Question: Based on the facts and results of

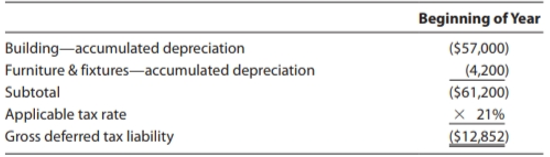

Based on the facts and results of Problem 30 and the beginning-of-the-year book-tax basis differences listed below, determine the change in Relix's deferred tax liabilities for the current year.

Data from Problem 30:

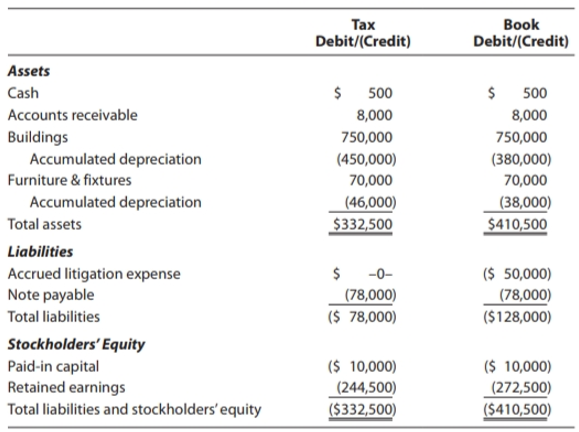

Relix, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Based on this information, determine Relix's net deferred tax asset or net deferred tax liability at year-end. Assume a 21% Federal corporate tax rate and no valuation allowance.

> What is securitization, and how does it facilitate investment in real estate assets?

> What role does an investment bank play in a public offering? Describe an underwriting syndicate.

> You are the chief financial officer (CFO) of Gaga Enterprises, an edgy fashion design firm. Your firm needs $10 million to expand production. How do you think the process of raising this money will vary if you raise it with the help of a financial instit

> What general procedures must a private firm follow to go public via an initial public offering (IPO)?

> What four ways do VCs use to organize their businesses? How do they structure and price their deals?

> Describe the roles of, and the relationships among, the major parties in a corporation: stockholders, board of directors, and managers. How are corporate owners rewarded for the risks they take?

> What different aspects of financial markets do the Securities Act of 1933 and the Securities Exchange Act of 1934 regulate?

> What are financial institutions? Describe the role they play within the financial market environment.

> If managers do not act in the best interests of shareholders, what role might incentives play in explaining that behavior?

> What are the major differences between accounting and finance with respect to emphasis on cash flows and decision making?

> What is the primary economic principle used in managerial finance?

> Why is it important that managers recognize that a tradeoff exists between risk and return? Why does that tradeoff exist?

> How can you determine the unknown number of periods when you know the present and future values—single amount or annuity—and the applicable rate of interest?

> What does it mean when we say that individuals as a group are net suppliers of funds for financial institutions? What do you think the consequences might be for financial markets if individuals consumed more of their incomes and thereby reduced the suppl

> Describe the procedure used to amortize a loan into a series of equal periodic payments.

> How can you determine the size of the equal, end-of-year deposits necessary to accumulate a certain future sum at the end of a specified future period at a given annual interest rate?

> For what three main reasons is profit maximization potentially inconsistent with wealth maximization?

> How do market forces—both shareholder activism and the threat of takeover—prevent or minimize the agency problem? What role do institutional investors play in shareholder activism?

> You are responsible for managing your company’s short-term investments and you know that the compounding frequency of investment opportunities is quite important. Using the information provided at MyLab Finance, calculate the future value of an investmen

> Differentiate between a nominal annual rate and an effective annual rate (EAR). Define annual percentage rate (APR) and annual percentage yield (APY).

> What two characteristics make a security marketable? Why are the yields on nongovernment marketable securities generally higher than the yields on government issues with similar maturities?

> What are three mechanisms of cash concentration? What is the objective of using a zero-balance account (ZBA) in a cash concentration system?

> What are the three main advantages of cash concentration?

> What are the firm’s objectives with regard to collection float and to payment float?

> Ross Company, a manufacturer of pharmaceuticals, has pretax ordinary income of $500,000 and has just sold for $150,000 an asset purchased 2 years ago for $125,000. Using Table 1.2, calculate the tax liability for the company this year. Table

> What is float, and what are its three components?

> What are some of the major reasons for the rapid expansion in international mergers and joint ventures of firms?

> Outline the changes to be undertaken in intra-MNC accounts if a subsidiary’s currency is expected to depreciate in value relative to the currency of the parent MNC.

> Discuss the steps to be followed in adjusting a subsidiary’s accounts relative to third parties when that subsidiary’s local currency is expected to appreciate in value in relation to the currency of the parent MNC.

