Question: Automotive assemblers and their inbound supply

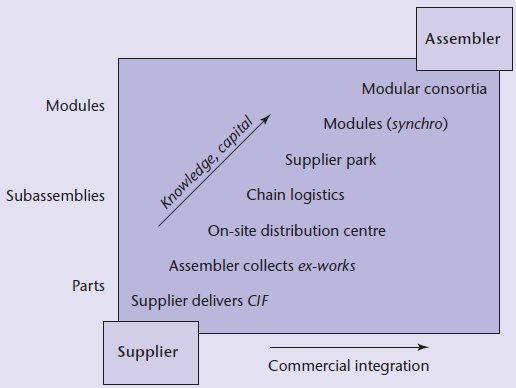

Automotive assemblers and their inbound supply chains have developed many solutions to orchestrate the manufacturing and delivery of the thousands of parts that go to make up a vehicle. The many potential inbound logistics solutions are summarized in Figure 8.13.

Figure 8.13

Evolving inbound supply relationships

Changes are of increasing value to the vehicle assemblers, where the complexity of the logistics operation has been greatly downsized by reducing the number of tier 1 suppliers and broadening their responsibilities. Yet the ability of the assemblers to customise their finished products has increased. Quality consistency is expected at 50 ppm, whilst demanding price reduction targets are the norm.

Supplier delivers CIF (carriage, insurance and freight)

The supplier delivers the ordered parts to the assembler’s factory, and includes the distribution costs in the piece part price.

Assembler collects ex-works

The assembler subcontracts the process of parts collection from a number of suppliers visited on a daily frequency. Parts are taken to a consolidation centre, where they are decanted into trailers destined for different assembly plants. An example is the Ford operation run by Exel at Birmingham in the UK. Parts collections are made from the Midlands region of the UK, and dispatched to 22 Ford plants around Europe.

Automotive supplier community

This is a dedicated co-location of suppliers in the region of dedicated vehicle manufacturers. The big difference from all the other integration types is that deliveries are made to more than one vehicle assembly plant. An example for more than one OEM plant is the BMW Innovation Estate in Wackersdorf where several suppliers provide parts for four BMW sites.

On-site distribution centre

Instead of delivering parts directly into the assembler’s plant, the logistics partner may deliver into a distribution centre positioned close to the assembler’s plant. The advantages are much more controlled inbound parts movements into the plant. The assembler is able to call up parts that are needed for a relatively short time period, thus improving material flow into the plant and reducing vehicle congestion. Additional value-adding activities may also be carried out in the DC. Thus, for example, suppliers carry out some final assembly and sequencing tasks in the new Integrated Logistics Centre at BMW, Cowley.

Supply centres

These are co-located supplier clusters on site and could be part invested by the VM and service provider (3PL). Supplier proximity enables late module configuration with smooth material flow. BMW Leipzig uses an electrical conveyor system to connect external and internal suppliers to the assembly line.

Chain logistics

Here the objective is to increase the speed of the inbound supply chain. If not planned and managed, drivers’ hours regulations across Europe can lead to waste as the supply chain stops to allow for rests. The higher the speed of inbound supply, the lower the stock that needs to be held at the assembly plant. A useful further advantage is that the higher the speed, the less packaging and fewer containers are needed in the supply chain. An example of chain logistics is the ALUK operation that supports the Toyota plant at Burnaston in the UK. Parts movements from a supplier in southern Spain are planned in four-hour stages, where the full trailer is swapped for an empty one in a similar fashion to the Pony Express in the days of the Wild West!

Supplier park

A supplier park is a cluster of suppliers located outside but close to a final assembly plant; popular with JIS suppliers and associated with new assembly plants linked to supplier by conveyor belts, tunnels or bridges. (JIS = just@in@sequence: the capability to supply a module in accordance with the drumbeat requirements of an assembler.) Major tier 1 subassembly manufacturers are positioned on a supplier park close to the assembly hall. Major subassemblies are then sequenced into the assembly hall in response to a ‘drumbeat’ (based on the master schedule – see Chapter 6), which identifies the precise specification of the next body to be dropped onto the trim and final assembly track. Suppliers then have a finite amount of time to complete assembly and deliver to the point of use on the track. An example here is the Exel operation at the VW–Seat plant at Martorell near Barcelona, where material movements on the supplier park are specified and orchestrated by means of Exel’s IT systems.

