Question: At the end of its first year,

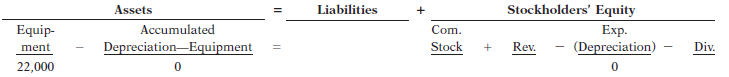

At the end of its first year, a tabular summary of transactions for Rayburn Company before adjustments include the following selected account information.

Depreciation for the year is estimated to be $2,750. Record the adjustment for depreciation in the tabular summary and indicate the adjusted balance in each account.

Transcribed Image Text:

Assets Liabilities Stockholders' Equity Exp. (Depreciation) Equip- Accumulated Com. ment Depreciation-Equipment Stock Rev. Div. 22,000

> At one time, Boeing closed a giant deal to acquire another manufacturer, Mc-Donnell Douglas. Boeing paid for the acquisition by issuing shares of its own stock to the stockholders of McDonnell Douglas. In order for the deal not to be revoked, the value o

> B. P. Palmer is the chief executive officer of Future Products. Palmer is an expert engineer but a novice in accounting. Instructions Write a letter to B. P. Palmer that explains (a) the three main types of ratios; (b) examples of each, how they are c

> Assume that Kohl’s Department Stores installed new cash registers in its stores. How do cash registers improve internal control over cash receipts?

> As a financial analyst in the planning department for Erin Industries, Inc., you must develop ratios from the comparative financial statements. This information is to be used to convince creditors that, despite a slight decline in sales, Erin Industries,

> The July 6, 2011, edition of the Wall Street Journal Online includes an article by Michael Rapoport entitled “U.S. Firms Clash Over Accounting Rules.” The article discusses why some U.S. companies favored adoption of International Financial Reporting Sta

> Suppose the following information was reported by Gap, Inc. (a) Determine the overall percentage decrease in Gap’s total assets from 2013 to 2017. What was the average decrease per year? (b) Comment on the change in Gapâ€&#

> The financial statements of Columbia Sportswear Company are presented in Appendix B. Financial statements of VF Corporation are presented in Appendix C. Instructions (a) For each company, calculate the following values for 2014. (1) Working capital. (3

> The financial statements of Apple Inc. are presented in Appendix A at the end of this textbook. Instructions Answer the following questions using the financial statements and the notes to the financial statements. (a) What were Apple’s total current ass

> Although Clif Bar & Company is not a public company, it does share its financial information with its employees as part of its open-book management approach. Further, although it does not publicly share its financial information, it does provide a differ

> Some people are tempted to make their finances look worse to get financial aid. Companies sometimes also manage their financial numbers in order to accomplish certain goals. Earnings management is the planned timing of revenues, expenses, gains, and loss

> Rules governing the investment practices of individual certified public accountants prohibit them from investing in the stock of a company that their firm audits. The Securities and Exchange Commission (SEC) became concerned that some accountants were vi

> Marci Ling is the bookkeeper for Samco Company, Inc. Marci has been trying to get the company’s balance sheet to balance. She finally got it to balance, but she still isn’t sure that it is correct. Instructions Expl

> Sylvia Ayala recently accepted a job in the production department at Apple. Before she starts work, she decides to review the company’s annual report to better understand its operations. The content and organization of corporate annual reports have becom

> As the company accountant, explain the following ideas to the management of Ortiz Company. (a) The concept of reasonable assurance in internal control. (b) The importance of the human factor in internal control.

> The June 22, 2011, issue of the Wall Street Journal Online includes an article by Michael Rapoport entitled “Auditors Urged to Tell More.” It provides an interesting discussion of the possible expanding role of CPAs. Instructions Read the article and an

> Purpose: Identify summary information about companies. This information includes basic descriptions of the company’s location, activities, industry, financial health, and financial performance. Address: http://biz.yahoo.com/i Steps 1. Type in a company n

> Xerox was not having a particularly pleasant year. The company’s stock price had already fallen in the previous year from $60 per share to $30. Just when it seemed things couldn’t get worse, Xerox’s s

