Question: Assume that you have been given the

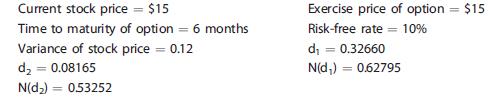

Assume that you have been given the following information on

Purcell Industries:

Using the Black-Scholes Option Pricing Model, what is the value of the option?

Transcribed Image Text:

Current stock price = $15 Exercise price of option = $15 Time to maturity of option = 6 months Variance of stock price = 0.12 Risk-free rate = 10% di 0.32660 %3D %D d, = 0.08165 N(d,) 0.62795 %3D N(d,) 053252 %3D

> Suppose a company simultaneously issues $50 million of convertible bonds with a coupon rate of 9% and $50 million of pure bonds with a coupon rate of 12%. Both bonds have the same maturity. Does the fact that the convertible issue has the lower coupon ra

> a. How would a firm’s decision to pay out a higher percentage of its earnings as dividends affect each of the following? (1) The value of its long-term warrants (2) The likelihood that its convertible bonds will be converted (3) The likelihood that its w

> What effect does the expected growth rate of a firm’s stock price (subsequent to issue) have on its ability to raise additional funds through (a) Convertibles and (b) Warrants?

> Suppose Congress changed the tax laws in a way that (1) Permitted equipment to be depreciated over a shorter period, (2) Lowered corporate tax rates, and (3) Reinstated the investment tax credit. Discuss how each of these changes would affect the rela

> Suppose there were no IRS restrictions on what constitutes a valid lease. Explain in a manner that a legislator might understand why some restrictions should be imposed.

> Pogue Industries Inc. has warrants outstanding that permit its holders to purchase 1 share of stock per warrant at a price of $21. (Refer to Chapter 18 for Parts a, b, and c.) a. Calculate the exercise value of Pogue’s warrants if the common stock sells

> Morris-Meyer Mining Company must install $1.5 million of new machinery in its Nevada mine. It can obtain a bank loan for 100% of the required amount. Alternatively, a Nevada investment banking firm that represents a group of investors believes that it ca

> Two textile companies, McDaniel-Edwards Manufacturing and Jordan-Hocking Mills, began operations with identical balance sheets. A year later both required additional manufacturing capacity at a cost of $200,000. McDaniel-Edwards obtained a 5-year, $200,0

> Look back at Table 7-4 and examine United Parcel Service and Telecom Italia Capital bonds that mature in 2013. a. If these companies were to sell new $1,000 par value long-term bonds, approximately what coupon interest rate would they have to set if they

> Gregg Company recently issued two types of bonds. The first issue consisted of 20-year straight (no warrants attached) bonds with an 8% annual coupon. The second issue consisted of 20-year bonds with a 6% annual coupon with warrants attached. Both bonds

> Elliott Athletics is trying to determine its optimal capital structure, which now consists of only debt and common equity. The firm does not currently use preferred stock in its capital structure, and it does not plan to do so in the future. Its treasury

> Connors Construction needs a piece of equipment that can be leased or purchased. The equipment costs $100. One option is to borrow $100 from the local bank and use the money to buy the equipment. The other option is to lease the equipment. If Connors cho

> O’Brien Computers Inc. needs to raise $35 million to begin producing a new microcomputer. O’Brien’s straight, nonconvertible debentures currently yield 12%. Its stock sells for $38 per share, the last dividend was $2.46, and the expected growth rate is a

> The Howe Computer Company has grown rapidly during the past 5 years. Recently, its commercial bank urged the company to consider increasing its permanent financing. Its bank loan under a line of credit has risen to $150,000, carrying a 10% interest rate,

> As part of its overall plant modernization and cost reduction program, the management of Tanner-Woods Textile Mills has decided to install a new automated weaving loom. In the capital budgeting analysis of this equipment, the IRR of the project was found

> In the summer of 2008, the Hadaway Company was planning to finance an expansion with a convertible security. They considered a convertible debenture but feared the burden of fixed interest charges if the common stock did not rise enough to make conversio

> Martha Millon, financial manager of Fish & Chips Inc., is facing a dilemma. The firm was founded 5 years ago to develop a new fast-food concept; and although Fish & Chips has done well, the firm’s founder and chairman believes that an industry shake-out

> Martha Millon, financial manager for Fish & Chips Inc., has been asked to perform a lease versus- buy analysis on a new computer system. The computer costs $1,200,000; and if it is purchased, Fish & Chips could obtain a term loan for the full amount at a

> Storm Software wants to issue $100 million in new capital to fund new opportunities. If Storm raised the $100 million of new capital in a straight-debt 20-year bond offering, Storm would have to offer an annual coupon rate of 12%. However, Storm’s advise

> Use the spreadsheet model to rework Parts a and b of Problem 20-8. Then answer the following question. c. Accepting that the corporate WACC should be used equally to discount all anticipated cash flows, at what cost of capital would the firm be indiffere

> Last year Joan purchased a $1,000 face value corporate bond with an 11% annual coupon rate and a 10-year maturity. At the time of the purchase, it had an expected yield to maturity of 9.79%. If Joan sold the bond today for $1,060.49, what rate of return

> Would a failure to recognize growth options tend to cause a firm’s actual capital budget to be above or below the optimal level? Would your answer be the same for abandonment, timing, and flexibility options? Explain.