Modules

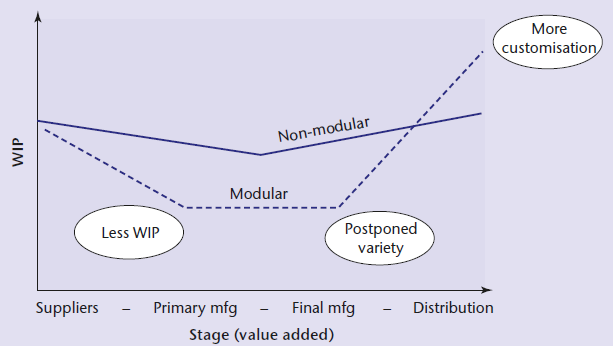

The VW–Seat plant at Martorell demonstrates a further advance in logistics thinking. Instead of delivering a large number of subassemblies, why not get the tier 1 suppliers to coordinate all the parts needed to produce a complete module that then simply can be bolted onto the car? Product variety can be increased by customization of the modules. The advantages are illustrated in Figure 8.14.

Figure 8.14

Modularization: doing more with less

Modular designs offer less WIP and a considerably downsized process for the assembler, and greater variety for the customer. Downsizing of the assembly process means that it is shorter, and can be positioned closer to customer demand. Complexity can then be added later in the pipeline between customer order and delivery of the specified car into the customer’s hands – a concept called postponed variety. The term synchronous supply has been used to describe the delivery of modules not just at the correct quality and correct time, but on a real-time basis with the assembler and with the added challenge of zero safety stock. The condominium approach goes a step further in integration. In this case the suppliers reside and operate under the same roof as the vehicle manufacturers. Due to outsourcing and the lean management, VMs often do not need adjacent space at the final assembly track and can thus offer their factory space to suppliers. Suppliers then assemble their own modules inside the assembly area. An example for the condominium is the Ford Industrial Complex at Camacari in Brazil.

Modular consortia

This is the highest possible integration step for suppliers in the automotive industry. The whole assembly operation is divided into separate modules, with a supplier responsible for each. Therefore, the suppliers not only assemble the modules, but they also perform part of the final vehicle assembly.

The VW bus and truck plant in Brazil is an experiment in the further development of the modular concept. The truck assembly operation has been divided into seven modules, with a supplier responsible for each. All the direct workers are on the supplier’s payroll, and the supplier not only assembles the module, but also performs final assembly of the vehicle. The assembler’s task has been downsized to engineering, design, supervision and administration. The Mercedes plant at Hambach in France, which produces the micro compact Smart Car, divides the vehicle into five main modules. Seven suppliers are fully integrated into the final assembly plant, whilst 16 non-integrated suppliers deliver submodules and parts. The whole information system – which supports manufacturing, logistics and distribution – is outsourced to Accenture.

Implications for suppliers

The demands on tier 1 suppliers increase in proportion to the various logistics solutions described earlier. A clear trend towards supplier parks and modularisation can be seen in the logistics strategies of automotive assemblers. Increasingly, tier 1 suppliers are being expected to control subsequent tiers in the supply chain, whilst ensuring delivery and quality to the assembler. At the same time, challenging cost reduction targets are being set, whilst the whole process is facilitated by tier 1 outbound defect levels that are less than 50 ppm. Many suppliers question whether the draconian demands for ‘cost down’ targets are compatible with such defect levels.

Four distinct stages can be seen in the development of capabilities by tier 1 suppliers:

. Tier 1 basic: suppliers with in-house design capability and project management capability who can ensure timely delivery and reasonable quality reliability (50 ppm). An example would be a tyre manufacturer who holds four–five days’ stock and who delivers to set time windows: that is, limited logistics capability.