> Columbia Sportswear Company’s financial statements are presented in Appendix B. Financial statements of VF Corporation are presented in Appendix C. Instructions (a) Based on the information in these financial statements, determine the following for each

> The financial statements of Apple Inc. for 2014 are presented in Appendix A. Instructions Refer to Apple’s financial statements and answer the following questions. (a) What were Apple’s total assets at September 27, 2014? At September 28, 2013? (b) How

> At the end of 2016, Safer Co. has accounts receivable of $700,000 and an allowance for doubtful accounts of $25,000. On January 24, 2017, it is learned that the company’s receivable from Madonna Inc. is not collectible and therefore management authorizes

> Presented below are three receivables transactions. Indicate whether these receivables are reported as accounts receivable, notes receivable, or other receivables on a balance sheet. (a) Advanced $10,000 to an employee. (b) Received a promissory note of

> For each of the following cases, state whether the statement is true for LIFO or for FIFO. Assume that prices are rising. (a) Results in a higher quality of earnings ratio. (b) Results in higher phantom profits. (c) Results in higher net income. (d) Resu

> In its first month of operation, Hoffman Company purchased 100 units of inventory for $6, then 200 units for $7, and finally 140 units for $8. At the end of the month, 180 units remained. Compute the amount of phantom profit that would result if the comp

> The management of Milque Corp. is considering the effects of various inventory costing methods on its financial statements and its income tax expense. Assuming that the price the company pays for inventory is increasing, which method will: (a) provide th

> How are each of the following financial statements interrelated? (a) Retained earnings statement and income statement. (b) Retained earnings statement and balance sheet. (c) Balance sheet and statement of cash flows.

> Data for McLanie Company are presented in BE6-4. Compute the cost of the ending inventory under the average-cost method. (Round the cost per unit to three decimal places.) Reference Data BE6-4: In its first month of operations, McLanie Company made thre

> In its fi rst month of operations, McLanie Company made three purchases of merchandise in the following sequence: (1) 300 units at $6, (2) 400 units at $8, and (3) 500 units at $9. Assuming there are 200 units on hand at the end of the period, compute th

> Use a tabular summary to record the following transactions for Borst Company using a perpetual inventory system. (a) On March 2, Borst Company sold $800,000 of merchandise to McLeena Company on account. The cost of the merchandise sold was $540,000. (b)

> Rita Company buys merchandise on account from Linus Company for $590. Rita sells the goods to Ellis for $900 cash. Use a tabular summary to record the transactions for Rita Company using a perpetual inventory system.

> Presented here are the components in Salas Company’s income statement. Determine the missing amounts. Gross Profit Sales Cost of Оperating Net Revenue Goods Sold Expenses Income $ 71,200 $108,000 (a) (b) $70,000 $71,900 $ 30,000 (c

> Spahn Company has these cash balances: cash in bank $12,742, payroll bank account $6,000, and plant expansion fund cash $25,000. Explain how each balance should be reported on the balance sheet.

> Using the data in BE5-8, indicate (a) the items that will result in an adjustment to the depositor’s records and (b) why the other items do not require adjustment. Data from BE5-8: The following reconciling items are applicable to the bank reconciliat

> The following reconciling items are applicable to the bank reconciliation for Forde Co. Indicate how each item should be shown on a bank reconciliation. (a) Outstanding checks. (b) Bank debit memorandum for service charge. (c) Bank credit memorandum for

> Luke Roye is uncertain about the control features of a bank account. Explain the control benefits of (a) a checking account and (b) a bank statement.

