Question: At the end of the year, Blue

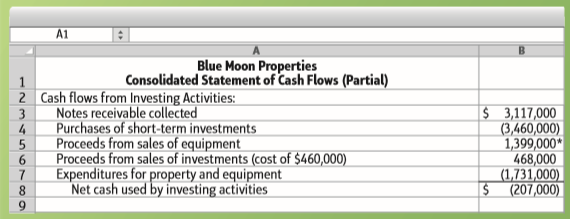

At the end of the year, Blue Moon Properties’ statement of cash flows reported the following for investing activities:

Requirement

1. For each item listed, make the journal entry that placed the item on Blue Moon’s statement of cash flows.

Transcribed Image Text:

A1 Blue Moon Properties Consolidated Statement of Cash Flows (Partial) 2 Cash flows from Investing Activities: Notes receivable collected $ 3,117,000 (3,460,000) 1,399,000* 468,000 (1,731,000) S (207,000) 3 4 Purchases of short-term investments Proceeds from sales of equipment Proceeds from sales of investments (cost of $460,000) 7 Expenditures for property and equipment 8 Net cash used by investing activities

> Refer to the Under Armour, Inc., Consolidated Financial Statements in Appendix B and online in the filings section of http://www.sec.gov. This case leads you through an analysis of the activity for some of Under Armour, Inc.’s, long-term assets, as well

> inventory; compute and evaluate gross profit and inventory turnover) Refer to Under Armour, Inc.’s, consolidated financial statements in Appendix B and online in the filings section of http://www.sec.gov. Show amounts in millions and round to the nearest

> This case is based on Under Armour, Inc.’s, consolidated balance sheets, consolidated statements of income, and Note 2 of its financial statements (Significant Accounting Policies) in Appendix B and online in the filings section of http://www.sec.gov. Req

> Refer to the Under Armour, Inc., Financial Statements in Appendix B and online in the filings section of http://www.sec.gov. Requirements 1. Focus on cash and cash equivalents. Why did cash and cash equivalents change during 2014? The s

> Refer to the consolidated financial statements of Under Armour, Inc., in Appendix B and online in the filings section of http:// www.sec.gov. During 2014, the company reported net revenues of $3,084 million in its consolidated statement of income. In add

> Refer to Under Armour, Inc.’s, financial statements in Appendix B and online in the filings section of http://www.sec.gov. Suppose you are an investor considering buying Under Armour, Inc.’s, common stock. The following questions are important. Show amount

> This and similar cases in each chapter are based on the consolidated financial statements of Under Armour, Inc., given in Appendix B and online in the filings section of http://www.sec .gov. As you work with Under Armour, Inc., you will develop the ability

> Refer to Apple Inc.’s consolidated financial statements in Appendix A and online in the filings section of http://www.sec.gov. Requirements 1. Did accounts payable for Apple Inc., increase or decrease in 2014? Calculate accounts payable turnover for 201

> The consolidated financial statements of Apple Inc. are given in Appendix A and online in the filings section of http://www.sec.gov. Requirements 1. Refer to Note 1—Summary of Significant Accounting Policies, under Cash Equivalents and Marketable Securi

> Refer to Apple Inc.’s Consolidated Financial Statements in Appendix A and online in the filings section of http://www.sec.gov., and answer the following questions: Requirements 1. Refer to Note 1 and Note 3 of the Notes to Consolidated Financial State

> Accounting records for Just Desserts, Inc., yield the following data for the year ended December 31, 2016 (amounts in thousands): Requirements 1. Journalize Just Desserts’s inventory transactions for the year under the periodic syste

> Assume a Championship outlet store began July 2016 with 52 units of inventory that cost $18 each. The sale price of these units was $75. During July, the store completed these inventory transactions: Requirements 1. Determine the storeâ€

> Refer to the Apple Inc. consolidated financial statements in Appendix A and online in the filings section of http://www.sec .gov. The cash and cash equivalents section of the Consolidated Balance Sheet shows a balance of $13,844 million as of September 27,

> Apple Inc.—like all other businesses—adjusts accounts prior to year-end to get correct amounts for the financial statements. Examine Apple Inc.’s Consolidated Balance Sheets in Appendix A and online in the filings section of http://www.sec.gov., and pay

> Refer to Apple Inc.’s financial statements in Appendix A and online in the filings section of http://www.sec.gov. Assume that Apple completed the following selected transactions during 2014: a. Made company sales (revenue) of $182,795 million, all on acco

> This and similar cases in succeeding chapters are based on the consolidated financial statements of Apple Inc., given in Appendix A and online in the filings section of http://www.sec.gov. As you work with Apple Inc. throughout this course, you will develo

