Question: Amy Dyken, controller at Fitzgerald Pharmaceutical

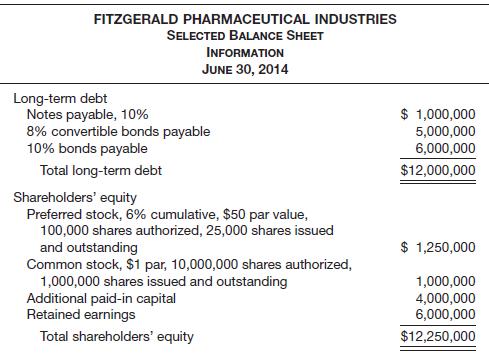

Amy Dyken, controller at Fitzgerald Pharmaceutical Industries, a public company, is currently preparing the calculation for basic and diluted earnings per share and the related disclosure for Fitzgerald’s financial statements. Below is selected financial information for the fiscal year ended June 30, 2014.

The following transactions have also occurred at Fitzgerald.

1. Options were granted on July 1, 2013, to purchase 200,000 shares at $15 per share. Although no options were exercised during fiscal year 2014, the average price per common share during fiscal year 2014 was $20 per share.

2. Each bond was issued at face value. The 8% convertible bonds will convert into common stock at 50 shares per $1,000 bond. The bonds are exercisable after 5 years and were issued in fiscal year 2013.

3. The preferred stock was issued in 2013.

4. There are no preferred dividends in arrears; however, preferred dividends were not declared in fiscal year 2014.

5. The 1,000,000 shares of common stock were outstanding for the entire 2014 fiscal year.

6. Net income for fiscal year 2014 was $1,500,000, and the average income tax rate is 40%.

Instructions

For the fiscal year ended June 30, 2014, calculate the following for Fitzgerald Pharmaceutical Industries.

(a) Basic earnings per share.

(b) Diluted earnings per share.

> At the end of the current period, Agler Inc. had a projected benefit obligation of $400,000 and pension plan assets (at fair value) of $350,000. What are the accounts and amounts that will be reported on the company’s balance sheet as pension assets or p

> What is an uncertain tax position, and what are the general guidelines for accounting for uncertain tax positions?

> Define the following terms. (a) Basic earnings per share. (b) Potentially dilutive security. (c) Diluted earnings per share. (d) Complex capital structure. (e) Potential common stock.

> Dierdorf Inc., a closely held corporation, has decided to go public. The controller, Ed Floyd, is concerned with presenting interim data when a LIFO inventory valuation is used. What problems are encountered with LIFO inventories when quarterly data are

> In January 2014, installation costs of $6,000 on new machinery were charged to Maintenance and Repairs Expense. Other costs of this machinery of $30,000 were correctly recorded and have been depreciated using the straight-line method with an estimated li

> What are “initial direct costs” and how are they accounted for?

> What is the meaning of “corridor amortization”?

> What controversy relates to the accounting for net operating loss carry forwards?

> Differentiate between investing activities, financing activities, and operating activities.

> What are the two types of losses that can become evident in accounting for long-term contracts? What is the nature of each type of loss? How is each type accounted for?

> Your classmate Kate believes that the equity method is applied with a strict application of the “20%” rule. Do you agree? Explain.

> What effect do stock dividends or stock splits have on the computation of the weighted-average number of shares outstanding?

> What are the accounting problems related to the presentation of interim data?

> Classify the following items as (1) Operating, (2) Investing, (3) Financing, or (4) significant non-cash investing and financing activities, using the direct method. (a) Cash payments to employees. (b) Redemption of bonds payable. (c) Sale of

> Describe the effect of a “bargain-purchase option” on accounting for a capital lease transaction by a lessee.

> How does an “asset gain or loss” develop in pension accounting? How does a “liability gain or loss” develop in pension accounting?

> What are the possible treatments for tax purposes of a net operating loss? What are the circumstances that determine the option to be applied? What is the proper treatment of a net operating loss for financial reporting purposes?

> Explain how the investment account is affected by investee activities under the equity method.

> At December 31, 2014, Reid Company had 600,000 shares of common stock issued and outstanding, 400,000 of which had been issued and outstanding throughout the year and 200,000 of which were issued on October 1, 2014. Net income for 2014 was $2,000,000, an

> Discuss briefly the three approaches that have been suggested for reporting changes in accounting principles.