> What is the Eurocurrency market? What are the main factors determining foreign exchange rates in that market? Differentiate between the nominal interest rate and the effective interest rate in this market.

> What are the long-run advantages of having more local debt and less MNC-based equity in the capital structure of a foreign subsidiary?

> Describe the difference between foreign bonds and Eurobonds. Explain how each is sold, and discuss the determinant(s) of their interest rates.

> Briefly discuss some of the international factors that cause the capital structures of MNCs to differ from those of purely domestic firms.

> Indicate how NPV can differ depending on whether it is measured from the parent MNC’s point of view or from that of the foreign subsidiary, when cash flows may be blocked by local authorities.

> Discuss macro and micro political risk. What is the emerging third path to political risk? Describe some techniques for dealing with political risk.

> Recently, some branches of Donut Shop, Inc., have dropped the practice of allowing employees to accept tips. Customers who once said, “Keep the change,” now have to get used to waiting for their nickels. Management even instituted a policy of requiring t

> Explain how differing inflation rates between two countries affect their exchange rate over the long term.

> Define spot exchange rate and forward exchange rate. Define and compare accounting exposures and economic exposures to exchange rate fluctuations.

> Under FASB No. 52, what are the translation rules for financial statement accounts? How does the temporal method differ from these rules?

> Discuss the major reasons for the growth of the Euro market. What is an offshore center? Name the major participants in the Euro market.

> From the point of view of a U.S.-based MNC, what key tax factors need to be considered?

> What is a joint venture? Why is it often essential to use this arrangement? What effect do joint-venture laws and restrictions have on the operation of foreign-based subsidiaries?

> What are the important international trading blocs? What is the European Union, and what is its single unit of currency? What is GATT? What is the WTO?

> All-Stores Inc. is a holding company that has voting control over both General Stores and Star Stores. All-Stores owns General Stores and Star Stores common stock valued at $15,000 and $12,000, respectively. General’s balance sheet lists $130,000 of tota

> Phylum Plants’ stock is currently trading at a price of $55 per share. The company is considering the acquisition of Taxonomy Central, whose stock is currently trading at $20 per share. The transaction would require Phylum to swap its shares for those of

> Willow Enterprises is considering the acquisition of Steadfast Corp. in a stock swap transaction. Currently, Willow’s stock is selling for $45 per share. Although Steadfast’s shares are currently trading at $30 per share, the firm’s asking price is $60 p

> You have been made treasurer for a day at AIMCO, which develops technology for video conferencing. A manager of the satellite division has asked you to authorize a capital expenditure in the amount of $100,000. The manager states that this expenditure is

> Santana Music is a U.S.-based MNC whose foreign subsidiary had pretax income of $55,000; all after-tax income is available in the form of dividends to the parent company. The local tax rate is 40%, the foreign dividend withholding tax rate is 5%, and the

> Based on the facts and results of Problems 30-32, determine Relix's change in net deferred tax asset or net deferred tax liability for the current year. Provide the journal entry to record this amount. Data from Problem 30: Relix, Inc., is

> Based on the facts and results of Problem 30 and the beginning-of-the year book-tax basis differences listed below, determine the change in Relix's deferred tax assets for the current year. Data from Problem 30: Relix, Inc., is a domestic corporation

> Relix, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year. Based on this information, determine Relix's net deferred tax asset or net deferred tax liability at year-end. Assume a 21% Federal

> Continue with the results of Problem 28. Prepare the GAAP journal entries for Willingham's income tax expense. Data from Problem 28: Willingham, Inc., an accn1al basis C corporation, reports pretax book income of $1.6 million. At the beginning of the t

> Rubio, Inc., an accrual basis C corporation, reports tl1e following amounts for tl1e tax year. The applicable income tax rate is 30%. Compute Rubio's taxable income. Book income, including the items below $80,000 Increase in book allowance for antic

> Continue with the results of Problem 24. Prepare the GAAP journal entries for Britton's year 1 income tax expense. Data from Problem 24: Britton, Inc., an accrual basis C corporation, sells widgets on credit. Its book and taxable income for year 1 tota

> Britton, Inc., an accrual basis C corporation, sells widgets on credit. Its book and taxable income for year 1 totals $60,000 before accounting for bad debts. Britton's book allowance for uncollectible accounts increased for year 1 by $10,000, but none o

> Continue with the results of Problem 22. Prepare the GAAP journal entries for Phillips's year 1 income tax expense. Data from Problem 22: Phillips, Inc., a cash basis C corporation, completes $100,000 in sales for year 1, but only $75,000 of this amoun

> In the current year, Dickinson, Inc., reports an effective tax rate of 36%, and Badger, Inc., reports an effective tax rate of 21%. Both companies are don1estic and operate in the same industry. Your initial examination of the financial statements of the

