Question: Beans Company purchased a special machine at

Beans Company purchased a special machine at a cost of $81,000 plus provincial sales tax of $6,480 (non-recoverable). Component parts are not significant and need not be recognized and depreciated separately. The machine is expected to have a residual value of $6,000 at the end of its service life.

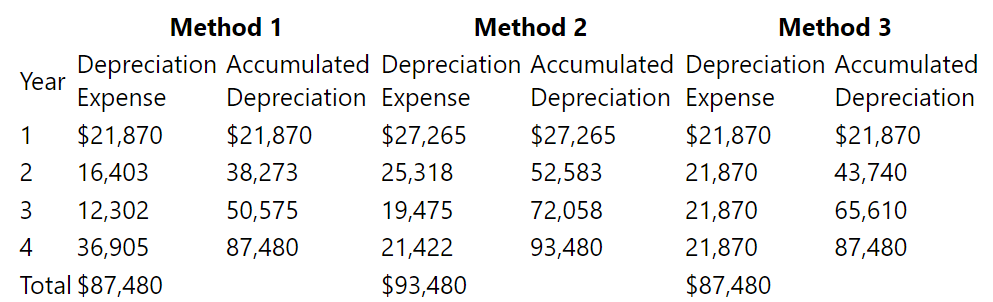

To assist in preparing the journal entries for depreciation of this machine, your assistant prepared the following spreadsheet:

Beans Company

Cost of asset $87,480

Asset’s residual value 6,000

Years of service life 4

Output in units Year 1 1,400

Year 2 1,300

Year 3 1,000

Year 4 1,100

The spreadsheet includes statistics relating to the machine and calculates depreciation using three different methods—productive-output, straight-line, and declining-balance at a 50% rate. However, due to some carelessness, your assistant made at least one error in the calculations for each method.

Required:

1. Identify which method is the:

1.Productive-output method

2.Straight-line method

3.Declining-balance method (50% rate)

2. Describe the error(s) made in the calculations for each method.

3. Recalculate depreciation expense for Year 2 under each method.

> 16 July 20X7: Sachet Inc. purchased the following 15,000 shares in Zynic Inc., a European corporation, for €32 per share. Management designated the shares as FVOCI. Total commissions and fees to purchase the shares: €1,300. - 31 December 20X7: Zynic shar

> On 22 May 20X5, Friedland Ltd. purchased 52,000 shares of Gerstan Ltd. for US$13.40 per share, plus US$2,000 in commissions and fees. The shares were purchased from a broker on account, with later cash payment. On 22 May 20X5, the exchange rate was US$1

> Cudmore Ltd. had two FVTPL investments at the end of 20X4, disclosed on the SFP as follows: Kelowna Ltd. 2,000 shares $ 88,700 Burnaby Corp. 7,200 shares 66,240 $154,940 By the end of 20X4, unrealized losses of $3,700 related to the Kelowna Ltd. shares a

> During 20X2, Morran Company purchased shares in two corporations and bond securities of a third. The share investments are classified as FVOCI-Equity and the bond investment is FVTPL. Transactions in 20X2 include: 1. Purchased 3,000 of the 100,000 common

> Selected accounts from the SFP of MNN Ltd. at 31 December 20X4 and 20X5 are presented below. Depreciation was $40,000 for equipment, $60,000 for buildings, and $75,000 for machinery. A new machine was purchased in 20X5, with 25% of the price paid in cash

> On 30 April 20X2, Marc Company purchased 4,000 shares of Spencer Ltd. for $17 per share plus $400 in commission. In 20X2, the company received a $0.65 per share dividend, and the shares had a fair value of $16 per share at the end of the year. In 20X3, t

> London Ltd. reported the following transactions and information regarding the shares of Dolma Corp: - 15 October 20X2, purchased 3,000 shares at $42 per share plus $1,200 commission. - 1 December 20X2, received $0.50 per share cash dividend. - 31 Decembe

> On 1 November 20X8, Porter Company acquired the following FVTPL investments: - Minto Corp.—2,000 common shares at $15 cash per share - Pugwash Corp.—700 preferred shares at $25 cash per share The annual reporting period ends 31 December. Quoted fair valu