> Each of the following items must be considered in preparing a statement of cash flows for Blackwell Inc. for the year ended December 31, 2014. State where each item is to be shown in the statement, if at all. (a) Plant assets that had cost $18,000 6½ yea

> Prior to 2014, Heberling Inc. excluded manufacturing overhead costs from work in process and finished goods inventory. These costs have been expensed as incurred. In 2014, the company decided to change its accounting methods for manufacturing inventories

> How should changes in the estimated unguaranteed residual value be handled by the lessor?

> Given the following items and amounts, compute the actual return on plan assets: fair value of plan assets at the beginning of the period $9,500,000; benefits paid during the period $1,400,000; contributions made during the period $1,000,000; and fair va

> Differentiate between “loss carryback” and “loss carry forward.” Which can be accounted for with the greater certainty when it arises? Why?

> For what reasons should the percentage-of-completion method be used over the completed-contract method whenever possible?

> What constitutes “significant influence” when an investor’s financial interest is below the 50% level?

> Hawkins Construction Co. has a $60 million contract to construct a highway overpass and cloverleaf. The total estimated cost for the project is $50 million. Costs incurred in the first year of the project are $8 million. Hawkins Construction Co. approp

> The following comment appeared in the financial press: “Inadequate financial disclosure, particularly with respect to how management views the future and its role in the marketplace, has always been a stone in the shoe. After all, if you don&rsq

> The net income for Letterman Company for 2014 was $320,000. During 2014, depreciation on plant assets was$124,000, amortization of patent was $40,000, and the company incurred a loss on sale of plant assets of $21,000. Compute net cash flow from operat

> Identify the two recognized lease accounting methods for lessees and distinguish between them.

> What are the major advantages of notes to the financial statements? What types of items are usually reported in notes?

> Aubrey Inc. issued $4,000,000 of 10%, 10-year convertible bonds on June 1, 2014, at 98 plus accrued interest. The bonds were dated April 1, 2014, with interest payable April 1 and October 1. Bond discount is amortized semiannually on a straight-line ba

> Assume that Sarazan Company has a share-option plan for top management. Each share option represents the right to purchase a $1 par value ordinary share in the future at a price equal to the fair value of the shares at the date of the grant. Sarazan ha

> Illiad Inc. has decided to raise additional capital by issuing $170,000 face value of bonds with a coupon rate of 10%. In discussions with investment bankers, it was determined that to help the sale of the bonds, detachable stock warrants should be iss

> What type of earnings per share presentation is required in a complex capital structure?

> On June 1, 2012, Andre Company and Agassi Company merged to form Lancaster Inc. A total of 800,000 shares were issued to complete the merger. The new corporation reports on a calendar-year basis. On April 1, 2014, the company issued an additional 400,

> Flagstad Inc. presented the following data. Instructions Compute earnings per share.

> The following two items appeared on the Internet concerning the GAAP requirement to expense stock options. WASHINGTON, D.C.—February 17, 2005 Congressman David Dreier (R–CA), Chairman of the House Rules Committee, and Congresswoman Anna Es

> Agassi Corporation is preparing the comparative financial statements to be included in the annual report to stockholders. Agassi employs a fiscal year ending May 31. Income from operations before income taxes for Agassi was $1,400,000 and $660,000, re

> Winsor Inc. recently purchased Holiday Corp., a large midwestern home painting corporation. One of the terms of the merger was that if Holiday’s income for 2014 was $110,000 or more, 10,000 additional shares would be issued to Holiday’s sto

> Discuss the similarities and the differences between convertible debt and debt issued with stock warrants.

> On January 1, 2014, Crocker Company issued 10-year, $2,000,000 face value, 6% bonds, at par. Each $1,000 bond is convertible into 15 shares of Crocker common stock. Crocker’s net income in 2014 was $300,000, and its tax rate was 40%. The company

> Briefly describe some of the similarities and differences between GAAP and IFRS with respect to the accounting for dilutive securities, stock-based compensation, and earnings per share.

> What is meant by the term antidilution? Give an example.

> McIntyre Corporation issued 2,000 $1,000 bonds at 101. Each bond was issued with one detachable stock warrant. After issuance, the bonds were selling separately at 98. The market price of the warrants without the bonds cannot be determined. Use the inc

> Explain how the conversion feature of convertible debt has a value (a) to the issuer and (b) to the purchaser.

> Capulet Company establishes a stock-appreciation rights program that entitles its new president Ben Davis to receive cash for the difference between the market price of the stock and a pre-established price of $30 (also market price) on December 31, 20

> Explain the treasury-stock method as it applies to options and warrants in computing dilutive earnings per share data.