> Stockwell Financial Services is considering two plans for raising $600,000 to expand operations. Plan A is to borrow at 6%, and plan B is to issue 125,000 shares of common stock at $4.80 per share. Before any new financing, Stockwell Financial Services ha

> Companies that operate in different industries may have very different financial ratio values. These differences may grow even wider when we compare companies located in different countries. Compare three leading companies (Company E, Com

> Footnote 7 of Ann Taylor Stores Corp.’s financial statements for fiscal year 2014 contains the following information: Requirements 1. Interpret the information in the footnote. What rights does the compa

> On June 30, 2016, the market interest rate is 6%. Grommet Candies Ltd. issues $2,000,000 of 8%, 10-year bonds payable. The bonds pay interest on June 30 and December 31. Grommet Candies Ltd. amortizes bond premium by the effective-interest method. Requ

> ActiveGo Sports Ltd. is authorized to issue $5,000,000 of 4%, 10-year bonds payable. On December 31, 2016, when the market interest rate is 4.5%, the company issues $4,000,000 of the bonds. ActiveGo Sports amortizes bond discount by the effective-interes

> City Bank has $100,000 of 7% debenture bonds outstanding. The bonds were issued at 103 in 2016 and mature in 2036. The bonds have annual interest payments. Requirements 1. How much cash did City Bank receive when it issued these bonds? 2. How much cas

> On January 31, 2016, Stonewall Logistics, Inc., issued 10-year, 5% bonds payable with a face value of $6,000,000. The bonds were issued at 96 and pay interest on January 31 and July 31. Stonewall Logistics, Inc., amortizes bond discount by the straight-l

> Assume Costello Electronics completed these selected transactions during September 2016: a. Sales of $2,500,000 are subject to estimated warranty cost of 3%. The estimated warranty payable at the beginning of the year was $36,000, and warranty payments

> Crockett Security Systems’ revenues for 2016 totaled $21.9 million. As with most companies, Crockett is a defendant in lawsuits related to its products. Note 14 of the Crockett annual report for 2016 reported the following: Requiremen

> Great Earth Homes, Inc., builds environmentally sensitive structures. The company’s 2016 revenues totaled $2,770 million. At December 31, 2016 and 2015, the company had, respectively, $653 million and $583 million in current assets. The

> At December 31, 2016, Saglio Real Estate reported a current liability for income tax payable of $73,000. During 2017, Saglio earned income of $650,000 before income tax. The company’s income tax rate during 2017 was 33%. Also during 2017, Saglio paid inc

> Assume that Boston Sales Company completed the following note payable transactions: Requirements 1. How much interest expense must be accrued at December 31, 2016? (Round your answer to the nearest whole dollar.) 2. Determine the amount of Boston Sal

> Penske has an annual payroll of $215,000. In addition, the company incurs payroll tax expense of 12%. At December 31, Penske owes salaries of $7,800 and FICA and other payroll tax of $550. The company will pay these amounts early next year. Show what Pe

> Great White Publishing completed the following transactions for one subscriber during 2016: Requirement 1. Journalize these transactions (explanations not required). Then report any liability on the company’s balance sheet at Decembe

> The accounting records of Carmine Appliances included the following balances at the end of the period: In the past, Carmine’s warranty expense has been 8% of sales. During the current period, the business paid $7,000 to satisfy the wa

> Kimball Sports Authority purchased inventory costing $22,500 by signing a 6% short-term, one-year note payable. The purchase occurred on July 31, 2016. Kimball pays annual interest each year on July 31. Journalize the company’s a. purchase of inventory;

> Green Nation Financial Services is considering two plans for raising $600,000 to expand operations. Plan A is to borrow at 5%, and plan B is to issue 100,000 shares of common stock at $6.00 per share. Before any new financing, Green Nation Financial Servi

> Companies that operate in different industries may have very different financial ratio values. These differences may grow even wider when we compare companies located in different countries. Compare three leading companies (Company F, Com

> Footnote 2 of Abercrombie and Fitch Co.’s financial statements for fiscal year 2014 (January 31, 2015) contains the following information: Requirements 1. Interpret the information in the footnote. Assum

> On June 30, 2016, the market interest rate is 8%. Team Sports Ltd. issues $800,000 of 10%, 10-year bonds payable. The bonds pay interest on June 30 and December 31. Team Sports Ltd. amortizes bond premium by the effective-interest method. Requirements

> Score Ltd. is authorized to issue $2,000,000 of 3%, 10-year bonds payable. On December 31, 2016, when the market interest rate is 7%, the company issues $1,600,000 of the bonds. Score Ltd. amortizes bond discount by the effective-interest method. The sem