> Tott Company has the following internal control procedures over cash disbursements. Identify the internal control principle that is applicable to each procedure. (a) Company checks are prenumbered. (b) The bank statement is reconciled monthly by an inter

> Bene Mart, a large national retail chain, is nearing its fiscal year-end. It appears that the company is not going to hit its revenue and net income targets. The company’s marketing manager, Ed Mellon, suggests running a promotion selling $50 gift cards

> While examining cash receipts information, the accounting department determined the following information: opening cash balance $150, cash on hand $1,125.74, and cash sales per register tape $988.62. Prepare a tabular analysis of the required adjustment

> Jolson Company has the following internal control procedures over cash receipts. Identify the internal control principle that is applicable to each procedure. (a) All over-the-counter receipts are entered in cash registers. (b) All cashiers are bonded. (

> The internal control procedures in Dayton Company result in the following provisions. Identify the principles of internal control that are being followed in each case. (a) Employees who have physical custody of assets do not have access to the accounting

> Pat Buhn is the new owner of Young Co. She has heard about internal control but is not clear about its importance for her business. Explain to Pat the four purposes of internal control, and give her one application of each purpose for Young Co.

> Match each situation with the fraud triangle factor (opportunity, financial pressure, or rationalization) that best describes it. (a) An employee’s monthly credit card payments are nearly 75% of her monthly earnings. (b) An employee earns minimum wage at

> The following selected accounts appear in the adjusted balances for Deane Company. Indicate the financial statement on which each account would be reported. (a) Accumulated Depreciation. (b) Depreciation Expense. (c) Retained Earnings (beginning). (d)

> Partial adjusted account balance data for Levin Corporation are presented in BE4-10. The balance in Retained Earnings is the balance as of January 1. Prepare a retained earnings statement for the year assuming net income is $10,400. Reference Data BE4-1

> The adjusted account balances of Levin Corporation at December 31, 2017, include the following accounts: Retained Earnings $17,200, Dividends $6,000, Service Revenue $32,000, Salaries and Wages Expense $14,000, Insurance Expense $1,800, Rent Expense $3,9

> Woods Company includes the following balance sheet accounts. Identify the accounts that might require adjustment. For each account that requires adjustment, indicate (1) the type of adjustment (prepaid expense, unearned revenue, accrued revenue, or accr

> The bookkeeper for Tran Company asks you to record the following accrual adjustments at December 31 in the tabular summary that follows. Use these account titles: Service Revenue, Accounts Receivable, Interest Expense, Interest Payable, Salaries and Wa

> Abe Technologies provides maintenance service for computers and office equipment for companies throughout the Northeast. The sales manager is elated because she closed a $300,000, 3-year maintenance contract on December 29, 2016, two days before the comp

> On July 1, 2017, Ling Co. pays $12,400 to Marsh Insurance Co. for a 2-year insurance contract. Both companies have fiscal years ending December 31. For Marsh Insurance Co., enter the July 1 transaction and the December 31 adjustment in the tabular summar

> On July 1, 2017, Ling Co. pays $12,400 to Marsh Insurance Co. for a 2-year insurance contract. Both companies have fiscal years ending December 31. For Ling Co., enter the July 1 transaction and the December 31 adjustment in the tabular summary that foll

> A tabular summary of transactions for Lahey Advertising Company before adjustments includes the following selected account information. On December 31, there is $1,100 of supplies on hand. Record the adjustment for supplies in the tabular summary and i

> Cortina Company accumulates the following adjustment data at December 31. Indicate (1) the type of adjustment (prepaid expense, accrued revenue, and so on) and (2) the status of the accounts before adjustment (for example, “assets understated and reven

> The records of Melmann Company include the following accounts. Explain why each account may require adjustment. (a) Prepaid Insurance. (c) Unearned Service Revenue. (b) Depreciation Expense. (d) Interest Payable.

> Transactions that affect earnings do not necessarily affect cash. Identify the effect, if any, that each of the following transactions would have upon cash and net income. The first transaction has been completed as an example. Purchased $100 of supplie

> During 2017, Rostock Company entered into the following transactions. 1. Purchased equipment for $286,176 cash. 2. Issued common stock to investors for $137,590 cash. 3. Purchased inventory of $68,480 on account. Using the following tabular analysis, sho

> During 2017, Manion Corp. entered into the following transactions. 1. Borrowed $60,000 by issuing a note. 2. Paid $9,000 cash dividend to stockholders. 3. Received $13,000 cash from a previously billed customer for services performed. 4. Purchased suppli

