Question: Assume that the business in Exercise 6-

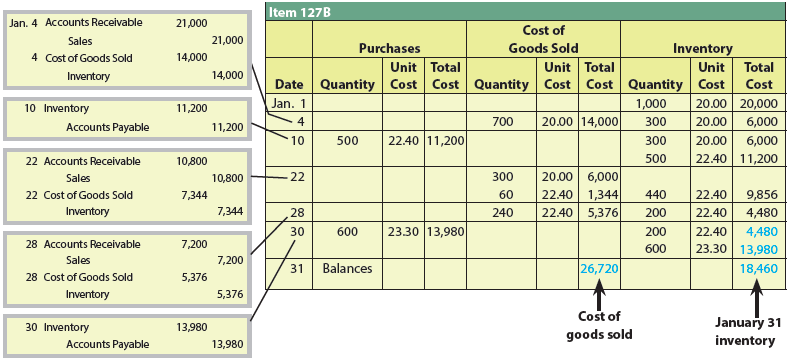

Assume that the business in Exercise 6-9 maintains a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale, assuming the first-in, first-out method. Present the data in the form illustrated in Exhibit 3.

Exhibit 3:

Exercise 6-9:

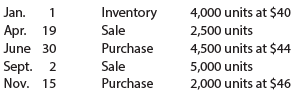

The following units of a particular item were available for sale during the calendar year:

The firm uses the weighted average cost method with a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale. Present the data in the form illustrated in Exhibit 5.

Exhibit 5:

Transcribed Image Text:

Item 127B Jan. 4 Accounts Receivable 21,000 Cost of Sales 21,000 Purchases Goods Sold Inventory Total 4 Cost of Goods Sold 14,000 Unit Total Date Quantity Cost Cost Quantity Unit Total Cost Cost Quantity 1,000 Unit Inventory 14,000 Cost Cost Jan. 1 20.00 20,000 10 Inventory 11,200 4 700 20.00 14,000 300 20.00 6,000 Accounts Payable 11,200 10 500 22.40 11,200 300 20.00 6,000 22 Accounts Receivable 10,800 500 22.40 11,200 20.00 6,000 22.40 1,344 22.40 5,376 Sales 10,800 22 300 22 Cost of Goods Sold 7,344 60 440 22.40 9,856 Inventory 7,344 28 240 200 22.40 4,480 30 600 23.30 13,980 200 22.40 4,480 28 Accounts Receivable 7,200 23.30 13,980 600 Sales 7,200 31 Balances 26,720 18,460 28 Cost of Goods Sold 5,376 Inventory 5,376 Cost of 30 Inventory January 31 13,980 goods sold inventory Accounts Payable 13,980 Jan. 1 Inventory 4,000 units at $40 Apr. 19 Sale 2,500 units June 30 Purchase Sept. 2 Nov. 15 4,500 units at $44 5,000 units 2,000 units at $46 Sale Purchase Item 127B Jan. 4 Accounts Receivable 21,000 Cost of Sales 21,000 Goods Sold Inventory Unit Total Date Quantity Cost Cost Quantity Cost Cost Quantity Cost Purchases 4 Cost of Goods Sold 14,000 Unit Total Unit Total Inventory 14,000 Cost 10 Inventory Jan. 1 1,000 20.00 20,000 11,200 Accounts Payable 11,200 -4 700 20.00 14,000 300 20.00 6,000 -10 500 22.40 11,200 800 21.50 17,200 7,740 21.50 5,160 22 Accounts Receivable 10,800 -22 360 21.50 440 21.50 9,460 4,300 22.85 18,280 22.85 18,280 Sales 10,800 28 240 200 21.50 22 Cost of Goods Sold 7,740 30 600 23.30 13,980 800 Inventory 7,740 31 Balances 26,900 800 28 Accounts Receivable 7,200 Sales 7,200 Cost of January 31 inventory 28 Cost of Goods Sold 5,160 goods sold Inventory 5,160 30 Inventory 13,980 Accounts Payable 13,980

