial statements: Prepare a classi&i

> Pounds-Away Services Co. offers personal weight reduction consulting services to individuals. On November 30, 20Y9, the balances of selected accounts of Pounds-Away Services Co. are as follows: Prepare a classified balance sheet that inc

> Clean Air Company is a consulting firm specializing in pollution control. The following adjustments were made for Clean Air Company: Identify each of the six pairs of adjustments. For each adjustment, indicate the account, whether the ac

> The accountant for Healthy Medical Co., a medical services consulting firm, mistakenly omitted adjusting entries for (a) unearned revenue earned during the year ($175,000) and (b) accrued wages ($12,300). Indicate the effect of each error

> Wal-Mart Stores Inc. (WMT) operates over retail stores throughout the world. In contrast, Alphabet Inc. (GOOG) is a technology company, formerly known as Google, that provides a variety of online services. 1. Using the following data (in millions) adapte

> List any errors you can find in the following balance sheet. Prepare a corrected balance sheet. ATLAS SERVICES CO. Balance Sheet For the Year Ended May 31, 20Y5 Assets Current assets: Cash....... $ 12,000 Accounts payable.. Supplies..

> Describe how the following transactions of McDonald’s Corp. (MCD), would affect the three elements of the accounting equation. a. Paid research and development expenses for the current year. b. Purchased machinery and equipment for cash. c. Received cash

> Using the financial data shown in Exercise 2-17 for Big Mountain Realty Inc., prepare a statement of cash flows for the month ending June 30, 20Y9. Data from Exercise 2-17: After its first month of operations

> Financial information related to Abby’s Interiors for October and November of 20Y6 is as follows: a. Prepare balance sheets for Abby’s Interiors as of October 31 and November 30, 20Y6. b. Determine the amount of net

> Use the following data (in millions) for Oracle Corporation (ORCL), for a recent year to answer the questions below: a. Determine the amount of earnings retained in Oracle for the year, assuming no dividends were paid during the year. b. Determine the

> Outlaw Realty, organized August 1, 20Y7, is owned and operated by Julie Baxter. How many errors can you find in the following financial statements for Outlaw Realty, prepared after its first month of operation

> One item is omitted from each of the following summaries of balance sheet and income statement data for four different corporations. Determine the amounts of the missing items, identifying them by letter. (Suggestion: First determine the amount of incr

> Based on the Amazon.com, Inc., financial statement data s

> Four different companies, Sierra, Tango, Yankee, and Zulu, show the same balance sheet data at the beginning and end of a year. These data, exclusive of the amount of stockholders’ equity, are summarized as follows: On the basis of th

> A company’s stakeholders often differ in their financial statement focus. For example, some stakeholders focus primarily on the income statement, while others focus primarily on the statement of cash flows or the balance sheet. For each of the following si

> Compare The Gap Inc. (MBA 3-6) and American Eagle Outfitters Inc. (MBA 3-7) liquidity positions for Year 2. Comment on the differences. Data from MBA 3-6: The Gap Inc. (GPS) operates specialty retail stores under such brand names as GAP, Old Navy, and B

> Looney Inc. was organized on July 1, Year 1. A summary of cash flows for July follows. Prepare a statement of cash flows for the month ended July 31, Year 1. Cash receipts: Cash received from customers $600,000 Cash re

> Using the financial data shown in Exercise 2-17 for Big Mountain Realty Inc., prepare a balance sheet as of June 30, 20Y9. Data from Exercise 2-17: After its first month of operations, the following amounts were taken from

> Using the financial data shown in Exercise 2-17 for Big Mountain Realty Inc., prepare a statement of stockholders’ equity for the month ending June 30, 20Y9. Data from Exercise 17:

> After its first month of operations, the following amounts were taken from the accounting records of Big Mountain Realty Inc. as of June 30, 20Y9. Prepare an income statement for the month ending June 30, 20Y9. $ 43,000 $ 50,000 8,00

> Financial information related to Montana Interiors for October and November 20Y8 is as follows: a. Prepare balance sheets for Montana Interiors as of October 31 and as of November 30, 20Y8. b. Determine the amount of net income for November, assuming t

> One item is omitted in each of the following summaries of balance sheet and income statement data for four different corporations, AL, CO, KS, and MT. Determine the missing amounts, identifying them by letter. AL co KS MT Beginning of the year: $ (

> Maynard Services was organized on August 1, 20Y5. A summary of the revenue and expense transactions for August follows: Prepare an income statement for the month ended August 31. Fees earned $3,400,000 2,150,000 55,000 320,000 Wages expense Miscell

> Financial information related to Webber Company for the month ended June 30, 20Y7, is as follows: Prepare a statement of stockholders’ equity for the month ended June 30, 20Y7. Common Stock, June 1, 20Y7 $ 60,000 Stock issued in J

> Illustrate the effects on the accounts and financial statements of recording the following selected transactions: a. Sold $11,250 of merchandise on account, subject to a sales tax of 6%. The cost of the merchandise sold was $6,750. b. Paid $63,120 to the

> Cheryl Alder operates her own catering service. Summary financial data for March are presented in the following equation form. Each line, designated by a number, indicates the effect of a transaction on the balance sheet. Each increase and

> A retailer is considering the purchase of 100 units of a specific item from either of two suppliers. Their offers are as follows: A: $390 a unit, total of $39,000, 1/10, n/30, plus freight of $750. B: $400 a unit, total of $40,000, 2/10, n/30, no charge f

> Using the income statement and statement of cash flows you prepared in Exercise 3-3, reconcile net income with the net cash flows from operations.

