Question: At the end of May, the first

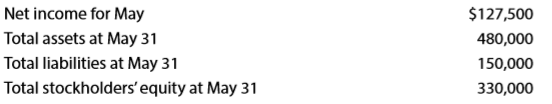

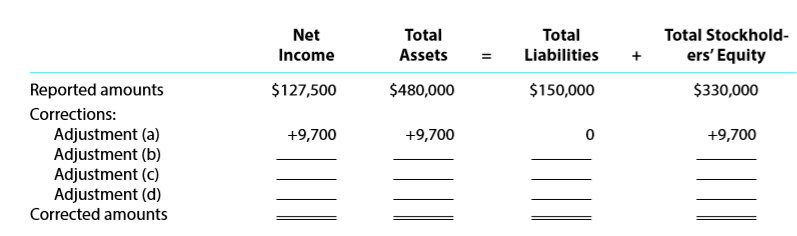

At the end of May, the ï¬rst month of operations, the following selected data were taken from the ï¬nancial statements of Julie Mortenson, Attorney at Law, P.C.:

In preparing the ï¬nancial statements, adjustments for the following data were overlooked:

a. Unbilled fees earned at May 31, $9,700

b. Depreciation of equipment for May, $8,000

c. Accrued wages at May 31, $1,150

d. Supplies used during May, $975

Instructions:

Determine the correct amount of net income for May and the total assets, liabilities, and stockholders’ equity at May 31. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the one shown below. Adjustment (a) is presented as an example.

Transcribed Image Text:

Net Income for May $127,500 Total assets at May 31 480,000 Total liabilities at May 31 150,000 Total stockholders'equity at May 31 330,000 Net Total Total Total Stockhold- Income Assets Liabilities ers' equity Reported amounts $127,500 $480,000 $150,000 $330,000 Corrections: Adjustment (a) Adjustment (b) Adjustment (c) Adjustment (d) Corrected amounts +9,700 +9,700 +9,700

> The adjustment for accrued fees of $13,400 was omitted at July 31, the end of the current year. Indicate which items will be in error because of the omission on (a) the income statement for the current year and (b) the balance sheet as of July 31. Also i

> The balance in the unearned fees account, before adjustment at the end of the year, is $900,000. Of these fees, $775,000 have been earned. In addition, $289,500 of fees have been earned but not billed to clients. What are the adjustments (a) to adjust t

> At the end of the current year, $47,700 of fees have been earned but not billed to clients. a. What is the adjustment to record the accrued fees? Indicate each account affected, whether the account is increased or decreased, and the amount of the increas

> If the net income for the current year had been $2,224,600 in Exercise 3-18, what would have been the correct net income if the proper adjustments had been made? Data from Exercise 3.18: The accountant for Healthy Medical Co., a medical services consult

> For a recent year, the balance sheet for The Campbell Soup Company (CPB) includes accrued expenses of $553 million. The income before taxes for the year was $1,073 million. a. Assume the accruals apply to the current year and were not recorded at the end

> Assume that the error in Exercise 3-15 was not corrected and that the $6,750 of accrued salaries was included in the first salary payment in January 20Y7. Indicate which items will be erroneously stated because of failure to correct the initial error on (

> Accrued salaries of $6,750 owed to employees for December 30 and 31 were not considered when preparing the financial statements for the year ended December 31, 20Y6. Indicate which items will be erroneously stated because of the error on (a) the income st

> The balances of the two accounts related to wages at October 31, after adjustments at the end of the first year of operations, are Wages Payable, $11,900, and Wages Expense, $825,000. Determine the amount of wages paid during the year.