> On June 25, Ritts Roofing extended an offer of $250,000 for land that had been priced for sale at $300,000. On July 9, Ritts accepted the seller’s counteroffer of $275,000. On October 1, the land was assessed at a value of $280,000 for property tax purpo

> Boyd Co. produces and sells aviation equipment. On the first day of its fiscal year, Boyd issued $80,000,000 of five-year, 9% bonds at a market (effective) interest rate of 12%, with interest payable semiannually. Compute the following, presenting figure

> Ware Co. produces and sells motorcycle parts. On the first day of its fiscal year, Ware issued $35,000,000 of five-year, 12% bonds at a market (effective) interest rate of 10%, with interest payable semiannually. Compute the following, presenting figures

> Shunda Corporation wholesales parts to appliance manufacturers. On January 1, Shunda issued $30,000,000 of five-year, 10% bonds at a market (effective) interest rate of 8%, receiving cash of $32,433,150. Interest is payable semiannually. Shunda’s fiscal

> Moss Co. issued $42,000,000 of five-year, 11% bonds, with interest payable semiannually, at a market (effective) interest rate of 9%. Determine the present value of the bonds payable using the present value tables in Exhibits 5 and 7. Round to the neares

> Assume the same data as in Exercise 11-10, except that the current interest rate is 12%. Will the present value of your winnings using an interest rate of 12% be more than the present value of your winnings using an interest rate of 5%? Why or why not?

> United States Steel Corporation’s (X) 7.5% bonds due in 2022 were reported as selling for 103.2. Were the bonds selling at a premium or at a discount? Why is United States Steel able to sell its bonds at this price?

> K. Mello Company has three employees—a consultant, a computer programmer, and an administrator. The following payroll information is available for each employee: For hourly employees, overtime is paid for hours worked in excess of 40

> An employee earns $30 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. If the employee worked 54 hours during the week, determine the employee’s (a) gross pay and (b) net pay for the week. Assume that the social security tax

> On June 30, Collins Management Company purchased land for $400,000 and a building for $560,000, paying $360,000 cash and issuing a 5% note for the balance, secured by a mortgage on the property. The terms of the note provide for 20 semiannual payments of

> A borrower has two alternatives for a loan: (1) issue a $150,000, 45-day, 4% note or (2) issue a $150,000, 45-day note that the creditor discounts at 4%. a. Calculate the amount of the interest expense for each option. b. Determine the proceeds received

> FedEx Corporation (FDX) had the following revenue and expense account balances (in millions) for a recent year ending May 31: a. Prepare an income statement. b. Compare your income statement with the income statement that is available at FedExâ&#

> General Motors Company (GM) disclosed estimated product warranty payable for comparative years as follows: Assume that GM’s sales were $166,380 million in the current year and that the total paid on warranty claims during the current

> On the first day of the fiscal year, Shiller Company borrowed $85,000 by giving a seven-year, 7% installment note to Soros Bank. The note requires annual payments of $15,772, with the first payment occurring on the last day of the fiscal year. The first

> In a recent year’s financial statements, Procter & Gamble (PG) showed an unfunded pension liability of $5,955 million and a periodic pension cost of $432 million. Explain the meaning of the $5,955 million unfunded pension liability and the $432 million p

> A business provides its employees with varying amounts of vacation per year, depending on the length of employment. The estimated amount of the current year’s vacation pay is $42,000. a. Journalize the adjusting entry required on January 31, the end of t

> Widmer Company had gross wages of $320,000 during the week ended June 17. The amount of wages subject to social security tax was $320,000, while the amount of wages subject to federal and state unemployment taxes was $48,000. Tax rates are as follows: S

> The payroll register for D. Salah Company for the week ended May 18 indicated the following: Salaries ………………………………………………………..……………………… $615,000 Federal income tax withheld ………………………………………………….. 165,000 The salaries were all subject to the 6.0% social s

> Bon Nebo Co. sold 30,000 annual subscriptions of Bjorn for $105 during December 20Y5. These new subscribers will receive monthly issues, beginning in January 20Y6. In addition, the business had taxable income of $970,000 during the first calendar quarter