> County Bank has $300,000 of 7% debenture bonds outstanding. The bonds were issued at 103 in 2016 and mature in 2036. The bonds have annual interest payments. Requirements 1. How much cash did County Bank receive when it issued these bonds? 2. How muc

> On January 31, 2016, Danvers Logistics, Inc., issued five-year, 7% bonds payable with a face value of $10,000,000. The bonds were issued at 96 and pay interest on January 31 and July 31. Danvers Logistics, Inc., amortizes bond discount by the straight-lin

> Assume that Banff Electronics completed these selected transactions during March 2016: a. Sales of $2,100,000 are subject to estimated warranty cost of 2%. The estimated warranty payable at the beginning of the year was $35,000, and warranty payments fo

> Barclay Systems’ revenues for 2016 totaled $26.2 million. As with most companies, Barclay is a defendant in lawsuits related to its products. Note 14 of the Barclay annual report for 2016 reported the following: Requirements 1. Suppo

> Earth Friendly Structures, Inc., builds environmentally sensitive structures. The company’s 2016 revenues totaled $2,760 million. At December 31, 2016, and 2015, the company had, respectively, $658 million and $603 million in current as

> At December 31, 2016, Hawley Real Estate reported a current liability for income tax payable of $78,000. During 2017, Hawley earned income of $650,000 before income tax. The company’s income tax rate during 2017 was 35%. Also during 2017, Hawley paid inc

> Assume that Cart Sales Company completed the following note payable transactions: Requirements 1. How much interest expense must be accrued at December 31, 2016? (Round your answer to the nearest whole dollar.) 2. Determine the amount of Cart Sales&a

> Perrault has an annual payroll of $190,000. In addition, the company incurs payroll tax expense of 8%. At December 31, Perrault owes salaries of $8,200 and FICA and other payroll tax of $700. The company will pay these amounts early next year. Show what

> TransWorld Publishing completed the following transactions for one subscriber during 2016: Requirement 1. Journalize these transactions (explanations not required). Then report any liability on the company’s balance sheet at December

> The accounting records of Jim’s Appliances included the following balances at the end of the period: In the past, Jim’s warranty expense has been 9% of sales. During the current period, the business paid $9,000 to sa

> Ivanhoe Sports Authority purchased inventory costing $28,000 by signing a 7% short-term, one-year note payable. The purchase occurred on July 31, 2016. Ivanhoe pays annual interest each year on July 31. Journalize the company’s a. purchase of inventory;

> Shriver Corp. purchased five $1,000 7% bonds of Geotherm Corporation when the market rate of interest was 8%. Interest is paid semiannually, and the bonds will mature in five years. Using the PV function in Excel, compute the price Shriver paid (the presen

> During fiscal year 2016, Ellis Bakery reported a net income of $130.7 million. Ellis Bakery received $1.4 million from the sale of other businesses. Ellis Bakery made capital expenditures of $10.6 million and sold property, plant, and equipment for $7.5 m

> Translate into dollars the balance sheet of Ohio Leather Goods’ Greek subsidiary. When Ohio Leather Goods acquired the foreign subsidiary, a euro was worth $1.06. The current exchange rate is $1.36. During the period when retained earnings were earned, t

> Gamma, Inc., owns Cressida Corp. These two companies’ individual balance sheets follow: Requirements 1. Prepare a consolidated balance sheet of Gamma, Inc. It is sufficient to complete the consolidation work sheet. Use Exhibit 8-7 as

> Agani Financial paid $570,000 for a 45% investment in the common stock of Sonic, Inc. For the first year, Sonic reported net income of $260,000 and at year-end declared and paid cash dividends of $135,000. On the balance-sheet date, the fair value of Agan

> Without making journal entries, record the transactions of E8-36B directly in the Watson T-account, Equity-method Investment. Assume that after all the noted transactions took place, Watson sold its entire investment in Smith Software for cash of $1,000,

> Watson Corporation owns equity-method investments in several companies. Suppose Watson paid $1,300,000 to acquire a 30% investment in Smith Software Company. Smith Software reported net income of $680,000 for the first year and declared and paid cash divi

> During the most recent year, Ogden Co. bought 2,800 shares of Dublin common stock at $35, 590 shares of Chile stock at $45.50, and 1,000 shares of Russian stock at $70—all as available-for-sale investments. At December 31, Hoover’s Online reports Dublin

> Journalize the following long-term, available-for-sale investment transactions of Hammond Department Stores: a. Purchased 410 shares of Potter Fine Foods common stock at $31 per share, with the intent of holding the stock for the indefinite future. b. R

