Question: Becky Olson established her corporation, Olson

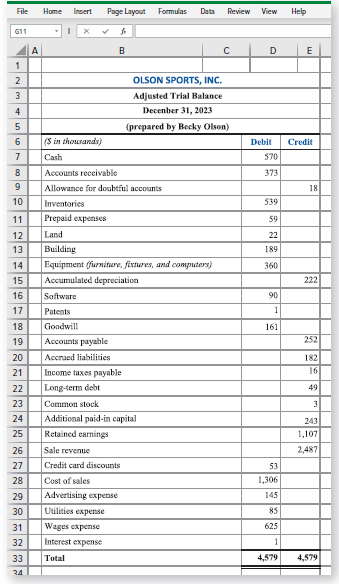

Becky Olson established her corporation, Olson Sports, Inc., several years ago in Boulder, Colorado, to sell hiking and ski equipment in her store and online. The annual reporting period for the company ends December 31. Becky prepared the adjusted trial balance below at the end of 2023. However, her CPA audited the trial balance information she presented and found several items that need to be updated before financial statements can be prepared. These items are listed below Becky’s trial balance. All amounts in the trial balance and in the listed items to be updated are in thousands of dollars.

a. On the last day of the year, failed to record the $100 sale of hiking merchandise to a customer who paid with his Visa credit card. Visa charges Olson Sports a 3 percent fee.

b. On December 31, failed to write off a $3 bad debt.

c. Failed to record bad debt expense for the year. After the write-off in (b), based on an aging of the accounts receivable, Olson Sports calculated that $21 will likely be uncollectible.

d. The auditor noted that the inventory is listed on the trial balance at current cost using the first-in, firstout method. However, it should be measured using the last-in, first-out method. Beginning inventory was 15 units at $10 per unit, the April 10 purchase was 40 units at $11 per unit, the July 2 purchase was 52 units at $13 per unit, and the October 4 purchase was 28 units at $16 per unit. The count of inventory on hand at the end of the year was 35 units.

e. Failed to record $10 in new store fixtures (equipment) that arrived at Olson Sports’s shipping dock during the last week of the year, with payment due to the manufacturer within 30 days. Olson Sports paid $1 cash for delivery and $3 to install the new fixtures.

f. On December 31, failed to record the sale of old computers (equipment) with a cost of $20 and a net book value of $8 for $3 cash. When they were sold, no depreciation had been recorded for the year. Olson Sports depreciates computer equipment using the straight-line method with a residual value of $4 over a four-year useful life. (Hint: Prepare two entries.)

g. Failed to amortize the accounting software that Olson Sports purchased at the beginning of the year. It is estimated to have a three-year useful life with no residual value. The company does not use a contra-account.

h. Failed to record the annual depreciation for the building and furniture (equipment):

• The building is depreciated using the straight-line method with a residual value of $9 over a 20-year useful life.

• Furniture costing $120 is depreciated using the double-declining-balance method with a residual value of $20 over a 10-year useful life. The accumulated depreciation of the furniture at the beginning of the year was $60.

i. Failed to record income tax expense for the year. Including the effects of the above entries, record Olson Sports’s income tax expense at an effective rate of 24 percent. Round your answer to the nearest dollar.

Required:

1. Prepare journal entries to record the transactions and adjustments listed in (a) through (i).

2. If you are completing this problem manually, create T-accounts, using the trial balance information as beginning balances, and then post the entries from requirement 1 to the T-accounts. Then prepare a revised adjusted trial balance. (If you are completing this problem in Connect, this requirement will be completed automatically for you using your responses to requirement 1.)

3. Prepare Olson Sports’s annual income statement (multiple-step format with income from operations subtotal), statement of stockholders’ equity, and classified balance sheet.

> Procter & Gamble is a multinational corporation that manufactures and markets many household products. In a recent year, sales for the company were $83,062 (all amounts in millions). The annual report did not disclose the amount of credit sales, so w

> Compute the component percentages for Trixy Magic’s income statement below. Discuss any trends you observe.