> The Home Depot, Inc. (HD) operates over 2,200 home improvement retail stores and is a competitor of Lowe’s (LOW). The following data (in millions) were adapted from recent financial statements of The Home Depot. 1. Comp

> Laguna Realty Co. pays weekly salaries of $8,000 on Friday for a five-day week ending on that day. What is the adjustment at the end of the accounting period, assuming that the period ends (a) on Monday or (b) on Wednesday? Indicate each account affected,

> At the end of August, the first month of the business year, the usual adjustment transferring rent earned of $36,750 to a revenue account from the unearned rent account was omitted. Indicate which items will be incorrectly stated because of the error on (

> The total assets and total liabilities for a recent year of Best Buy (BBY) and Games top (GME) are shown below. Determine the stockholders’ equity of each company. Best Buy Gamestop (in millions) (in millions) Assets $15,256 $4,24

> For a recent year, Microsoft Corporation (MSFT) reported short-term unearned revenue of $23,223 million. For the same year, Microsoft also reported total revenues of $93,580 million. a. Assume that Microsoft recognized $2,000 million of unearned revenue

> The balance in the unearned fees account, before adjustment at the end of the year, is $1,375,000. What is the adjustment if the amount of unearned fees at the end of the year is $1,100,000? Indicate each account affected, whether the account is increase

> Crazy Mountain Sports sells hunting and fishing equipment and provides guided hunting and fishing trips. Crazy Mountain is owned and operated by Karl Young, a well-known sports enthusiast and hunter. Karl’s

> Critelli Company has provided the following comparative information: You have been asked to evaluate the historical performance of the company over the last five years. Selected industry ratios have remained relatively steady at the foll

> The comparative financial statements of Automotive Solutions Inc. are as follows. The market price of Automotive Solutions Inc. common stock was $119.70 on December 31, 20Y8. Instructions: Determine the following measures for 20Y8. Rou

> Data pertaining to the current position of Newlan Company are as follows: Instructions: 1. Compute (a) the working capital, (b) the current ratio, and (c) the quick ratio. 2. List the following captions on a sheet of paper: Compute the working capi

> For 20Y6, Fishing Experiences Inc. initiated a sales promotion campaign that included the expenditure of an additional $45,000 for advertising. At the end of the year, Colt Schultz, the president, is presented with the following condensed comparative inc

> For each of the following companies, indicate whether you think the ratio of liabilities to total assets is more than 50%. Also, indicate whether you think the price-earnings ratio is above 10. Debt Ratio Price-Earnings Ratio Above 10 (Yes, No) More

> For 20Y3, Greyhound Technology Company reported its most significant decline in net income in years. At the end of the year, Duane Vogel, the president, is presented with the following condensed comparative income statement: Instructions

> Yukon Bike Corp. manufactures mountain bikes and distributes them through retail outlets in Canada, Montana, Idaho, Oregon, and Washington. Yukon Bike Corp. declared the following annual dividends over a six-year period ending December 31 of each year: Y

> Vaga Optics produces medical lasers for use in hospitals. The following accounts and their balances appear in the ledger of Vaga Optics on December 31 of the current year: At the annual stockholders’ meeting on January 31,

> Beaufort Vaults Corporation produces and sells burial vaults. On July 1, 20Y3, Beaufort Vaults Corporation issued $25,000,000 of 10-year, 8% bonds at par. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the com

> The following information about the payroll for the week ended October 4 was obtained from the records of Simkins Mining Co.: Instructions: 1. For the October 4 payroll, determine the employee FICA tax payable. 2. Illustrate the effect on the accounts

> Three different plans for financing a $5,000,000 corporation are under consideration by its organizers. Under each of the following plans, the securities will be issued at their par or face amount, and the income tax rate is estimated at 4

> Data related to the acquisition of timber rights and intangible assets of Gemini Company during the current year ended December 31 are as follows: a. On December 31, Gemini Company determined that $3,000,000 of goodwill was impaired. b. Governmental and

> New tire retreading equipment, acquired at a cost of $140,000 at the beginning of a fiscal year, has an estimated useful life of four years and an estimated residual value of $10,000. The manager requested information regarding the effect

> Knife Edge Company purchased tool sharpening equipment on July 1, 20Y5, for $16,200. The equipment was expected to have a useful life of three years and a residual value of $900. Instructions: Determine the amount of depreciation expense for the years