> Assume that on September 30, 2016, Baytex, Inc., purchased 5% bonds of Hartley Corporation at 97 as a long-term, held-to-maturity investment. The maturity value of the bonds will be $46,000 on September 30, 2021. The bonds pay interest on March 31 and Se

> Stockman Corp. purchased ten $1,000 6% bonds of Voltgo Corporation when the market rate of interest was 7%. Interest is paid semiannually, and the bonds, and the bonds will mature in eight years. Using the PV function in Excel, compute the price Stockman

> At the end of the year, Cityside Properties’ statement of cash flows reported the following for investment activities: Requirement 1. For each item listed, make the journal entry that placed the item on Cityside Proper

> During fiscal year 2016, Honey Bakery reported a net income of $132.4 million. Honey Bakery received $1.4 million from the sale of other businesses. Honey Bakery made capital expenditures of $10.0 million and sold property, plant, and equipment for $7.3 m

> Translate into dollars the balance sheet of North Carolina Leather Goods’ German subsidiary. When North Carolina Leather Goods acquired the foreign subsidiary, a euro was worth $1.06. The current exchange rate is $1.326. During the period when retained e

> Nutone, Inc., owns Othello Corp. The two companies’ individual balance sheets follow: Requirements 1. Prepare a consolidated balance sheet of Nutone, Inc. It is sufficient to complete the consolidation work sheet. Use Exhibit 8-7 as

> Ashcroft Financial paid $500,000 for a 30% investment in the common stock of Magic, Inc. For the first year, Magic reported net income of $220,000 and at year-end declared and paid cash dividends of $140,000. On the balance-sheet date, the fair value of A

> Without making journal entries, record the transactions of E8-25A directly in the Nelson T-account, Equity-method Investment. Assume that after all the noted transactions took place, Nelson sold its entire investment in Simpson Software for cash of $1,50

> Nelson Corporation owns equity-method investments in several companies. Suppose Nelson paid $1,500,000 to acquire a 40% investment in Simpson Software Company. Simpson Software reported net income of $670,000 for the first year and declared and paid cash

> During the most recent year, Michael Co. bought 3,800 shares of Canada common stock at $38, 640 shares of Brazil stock at $47.25, and 1,500 shares of Russian stock at $77— all as available-for-sale investments. At December 31, Hoover’s Online reports Can

> Journalize the following long-term, available-for-sale security transactions of Isley Department Stores: a. Purchased 400 shares of Howell Fine Foods common stock at $35 per share, with the intent of holding the stock for the indefinite future. b. Recei

> Assume that on September 30, 2016, Rentex, Inc., purchased 6% bonds of Morin Corporation at 97 as a long-term, held-to-maturity investment. The maturity value of the bonds will be $30,000 on September 30, 2021. The bonds pay interest on March 31 and Sept

> Assume Thomas Manufacturing Corporation completed the following transactions: a. Sold a store building for $600,000. The building had cost Thomas Manufacturing $1,300,000, and at the time of the sale, its accumulated depreciation totaled $700,000. b. L

> Kirby, Inc., one of the largest home improvement retailers, reported the following information (adapted) in its comparative financial statements for the fiscal year ended January 31, 2015: Requirements 1. Compute net profit margin ratio for the years

> Assume Doltron Co. paid $18 million to purchase Bailey Industries. Assume further that Bailey Industries had the following summarized data at the time of the Doltron Co. acquisition (amounts in millions): Bailey Industries’ current as

> 1. Midway Printers incurred external costs of $600,000 for a patent for a new laser printer. Although the patent gives legal protection for 20 years, it is expected to provide Midway Printers with a competitive advantage for only ten years. Assuming the

> Nero Mines paid $432,000 for the right to extract ore from a 425,000-ton mineral deposit. In addition to the purchase price, Nero Mines also paid a $150 filing fee, a $2,700 license fee to the state of Utah, and $92,150 for a geologic survey of the prope

> Carson Truck Company is a large trucking company that operates throughout the United States. Carson Truck Company uses the units-of production method to depreciate its trucks. Carson Truck Company trades in trucks often to keep driver morale high and to

> Assume that on January 2, 2016, Drake-Neiman purchased fixtures for $8,000 cash, expecting the fixtures to remain in service for five years. Drake-Neiman has depreciated the fixtures on a double-declining-balance basis, with $1,500 estimated residual val

> On January 1, 2013, Regal Manufacturing purchased a machine for $850,000. Regal Manufacturing expects the machine to remain useful for eight years and to have a residual value of $40,000. Regal Manufacturing uses the straight-line method to depreciate i