> At the end of 20X9, Canfrax Corp. Ltd. reported an unrealized loss on Comet Company shares of $24,600 in earnings. Investments were reported on the statement of financial position as follows: Long-term assets: investments: Star Co. common shares $1,370,1

> Shyloft Corporation purchased $85,000, 7% bonds of Coyyle Ltd. on 2 July 20X3. Interest is paid 1 July and 1 January. The bonds expire on 30 June 20X13. The market interest rate at the time of purchase was 6.5%. The fair value of the bond is as follows:

> The following investments are held by investors that are public companies: 1. A $5,000,000 5% publicly traded 10-year bond of Tree Ltd. The bonds are held for short-term capital appreciation, as the investor is expecting interest rates to change. 2. A $4

> Quality Producers acquired factory equipment on 1 January 20X5, costing $156,000. Component parts are not significant and need not be recognized and depreciated separately. In view of pending technological developments, it is estimated that the machine w

> Mace Company acquired equipment that cost $36,000, which will be depreciated on the assumption that the equipment will last six years and have a $2,400 residual value. Component parts are not significant and need not be recognized and depreciated separat

> You have been asked to explain the appropriate policy for depreciation for the following two cases for a major utility: 1. Case A The utility has a number of transformers in its transformer stations that transform power from a high voltage to a lower vol

> The company purchased a machine for $25,000 cash. The machine will probably have a useful life of 10 years but it has a component part that will need to be replaced every two and a half years. The cost to replace this part is $250. 2. Case B The company

> Selected accounts from the SFP of Lexy Ltd. at 31 December 20X7 and 20X6 are presented below. During the year, equipment with an original cost of $200,000 and net book value of $85,000 was sold at a loss of $15,000. Other equipment was purchased for cash

> Technology Inc. (TI) has the following intangible assets: 1. Case A TI acquired a patent from another company that expires in 10 years. The purpose of the purchase was to eliminate competition for one of its top-selling products. Based on market surveys,

> The methods of depreciation or amortization demonstrated in the chapter include the following: 1. Straight-line 2. Productive-output 3. Declining-balance Required: Indicate the likely choice of depreciation or amortization method expected under each of t

> Tinoy Corporation manufactures bath toys for toddlers. Tinoy has 3 machines it utilizes in the manufacturing process. Between 20X5 and 20X9 production volume has been consistent with each machine producing approximately the same production totals. The ma

> Bitum Incorporated purchased equipment in 20X1 and at that time the estimated useful life of the equipment was estimated to be 12 years. Management’s estimated maintenance costs would be less than $300 in the first 2 years, $500 in the

> The following information is available for a machine owned by Sorano Inc. at 31 December 20X4: Machine original cost $12 million Salvage value $0 Purpose of machine: Manufacturing Remaining useful life 5 years Depreciation method Straight-line Machine—ac

> Immersive Inc. adopts IFRS and has a 31 December year-end date. 2. On 1 January 20X3 Immersive Inc. acquired a tract of land and a building for a lump-sum price of $35 million; $25 million was allocated to the land and $10 million to the building. The bu

> Kalua Inc. is a small manufacturing plant. All produced goods pass through one key piece of machinery that was purchased in 20X2 for $6 million. The machine is being depreciated using a variable charge method. Revenues have been relatively stable between

> Gardner Inc. manufactures products in two plants. One of the plants is an area where there has been a downturn in the market, and indications are that there has been potential impairment. Gardner has determined that the asset group includes land, buildin

> Refer to the facts in A10-22 and assume the company is following the accounting standards for private enterprises. Required: Is the machine impaired? If so, what is the amount of the impairment loss? Data from A10-22: Yuan Inc. has a large piece of mach

> Brioche Incorporated is a private company that uses IFRS for financial reporting. The company acquired equipment for $90,000 on 1 January 20X1. At acquisition, Brioche estimated the equipment would have a useful life of 10 years. The residual value was e