> Presented below are three transactions. Mark each transaction as affecting common stock (C), dividends (D), revenue (R), expense (E), or not affecting stockholders’ equity (NSE). ______ (a) Received cash for services performed. ______ (b) Paid cash to pu

> Are the following events recorded in the accounting records? Explain your answer in each case. (a) A major stockholder of the company dies. (b) Supplies are purchased on account. (c) An employee is fired. (d) The company pays a cash dividend to its stock

> Indicate the effect each account has on Retained Earnings. ______ (a) Advertising expense. ______ (b) Service revenue. ______ (c) Insurance expense. ______ (d) Salaries and wages expense. ______ (e) Dividends. ______ (f) Rent revenue. ______ (g) Utilitie

> Follow the same format as BE3-6 above. Determine the effect on assets, liabilities, and stockholders’ equity of the following three transactions. (a) Stockholders invested cash in the business for common stock. (b) Paid a cash dividend. (c) Received cash

> Presented below are three economic events. On a sheet of paper, list the letters (a), (b), and (c) with columns for assets, liabilities, and stockholders’ equity. In each column, indicate whether the event increased (+), decreased (−), or had no effect (

> The full disclosure principle dictates that: (a) financial statements should disclose all assets at their cost. (b) financial statements should disclose only those events that can be measured in dollars. (c) financial statements should disclose all event

> Here are some qualitative characteristics of useful accounting information: 1. Predictive value 3. Verifiable 2. Neutral 4. Timely Match each qualitative characteristic to one of the following statements. ______ (a) Accounting information should hel

> Given the characteristics of useful accounting information, complete each of the following statements. (a) For information to be _____, it should have predictive and confirmatory value. (b) _____ means that information accurately depicts what really happ

> The accompanying chart shows the qualitative characteristics of useful accounting information. Fill in the blanks. Enhancing Qualities Fundamental Usefulness Qualities Relevance (f) (a) (g) (b) (h) (c) Understandability Faithful Representation (d) N

> Indicate whether each statement is true or false. (a) GAAP is a set of rules and practices established by accounting standard-setting bodies to serve as a general guide for financial reporting purposes. (b) Substantial authoritative support for GAAP usua

> Ross Music Inc. reported the following selected information at March 31. 2017 Total current assets…………………………………..$262,787 Total assets………………………………………………..439,832 Total current liabilities………………………………..293,625 Total liabilities…………………………………………..376,002

> These selected condensed data are taken from a recent balance sheet of Bob Evans Farms (in millions of dollars). Cash………………………………………..$ 29.3 Accounts receivable……………………20.5 Inventory………………………………….28.7 Other current assets………………….24.0 Total current assets

> Can a business enter into a transaction that affects only the left side of the basic accounting equation? If so, give an example.

> The following information (in millions of dollars) is available for Limited Brands for a recent year: sales revenue $9,043, net income $220, preferred dividend $0, and weighted-average shares outstanding 333 million. Compute the earnings per share for Li

> A list of financial statement items for Chin Company includes the following: accounts receivable $14,000, prepaid insurance $2,600, cash $10,400, supplies $3,800, and debt investments (short-term) $8,200. Prepare the current assets section of the balance

> The following are the major balance sheet classifications: Current assets (CA) Current liabilities (CL) Long-term investments (LTI) Long-term liabilities (LTL) Property, plant, and equipment (PPE) Common stock (CS) Intangible assets (IA) Ret

> Which is not a required part of an annual report of a publicly traded company? (a) Statement of cash flows. (c) Management discussion and analysis. (b) Notes to the financial statements. (d) All of these are required.

> Indicate whether each of these items is an asset (A), a liability (L), or part of stockholders’ equity (SE). (a) Accounts receivable. (d) Supplies. (b) Salaries and wages payable. (e) Common stock. (c) Equipment. (f) Notes payable.