> Should firms require higher rates of return on foreign projects than on identical projects located at home? Explain.

> What is a Eurodollar? If a French citizen deposits $10,000 in Chase Manhattan Bank in New York, have Eurodollars been created? What if the deposit is made in Barclay’s Bank in London? Chase Manhattan’s Paris branch? Does the existence of the Eurodollar m

> Why might purchasing power parity fail to hold?

> Does interest rate parity imply that interest rates are the same in all countries?

> Six-month T-bills have a nominal rate of 7%, while default-free Japanese bonds that mature in 6 months have a nominal rate of 5.5%. In the spot exchange market, 1 yen equals $0.009. If interest rate parity holds, what is the 6–month forward exchange rate

> A currency trader observes that in the spot exchange market, 1 U.S. dollar can be exchanged for 3.50 Israeli shekels or for 104.00 Japanese yen. What is the cross exchange rate between the yen and the shekel; that is, how many yen would you receive for e

> Solitaire Machinery is a Swiss multinational manufacturing company. Currently, Solitaire’s financial planners are considering undertaking a 1-year project in the United States. The project’s expected dollar-denominated cash flows consist of an initial in

> After all foreign and U.S. taxes, a U.S. corporation expects to receive 3 pounds of dividends per share from a British subsidiary this year. The exchange rate at the end of the year is expected to be $2 per pound, and the pound is expected to depreciate

> You are the vice president of International InfoXchange, headquartered in Chicago, Illinois. All shareholders of the firm live in the United States. Earlier this month you obtained a loan of 5 million Canadian dollars from a bank in Toronto to finance th

> Chamberlain Canadian Imports has agreed to purchase 15,000 cases of Canadian beer for 4 million Canadian dollars at today’s spot rate. The firm’s financial manager, James Churchill, has noted the following current spot

> Explain in general terms what each of the following real options is and how it could change projects’ NPVs and their corresponding risk relative to what would have been estimated if the options had not been considered. a. abandonment b. timing c. growth

> You are considering a 10-year, $1,000 par value bond. Its coupon rate is 9%, and interest is paid semiannually. If you require an “effective” annual interest rate (not a nominal rate) of 8.16%, how much should you be willing to pay for the bond?

> Assume that interest rate parity holds and that 90-day risk-free securities yield 5% in the United States and 5.3% in Britain. In the spot market, 1 pound ¼ $2. a. Is the 90-day forward rate trading at a premium or a discount relative to the spot rate? b

> Assume that interest rate parity holds. In both the spot market and the 90-day forward market, 1 Japanese yen = 0.0086 dollar. And 90-day risk-free securities yield 4.6% in Japan. What is the yield on 90-day risk-free securities in the United States?

> Use the foreign exchange section of a current issue of The Wall Street Journal to look up the three currencies in Problem 19-8. What is the current exchange rate between Swedish kronas and pounds? Data from Problem 19-8 Suppose the exchange rate between

> Use the foreign exchange section of a current issue of The Wall Street Journal to look up the six currencies in Problem 19-5. a. What is the current exchange rate for changing dollars into 1,000 units of pounds, Canadian dollars, euros, yen, Mexican peso

> Table 19-1 lists foreign exchange rates for May 26, 2008. On that day, how many dollars would be required to purchase 1,000 units of each of the following: British pounds, Canadian dollars, EMU euros, Japanese yen, Mexican pesos, and Swedish kronas? Tabl

> Citrus Products Inc. is a medium-sized producer of citrus juice drinks with groves in Indian River County, Florida. Until now, the company has confined its operations and sales to the United States; but its CEO, George Gaynor, wants to expand into the Pa

> Yohe Telecommunications is a multinational corporation that produces and distributes telecommunications technology. Although its corporate headquarters are located in Maitland, Florida, Yohe usually buys its raw materials in several different foreign cou

> Discuss some of the techniques available to reduce risk exposure.

> Why do options typically sell at prices higher than their exercise values?

> What is a post-audit, why do firms use them, and what problems can arise when they are used?

> List seven reasons risk management might increase the value of a firm.

> Bond X is non callable and has 20 years to maturity, a 9% annual coupon, and a $1,000 par value. Your required return on Bond X is 10%; and if you buy it, you plan to hold it for 5 years. You (and the market) have expectations that in 5 years, the yield

> Give two reasons stockholders might be indifferent between owning the stock of a firm with volatile cash flows and the stock of a firm with stable cash flows.