> Bayside Coatings Company purchased water proofing equipment on January 2, 20Y4, for $190,000. The equipment was expected to have a useful life of four years and a residual value of $9,000. Instructions: Determine the amount of depreciatio

> Alphabet (formerly known as Google) (GOOG) is a technology company that offers users Internet search and e-mail services. Google also developed the Android operating system for use with cell phones and other mobile devices. The following data (in million

> The following payments and receipts are related to land, land improvements, and buildings acquired for use in a wholesale apparel business. The receipts are identified by an asterisk. Instructions: 1. Assign each payment and receipt to L

> Data on the physical inventory of Moyer Company as of December 31, 20Y9, are presented below. Quantity and cost data from the last purchases invoice of the year and the next-to the-last purchases invoice are summarized as follows: Instructions: Deter

> Details regarding the inventory of appliances on January 1, 20Y7, purchases invoices during the year, and the inventory count on December 31, 20Y7, of Amsterdam Appliances are summarized as follows: Instructions: 1. Determine the cost of the inventory

> Cyber Space Company, which operates a chain of 65 electronics supply stores, has just completed its fourth year of operations. The direct write-off method of recording bad debt expense has been used during the entire period. Because of substantial increa

> For several years, EquiPrime Co.’s sales have been on a “cash only” basis. On January 1, 20Y2, however, EquiPrime Co. began offering credit on terms of n/30. The amount of the adjusting entry to recor

> Averys All-Natural Company supplies wigs and hair care products to beauty salons throughout Texas and the Southwest. The accounts receivable clerk for Averys All- Natural prepared the following aging-of-receivables schedule as of the end of business on D

> Rancho Foods deposits all cash receipts each Wednesday and Friday in a night depository, after banking hours. The data required to reconcile the bank statement as of May 31 have been taken from various documents and records and are reproduced as follows.

> The cash account for All American Sports Co. on April 1, 20Y5, indicated a balance of $23,600. During April, the total cash deposited was $80,150, and checks written totaled $72,800. The bank statement indicated a balance of $40,360 on April 30, 20Y5. Co

> The cash account for Deaver Consulting at October 31, 20Y6, indicated a balance of $15,750. The bank statement indicated a balance of $31,095 on October 31, 20Y6. Comparing the bank statement and the accompanying canceled checks and memos with the record

> The following procedures were recently implemented by Wind Rivers Clothing Co.: a. Each cashier is assigned a separate cash register drawer to which no other cashier has access. b. All sales are rung up on the cash register, and a receipt is given to the

> Boston Scientific Corporation (BSX) is a competitor of Kips Bay Medical (MBA 5-3). It was organized in 1979 and also develops, produces, and sells medical devices. The following data (in thousands) were adapted from Boston Scientificâ

> For the year ending March 31, 20Y5, Omega Systems Inc. reported net income of $105,450 and paid dividends of $7,500. Comparative balance sheets as of March 31, 20Y5 and 20Y4, are as follows: Instructions: 1. Prepare a statement of cash flows, using the

> Selected accounts and related amounts for Prescott Inc. for the fiscal year ended September 30, 20Y8, are presented in Problem 4-4. Instructions: 1. Prepare a single-step income statement in the format shown in Exhibit 8. 2. Prepare a sta

> The following selected accounts and their current balances appear in the ledger of Prescott Inc. for the fiscal year ended September 30, 20Y8: Instructions: 1. Prepare a multiple-step income statement. 2. Prepare a statement of stockhold

> The following selected transactions were completed during June between Snipes Company and Beejoy Company June 8. Snipes Company sold merchandise on account to Beejoy Company, $18,250, terms FOB destination, 2/15, n/eom. The cost of the merchandise sold w

> The following selected transactions were completed by Affordable Supplies Co., which sells supplies primarily to wholesalers and occasionally to retail customers. Jan. 6. Sold merchandise on account, $14,000, terms FOB shipping point, n/eom. The cost of