> On May 1, 2014, Friendly Company issued 2,000 $1,000 bonds at 102. Each bond was issued with one detachable stock warrant. Shortly after issuance, the bonds were selling at 98, but the fair value of the warrants cannot be determined. Instructions (a)

> Tweedie Company issues 10,000 shares of restricted stock to its CFO, Mary Tokar, on January 1, 2014. The stock has a fair value of $500,000 on this date. The service period related to this restricted stock is 5 years. Vesting occurs if Tokar stays with

> Brad Dolan, a stockholder of Rhode Corporation, has asked you, the firm’s accountant, to explain why his stock warrants were not included in diluted EPS. In order to explain this situation, you must briefly explain what dilutive securities are, w

> Archer Inc. issued $4,000,000 par value, 7% convertible bonds at 99 for cash. If the bonds had not included the conversion feature, they would have sold for 95. Prepare the journal entry to record the issuance of the bonds.

> What effect do stock dividends or stock splits have on the computation of the weighted-average number of shares outstanding?

> What are stock rights? How does the issuing company account for them?

> Vargo Company has bonds payable outstanding in the amount of $500,000, and the Premium on Bonds Payable account has a balance of $7,500. Each $1,000 bond is convertible into 20 shares of preferred stock of par value of $50 per share. All bonds are conv

> Where can authoritative IFRS be found related to dilutive securities, stock-based compensation, and earnings per share?

> Melton Corporation is preparing the comparative financial statements for the annual report to its shareholders for fiscal years ended May 31, 2014, and May 31, 2015. The income from operations for each year was $1,800,000 and $2,500,000, respectively.

> Refer to the data for Barwood Corporation in BE16-6. In BE16-6 On January 1, 2014, Barwood Corporation granted 5,000 options to executives. Each option entitles the holder to purchase one share of Barwood’s $5 par value common stock at $50 per

> On January 1, 2014, Lennon Industries had stock outstanding as follows. To acquire the net assets of three smaller companies, Lennon authorized the issuance of an additional 160,000 common shares. The acquisitions took place as shown below. O

> DiCenta Corporation reported net income of $270,000 in 2014 and had 50,000 shares of common stock outstanding throughout the year. Also outstanding all year were 5,000 shares of cumulative preferred stock, each convertible into 2 shares of common. The

> For various reasons a corporation may issue warrants to purchase shares of its common stock at specified prices that, depending on the circumstances, may be less than, equal to, or greater than the current market price. For example, warrants may be iss

> Explain how the conversion feature of convertible debt has a value (a) To the issuer and (b) To the purchaser.

> Volker Inc. issued $2,500,000 of convertible 10-year bonds on July 1, 2014. The bonds provide for 12% interest payable semiannually on January 1 and July 1. The discount in connection with the issue was $54,000, which is being amortized monthly on a st

> Rockland Corporation earned net income of $300,000 in 2014 and had 100,000 shares of common stock outstanding throughout the year. Also outstanding all year was $800,000 of 10% bonds, which are convertible into 16,000 shares of common. Rockland’s

> On January 1, 2015, Titania Inc. granted stock options to officers and key employees for the purchase of 20,000 shares of the company’s $10 par common stock at $25 per share. The options were exercisable within a 5-year period beginning January 1

> The stockholders’ equity section of Martino Inc. at the beginning of the current year appears below. During the current year, the following transactions occurred. 1. The company issued to the stockholders 100,000 rights. Ten rights are need

> Earnings per share can affect market prices of common stock. Can market prices affect earnings per share? Explain.

> Define the following terms. (a) Basic earnings per share. (b) Potentially dilutive security. (c) Diluted earnings per share. (d) Complex capital structure. (e) Potential common stock.

> The financial statements of Marks and Spencer plc (M&S) are available at the book’s companion website or can be accessed at http://annualreport.marksandspencer.com/_assets/downloads/Marks-and-Spencer-Annual-report-and-financial-statements-20

> The information below pertains to Barkley Company for 2015. There were no changes during 2015 in the number of common shares, preferred shares, or convertible bonds outstanding. There is no treasury stock. The company also has common stock options

> Under what conditions of bond issuance does a discount on bonds payable arise? Under what conditions of bond issuance does a premium on bonds payable arise?