> At the beginning of the year, Morales Company had total assets of $800,000 and total liabilities of $500,000. (Treat each item independently.) (a) If total assets increased $150,000 during the year and total liabilities decreased $80,000, what is the amo

> Use the basic accounting equation to answer these questions. (a) The liabilities of Lantz Company are $90,000 and the stockholders’ equity is $230,000. What is the amount of Lantz Company’s total assets? (b) The total assets of Salley Company are $170,00

> Indicate which statement you would examine to find each of the following items: income statement (IS), balance sheet (BS), retained earnings statement (RES), or statement of cash flows (SCF). (a) Revenue during the period. (b) Supplies on hand at the end

> Eskimo Pie Corporation markets a broad range of frozen treats, including its famous Eskimo Pie ice cream bars. The following items were taken from a recent income statement and balance sheet. In each case, identify whether the item would appear on the ba

> In alphabetical order below are balance sheet items for Karol Company at December 31, 2017. Prepare a balance sheet following the format of Illustration 1-7 (page 13). Accounts payable…………………. $65,000 Accounts receivable…………………. 71,000 Cash…………………………………

> Holding all other factors constant, indicate whether each of the following signals generally good or bad news about a company. (a) Increase in earnings per share. (b) Increase in the current ratio. (c) Increase in the debt to assets ratio. (d) Decrease i

> Presented below are a number of transactions. Determine whether each transaction affects common stock (C), dividends (D), revenues (R), expenses (E), or does not affect stockholders’ equity (NSE). Provide titles for the revenues and expenses. (a) Costs i

> For each item below, indicate the type of business activity: operating (O), investing (I), or financing (F). (a) _____ Cash received from customers. (b) _____ Cash paid to stockholders (dividends). (c) _____ Cash received from issuing new common stock. (

> Match each of the following types of evaluation with one of the listed users of accounting information. 1. Trying to determine whether the company complied with tax laws. 2. Trying to determine whether the company can pay its obligations. 3. Trying to de

> Match each of the following forms of business organization with a set of characteristics: sole proprietorship (SP), partnership (P), corporation (C). (a) _____ Shared control, tax advantages, increased skills and resources. (b) _____ Simple to set up and

> (a) What are generally accepted accounting principles (GAAP)? (b) What body provides authoritative support for GAAP?

> Tom Dawes, the founder of Footwear Inc., needs to raise $500,000 to expand his company’s operations. He has been told that raising the money through debt will increase the riskiness of his company much more than issuing stock. He doesn’t understand why t

> Name ratios useful in assessing (a) liquidity, (b) solvency, and (c) profitability.

> (a) Geena Lowe believes that the analysis of financial statements is directed at two characteristics of a company: liquidity and profitability. Is Geena correct? Explain. (b) Are short-term creditors, long-term creditors, and stockholders primarily inter

> Identify the two parts of stockholders’ equity in a corporation and indicate the purpose of each.

> How do current liabilities differ from long-term liabilities?

> Which ratio or ratios from this chapter do you think should be of greatest interest to: (a) a pension fund considering investing in a corporation’s 20-year bonds? (b) a bank contemplating a short-term loan? (c) an investor in common stock?

> Define current assets. What basis is used for ordering individual items within the current assets section?

> The accounting equation is Assets = Liabilities + Stockholders’ Equity. Appendix A, at the end of this textbook, reproduces Apple’s financial statements. Replacing words in the equation with dollar amounts, what is Apple’s accounting equation at Septembe

> What types of information are presented in the notes to the financial statements?

> Why is it important for financial statements to receive an unqualified auditor’s opinion?

> What is the purpose of the management discussion and analysis section (MD&A)?

> What was Apple’s largest current asset, largest current liability, and largest item under “Assets” at September 27, 2014?

> Which of these items are liabilities of White Glove Cleaning Service? (a) Cash. (f) Equipment. (b) Accounts payable. (g) Salaries and wages payable. (c) Dividends. (h) Service revenue. (d) Accounts receivable. (i) Rent expense. (e) Supplies.

> (a) Define the terms assets, liabilities, and stockholders’ equity. (b) What items affect stockholders’ equity?

> What is the basic accounting equation?

> What is retained earnings? What items increase the balance in retained earnings? What items decrease the balance in retained earnings?