> Four different companies—Chang, Henry, Nagel, and Wilcox—show the same balance sheet data at the beginning and end of a year. These data, exclusive of the amount of stockholders’ equity, are summarize

> The following accounts were taken from the unadjusted trial balance of Inter Circle Co., a congressional lobbying firm. Indicate whether or not each account would normally require an adjusting entry. If the account normally requires an adj

> Classify the following items as (a) deferred expense (prepaid expense), (b) deferred revenue (unearned revenue), (c) accrued expense (accrued liability), or (d) accrued revenue (accrued asset). 1. Subscriptions received in advance by a magazine publis

> Margie Van Epps established Health Services, P.C., a professional corporation, in March of the current year. Health Services offers healthy living advice to its clients. The effect of each transaction on the balance sheet and the balances after each tran

> The following are recent year summaries of balance sheet and income statement data (in millions) for Apple Inc. (AAPL) and Verizon Communications (VZ). Determine the amounts of the missing items (a) through (i). Apple Verizon Year 1: Assets $231,83

> Using the data from Exercises 3-1 and 3-2, prepare financial statements for February, including income statement, statement of stockholders’ equity, balance sheet, and statement of cash flows. Data from Exercise 3.1: Terry Mason organized The Fifth Season

> Using the data from Exercise 3-1, record the adjusting entries at the end of February to record the insurance expense and supplies expense. There was $150 of supplies on hand as of February 28. Identify the adjusting entry for insurance as (a1) and suppl

> Terry Mason organized The Fifth Season at the beginning of February 20Y4. During February, The Fifth Season entered into the following transactions: a. Terry Mason invested $15,000 in The Fifth Season in exchange for common stock. b. Paid $2,700 on Febru

> The Gap Inc. (GPS) operates specialty retail stores under such brand names as GAP, Old Navy, and Banana Republic. The following asset and liability data (in millions) were adapted from recent financial statements. 1. Compute quick assets

> Match each of the following statements with the appropriate accounting concept. Some concepts may be used more than once, while others may not be used at all. Use the notations shown to indicate the appropriate accounting concept. Statements: 1. Assume

> For a recent year, Barnes & Noble Inc. (BKS) reported (in thousands) Property and Equipment of $3,076,299 and Accumulated Depreciation of $2,627,007. a. What was the book value of the fixed assets? b. Would the book values of Barnes & Noble’s fixed asset

> Though the McDonald’s (MCD) menu of hamburgers, cheeseburgers, the Big Mac®, Quarter Pounder®, Filet-O-Fish®, and Chicken McNuggets® is easily recognized, McDonald’s ï&n

> Based upon the financial transactions for McDonald’s Corp. (MCD), shown in Exercise 2-21, indicate whether the transaction would be reported in the cash flows from operating, investing, or financing sections of the statement of cash flows. Data from Exercis

> Amazon.com, Inc., (AMZN) operates as an online retailer in North America and internationally. Both Amazon and third parties, via the Amazon.com Web site, sell products across various product categories. The following items were adapted from a recent annu

> Describe how the following business transactions affect the three elements of the accounting equation. a. Received cash for services performed. b. Paid for utilities used in the business. c. Borrowed cash at local bank. d. Issued common stock for cash. e

> Campbell Soup Co. (CPB) had the following assets and liabilities (in millions) at the end of Year 1. Assets ……………………… $ 8,113 Liabilities …………………. 6,498 a. Determine the stockholders’ equity of Campbell Soup at the end of Year 1. b. If assets decreased

> Identify the primary business emphasis of each of the following companies as (a) a low cost emphasis or (b) a premium-price emphasis. If you are unfamiliar with the company, you may use the Internet to locate the company’s home page o

> Indicate whether each of the following activities would be reported on the statement of cash flows as (a) an operating activity, (b) an investing activity, or (c) a financing activity. 3. Cash paid for expenses 4. Cas

> Indicate whether each of the following cash activities would be reported on the statement of cash flows as (a) an operating activity, (b) an investing activity, or (c) a financing activity. 6. Sold excess office equip

> GameStop Corporation (GME) has over 6,500 retail stores worldwide and sells new and used video games. The following asset and liability data (in millions) were adapted from recent financial statements. 1. Compute quick assets for Years 2