> Assume the same facts as in Exercise 9-23, except that the book value of the press traded in is $108,500. Exercise 9-23: A printing press priced at a fair market value of $275,000 is acquired in a transaction that has commercial substance by trading i

> Apple Inc. (AAPL) designs, manufactures, and markets personal computers and related software. Apple also manufactures and distributes music players (iPod), mobile phones (iPhone), and smart watches (Apple Watch) along with related accessories and service

> Equipment acquired on January 8 at a cost of $212,000 has an estimated useful life of 15 years, has an estimated residual value of $14,000, and is depreciated by the straight-line method. a. What was the book value of the equipment at December 31 the en

> For two recent years, Robinhood Company reported the following: a. Determine the accounts receivable turnover for 20Y9 and 20Y8. Round answers to one decimal place. b. Determine the days’ sales in receivables for 20Y9 and 20Y8. Use 36

> Toot Auto Supply distributes new and used automobile parts to local dealers throughout the Midwest. Toot’s credit terms are n/30. As of the end of business on October 31, the following accounts receivable were past due: Determine the

> Journalize the following transactions in the accounts of Zippy Interiors Company, a restaurant supply company that uses the allowance method of accounting for uncollectible receivables: May 24. Sold merchandise on account to Old Town Cafe, $24,450.

> Journalize the following transactions in the accounts of Canyon River Medical Co., a medical equipment company that uses the direct write-off method of accounting for uncollectible receivables: Jan. 19. Sold merchandise on account to Dr. Kyle Norby,

> List any errors you can find in the following partial balance sheet: Napa Vino Company Balance Sheet December 31, 20Y6 Assets Current assets: Cash $ 78,500 $ 300,000 (4,500) Notes recelvable Interest receivable Notes receivable, net 295,500 Accounts

> Journalize the following transactions in the accounts of Missouri Gaming Co., which operates a riverboat casino: Mar. 29. Received a $30,000, 60-day, 5% note dated March 29 from Karie Platt on account. Apr. 30. Received a $24,000, 60-day, 8% note da

> The following selected transactions were completed by Interlocking Devices Co., a supplier of zippers for clothing: Journalize the entries to record the transactions. 20Y7 Dec. 7. Received from Unitarian Clothing & Bags Co., on account, a $75,000,

> The series of five transactions, (a) through (e), recorded in the following T accounts were related to a sale to a customer on account and the receipt of the amount owed. Briefly describe each transaction. Cash Notes Receivable (e) 76,500 (C) 75,000

> Seaforth International wrote off the following accounts receivable as uncollectible for the year ending December 31: Customer Amount Kim Abel …………â€&brvba

> Outlaw Bike Co. is a wholesaler of motorcycle supplies. An aging of the company’s accounts receivable on December 31 and a historical analysis of the percentage of uncollectible accounts in each age category are as follows: Estimate w

> Using data in Exercise 8-9, assume that the allowance for doubtful accounts for Evers Industries has a credit balance of $8,240 before adjustment on July 31. Journalize the adjusting entry for uncollectible accounts as of July 31. Exercise 8-9: Evers I

> The following revenue and expense account balances were taken from the ledger of Acorn Health Services Co. after the accounts had been adjusted on January 31, 20Y7, the end of the fiscal year: Prepare an income statement. Depreciation Expense Insur

> Alaska Impressions Co. records all cash receipts on the basis of its cash register tapes. Alaska Impressions discovered during October 20Y3 that one of its sales clerks had stolen an undetermined amount of cash receipts by taking the daily deposits to th

> The following bank reconciliation was prepared as of June 30, 20Y7: a. Identify the errors in the bank reconciliation. b. Prepare a corrected bank reconciliation. Poway Co. Bank Reconciliation For the Month Ended June 30,20Y7 Cash balance according

> An accounting clerk for Chesner Co. prepared the following bank reconciliation: a. From the data in this bank reconciliation, prepare a new bank reconciliation for Chesner Co., using the format shown in the Let’s Review section. b. If

> Faith Cassen has recently been hired as the manager of Gibraltar Coffee Shop. Gibraltar Coffee Shop is a national chain of franchised coffee shops. During her first month as store manager, Faith encountered the following internal control situations: a. F