> Selected accounts from the SFP of Gabby Ltd. at 31 December 20X7 and 20X6 are presented below. Gabby reported earnings of $125,000 in 20X7, and depreciation expense was $20,000. Required: Calculate cash from operating activities for 20X7. Good form is no

> There are three valuation models described in Chapters 9 and 10: 1. Cost model 2. Revaluation model 3. Fair-value model Required: Explain the major differences among the models, including an explanation of how depreciation and impairment is treated in ea

> Scenario A Yaloo Incorporated purchased machinery on 2 December 20X2. Delivery was guaranteed within 10 days and the machinery arrived on 7 December 20X2. Installation took place between 10 December and 15 December 20X2. Testing of the machinery commence

> MH Plumbing Inc. (MH) is the largest plumbing contractor in Moncton, Alberta. Information on selected transactions/events is given below: 1. On 15 January 20X2, MH purchased land and a warehouse building for $455,000. The land was appraised at $175,000,

> Syan Corp. reflected the following on the 31 December statement of financial position: Syan Corp. also reflected the following on the 31 December year-end adjusted trial balance: Impairment loss $120,000 Depreciation expense 50,000 Gain on sale of machin

> Lindsay Ltd. reflected the following items in the 20X5 financial statements: Income statement Depreciation expense, machinery $1,200,000 Amortization expense, patent 240,000 Loss on sale of machinery 100,000 Gain on sale of land 120,000 Balance sheet Dec

> Information has been collected regarding Price Inc.’s cash-generating unit that includes goodwill. At 31 December 20X5, the assets of the Price’s CGU are shown as follows (in millions): An impairment test indicates tha

> Information has been collected regarding Orange Company’s cash-generating unit that includes goodwill. At 31 December 20X5, the assets of the Orange Company’s cash-generating unit are shown as follows (in millions) on

> The abrasives group of Chemical Products Inc. (CPI) has been suffering a decline in its business, due to new product introductions by competitors. At 31 December 20X5, the assets of the abrasives cash-generating unit are shown as follows (in millions) on

> Yuan Inc. has a large piece of machinery, and management has determined there is potential impairment. This piece of machinery has independent cash inflows. The following information relates to the machine: - Net book value is $14 million. - The machine

> Softsweat Inc. is a software development company. It has several products on the market, including the widely used PlayMark animation software. The cash flows from PlayMark are clearly distinguishable within Softsweat. The company has recorded developmen

> Selected accounts from the SFP of UVI Ltd. at 31 December 20X4 and 20X5 are presented below. UVI reported earnings of $407,000 in 20X5, and depreciation expense was $35,000. Required: Calculate cash from operating activities for 20X5. Good form is not re

> Marlene Inc. produces several lines of office furniture. All of the furniture is sold through sales agents who sell the full array of lines. Each line is developed by the company internally, and the development costs are capitalized and amortized over 12

> Portions of the 20X2 financial statements of Williams Company, a paint manufacturer, are reproduced below (in thousands of dollars): Partial Income Statement for the year ended 31 December 20X2 Net sales $2,266,732 Total expenses 2,079,455 Income before

> Bright Designs Ltd. began operations in 20X5 and, at the end of its first year of operations, reported a balance of $601,500 in an account called “intangibles.” Upon further investigation, it is discovered that the account had been debited throughout the

> The following select data has been extracted from Reelo Inc.’s financial records relating to equipment acquisitions during 20X7 and 20X8. On 31 December 20X8 equipment was retired which had an original cost of $56,000. The retirement ha

> The following information relates to Riggs Corp.’s purchase of equipment on 15 June 20X7: Invoice price $420,000 Discount for early payment (if paid by 30 June) 2,100 Shipping costs 4,000 Installation 3,000 Testing 6,000 The equipment was installed and t

> A large piece of equipment acquired on 1 January 20X5 by Kapadia Company has four major components for depreciation. Details regarding each component are given in the schedule below: Required: 1. Calculate the depreciation for 20X5. Use the straight-line