. Tier 1 synchro: suppliers who provide all of the basic capabilities, but with virtually no safety stock. Additional capabilities for the supplier are synchro logistics and IT expertise, which is closely integrated with the assembler, greater flexibility and more secure emergency procedures. They operate through ‘clone’ plants that are situated on supplier parks no more than 10 minutes’ travel time from the assembler’s production line.

. Tier 0.5: full service providers, who integrate component manufacturing through supply chain management to achieve the optimum design of a given module. They carry out pre-emptive market research and develop innovative designs through shelf engineering (designs that are prepared proactively in advance of need and placed ‘on the shelf’, thus saving time in the event that the need does arise). They are partners in major cost reduction projects at each model change, and in continuous improvement projects in between.

. Tier 0: the highest possible integration. In addition to tier 0.5 responsibilities, the tier 0 supplier is responsible for a vehicle manufacturer’s main assembly operations divided into separate modules, with a tier 0 supplier responsible for each. Therefore, the supplier performs final VM module assembly operations. Final VM assembly line work retention is a matter of the VM’s strategic choice but it could be performed by the tier 0, as exhibited online by supplier Magna for BMW.

There is a substantial passing of risk from the assembler to the tier 1 supplier at each stage. Increasingly, the supplier takes responsibility for designing and developing new products of increasing complexity in advance of new model programmes. And there is no guarantee that the supplier will get the work, because competitive tenders are issued for each new model. This forces suppliers to keep primary manufacturing and core business at a ‘home’ location, and to construct low-cost, late-configuration ‘postponement’ plants near the OEM’s assembly hall to enable synchro deliveries. The decision by BMW to switch R50 (Mini) assembly from Longbridge to Cowley left a number of suppliers with £2 million synchro assembly units in the wrong place.

The strategic dilemma for tier 1 suppliers who currently supply the assemblers directly is whether to expand into system integrators (tier 0.5), or to become indirect suppliers to such organizations. Siegfried Wolf of Magna International described the tier 0.5 transition as follows:

To become part of this new tier, companies will require a worldwide presence, global sourcing, programme management, technology, JIT and JIS know-how and specialist production knowledge. They will also require a high level of R&D spend.

So, after tier 0.5, where do the competitive challenges lie? Tier 2 suppliers still will be largely low-overhead, product-based companies that have limited service capability. Price pressure will continue to be severe, and return on sales often little above breakeven. Tier 2 suppliers often cannot afford expensive inspection and test resources, so defect levels will continue to be relatively high, often in the range 1,000–2,000 ppm (i.e. 1–2 per cent). This will present major challenges for tier 0.5 suppliers, who must also guarantee delivery reliability to the assembly track, and a module that fits perfectly at all times.

As an example of tier 0.5 evolution, the joint venture between Canada’s Magna International and Japan’s Calsonic Kansei (‘Magna Kansei’) produces the complete fascia (‘cockpit module’) for the Nissan Micra at a new facility close to Nissan’s Washington plant in north-east England. Sales of the joint venture have almost trebled as it assumes responsibility for all of the components and subassemblies that make up the module. Calsonic Kansei designed, developed and tested the Micra fascia from a Nissan-engineered concept design. Co-location of supplier engineers at the Nissan development HQ in Atsugi City meant that Nissan product development teams supervised the design and development process. Magna Kansei assumes responsibility for parts it makes itself, for sourcing externally made parts, and for final module assembly and shipment JIS to the Nissan plant. There are 32 tier 2 suppliers: 18 are imposed, where Nissan sets the price and commercial details. The rest are nominated by Magna Kansei. This effectively limits the amount of integration that can take place at the design stage. Imposed suppliers that have been selected mainly on price act as barriers for improvement of quality capability.

Questions

1. Summaries the advantages and risks to suppliers who want to achieve tier 0.5 status.

2. Consider the differences that can be seen between the logistics conditions of the supplier integration models discussed above. Comment on the geographic proximity, shared investment, asset specificity, IT-system integration and transport costs connected with the above models in a drive towards a ‘tier zero’ status for progressive suppliers and their vehicle manufacturers.