> The following selected transactions were completed by Epic Co. during August of the current year: Aug. 3. Purchased merchandise on account for $33,400, terms FOB destination, 2/10, n/30. 9. Issued debit memorandum for $2,500 ($2,450 net of 2% discount) f

> Adjustment data for Ms. Ellen’s Laundry Inc. for the year ended December 31, 20Y8, are as follows: a. Wages accrued but not paid at December 31, $2,150 b. Depreciation of equipment during the year, $12,500 c. Laundry supplies on hand at

> Data for San Mateo Health Care for January are provided in Problems 3-1, 3-2, and 3-3. Instructions: 1. Prepare a statement of cash flows for January. 2. Reconcile the net cash flows from operating activities with the net income for January. Data fro

> Data for San Mateo Health Care for January are provided in Problems 3-1 and 3-2. Instructions: Prepare an income statement, statement of stockholders’ equity, and a classified balance sheet for January. The note payable is due in ten years. Data from P

> Kips Bay Medical Inc. is a medical device company that develops, produces, and sells products used in coronary surgery. The following data (in thousands) were adapted from recent financial statements. 1. Compute the monthly cash expenses

> Adjustment data for San Mateo Health Care Inc. for January are as follows: 1. Insurance expired, $900. 2. Supplies on hand on January 31, $1,200. 3. Depreciation on building, $2,300. 4. Unearned rent revenue earned, $3,000. 5. Wages owed employees but no

> San Mateo Health Care Inc. is owned and operated by Rachel Fields, the sole stockholder. During January 20Y6, San Mateo Health Care entered into the following transactions: Jan. 1 Received $27,000 from Hillard Company as rent for the use of a vacant of&i

> The financial statements at the end of Network Realty, Inc.’s first month of operations are shown below. By analyzing the interrelationships among the financial statements, fil

> Starwood Hotels & Resorts Worldwide Inc. (HOT) and Wyndham Worldwide Corporation (WYN) are two major owners and managers of lodging and resort properties in the United States. Financial data (in millions) for a recent year for the two companies are a

> Harley-Davidson, Inc. (HOG), is a leading motorcycle manufacturer in the United States. The company manufactures and sells a number of different types of motorcycles, a complete line of motorcycle parts, and brand-related accessories, clothing, and colle

> The condensed income statements through operating income for Apple Inc. and Best Buy Co. Inc. (BBY) are reproduced below for recent fiscal years (numbers in millions of dollars). Prepare comparative common-sized statements, rounding perc

> Thornby Inc. completed its fiscal year on December 31. The auditor, Kim Holmes, has approached the CFO, Brad Potter, regarding the year-end receivables and inventory levels of Thornby Inc. The following conversation takes place: Kim: We are beginning our

> Assume that the president of Elkhead Brewery made the following statement in the Annual Report to Shareholders: “The founding family and majority shareholders of the company do not believe in using debt to finance future growth. The founding family learn

> You hold a 30% common stock interest in the family-owned business, a vending machine company. Your sister, who is the manager, has proposed an expansion of plant facilities at an expected cost of $6,000,000. Two alternative plans have been suggested as m

> Padget Home Services began its operations on January 1, 20Y7 (see Problem 2-3). After its second year of operations, the following amounts were taken from the accounting records of Padget Home Services, Inc., as of December 31, 20Y8. Instructions: 1. P

> Living Smart Inc. has decided to expand its operations to owning and operating long-term health care facilities. The following is an excerpt from a conversation between the chief executive officer, Mark Vierra, and the vice president of finance, Jolin Kil

> Sahara Unlimited Inc. began operations on January 2, 20Y4, with the issuance of 250,000 shares of $8 par common stock. The sole stockholders of Sahara Unlimited Inc. are Karina Takemoto and Dr. Noah Grove, who organized Sahara Unlimited Inc. with the obj