> Earth Construction Inc. (ECI) bought a large piece of construction equipment at the beginning of 20X5. - The construction equipment was a large piece of heavy equipment with an original cost of $1,200,000. This equipment was broken out into four componen

> Boat Ltd. has a major asset that has just been purchased and has been segregated into the following significant components made up of spare parts and major inspections. Component D consists of a group of insignificant components lumped together with an a

> On 1 March 20X9 Tunio Corp. purchased a copper mine on a land site for $3,500,000, and $1 million of the purchase price related to the land. At the time of purchase, an expert estimated 5 million tonnes of copper could be extracted. Tunio invested $500,0

> Gaspe Mining Corp. bought mineral-bearing land for $600,000. Engineers and geologists estimate that the site will yield 400,000 kilograms of economically removable ore. The land will have a net recoverable value of $80,000 after the ore is removed; this

> The following items may represent specific line item requirements on the statement of cash flows. Required: Indicate whether each item is required by IFRS, by ASPE, or by both in preparing a cash flow statement.

> Bellair Corp. a tool-making company, acquired equipment for $4M on 1 January 20X7. The equipment had an estimated useful life of eight years at acquisition and the residual value was estimated at $440,000. Bellair Corp. estimated that the newly acquired

> Nancy O’Callaghan, the president of Clean Enterprises, is proposing the following amortization policy for property, plant, and equipment: I want to keep things simple and minimize any deferred tax liabilities. I propose we use the CCA rates for declining

> Tillie Corp. had the following accounts relating to property, plant, and equipment on its 31 December 20X2 balance sheet: Land $384,000 Buildings 832,000 Equipment 1,024,000 Leasehold improvements 512,000 The following information was provided relating t

> 1. Cost of an oil change on the company’s truck. 2. Cost of major brake replacement in a large piece of construction equipment that is expected to be completed every two years. 3. Lawyers’ fees associated with a successful patent application. 4. Lawyers’

> GTT Company had the following transactions in 20X4: 1. On 1 January 20X4, a new machine was purchased at a list price of $22,500. The company did not take advantage of a 2% cash discount available upon full payment of the invoice within 30 days. Shipping

> Starling Ltd. bought a building for $1,060,000. Before using the building, the following expenditures were made: Repair and renovation of building $105,000 Construction of new paved driveway 27,500 Upgraded landscaping 4,200 Wiring 16,000 Deposits with u

> Kettle Creek Inc. has various transactions in 20X6: 1. Plant maintenance was done at a cost of $70,400. 2. The entire manufacturing facility was repainted at a cost of $88,000. 3. The roof on the manufacturing facility was replaced at a cost of $132,400.

> IMG owns a number parcels of land. The land is held by IMG for future development purposes (no intention to sell). IMG accounts for its land using the revaluation model under IFRS. The below graph summarizes the fair-value changes for the land owned for

> On 13 February 20X5, Reekwa Company purchased an office tower for $30 million. The office is a mixed-use property: it is owner-occupied and includes rental units. The fair value of the building on 31 December 20X6 is $30.4 million and $26.9 million on 31

> The following independent items relate to classification on the statement of cash flows in accordance with IFRS. True / False? 1. Cash paid for income tax may be included in any section of the statement of cash flows, based on management discretion. 2. C

> Indicate whether each statement is true or false. If the statement is false, provide a brief explanation of why it is false. 1. The U.S. SEC will accept financial statements from U.S.-listed foreign companies in their home-country accounting standards. 2

> On 28 April 20X2, Peele Realty purchased land and building for $4.65 million and $2.79 million, respectively. The company uses the revaluation model for the land and building. Assume that the land is revalued annually. The building is revalued every two

> Real Estate Inc. (REI) has made the decision to use the revaluation model for its land. This is the only tract of land in this class. REI has a 31 December year-end. The following are independent situations. 1. Case A REI purchased a tract of land in 20X

> Scarlett Inc. purchased a tract of land with an office building and equipment included. The cash purchase price was $900,000 plus $50,000 in fees connected with the purchase. The following data were collected concerning the property: Required: Give the e