> The Tech Student Government Association (SGA) has several campus projects it undertakes each year, and its primary source of funding to support these projects is a T-shirt sale in the fall for what is known as the “orange effect” football game (with oran

> Solve the linear programming model formulated in Problem 12 for United Aluminum Company graphically. a. How much extra (i.e., surplus) high-, medium-, and low-grade aluminum does the company produce at the optimal solution? b. What would be the effect on

> United Aluminum Company of Cincinnati produces three grades (high, medium, and low) of aluminum at two mills. Each mill has a different production capacity (in tons per day) for each grade, as follows: The company has contracted with a manufacturing firm

> Solve the linear programming model formulation in Problem 9 for the fitter by using the computer. a. If the fitter can obtain additional hours either to cutter or grinder (but not both), which should he select? How much? Explain your answer. b. Identify

> Solve Problem 9 graphically. a. How many hours of the cutter’s time are used? Does it have any leftover time? b. If the fitter is able to reduce the cost of product A from €8 to €6 and product B from €12 to €9, what will be the impact of cost reduction o

> Given the following QM for Windows computer solution of a linear programming model, graph the problem and identify the solution point, including variable values and slack, from the computer output:

> Solve the following linear programming model graphically: maximize Z = 3x1 + 6x2 subject to 3x1 + 2x2 … 18 x1 + x2 Ú 5 x1 … 4 x1, x2 Ú 0

> In Problem 7, how much flour and sugar will be left unused if the optimal numbers of cakes and Danish are baked?

> The Crumb and Custard Bakery makes coffee cakes and Danish pastries in large pans. The main ingredients are flour and sugar. There are 25 pounds of flour and 16 pounds of sugar available, and the demand for coffee cakes is 5. Five pounds of flour and 2 p

> Refer to Problem 5. a. How much iron and labor will be unused if the optimal number of windows and doors are produced? b. Explain the effect on the optimal solution of changing the profit on a window from € 500 to € 300.

> A metal shop fabricates windows and doors to construction companies. To fabricate these, the shop uses iron, glass, and labor. The company has 80 units of standard size iron, 60 square feet of glass, and unlimited hours of labor but the shop has to use 5

> A group of developers is opening a health club near a new housing development. The health club— which will have exercise and workout equipment, basketball courts, swimming pools, an indoor walking/running track, and tennis courts—is one of the amenities

> Angela and Bob Ray keep a large garden in which they grow cabbage, tomatoes, and onions to make two kinds of relish—chow-chow and tomato. The chow-chow is made primarily of cabbage, whereas the tomato relish has more tomatoes than does the chow-chow. Bot

> In Problem 40: a. Suppose Shirtstop decided it wanted to minimize the defective shirts while keeping costs below $2,000. Reformulate the problem with these changes and solve graphically. b. How many fewer defective items were achieved with the model in (

> Shirtstop makes T-shirts with logos and sells them in its chain of retail stores. It contracts with two different plants—one in Puerto Rico and one in The Bahamas. The shirts from the plant in Puerto Rico cost $0.46 apiece, and 9% of them are defective a

> The Kalo Fertilizer Company makes a fertilizer using two chemicals that provide nitrogen, phosphate, and potassium. A pound of ingredient 1 contributes 10 ounces of nitrogen and 6 ounces of phosphate, whereas a pound of ingredient 2 contributes 2 ounces

> In Problem 38, if Kroeger discounts the price of its own brand of peas, the store will sell at least 1.5 times as much of the national brands as its own brand, but its profit margin on its own brand will be reduced to $0.23 per can. What effect will the

> Kroeger supermarket sells its own brand of canned peas as well as several national brands. The store makes a profit of $0.28 per can for its own peas and a profit of $0.19 for any of the national brands. The store has 6 square feet of shelf space availab

> In Problem 36, a. How many hours are left unused at the optimal solution? b. What would be the effect on the optimal solution of increasing the available cloth from 90 to 100 meters?