> The following data were accumulated for use in reconciling the bank account of Creative Design Co. for August 20Y6: 1. Cash balance according to the company’s records at August 31, $42,920. 2. Cash balance according to the bank statemen

> The following units of a particular item were available for sale during the calendar year: The firm uses the weighted average cost method with a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after

> The following units of a particular item were available for sale during the calendar year: The firm uses the weighted average cost method with a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after

> Beginning inventory, purchases, and sales data for DVD players are as follows: The business maintains a perpetual inventory system, costing by the first-in, first-out method. a. Determine the cost of goods sold for each sale and the inventory balance a

> The inventory was destroyed by fire on December 31. The following data were obtained from the accounting records: a. Estimate the cost of the inventory destroyed. b. Briefly describe the situations in which the gross profit method is useful. Jan. 1

> Fonda Motorcycle Shop sells motorcycles, ATVs, and other related supplies and accessories. During the taking of its physical inventory on December 31, 20Y1, Fonda incorrectly counted its inventory as $452,500 instead of the correct amount of $425,500. a.

> IZ Corporation purchased land for $500,000. Later in the year, the company sold a different piece of land with a book value of $250,000 for $280,000. How are the effects of these transactions reported on the statement of cash flows?

> Madison River Supply Co. sells canoes, kayaks, whitewater rafts, and other boating supplies. During the taking of its physical inventory on December 31, 20Y8, Madison incorrectly counted its inventory as $545,000 instead of the correct amount of $555,400

> The units of an item available for sale during the year were as follows: There are 208 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the ending inventory cost and the cost of goods sold by

> The units of an item available for sale during the year were as follows: There are 1,500 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost by the (a) first-in, first-out meth

> Assume that the business in Exercise 6-9 maintains a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale, assuming the last-in, first-out method. Present the data in the form illustrated in

> Journalize the entries for the following transactions: a. Sold merchandise for cash, $25,000. The cost of the goods sold was $17,500. b. Sold merchandise on account, $98,000. The cost of the goods sold was $58,800. c. Sold merchandise to customers who us

> Journalize entries for the following related transactions of Lilly Heating & Air Company: a. Purchased $36,000 of merchandise from Schell Co. on account, terms 1/10, n/30. b. Paid the amount owed on the invoice within the discount period. c. Discovered t

> Stylon Co., a women’s clothing store, purchased $48,000 of merchandise from a supplier on account, terms FOB destination, 2/10, n/30. Stylon returned merchandise with an invoice amount of $7,500, receiving a credit memo. Journalize Stylon’s entries to re

> The debits and credits from four related transactions, (1) through (4), are presented in the following T accounts. Assume that the freight terms were FOB shipping point and that the credit terms were 1/10, n/30. a. Describe each transaction. b. Determi

> United Rug Company is a small rug retailer owned and operated by Pat Kirwan. After the accounts have been adjusted on December 31, the following selected account balances were taken from the ledger: Advertising Expense . . . . . . . . . . . . . . . . .

> The following account balances were taken from the adjusted trial balance for Urgent Messenger Service, a delivery service firm, for the fiscal year ended November 30, 20Y1: Prepare an income statement. Depreciation Expense $ 12,200 Rent Expense $

> Identify the errors in the following schedule of the cost of goods sold for the year ended May 31, 20Y5: Cost of goods sold: Inventory, May 31, 20Y5 . Cost of merchandise purchased: $ 105,000 ..... .... Purchases ..... $ 1,110,000 Purchases returns

> Monet Paints Co. is a newly organized retail business with a list of accounts arranged in alphabetical order, as follows: Accounts Payable Accounts Receivable Accumulated Depreciation—Office Equipment Accumulated Depreciationâ

> Summary operating data for Custom Wire & Tubing Company during the year ended April 30, 20Y2, are as follows: cost of goods sold, $6,100,000; administrative expenses, $740,000; interest expense, $25,000; rent revenue, $60,000; sales, $9,332,500; and sell