> Five years ago, Bridget decided to purchase a limited partnership interest in a fast-food restaurant conveniently located near the campus of Southeast State University. The general partner of the restaurant venture promised her that the investment would

> HippCo and HoppCo operate in the same industry and report the following tax rate reconciliations in their tax footnotes. Compare and contrast the effective tax rates of these two con1panies. HippCo НoppCo Hypothetical tax at U.S. rate 35.0% 35.0% St

> Jill i5 the CFO of PorTech, Inc. PorTech's tax advisers have recommended two tax Decision Making planning ideas that will each provide $5 million of current-year cash tax savings. One idea is based on a timing difference and is expected to reverse in ful

> You saw on the Business News Today blog that YoungCo has "released one third of its valuation allowances because of an upbeat forecast for sales of its tablet computers over the next 30 months." What effect does such a release likely have on YoungCo's cu

> Using the facts of Problem 14, detern1ine the following. a. The 2019 end-of-year balance in Mini's deferred tax asset and deferred tax liability balance sheet accounts. b. The cost to Mini of the deferral of the bad debt deduction, considering the time v

> Mini, in Problem 12, reports $800,000 of pretax book net income in 2019. For that year, Mini did not deduct any bad debt expense for book purposes but did deduct $15,000 in bad debt expense for tax purposes. Mini reports no other temporary or permanent d

> Using the facts of Problem 10, determine the following. a. The 2019 end-of-year balance in Prance's deferred tax asset and deferred tax liability balance sheet accounts. b. The value to Prance of d1e accelerated tax deduction for depreciation, consideri

> Locate the following Code provisions, and give a brief description of each Communications in an e-mail to your instructor. a. § 6l (a)(l3). b. § 643(a)(2). c. § 2503(g)(2)(A).

> Is there an auton1atic right to appeal to the U.S. Supreme Court? If so, what is the process?

> In the citation Schuster's Express, Inc., 66 T.C. 588 (1976), aff'd 562 F.2d 39 (CA-2, 1977), nonacq., to what do the 66, 39, and nonacq. refer?

> Discuss the probable non-revenue justifications for each of the following provisions of the tax law. a. A tax credit allowed for electricity produced from renewable sources. b. A tax credit allowed for the purchase of a motor vehicle that operates on al

> Ruth Ames died on January IO, 2018. In filing the estate tax return, her executor, Melvin Sims, elects the primary valuation date and amount (fair market value on the date of death). On March 12, 2018, Melvin invests $30,000 of cash that Ruth had in her

> A disproportionate amount of the Federal income tax is paid by individuals Communications at upper income levels. Is this a desirable condition? Defend your position in no more than three PowerPoint slides, to be presented to your Business Economics clas

> Ashley runs a small business in Boulder, Colorado, that makes snow skis. She expects the business to grow substantially over the next three years. Because she is concerned about product liability and is planning to take the company public in year 2, she

> LaceCo has adopted certain aggressive policies concerning it5 transfer pricing procedures. The entity estimates that it will reduce its Federal income tax liability by $400,000 as a result of these strategies, but that the IRS is likely to challenge die

> On May 28, 2018, J\1ary purchased and placed in service a new $20,000 car. The car was used 600A. for business, 200A. for production of income, and 200/o for personal use in 2018. In 2019, the usage changed to 400/o for business, 300A. for production of

> On June 5, 2017, Leo purchased and placed in service a new car that cost $20,000. The business use percentage for the car is always 100%.. Leo claims any available additional first-year depreciation. Compute Leo's cost recovery deduction for 2017 and 201

> On October 15, 2018, Jon purchased and placed in service a used car. The purchase price was $25,000. This was the only business use asset Jon acquired in 2018. He used the car 80% of the time for business and 200A. for personal use. Jon used the regular

> Jabari Johnson is considering acquiring an automobile at the beginning of 2019 that he will use 100% of the time as a taxi. The purchase price of the automobile is $35,000. Johnson has heard of cost recovery limits on automobiles and wants to know die ma

> Jamie purchased $100,000 of new office f1.1miture for her business in June of the current year. Jamie understands that if she elects to use ADS to compute her regular income tax, there will be no difference between the cost recovery for computing the reg

> In January 2018, Pelican, Inc., established an allowance for uncollectible accounts (bad debt reserve) of $70,000 on its books and increased the allowance by S 120,000 during the year. As a result of a client's bankruptcy, Pelican, Inc., decreased the al

> On June 5, 2017,Javier Sanchez purchased and placed in service a 7-year class asset costing $560,000 for use in his landscaping business, which he operates as a single member LLC (Sanchez Landscaping LLC). During 2017, his business generated a net income