> On the UAE national day, children wear new clothes with the national flag embroidered on them. A tailor has three weeks before the national day and plans to work for up to 40 hours per week for the next three weeks. He earns a revenue of AED100 for stitc

> Assume that the objective function in Problem 34 has been changed from Z = 30x1 + 70x2 to Z = 90x1 + 70x2. Determine the slope of each objective function, and discuss what effect these slopes have on the optimal solution.

> A manufacturing firm produces two products. Each product must undergo an assembly process and a finishing process. It is then transferred to the warehouse, which has space for only a limited number of items. The firm has 80 hours available for assembly a

> The Youth Cricket Club of a small city has a team of 20 members. The club provides professional coaching to its members. The club needs a budget of $75,000 every year to support its team and to pay the coaches’ salaries. To generate this amount, the club

> A canning company produces two sizes of cans—regular and large. The cans are produced in 10,000-can lots. The cans are processed through a stamping operation and a coating operation. The company has 30 days available for both stamping and coating. A lot

> Copperfield Mining Company owns two mines, each of which produces three grades of ore— high, medium, and low. The company has a contract to supply a smelting company with at least 12 tons of high-grade ore, 8 tons of medium-grade ore, and 24 tons of low-

> In Problem 30, how much additional profit would the restaurant realize each week if it increased its freezer capacity to accommodate 20 extra gallons total of ice cream and yogurt?

> Gillian’s Restaurant has an ice-cream counter where it sells two main products, ice cream and frozen yogurt, each in a variety of flavors. The restaurant makes one order for ice cream and yogurt each week, and the store has enough freezer space for 115 g

> What would be the effect on the optimal solution in Problem 2 if the cost of rice increased from $0.03 per ounce to $0.06 per ounce?

> Solve the following linear programming model graphically:

> Solve the following linear programming model graphically:

> Solve the following linear programming model graphically: minimize Z = 5x1 + x2 subject to 3x1 + 4x2 = 24 x1 … 6 x1 + 3x2 … 12 x1, x2 Ú 0

> In Problem 25, what would be the effect on the solution if the constraint x2 ≤ 7 were changed to x2 ≥7?

> Solve the following linear programming model graphically: minimize Z = 3x1 + 6x2 subject to 3x1 + 2x2 … 18 x1 + x2 Ú 5 x1 … 4 x2 … 7 x2∙x1 … 7/8 x1, x2 Ú 0

> The College of Business at Tech is planning to begin an online MBA program. The initial start-up cost for computing equipment, facilities, course development, and staff recruitment and development is $350,000. The college plans to charge tuition of $18,0

> Pastureland Dairy makes cheese, which it sells at local supermarkets. The fixed monthly cost of production is $4,000, and the variable cost per pound of cheese is $0.21. The cheese sells for $0.75 per pound; however, the dairy is considering raising the

> Tilda Limited is a food manufacturer and major supplier of pure basmati rice to the UK grocery, wholesale and food service sectors. The rice is sourced from the foothills of the Himalayas and undergoes stringent quality and DNA verification tests across

> CleanCo is a manufacturer of cleaning products that serves the European grocery retailing market. CleanCo currently segments its customers on the value of customer accounts. The primary division is between national accounts, for which 10 accounts constit

> At the time Tom Cross took over as managing director at Powerdrive Motors in South Africa, the company was an established manufacturer of small electric motors with a strong reputation for product reliability and technical leadership. On the downside, it

> Electrolux is a manufacturer of domestic appliances such as dishwashers and vacuum cleaners. The company has developed a programme to boost innovation, based on joint innovation efforts with suppliers and originating from the simple realization that supp

> Unilever has also become very focused on seeking upstream collaboration opportunities to support its ambition to double the size of the company whilst reducing its environmental impact. For procurement and supply chain, this target meant it needed to inv

> Haiti was hit by a disastrous earthquake of 7.0 magnitude on 12 January 2010. It caused more than 120,000 deaths, more than 300,000 injuries and more than 1.5 million people to become homeless. The country of Haiti (established in 1804) has always experi