> The following data were extracted from the accounting records of Harkins Company for the year ended April 30, 20Y8: Estimated returns of current year sales …………………………………………… $ 11,600 Inventory, May 1, 20Y7 …………………………………………………………………… 380,000 Inventory, A

> The following income statement for Curbstone Company was prepared for the year ended August 31, 20Y5: a. Identify the errors in the income statement. b. Prepare a corrected income statement. Curbstone Company Income Statement For the Year Ended Aug

> Statz Company had sales of $1,800,000 and related cost of goods sold of $1,150,000 for its first year of operations ending December 31, 20Y1. Statz provides customers a refund for any returned or damaged merchandise. At the end of 20Y1, Statz Company est

> Determine the amount to be paid in full settlement of each of the following invoices, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period: Merchandise Invoice Amoun

> The following were selected from among the transactions completed by Strong Retail Group during August of the current year: a. Journalize the August transactions using the gross method of recording sales discounts. b. Journalize the August transactions u

> The debits and credits for five related transactions, (1) through (5), are presented in the following T accounts. Assume the credit terms were 2/10, n/30. a. Describe each transaction. b. What was the invoice amount of the merchandise that was returned

> The following data were extracted from the accounting records of Sacajawea Mercantile Co. for the year ended June 30, 20Y4: a. Journalize the June 30, 20Y4, adjusting entry for estimated sales discounts. b. How would sales and accounts receivable be re

> Staley Inc. reported the following data: Net income ……………………………………………………….……………. $396,200 Depreciation expense …………………………………………………………… 61,250 Loss on disposal of equipment ……………………………………………… 27,600 Increase in accounts receivable ……………………………………………… 9,00

> The following were selected from among the transactions completed by Essex Company during March of the current year: Journalize the March transactions using the gross method of recording sales discounts. Mar. 2. Sold merchandise on account to Parsl

> Schofield Co. sold merchandise on account to Bernard Retail Inc. for $15,000, terms 2/10, n/30. The cost of the merchandise sold was $8,000. Assuming Schofield Co. uses the gross method of recording sales discounts, journalize the entries to record (a) t

> On December 28, 20Y3, Silverman Enterprises sold $18,500 of merchandise to Beasley Co. with terms 2/10, n/30. The cost of the goods sold was $11,200. On December 31, 20Y3, Silverman prepared its adjusting entries, yearly financial statements, and closing

> Based on the data presented in Exercise 5-27, journalize the closing entries. Exercise 5-27: On March 31, 20Y9, the balances of the accounts appearing in the ledger of Royal Furnishings Company, a furniture store, are as follows: $ 170,000 Invento

> Based on the data in Exercise 4-22, prepare the closing entries for Alert Security Services Co. Exercise 4-22: Alert Security Services Co. offers security services to business clients. Complete the following end-of-period spreadsheet for Alert Security

> Based on the data in Exercise 4-21, prepare the adjusting entries for Alert Security Services Co. Exercise 4-21: Alert Security Services Co. offers security services to business clients. The trial balance for Alert Security Services has been prepared o

> On the basis of the following data, (a) journalize the adjusting entries at June 30, the end of the current fiscal year, and (b) journalize the reversing entries on July 1, the first day of the following year: 1. Wages are uniformly $66,000 for a five-da

> On the basis of the following data, (a) journalize the adjusting entries at December 31, the end of the current fiscal year, and (b) journalize the reversing entries on January 1, the first day of the following year: 1. Sales salaries are uniformly $11,7

> The unadjusted and adjusted trial balances for American Leaf Company on October 31, 20Y2, follow: Journalize the five entries that adjusted the accounts at October 31, 20Y2. None of the accounts were affected by more than one adjusting entry. Ameri

> If the net income for the current year had been $196,400 in Exercise 3-23, what would have been the correct net income if the proper adjusting entries had been made? Exercise 3-23: The accountant for Healthy Life Company, a medical services consulting

> For a recent year, the balance sheet for The Campbell Soup Company (CPB) includes accrued expenses of $604 million. The income before taxes for Campbell for the year was $849 million. a. Assume the adjusting entry for $604 million of accrued expenses was