> Pipa Incorporated entered into an arrangement with Gianardo Ltd. to exchange equipment and cash. Pipa gave up a piece of equipment that was no longer being used by the business, as well as $11,500 in cash. The equipment had a net book value of $38,000 (c

> Ricardo Heavy Hauling has some earth-moving equipment that cost $432,000; accumulated amortization is $288,000. Ricardo traded equipment with another construction company. The fair value of Ricardo’s old equipment is estimated to be $225,000, and the fai

> 1. GYT Co. exchanges a machine that cost $4,000 and has accumulated amortization of $2,560 for a similar machine. GYT also receives $25 in the exchange. The fair market value of the old asset is $750. The fair market value of the new asset is $725. There

> Refer to the facts in A9-8. Required: For each of the above items, using ASPE, give the name of the account to which the expenditure should be charged. That is, which account should be debited? Be specific. Indicate the items that are different as compar

> Parks Inc. had recently completed construction of a new manufacturing facility. Prior to the approval of the building permits, the company operated a parking lot on the land. The lot had revenues, net of costs, of $130,000. Construction will take place o

> On 27 February 20X7, JJJ Inc. upgraded its windows and doors in order to make the building green-certified. The upgrades have a 20-year useful life. JJJ will receive a 30% rebate on total cost if it can demonstrate reduced utilities draw by 50% over a 5-

> Gysbers Company has embarked on a 2-year pollution-control program that will require the purchase of 2 smokestack scrubbers costing a total of $600,000. One scrubber will be bought in 20X5 and one in 20X6. These scrubbers qualify for an investment tax cr

> Information related to various financial statement items is provided for three cases: Case A Interest expense was $26,400. Interest payable had an opening balance of $11,200 and a closing balance of $7,300. The discount on bonds payable was amortized by

> On 1 July 20X4, Theriout Corp. acquired a manufacturing plant in Cape Breton for $1,750,000. The plant, employing 50 workers, began operation immediately and is expected to be in operation for 16 years with no residual value. In connection with the purch

> On 1 January 20X2, Rental Inc. purchased an apartment building. Apartments in this area are in high demand, and a wait list exists for potential tenants. The following costs were incurred for the purchase: cash $8,000,000; legal fees $1,200,000; and repa

> Real Estate Company (REC) has a number of apartment buildings that it holds for rent. In addition, it is holding land for capital appreciation. REC will either sell the land if the price is right or use it to build additional rental property. This land h

> Macmulk purchased a new facility to run its operations. The total cost of the space was $1,719,000. The facility had the following significant components: Land, building, electrical, roof, interior fixtures, HVAC. The total fair value of the land was est

> Quispamsis Inc. (QI) recorded the following asset disposals during the year: 1. A computer system with an original cost of $47,600, 80% depreciated, was judged obsolete during the period and scrapped. 2. Automotive equipment, a large truck with an origin

> Machinery that cost $192,000 on 1 January 20X1 was sold for $72,000 on 30 June 20X6. It was being depreciated over a 10-year life by the straight-line method, assuming its residual value would be $12,000. A building that cost $1,700,000, residual value $

> During 20X4, the Pencil Corp. entered into negotiations to buy Stilo Company, finally agreeing on a final cash purchase price of $534,000. Pencil will acquire all assets and liabilities of Stilo effective 31 December 20X4, except for the existing cash ba

> Purple Corp. purchased all of the listed assets and liabilities of Sudden Corp. for $1,600,000. The following assets and liabilities were purchased: Required: 1. What is the appropriate amount that would be recorded for goodwill? 2. Prepare the journal e

> Cocochips is a manufacturer of vegan snacks and treats, including a unique brand of granola and a distinct brand of coconut-flavoured chips and snacks. The company began its operations in 20X8, and incurred the following amounts: 1. $4,500 to a consultin

> Transactions during 20X5, the first year of the newly organized Nancy’s Discount Foods Corp. (NDFC), included the following: 2 Jan. Paid $12,000 lawyer’s fees and other, related costs to register the name and trademark of the company in various jurisdict

> Selected accounts from the SFP of TMI Ltd. at 31 December 20X4 and 20X5 are presented below. Required: Calculate the change in cash for the year.