> McCormick Corporation issued a 4-year, $40,000, 5% note to Greenbush Company on January 1, 2014, and received a computer that normally sells for $31,495. The note requires annual interest payments each December 31. The market rate of interest for a note

> Samson Corporation issued a 4-year, $75,000, zero-interest-bearing note to Brown Company on January 1, 2014, and received cash of $47,664. The implicit interest rate is 12%. Prepare Samson’s journal entries for (a) The January 1 issuance and (b) The De

> Matt Ryan Corporation is interested in building its own soda can manufacturing plant adjacent to its existing plant in Partyville, Kansas. The objective would be to ensure a steady supply of cans at a stable price and to minimize transportation costs. Ho

> What are the general rules for measuring and recognizing gain or loss by a debt extinguishment with modification?

> Teton Corporation issued $600,000 of 7% bonds on November 1, 2014, for $644,636. The bonds were dated November 1, 2014, and mature in 10 years, with interest payable each May 1 and November 1.Teton uses the effective-interest method with an effective rat

> Under what conditions a provision should be recorded?

> On January 1, 2014, Ellen Greene Company makes the two following acquisitions. 1. Purchases land having a fair value of $200,000 by issuing a 5-year, zero-interest-bearing promissory note in the face amount of $337,012. 2. Purchases equipment by issu

> Assume the bonds in BE14-6 were issued for $644,636 and the effective-interest rate is 6%. Prepare the company’s journal entries for (a) The January 1 issuance, (b) The July 1 interest payment, and (c) The December 31 adjusting entry.

> Under what conditions should a contingent liability be recorded?

> On January 1, 2014, JWS Corporation issued $600,000 of 7% bonds, due in 10 years. The bonds were issued for $559,224, and pay interest each July 1 and January 1. JWS uses the effective-interest method. Prepare the company’s journal entries for (

> Devers Corporation issued $400,000 of 6% bonds on May 1, 2014. The bonds were dated January 1, 2014, and mature January 1, 2017, with interest payable July 1 and January 1. The bonds were issued at face value plus accrued interest. Prepare Devers’s journ

> Distinguish between the following values relative to bonds payable: (a) Maturity value. (b) Face value. (c) Market (fair) value. (d) Par value.

> Assume the bonds in BE14-2 were issued at 103%. Prepare the journal entries for (a) January 1, (b) July 1, and (c) December 31. Assume The Colson Company records straight-line amortization semiannually.

> Grant Company has had a record-breaking year in terms of growth in sales and profitability. However, market research indicates that it will experience operating losses in two of its major businesses next year. The controller has proposed that the company

> Assume the bonds in BE14-2 were issued at 98%. Prepare the journal entries for (a) January 1, (b) July1, and (c) December 31. Assume The Colson Company records straight-line amortization semiannually.

> What are some forms of off-balance-sheet financing?

> The Colson Company issued $300,000 of 10% bonds on January 1, 2014. The bonds are due January 1, 2020, with interest payable each July 1 and January 1. The bonds are issued at face value. Prepare Colson’s journalentries for (a) The January issuance, (b

> Whiteside Corporation issues $500,000 of 9% bonds, due in 10 years, with interest payable semi annually. At the time of issue, the market rate for such bonds is 10%. Compute the issue price of the bonds.

> What is the required method of amortizing discount and premium on bonds payable? Explain the procedures.

> Distinguish between a determinable current liability and a contingent liability. Give two examples of each type.

> Linda Day George Company had bonds outstanding with a maturity value of $300,000. On April 30, 2014, when these bonds had an unamortized discount of $10,000, they were called in at 104. To pay for these bonds, George had issued other bonds a month earl

> Under what circumstances would a transaction be recorded as a troubled-debt restructuring by only one of the two parties to the transaction?

> What is meant by “accounting symmetry” between the entries recorded by the debtor and creditor in a troubled debt restructuring involving a modification of terms? In what ways is the accounting for troubled-debt restructurings non-symmetrical?

> What are the general rules for measuring and recognizing gain or loss by both the debtor and the creditor in a troubled debt restructuring involving a modification of terms?

> On February 1, 2015, one of the huge storage tanks of Viking Manufacturing Company exploded. Windows in houses and other buildings within a one-mile radius of the explosion were severely damaged, and a number of people were injured. As of February 15,

> Presented below is a note disclosure for Matsui Corporation. Litigation and Environmental: The Company has been notified, or is a named or a potentially responsible party in a number of governmental (federal, state and local) and private actions assoc

> On June 30, 2006, County Company issued 12% bonds with a par value of $800,000 due in 20 years. They were issued at 98 and were callable at 104 at any date after June 30, 2014. Because of lower interest rates and a significant change in the company&rsq

> Sycamore Candy Company offers an MP3 download (seven-single medley) as a premium for every five candy bar wrappers presented by customers together with $2.50. The candy bars are sold by the company to distributors for 30 cents each. The purchase price