> During 2018, John was the chief executive officer and a shareholder of Maze, Inc. He owned 60% of the outstanding stock of Maze. In 2015, John and Maze, as co-borrowers, obtained a $100,000 loan from United National Bank. This loan was secured by John's

> Dove Corporation, a calendar year C corporation, had the following information for 2018: Based on the above information, use Schedule M-2 of Form 1120 (see Example 50 in the text) to determine Dove's unappropriated retained earnings balance as of Decem

> A business building owned by an individual taxpayer on which straight- Digging Deeper line depreciation of $13,000 was taken is sold on the installment basis for S 100,000 with $20,000 down and four yearly installments of $20,000 plus interest. The adjus

> The following information for 2018 relates to Sparrow Corporation, a calendar year, accrual method taxpayer. Based on the above information, use Schedule M- 1 of Form 1120, which is available on the IRS website, to determine Sparrow's taxable income fo

> Hector and Walt are purchasing the Copper Partnership from Jan and Gail for $700,000; Hector and Walt will be equal partners. During the negotiations, Jan and Gail succeeded in having the transaction structured as the purchase of the partnership rather t

> Repeat the computations of Problem 36, but now assume that State B uses a double-weighted sales factor in its apportionment formula. Data from Problem 36: PinkCo, Inc., operates in two states, both of which equally weight the three apportionment factor

> Renee and Sanjeev Patel, who are n1arried, reported taxable income of $1,008,000 for 2018. They incurred positive AMT adjustments of $75,000 and tax preference iten1s of $67,500. The couple itemizes their deductions. a. Compute the Patels' AMT! for 2018

> Pat is 40, is single, and has no dependents. She received a salary of $390,000 in 2018. She earned interest income of $11,000, dividend income of $15,000, gambling winnings of $14,000, and interest income from private activity bonds (issued in 2015) of $

> Jane and Robert Brown are married and have eight children, all of whom are eligible to be claimed as the couple's dependents. Robert earns $196,000 working as a senior n1anager in a public accounting firm, and Jane earns $78,000 as a second-grade teacher

> Tan1my and Willy own 40%. of the stock of Roadn1nner, an S corporation. The other 60"A. is owned by 99 other shareholders, all of whom are single and unrelated. Tamn1y and Willy have agreed to a divorce and are in the process of negotiating a property se

> Included in Alice's regular taxable income and in her AMT base is a $300,000 capital gain on the sale of stock she owned for three years. Alice is in the 20% tax bracket for net capital gains for regular incon1e tax purposes. a. What rate should Alice us

> Esther owns a large home on the East Coast. Her home is surrounded by large, mature oak trees that significantly increase the value of her home. In August 2017, a hurricane damaged many of the trees surrounding her home; her region was declared a Federal

> Chuck is single, has no dependents, and does not itemize deductions. In 2018, he reports taxable income of $320,000. His tax preferences total $51,000. What is Chuck's AMTI for 2018?

> Gabriel, age 40, and Emma, age 33. are married with two dependents. They recorded AG! of $250,000 in 2018 that included net investment income of $3,000 and gambling winnings of $2,500. The couple incurred the following expenses during the year (all of wh

> Ann and Bill were on the list of a local adoption agency for several years, seeking to adopt a child. Finally, in 2017, good news comes their way, and an adoption seems imminent. They paid qualified adoption expenses of $5,000 in 2017 and $11,000 in 2018

> Rover Corporation would like to transfer excess cash to its sole shareholder, Aleshia, who is also an employee. Aleshia is in the 24% tax bracket, and Rover is in the 21 % bracket. Because Aleshia's contribution to Rover's profit is substantial, Rover be

> Turtle, a C corporation, reports taxable income of $200,000 before paying salaries to the two equal shareholder-employees, Britney and Alan. Turtle follows a policy of distributing all after-tax earnings to the shareholders. a. Determine the tax conseque

> Sammy and Monica, both age 67, incur and pay n1edical expenses in excess of insurance reimbursements during the year as follows. Sammy and Monica's 2018 AG! is $130,000. They file a joint return. Chuck and Carter are Sammy and Monica's dependents. a.

> Flicker, a single men1ber LLC, acquired a passive activity this year. Gross income from operations of the activity was S 160,000. Operating expenses, not including depreciation, were $122,000. Regular income tax depreciation of $49,750 was computed under

> Lilia is going to be subject to the AMT in 2018. She owns an investment building and is considering disposing of it and investing in other realty. Based on an appraisal of the building's value, the realized gain would be $85,000. Two individuals have ind

> Jo and Velma are equal owners of JV Company. Jo invests $500,000 cash in the venture. Velma contributes land and a building (basis to her of $125,000, fair market value of $500,000). TI1e entity then borrows $250,000 cash using recourse financing and $10