> Yucatan Tours Corp. (YTC) established a new division in 20X8. The mandate of this new division is to establish a presence in the growing luxury eco-tourism travel business. This division will offer, through a sophisticated website, online quotes and book

> Images Ltd. is a new company whose only operation is the development of a new kind of video camera that will link to home computers and easily allow image transfer. The camera will come with a program to allow editing, so customers can edit their home mo

> Impact Systems Inc. has recently designed and developed its own payroll system intended for internal use. If there is a market, the company may also decide to sell it to outside companies. Work on this project was completed over an 18-month period. The f

> Victor Medical Solutions Ltd. has a major scientific program under way, financed through an issuance of common shares. The program has an expected budget in excess of $55 million, and $17.9 million has been spent to date. The program targets technology t

> AGT Ltd. has identified several assets: 1. Airplane 2. Wind farm 3. Manufacturing facility 4. Cruise ship 5. Hydro lines Required: 1. For each asset, identify the possible significant components. 2. AGT has purchased an asset for $170,000; the asset has

> Discoveries Ltd. (DL) is involved in research and development related to new processes to make manufacturing more efficient and environmentally friendly. The company has been working on a number of new projects for the past three years. On 31 October 20X

> Airfield Answers Corp. had several expenditures in 20X5: 1. Testing new plastic prior to use in commercial production 2. Redesign of prototype to improve performance 3. Testing electronic instrument components during their production 4. Study of the poss

> Acehil owns and manages a consortium of apartments in the Edmonton Metropolitan Region. As part of a recent inspection by the fire department, Acehil has been mandated to upgrade the fire monitoring and sprinkler systems in 6 of their older buildings. In

> CC Recyclo Inc (CCRI) is a recycling manufacturer that melts down used plastic and repurposes them into new materials. CCRI has a factory (and land) located just outside of London, Ontario. On 5 January 20X1, new environmental legislation was passed requ

> Bruce Networks Ltd. (BNL) has a 10-year renewable lease contract with Open Ltd. (OL), the owner of a tall building in a major city. BNL is permitted to erect a transmission tower on the top of the building. BNL’s contract with OL requires BNL to dismantl

> 1. ASPE and IFRS both require note disclosure for related party transactions. 2. Future accounting policy changes are required note disclosure in IFRS only. 3. Both ASPE and IFRS require accrual of lawsuits that there is a 70% probability they will lose.

> Fong Corp. reported various transactions in 20X2: 1. Equipment with an original cost of $32,500 and accumulated depreciation of $26,000 was deemed unusable and was sold for $250 scrap value. 2. A new machine was acquired for $37,850. The invoice was mark

> Markus Company received two donations during the year. A long-term client donated a piece of artwork from his personal art collection to display in the company’s entranceway as a thank-you for all of the years the company had completed work for him immed

> Casa Corp. needed a warehouse and maintenance facility on its company site, which already housed three manufacturing/storage facilities and the company head office. The lowest outside bid for the facility was $3,200,000. Casa believed that it could succe

> Wonder Mountain Company operates a snow sports resort for skiers and snowboarders. The company has recently decided to replace an existing old chair lift with a new high-speed quad chair and expand the hill to allow for increased capacity. The chair lift

> Ted Khan owns Khan Development Inc. During 20X7, the following transactions took place: 1. Transaction A Khan acquired a parcel of land for $10,500,000 (plus 3% in real estate commissions). On closing, Khan paid $44,500 in legal fees as well as $22,400 i

> For each of the following assets, assign the asset to a category of long-lived asset and identify the available choices for valuation models (IFRS): 1. Rental apartment buildings 2. Manufacturing facility 3. Vacant land held for eventual sale 4. Vines in

> Yarn Textiles manufactures laces used in shoes, boots and sporting goods. The cost to manufacture shoe laces is $0.75 in direct materials, $0.60 in direct labour. Under normal capacity, the company estimates that total overhead is $0.58 per unit, based o