> Mars, the manufacturer of confectionery and pet food, has been on a multi-year journey towards supplier relationship management. In 2015 the company evaluated its existing performance and process and designed a ‘to be’ future design and suite of tools an

> Auto Roadside Recovery (ARR) is a medium sized company operating around Madrid. ARR provides a vehicle breakdown service offering roadside repair and recovery of the vehicle. Frequently used parts include starters and alternators, which are sourced from

> Eaton Corporation is a $16 billion diversified power management and technology manufacturer of over 400,000 products as diverse as pumps and valves, cylinders, connectors, hoses and motors. The company has a programme under way to move from 700+ to some

> Boeing’s challenges with the market introduction of the Dreamliner plane are already touched upon in Chapter 4. After its introduction, the Dreamliner ended up grounded due to battery issues. Boeing was in need of changing its battery design and technolo

> With whom was about €1 billion. The procurement team analysed this supply base, and was helped in this task because there was one single list of suppliers – which is not at all always the case! In more internationally operating companies there are often

> SKF is a manufacturing company based in Sweden that produces a wide range of industrial parts and equipment. The company has undergone a multi-year effort to centre its sourcing more on TCO. In the company’s experience, TCO has an impact on the evaluatio

> Cofely, in the Netherlands, is an installation and technical services company with annual revenues of €1.3 billion and some 7,000 staff. The firm is organised into 14 distinct businesses with their own profit and loss accounts. These businesses serve eit

> Johnson & Johnson (J&J) is a $65+ billion health care company that employs more than 129,000 employees and 10,000+ suppliers around the world. The company’s procurement leadership has defined an ambition agenda of building blocks for procurement excellen

> Marine Transport International (MTI), together with Agility Science (AS), developed the aptly named Container Streams distributed ledger technology, based on open source with an MIT permission license. According to Jody Cleworth, CEO of MTI: The creation

> In 2003 Walmart began a programme implementing RFID, which turned out to be far more challenging than expected and reveals the many issue in the retail sector. Problems began shortly after the announcement in June 2003 of the initiative to tag cases and

> Global ‘vertical’ supply strategies in the apparel industry aim to emulate retailers such as Zara, which sources everything from set manufacturing plants that are situated within the same geographic region as most of its retail outlets. Setting up a simi

> In January 2007 Marks & Spencer (M&S) launched ‘Plan A’, its five-year strategy to improve the retailer’s social and environmental impact. Plan A set out 100 commitments – goals to be achieved by 2012 – covering climate change, raw materials, waste, heal

> The Bose Corporation, a USA-based manufacturer of hi-fi equipment (as shown in Figure 8.9) developed the JIT2 concept in the early 1990s. Bose recognized that, if the traditional buyer–supplier relationships were to be made more effecti

> O2 is Telefonica’s UK commercial brand and provides the communication network and supply mobile phone devices through its network of retail stores. The supply chain team have established a high degree of collaboration with their suppliers (and internal c

> CPFR pilots have been a popular diversion in the UK grocery sector. Often, they show – as in this case – that considerable opportunities for improvement exist, but that the problems of scaling up the pilot are too grea

> Travis Perkins plc (TP) is the largest UK merchant supplier of building material to selfbuilders and the construction industry. It has doubled in size in recent years, in part through acquisitions, and now owns 25 businesses, including Wickes and Tool st

> Located on the coast of east Tianjin, Binhai New Area (BNA) is at the intersection of the Bohai Economic Belt and Jing-Jin-Ji Metropolitan Circle and Bohai Economic Sphere. This is also the starting point of the Eurasian Continental Bridge and an importa

> The National Association of Italian Footwear Manufacturers (Assocalzaturifici – http:// www.assocalzaturifici.it) explains, The success of the footwear sector in Italy is linked to an enterprising spirit and to the structure of the sect

> A major supplier of digital telecommunications systems, which we shall call ‘Cymru’, had established a successful manufacturing plant in Wales. The European region had been restructured into five customer-facing divisi