> How can swaps be used to reduce the risks associated with debt contracts?

> Explain how the futures markets can be used to reduce interest rate and input price risk.

> Which of the following events are likely to increase the market value of a call option on a common stock? Explain. a. An increase in the stock’s price b. An increase in the volatility of the stock price c. An increase in the risk-free rate d. A decrease

> Stewart Enterprises’ current stock price is $60 per share. Call options for this stock exist that permit the holder to purchase one share at an exercise price of $50. These options will expire at the end of 1 year, at which time Stewart’s stock will be s

> Audrey is considering an investment in Morgan Communications, whose stock currently sells for $60. A put option on Morgan’s stock, with an exercise price of $55, has a market value of $3.06. Meanwhile, a call option on the stock with the same exercise pr

> The Zinn Company plans to issue $20,000,000 of 10-year bonds in December to help finance a new research and development laboratory. It is now August, and the current cost of debt to the high-risk biotech company is 11%. However, the firmâ€

> How might a firm’s corporate WACC be affected by the size of its capital budget?

> 21st Century Educational Products (21st Century) is a rapidly growing software company; and consistent with its growth, it has a relatively large capital budget. While most of the company’s projects are fairly easy to evaluate, a handfu

> Bankers’ Services Inc. (BSI) is considering a project that has a cost of $10 million and an expected life of 3 years. There is a 30% probability of good conditions, in which case the project will provide a cash flow of $9 million at the end of each year

> What are some differences in the analysis for a replacement project versus that for a new expansion project?

> Most firms generate cash inflows every day, not just once at the end of the year. In capital budgeting, should we recognize this fact by estimating daily project cash flows and then using them in the analysis? If we do not, are our results biased? If so,

> Suppose you believe that the economy is just entering a recession. Your firm must raise capital immediately, and debt will be used. Should you borrow on a long-term or a short term basis? Why?

> Explain why working capital is included in a capital budgeting analysis and how it is recovered at the end of a project’s life.

> Explain why sunk costs should not be included in a capital budgeting analysis but opportunity costs and externalities should be included. Give an example of each.

> What is a “replacement chain?” When and how should replacement chains be used in capital budgeting?

> If you were the CFO of a company that had to decide on hundreds of potential projects every year, would you want to use sensitivity analysis and scenario analysis as described in the chapter or would the amount of arithmetic required take too much time a

> Define (a) Sensitivity analysis, (b) Scenario analysis, and (c) Simulation analysis. If GE was considering two projects (one for $500 million to develop a satellite communications system and the other for a $30,000 new truck) on which project would th

> In theory, market risk should be the only “relevant” risk. However, companies focus as much on stand-alone risk as on market risk. What are the reasons for the focus on stand-alone risk?

> Distinguish among beta (or market) risk, within-firm (or corporate) risk, and stand-alone risk for a project being considered for inclusion in a firm’s capital budget.

> The Butler-Perkins Company (BPC) must decide between two mutually exclusive projects. Each costs $6,750 and has an expected life of 3 years. Annual project cash flows begin 1 year after the initial investment and are subject to the following probability

> Mississippi River Shipyards is considering replacing an 8-year-old riveting machine with a new one that will increase earnings before depreciation from $27,000 to $54,000 per year. The new machine will cost $82,500, and it will have an estimated life of

> The Dauten Toy Corporation uses an injection molding machine that was purchased 2 years ago. This machine is being depreciated on a straight-line basis, and it has 6 years of remaining life. Its current book value is $2,100, and it can be sold for $2,500

> In late 1980, the U.S. Commerce Department released new data showing inflation was 15%. At the time, the prime rate of interest was 21%, a record high. However, many investors expected the new Reagan administration to be more effective in controlling inf

> You must evaluate a proposal to buy a new milling machine. The base price is $108,000, and shipping and installation costs would add another $12,500. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $65,000. The appli

> You must evaluate a proposed spectrometer for the R&D Department. The base price is $140,000, and it would cost another $30,000 to modify the equipment for special use by the firm. The equipment falls into the MACRS 3-year class and would be sold after 3

> Kristin is evaluating a capital budgeting project that should last 4 years. The project requires $800,000 of equipment. She is unsure what depreciation method to use in her analysis, straight-line or the 3-year MACRS accelerated method. Under straight-li

> Corcoran Consulting is deciding which of two computer systems to purchase. It can purchase state-of-the-art equipment (System A) for $20,000, which will generate cash flows of $6,000 at the end of each of the next 6 years. Alternatively, the company can

> The Chang Company is considering the purchase of a new machine to replace an obsolete one. The machine being used for the operation has a book value and a market value of zero. However, the machine is in good working order and will last at least another