> Each of the following items is shown in the financial statements of ExxonMobil Corporation. Identify the financial statement (balance sheet or income statement) in which each item would appear. i. Marketable securities

> The Walt Disney Company (DIS) had the following assets and liabilities (in millions) at the end of Year 1. Assets …….…………… $ 84,141 Liabilities ……………… 39, 183 a. Determine the stockholders’ equity of Walt Disney at the end of Year 1. b. If assets

> The income statement of a corporation for the month of February indicates a net income of $32,000. During the same period, $40,000 in cash dividends were paid. Would it be correct to say that the business incurred a net loss of $8,000 during the month? D

> On Time Delivery Service had the following selected transactions during November: 1. Received cash from issuance of common stock, $75,000. 2. Paid rent for November, $5,000. 3. Paid advertising expense, $3,000. 4. Received cash for providing delivery ser

> Determine the missing amount for each of the following: Assets Liabilities + Stockholders' Equity a. $715,000 $1,185,000 $ 510,000 b. $600,000 c. $112,400 $23,750 + + + || ||||

> Identify each of the following items as (a) an asset, (b) a liability, (c) revenue, (d) an expense, or (e) a dividend: 6. Equipment 7. Note payable owed to the bank 8. Rent paid for the month 9. Sales commissions paid to salespersons 1. Amounts

> Based on the data presented in Exercise 1-10, identify those items that would appear on the income statement. Data from Exercise 1-10: From the following list of selected items taken from the records of Flip Flop Sandals Inc. as of a speciï¬

> From the following list of selected items taken from the records of Flip Flop Sandals Inc. as of a specific date, identify those that would appear on the balance sheet. 1. Accounts Receivable 6. Salaries Expense 7. Salaries Payable 8.

> Indicate whether each of the following companies is primarily a service, merchandise, or manufacturing business. If you are unfamiliar with the company, you may use the Internet to locate the company’s home page or use the ï¬&#

> What is the objective of most businesses?

> Using the transactions listed in P3-1 for San Mateo Health Care, indicate the effects of each transaction on the liquidity metric Quick Assets and profitability metric Net Income – Accrual Basis. Data from Problem 3-1: S

> Favorable business conditions may bring about certain seemingly unfavorable ratios, and unfavorable business operations may result in apparently favorable ratios. For example, Shaddox Company increased its sales and net income substantially for the curre

> The price-earnings ratio for the common stock of In-Work Company was 15 at December 31, the end of the current fiscal year. What does the ratio indicate about the selling price of the common stock in relation to current earnings?

> The net income (after income tax) of Fleming Inc. was $4.80 per common share in the latest year and $7.50 per common share for the preceding year. At the beginning of the latest year, the number of shares outstanding was doubled by a stock split. There w

> Deere & Company (DE), a company well known for manufacturing farm equipment, reported more than $800 million of product warranties in recent financial statements. How would costs of repairing a defective product be recorded?

> When should the liability associated with a product warranty be recorded? Discuss.

> The following data relate to an $8,000,000, 7% bond issue for a selected semiannual interest period: a. Were the bonds issued at a discount or at a premium? b. What expense account is affected by the amortization of the discount or premium? Bond ca

> A corporation issues $40,000,000 of 6% bonds to yield an effective interest rate of 8%. a. Was the amount of cash received from the sale of the bonds more or less than $40,000,000? b. Identify the following amounts related to the bond issue: (1) face amo

> Identify the two distinct obligations incurred by a corporation when issuing bonds.

> To match revenues and expenses properly, should the expense for employee vacation pay be recorded in the period during which the vacation privilege is earned or during the period in which the vacation is taken?

> For each of the following payroll-related taxes, indicate whether it generally applies to (1) employees only, (2) employers only, or (3) both employees and employers: a. Federal income tax b. Federal unemployment compensation tax c. Medicare tax d. Socia

> Using the transactions listed in E3-5 for Health Services, P.C., indicate the effects of each transaction on the liquidity metric Quick Assets and profitability metric Net Income Accrual Basis. Data from Exercise 3-5: Margie Van Epps esta

> When are short-term notes payable issued?

> What is the primary purpose of a stock split?

> An owner of 300 shares of Colorado Spring Company common stock receives a stock dividend of 6 shares. a. What is the effect of the stock dividend on the stockholder’s proportionate interest (equity) in the corporation? b. How does the total equity of 30

> A corporation with preferred stock and common stock outstanding has a substantial balance in its retained earnings account at the beginning of the current fiscal year. Although net income for the current year is sufficient to pay the preferred dividen

> The treasury stock in Question 14 is resold for $2,400,000. a. What is the effect on the corporation’s revenue of the period? b. What is the effect on stockholders’ equity?

> A corporation reacquires 18,000 shares of its own $50 par common stock for $2,250,000, recording it at cost. a. What effect does this transaction have on revenue or expense of the period? b. What effect does it have on stockholders’ equity?

> a. In what respect does treasury stock differ from unissued stock? b. How should treasury stock be presented on the balance sheet?