> Altria Group, Inc., has a note dedicated to describing contingent liabilities in its recent financial statements. This note includes extensive descriptions of multiple contingent liabilities. Go to the Web site http://www.sec.gov/edgar/searchedgar/company

> Jas Carillo was discussing summer employment with Maria Perez, president of Valparaiso Construction Service: Maria: I’m glad that you’re thinking about joining us for the summer. We could certainly use the help. Jas: Sounds good. I enjoy outdoor work, an

> The following is an excerpt from a conversation between the chief executive officer, Kim Jenkins, and the chief financial officer, Steve Mueller, of Quatro Group Inc.: Kim: Steve, as you know, the auditors are coming in to audit our year-end financial stat

> Go to the Internet and review the procedures for applying for a patent, a copyright, and a trademark. One Internet site that is useful for this purpose is www .idresearch.com. Prepare a written summary of these procedures.

> You are planning to acquire an asset for use in your business. In groups of three or four, use the Internet to research some factors that should be considered in deciding whether to purchase or lease an asset. Summarize the considerations you have identi

> Einstein Construction Co. specializes in building replicas of historic houses. Bree Andrus, president of Einstein Construction, is considering the purchase of various items of equipment on July 1, 20Y2, for $300,000. The equipment would have a useful lif

> The following is an excerpt from a conversation between two employees of Linquest Technologies, Don Corbet and Rita Shevlin. Don is the accounts payable clerk, and Rita is the cashier. Don: Rita, could I get your opinion on something? Rita: Sure, Don. Do

> Rowel Baylon, CPA, is an assistant to the controller of Arches Consulting Co. In his spare time, Rowel also prepares tax returns and performs general accounting services for clients. Frequently, Rowel performs these services after his normal working hour

> The following amounts were taken from the accounting records of Padget Home Services, Inc., as of December 31, 20Y7. Padget Home Services began its operations on January 1, 20Y7. Instructions: 1. Prepare an income statement for the year ending December

> The following is an excerpt from a conversation between Evan Eberhard, the warehouse manager for Greenbriar Wholesale Co., and its accountant, Marty Hayes. Greenbriar operates a large regional warehouse that supplies produce and other grocery products to

> Mitchell Co. is experiencing a decrease in sales and operating income for the fiscal year ending December 31, 20Y1. Gene Lumpkin, controller of Mitchell Co., has suggested that all orders received before the end of the fiscal year be shipped by midnight, D

> The following is an excerpt from a conversation between the office manager, Terry Holland, and the president of Northern Construction Supplies Co., Janet Austel. Northern Construction Supplies sells building supplies to local contractors. Terry: Janet, we

> Sybil Crumpton, vice president of operations for Bob Marshall Wilderness Bank, has instructed the bank’s computer programmer to use a 365-day year to compute interest on depository accounts (payables). Sybil also instructed the programmer to use a 360-da

> Select a business in your community and observe its internal controls over cash receipts and cash payments. The business could be a bank or a bookstore, restaurant, department store, or other retailer. In groups of three or four, identify and discuss the

> The records of Clairemont Company indicate an August 31, 20Y1 cash balance of $6,675, which includes under posited receipts for August 30 and 31. The cash balance on the bank statement as of August 31 is $5,350. This balance includes a note of $3,000 plu

> Javier Meza and Sue Quan are both cash register clerks for Healthy Markets. Ingrid Perez is the store manager for Healthy Markets. The following is an excerpt of a conversation between Javier and Sue: Javier: Sue, how long have you been working for Heal

> The following is an excerpt from a conversation between the store manager of La Food Grocery Stores, Amy Locke, and Steve Meyer, president of La Food Grocery Stores. Steve: Amy, I’m concerned about this new scanning system. Amy: What’s the problem? Steve

> The following is an excerpt from a conversation between two sales clerks, Tracy Rawlin and Jeff Weimer. Both Tracy and Jeff are employed by Magnum Electronics, a locally owned and operated electronics retail store. Tracy: Did you hear the news? Jeff: Wha