> Eisenhower Communications is trying to estimate the first-year net cash flow (at Year 1) for a proposed project. The financial staff has collected the following information on the project: The company has a 40% tax rate, and its WACC is 10%. a. What is

> Truman Industries is considering an expansion. The necessary equipment would be purchased for $9 million, and the expansion would require an additional $3 million investment in working capital. The tax rate is 40%. a. What is the initial investment outla

> The Bigbee Bottling Company is contemplating the replacement of one of its bottling machines with a newer and more efficient one. The old machine has a book value of $600,000 and a remaining useful life of 5 years. The firm does not expect to realize any

> The Erley Equipment Company purchased a machine 5 years ago at a cost of $90,000. The machine had an expected life of 10 years at the time of purchase, and it is being depreciated by the straight-line method by $9,000 per year. If the machine is not repl

> Holmes Manufacturing is considering a new machine that costs $250,000 and would reduce pretax manufacturing costs by $90,000 annually. Holmes would use the 3-year MACRS method to depreciate the machine, and management thinks the machine would have a valu

> Suppose the inflation rate is expected to be 7% next year, 5% the following year, and 3% thereafter. Assume that the real risk-free rate, r*, will remain at 2% and that maturity risk premiums on Treasury securities rise from zero on very short-term bonds

> Your firm, Agrico Products, is considering a tractor that would have a net cost of $36,000, would increase pretax operating cash flows before taking account of depreciation by $12,000 per year, and would be depreciated on a straight-line basis to zero ov

> A firm has two mutually exclusive investment projects to evaluate; both can be repeated indefinitely. The projects have the following cash flows: Projects X and Y are equally risky and may be repeated indefinitely. If the firm’s WACC i

> The Fernandez Company has an opportunity to invest in one of two mutually exclusive machines that will produce a product the company will need for the next 8 years. Machine A costs $10 million but will provide after-tax inflows of $4 million per year for

> Zappe Airlines is considering two alternative planes. Plane A has an expected life of 5 years, will cost $100 million, and will produce after-tax cash flows of $30 million per year. Plane B has a life of 10 years, will cost $132 million, and will produce

> Cotner Clothes Inc. is considering the replacement of its old, fully depreciated knitting machine. Two new models are available: (a) Machine 190-3, which has a cost of $190,000, a 3-year expected life, and after-tax cash flows (labor savings and depreci

> Haley’s Graphic Designs Inc. is considering two mutually exclusive projects. Both projects require an initial investment of $10,000 and are typical average-risk projects for the firm. Project A has an expected life of 2 years with after-tax cash inflows

> Allied Food Products is considering expanding into the fruit juice business with a new fresh lemon juice product. Assume that you were recently hired as assistant to the director of capital budgeting and you must evaluate the new project. The lemon juic

> You must analyze a potential new product—a caulking compound that Cory Materials’ R&D people developed for use in the residential construction industry. Cory’s marketing manager thinks the company can sell 115,000 tubes per year for 3 years at a price of

> What is a mutually exclusive project? How should managers rank mutually exclusive projects?

> What are three potential flaws with the regular payback method? Does the discounted payback method correct all three flaws? Explain.

> A 5-year Treasury bond has a 5.2% yield. A 10-year Treasury bond yields 6.4%, and a 10-year corporate bond yields 8.4%. The market expects that inflation will average 2.5% over the next 10 years (IP10 ¼ 2.5%). Assume that there is no maturity risk premiu

> How are project classifications used in the capital budgeting process?

> A firm has a $100 million capital budget. It is considering two projects, each costing $100 million. Project A has an IRR of 20%; has an NPV of $9 million; and will be terminated after 1 year at a profit of $20 million, resulting in an immediate increase

> What reinvestment rate assumptions are built into the NPV, IRR, and MIRR methods? Give an explanation (other than “because the text says so”) for your answer.

> Project X is very risky and has an NPV of $3 million. Project Y is very safe and has an NPV of $2.5 million. They are mutually exclusive, and project risk has been properly considered in the NPV analyses. Which project should be chosen? Explain.

> Why might it be rational for a small firm that does not have access to the capital markets to use the payback method rather than the NPV method?

> Discuss the following statement: If a firm has only independent projects, a constant WACC, and projects with normal cash flows, the NPV and IRR methods will always lead to identical capital budgeting decisions. What does this imply about the choice betwe

> If two mutually exclusive projects were being compared, would a high cost of capital favor the longer-term or the shorter-term project? Why? If the cost of capital declined, would that lead firms to invest more in longer-term projects or shorter-term pro

> An electric utility is considering a new power plant in northern Arizona. Power from the plant would be sold in the Phoenix area, where it is badly needed. Because the firm has received a permit, the plant would be legal; but it would cause some air poll