> For a recent period, the balance sheet for Costco Wholesale Corporation (COST) reported accrued expenses of $3,498 million. For the same period, Costco reported income before income taxes of $3,619 million. Assume that the adjusting entry for $3,498 mill

> J. C. Penney Company, Inc. (JCP) and Macy’s, Inc. (M) are large department store chains in the United States. Information from recent annual reports for both companies is as follows (in millions): a. Determine the daysâ€

> When preparing the financial statements for the month ended January 31, accrued salaries owed to employees for January 30 and 31 were overlooked. The accrued salaries were included in the first salary payment in February. Indicate which items will be err

> The adjusting entry for accrued wages was omitted at July 31, the end of the current year. Indicate which items will be in error, because of the omission, on (a) the income statement for the current year and (b) the balance sheet as of July 31. Also indi

> We-Sell Realty was organized as a corporation on August 1, 20Y7, by the issuance of common stock of $15,000. We-Sell Realty is owned and operated by Omar Farah, the sole stockholder. The following statements for We-Sell Realty were prepared after its fir

> Huluduey Corporation’s comparative balance sheet for current assets and liabilities was as follows: Adjust net income of $75,800 for changes in operating assets and liabilities to arrive at net cash flow from operating activities.

> At March 31, the end of the first month of operations, the usual adjusting entry transferring prepaid insurance expired to an expense account is omitted. Which items will be incorrectly stated, because of the error, on (a) the income statement for March

> The supplies and supplies expense accounts at December 31, after adjusting entries have been posted at the end of the first year of operations, are shown in the following T accounts: Determine the amount of supplies purchased during the year. Suppl

> The Kroger Company (KR), a grocery store chain, recently had a price-earnings ratio of 13.7, while the average price-earnings ratio in the grocery store industry was 22.5. What might explain this difference?

> Is it necessary for a business to use the same method of computing depreciation (a) for all classes of its depreciable assets and (b) for financial statement purposes and in determining income taxes?

> Using the following data, how should the inventory be valued under lower of cost or market? Original cost ……………………………………………………………………… $1,350 Estimated selling price ………………………………………………………… 1,475 Selling expenses ……………………………………………………………………. 180

> Name three accounts that would normally appear in the chart of accounts of a retail business but would not appear in the chart of accounts of a service business.

> Checking accounts are one of the most common forms of deposits for banks. Assume that Surety Storage has a checking account at Ada Savings Bank. What type of account (asset, liability, stockholders’ equity, revenue, expense, dividends) does the account b

> The financial statements are interrelated. (a). What item of financial or operating data appears on both the income statement and the statement of stockholders’ equity? (b). What item appears on both the balance sheet and the statement of stockholders’

> Which step of the accounting cycle is optional?

> Does every adjusting entry have an effect on determining the amount of net income for a period? Explain.

> A summary of cash flows for Parker Consulting Group for the year ended January 31, 2014, follows: Cash receipts: Cash received from customers …………………………….. $1,200,000 Cash received from issuing common stock ………………… 90,000 Cash payments: Cash paid for op

> Who is responsible for freight when the terms of sale are (a) FOB shipping point, (b) FOB destination?

> The wages payable and wages expense accounts at August 31, after adjusting entries have been posted at the end of the first month of operations, are shown in the following T accounts: Determine the amount of wages paid during the month. Wages Payab

> During the month, Gates Labs Co. has a substantial number of transactions affecting each of the following accounts. State for each account whether it is likely to have (a) debit entries only, (b) credit entries only, or (c) both debit and credit entries.

> The following table summarizes the rules of debit and credit. For each of the items a through l, indicate whether the proper answer is a debit or a credit. Increase Decrease Normal Balance Balance sheet accounts: Asset (a) Credit (b) Liability Stock

> Classify the following items as (a) accrued revenue, (b) accrued expense, (c) unearned revenue, or (d) prepaid expense: 1. A two-year premium paid on insurance policy. 2. Fees earned but not yet received. 3. Fees received but not yet earned. 4. Salary ow

> Why is it important to periodically take a physical inventory when using a perpetual inventory system?