> Your sister operates Harbor Ready Parts Company, an online boat parts distributorship that is in its third year of operation. The income statement is shown below and was recently prepared for the year ended October 31, 20Y6. Your sister is considering

> James Nesbitt established Up-Date Computer Services on August 1, 20Y4. The effect of each transaction and the balances after each transaction for August are shown below in the integrated financial statement framework. Instructions: 1. Pre

> The following is an excerpt from a conversation between Eric Jackson and Carlie Miller. Eric is debating whether to buy a stereo system from First Audio, a locally owned electronics store, or Dynamic Sound Systems, an online electronics company. Eric: Ca

> The Laurel Co. is owned and operated by Paul Laurel. The following is an excerpt from a conversation between Paul Laurel and Maria Fuller, the chief accountant for Laurel Co. Paul: Maria, I’ve got a question about this recent balance sheet. Maria: Sure,

> On July 29, 20Y1, Ever Green Company, a garden retailer, purchased $12,000 of seed, terms 2/10, n/30, from Fleck Seed Co. Even though the discount period had expired, Mary Jasper subtracted the discount of $240 when she processed the documents for paymen

> The following data (in millions) were taken from http://finance.yahoo.com. 1. Match each of the following companies with the data for Company A, B, C, or D: Apple Inc. (AAPL) Facebook, Inc. (FB) International Business Machines Corporatio

> Cigna Corp. (CI) provides insurance services, and Deere & Company (DE) manufactures and sells farm and construction equipment. The following data (in millions) were adapted from recent financial statements of each company. 1. Compute

> Assume that you and two friends are debating whether to open an automotive and service retail chain that will be called Auto-Mart. Initially, Auto-Mart will open three stores locally, but the business plan anticipates going nationwide within five years. C

> Several years ago, your brother opened Ready Appliance Repairs. He made a small initial investment and added money from his personal bank account as needed. He withdrew money for living expenses at irregular intervals. As the business grew, he hired an a

> The following is an excerpt from a conversation between Monte Trask and Jamie Palk just before they boarded a flight to Berlin on American Airlines. They are going to Berlin to attend their company’s annual sales conference. Monte: Jamie, aren’t you takin

> Yahoo.com’s (YHOO) finance Internet site provides summary financial information about public companies, such as stock quotes, recent financial filings with the Securities and Exchange Commission, and recent news stories. Go to Yahoo.com’s financial Web site

> Amazon.com (AMZN), an Internet retailer, was incorporated in the early 1990s and opened its virtual doors on the Web shortly thereafter. On its statement of cash flows, would you expect Amazon.com’s net cash ï¬&#

> Les Stanley established an insurance agency on July 1, 20Y5, and completed the following transactions during July: a. Opened a business bank account in the name of Stanley Insurance Inc., with a deposit of $60,000 in exchange for common stock. b. Borrowe

> On August 1, 20Y7, Dr. Ruth Turner established SickCo, a medical practice organized as a professional corporation. The following conversation occurred the following February between Dr. Turner and a former medical school c lassmate, Dr. Shonna Rees, at a

> Enron Corporation, headquartered in Houston, Texas, provided products and services for natural gas, electricity, and communications to wholesale and retail customers. Enron’s operations were conducted through a variety of subsidiaries a

> Assume that you are considering developing a nationwide chain of women’s clothing stores. You have contacted a Seattle-based firm that specializes in financing new business ventures and enterprises. Such firms, called venture capital firms, finance new busine

> On January 9, 20--, Dr. Susan Tempkin established DocMed, a medical practice organized as a professional corporation. The below conversation took place the following September between Dr. Tempkin and a former medical school classmate, Dr. Phil Anzar, at

> Assume that you are the chief executive officer for a national poultry producer. The company’s operations include hatching chickens through the use of breeder stock and feeding, raising, and processing the mature chicks into finished products. The finished