> Many basic improvements were identified when the supply chain executive team from Alfa Laval examined the alignment throughout the company, as illustrated in Figure 8.4, Four areas of alignment improvement initiatives were highlighted: interactions with

> DW Windsor is a service-led manufacturer of exterior lighting that delivers road and street lighting products and design services to clients globally from their world-class production facility. The business was established in the late 1970â€&#

> Li & Fung is a Hong Kong based company that was established in the early 1900s as a mediator between Chinese speaking sellers and English speaking buyers. A century later it is one of the world’s leading textile exporters (the large

> Consumer products giant P&G has its share of supply chain scope. In 2012 the company realised $84 billion in sales and 25 of its brands generated $1 billion or more revenue. In order to realise this revenue, the company procures inputs worth over $51 bil

> Micro Compact Car AG (MCC), a wholly owned subsidiary of Daimler-Benz (formerly a joint venture of Daimler-Benz and Swatch), is the company behind the Smart Car. The Smart City Coupé is a two-seater car measuring 2.5 metres in length, which

> Bacalao is fish that has been salted and dried, traditionally in the open air on rocks; today it is done in a drier. It has been produced in Norway since about 1640, can be kept refrigerated for several years, and is said to improve over time. It has dev

> Almost a fifth of the UK’s wheat crop goes into poultry feed and, although feed supply chains are often short and integrated, there are opportunities to improve the performance, even in these commodity chains. This was found to be the c

> The Institute of Grocery Distribution (IGD) supports the development and progress of ECR initiatives in the UK and across Europe. IGD aims to fulfil consumer wishes better, faster and at less cost with forums such as reducing wasted miles (2018). The wor

> A car assembly plant is built around a simple sequence of tasks that starts in the press shop and ends as a car rolls off the final assembly line. Figure 6.13 shows these basic tasks in summary form: Figure 6.13 Basic tasks in a car assembly plant Whils

> This case study, although simplified, has been derived from a real world industrial situation. The Cranfield Currency Company (CCC) manufactures various types of cash machines under three product families, which are each produced in three variants: . The

> Victoria SA makes ‘fantastically good cakes’ from basic ingredients such as flour, eggs and butter. Demand for Victoria sponge cakes comes from two sources. Some big retailers place their order with the firm two days i

> The vast majority of warehouses in the developed world still use the pick-by-paper approach. But any paper-based approach is slow and error prone. Furthermore, picking work is often undertaken by temporary workers who usually require cost-intensive train

> As a global business serving the world’s leading vehicle manufacturers, GKN Driveline develops, builds and supplies an extensive range of automotive driveline products and systems, for use in everything from the most sophisticated premi

> The managing director of Wiltshire Distribution Transformers (WDT) had concentrated on a new generation of simplified, modular designs that used proven US technology. He had energetically exploited the market advantages this had given. WDT now has two ma

> A problem that is all too familiar to suppliers in the automotive industry is that of schedule variability. A vehicle assembler issues delivery schedules to specify how many parts of each type are required each day for the following month. And each day a

> Electro-Coatings Ltd electroplates parts for the automotive industry, for example, the marque badges fitted to the front of prestige cars. Customers were becoming increasingly demanding, resulting in Electro-Coatings undertaking a review of its internal

> Nearly 75 per cent of footballs were produced in Pakistan, mostly in the Sialkot district, Pakistan’s ‘export capital’ close to the border with India. However, an International Labour Organisation (ILO) study in 2002 showed that more than 7,000 children

> In 2005, Cisco Systems dealt with US$500 million of returned products and parts through a cost centre whose annual operating cost was just US$8 million. All returns were treated as defective product and service returns with the rationale being that all r

> Bloomberg is an information services provider that offers real-time financial data on the companies it monitors. This enables businesses to risk monitor these companies. A new development that Bloomberg is developing (internally first) is to extend the r

> For the last several years, convenience store chains across the country have launched fresh channel initiatives, which have included adding salads, freshly made sandwiches and other fresh grab-and-go products to its offerings. Penske Logistics was asked