> Assume Franklin Security Consultants purchased a building for $430,000 and depreciated it on a straight-line basis over 40 years. The estimated residual value was $70,000. After using the building for 20 years, Franklin realized that the building will re

> Is the payment of the face amount of a bond on its maturity date regarded as an operating activity, an investing activity, or a financing activity? a. Operating activity b. Investing activity c. Financing activity

> The journal entry on the maturity date to record the payment of $2,500,000 of bonds payable that were issued at a $90,000 discount includes a. a debit to Discount on Bonds Payable for $90,000. b. a debit to Bonds Payable for $2,500,000. c. a credit to

> Amortizing the discount on bonds payable a. reduces the semiannual cash payment for interest. b. is necessary only if the bonds were issued at more than face value. c. increases the recorded amount of interest expense. d. reduces the carrying value o

> Using the facts in the preceding question, McIntosh’s entry to record the interest expense on July 1, 2016, will include a a. credit to Interest Expense. b. debit to Bonds Payable. c. credit to Discount on Bonds Payable. d. debit to Premium on Bonds

> Sweetwater Company sells $300,000 of 13%, 15-year bonds for 96.8507 on April 1, 2016. The market rate of interest on that day is 13.5%. Interest is paid each year on April 1. Using straight-line amortization, write the adjusting entry required at Decembe

> Sweetwater Company sells $300,000 of 13%, 15-year bonds for 96.8507 on April 1, 2016. The market rate of interest on that day is 13.5%. Interest is paid each year on April 1. Sweetwater Company uses the straight-line amortization method. The amount of in

> Sweetwater Company sells $300,000 of 13%, 15-year bonds for 96.8507 on April 1, 2016. The market rate of interest on that day is 13.5%. Interest is paid each year on April 1. The entry to record the sale of the bonds on April 1 would be as follows:

> What type of account is Discount on Bonds Payable, and what is its normal balance? a. Contra liability; Credit b. Adjusting account; Credit c. Contra liability; Debit d. Reversing account; Debit

> Bond carrying value equals Bonds Payable a. minus Premium on Bonds Payable. b. plus Discount on Bonds Payable. c. minus Discount on Bonds Payable. d. plus Premium on Bonds Payable. e. both a and b. f. both c and d.

> A bond with a face amount of $17,000 has a current price quote of 103.85. What is the bond’s price? a. $17,103.85 b. $176,545 c. $1,765.45 d. $17,654.50

> Maridell’s Fashions has a debt that has been properly reported as a long-term liability up to the present year (2016). Some of this debt comes due in 2016. If Maridell’s Fashions continues to report the current position as a long-term liability, the effe

> Myron, Inc., manufactures and sells computer monitors with a three-year warranty. Warranty costs are expected to average 7% of sales during the warranty period. The following table shows the sales and actual warranty payments during the first two years o

> An end-of-period adjusting entry that debits Unearned Revenue most likely will credit a. an asset. b. a liability. c. a revenue. d. an expense.

> What kind of account is Unearned Revenue? a. Asset account b. Revenue account c. Expense account d. Liability account

> Tennis Shoe Warehouse operates in a state with a 6.5% sales tax. For convenience, Tennis Shoe Warehouse credits Sales Revenue for the total amount (selling price plus sales tax) collected from each customer. If Tennis Shoe Warehouse fails to make an adju

> Failure to accrue interest expense results in a. an overstatement of net income and an understatement of liabilities. b. an overstatement of net income and an overstatement of liabilities. c. an understatement of net income and an overstatement of lia

> For the purpose of classifying liabilities as current or noncurrent, the term operating cycle refers to a. the time period between purchase of merchandise and the conversion of this merchandise back to cash. b. a period of one year. c. the average tim

> Consolidation of a foreign subsidiary usually results in a a. gain or loss on consolidation. b. foreign-currency translation adjustment. c. foreign-currency transaction gain or loss. d. LIFO/FIFO difference.

> What is the present value of bonds with a face value of $2,000, a stated interest rate of 6%, a market rate of 9%, and a maturity date six years in the future? Interest is paid semiannually. Use Excel. a. $1,010 b. $1,726 c. $2,456 d. $2,000

> Which of the following is not needed to compute the present value of an investment? a. The length of time between the investment and future receipt b. The rate of inflation c. The interest rate d. The amount of the receipt

> The present value of $2,000 at the end of four years at 8% interest is a. $6,624 b. $1,228. c. $1,470. d. $2,000.

> Return to Macrostore, Inc.’s bond investment in the preceding question. For the year ended December 31, 2017, Macrostore received cash interest of $5,000. What was the interest revenue that Macrostore earned in this year? a. $2,000 b. $5,000 c. $7,000