> Smiths Aerospace is a largely UK-based supplier to both military and civilian aircraft and engine manufacturers, and is owned by General Electric of the USA. Several years ago, Smiths launched an initiative to outsource production of parts from UK suppli

> Nike has a central customer service centre (distribution centre) located at Laakdal in Belgium. The centre is 200,000 square meters in size and serves 45,000 customers in EMEA with footwear, apparel and equipment. The centre receives products from suppli

> The subject of air miles appears regularly in media headlines today. Here are two contrasting views of what is happening. Supermarkets and food producers are taking their products on huge journeys, despite pledging to cut their carbon emissions. Home-gro

> Rio Tinto is a globally operating mining company that has created central buying centres, including one in Singapore where dedicated teams buy in the supply market against forecasted demand from businesses inside Rio Tinto. This is different from traditi

> SC Johnson, the consumer products company, has gone through a major development in its Asian procurement operations, in an effort to incorporate the region into the global governance. Whilst, in the past, Asia was a more removed decentralized outpost wit

> Once the problems of introducing ‘just-in-time’ production systems (internal logistics) had been solved at the Xerox plant making photocopiers at Venray in Holland, attention shifted towards the finished product invent

> Walmart has set three ambitious goals for sustainability: 1. To be supplied by 100 per cent renewable energy. 2. To create zero waste. 3. To sell products that sustain the environment. In moving towards these goals, several key projects have been rolled

> Akzo, the Dutch-based chemicals and coatings company, owner of ICI and many other brands, has appointed a CSR officer to drive and coordinate CSR efforts across the company. To drive ownership, consideration and focus broadly across the company and in al

> When Airbus introduced its Airbus A380 double decker super plane in January 2005 to the press and the world it was an impressive show that brought out government leaders and made headlines all over the world. A little while later, however, delays to the

> The supply chain manager of OTIF plc is considering investment into a computerized routing and scheduling system for the distribution operation. The initial capital expenditure will be £25,000 and it is anticipated to have a useful life of f

> Komplex GmbH has four production lines, each of which operates for 8,000 hours a year. Each line makes a number of products, which are based on size and colour. Therefore, many changeovers are required, each incurring set-up and maintenance costs. Tradit

> Glup SA supplies a range of household soaps to supermarkets in northern Europe. There are 12 stock-keeping units (SKUs) in the range. The logistics manager has determined that an investment of €0.5 million on improved material handling equipment would co

> Filmco makes two thin film (gauge = 12μm) products for packaging applications in the food industry. Product A is coated so that subsequently it can be printed on; product B is uncoated. There is no changeover time on the production line, be

> Bond SA is planning to manufacture a new product with an initial sales forecast of 3,600 units in the first year at a selling price of €800 each. The finance department has calculated that the variable cost for each truck will be â

> Food supply chains are driven often by retailers and this holds for this case, which features a food sold in supermarkets that can be classed as a fast-moving consumer good (FMCG). Table 3.2 illustrates the cash-to-cash cycle times for three companies in

> For more than a century, Kimberly Clark (K-C) has supplied personal care products and now can claim that nearly a quarter of the world’s population, across 175 countries, use their products.. The K-C product range spans personal care, h

> Tesco PLC is the UK’s largest food retailer, with a revenue of about £51 billion for the financial year 2016–17. Across 11 countries in Central Europe and Asia, Tesco employs about 440,000 people making it

> Consider how you would react to 360-degree feedback. If you were the one receiving the feedback, whose views would you value most: your manager’s or your peer’s? If you were asked to assess a peer, would you want your opinion to affect that peer’s raises

> For junior-level employees who are trying to impress higher-ups and secure themselves a very lucrative career in the investment banking and financial services industry, the demands and stress levels can be especially intense. The responsibility, workload

> As Bobby Kotick described, a lot of the job satisfaction felt by Activision Blizzard employees comes from the mission of their company. One employee summarized that mission this to a number of dif ferent jobs at a number of dif ferent companies. Employee