> Cintas designs and manufactures uniforms for corporations throughout the United States and Canada. The company’s stock is traded on the NASDAQ. Selected information from the company’s financial statements follows. Requ

> Last year, Spruce Company reported the following: This year, Spruce is considering whether to issue more debt to fund a $200,000 project or to issue additional shares of common stock. Both options will bring in exactly $200,000. Spruce’

> Caterpillar is the world’s leading manufacturer of construction and mining equipment. For each of the following transactions, indicate whether net cash inflows (outflows) from operating activities (NCFO), investing activities (NCFI), or financing activit

> Dell Technologies Inc. is a global technology provider that brings together hardware, software, and services. Some of the items included in its recent annual consolidated statement of cash flows presented using the indirect method are listed here. Indica

> As described in a recent annual report, Verizon Communications provides wireless voice and data services across one of the most extensive wireless networks in the United States. Verizon now serves more than 100 million customers, making it the largest wi

> A recent statement of cash flows for Apple contained the following information (dollars in millions): Required: For each of the asset and liability accounts listed on the statement of cash flows, determine whether the account balances increased or decrea

> Adidas AG is a global company that designs and markets sports and fitness products, including footwear, apparel, and accessories. Some of the items included in its recent annual consolidated statement of cash flows presented using the indirect method are

> Procter & Gamble (P&G) brands touch the lives of people around the world. Assume that in the current year the company had 10 billion shares of common stock authorized, 4 billion shares issued, and 3 billion shares outstanding. Par value is $1 per share.

> Assume General Motors Corporation is planning to issue bonds with a face value of $250,000 and a coupon rate of 6 percent. The bonds mature in five years and pay interest semiannually every June 30 and December 31. All of the bonds were sold on January 1

> Determine whether each of the following events results in an inflow or outflow of cash. For those that affect cash, state whether the inflow or outflow would be considered an operating, investing, or financing cash flow under GAAP. Required: 1. A bond wi

> Using the data from the previous exercise, complete the following requirements. Required: Determine the financial statement effects for each of the following: (a) the issuance of the note on November 1, (b) the impact of the adjusting entry at the end of

> On January 1, Steph Grant decided to deposit $58,800 in a savings account that will provide funds four years later to send his son to college. The savings account will earn 8 percent annually. Any interest earned will be added to the fund at year-end (ra

> Tootsie Roll Industries, Inc., is engaged in the manufacture and sale of confectionery products. Assume that last year, Tootsie Roll reported cost of goods sold of $352 million. This year, cost of goods sold was $342 million. Accounts payable was $9 mill

> Saks Fifth Avenue’s balance sheet for a recent year revealed the following information: Determine the amount of working capital reported in the balance sheet.

> In a recent 10-K report, United Parcel Service states it “is the world’s largest package delivery company, a leader in the United States less-than-truckload industry, and the premier provider of global supply chain man

> Abercrombie and Fitch is a leading retailer of casual apparel for men, women, and children. Assume that you are employed as a stock analyst and your boss has just completed a review of the new Abercrombie annual report. She provided you with her notes, b

> Matching Financial Statement Items to Financial Statement Categories Tootsie Roll Industries is engaged in the manufacture and sale of candy. Major products include Tootsie Rolls, Tootsie Roll Pops, Tootsie Pop Drops, Tootsie Flavor Rolls, Charms, and Bl

> The following transactions were selected from among those completed by Hailey Retailers in the current year: Required: 1. Give the appropriate journal entry for each of these transactions. Do not record cost of goods sold. 2. Compute Net Sales.

> Scott’s Cycles sells merchandise on credit terms of 2/15, n/30. A sale invoiced at $1,500 (cost of sales $975) was made to Shannon Allen on February 1. The company uses the gross method of recording sales discounts. Required: 1. Give the journal entry to

> Bentley Company’s June 30 bank statement and June ledger account for cash are summarized below: Required: 1. Reconcile the bank account. A comparison of the checks written with the checks that have cleared the bank shows outstanding che

> Assume that a retailer’s beginning inventory and purchases of a popular item during January included (1) 300 units at $7 in beginning inventory on January 1, (2) 450 units at $8 purchased on January 8, and (3) 750 units at $9 purchased on January 29. The

> Sanchez Company was formed on January 1 of the current year and is preparing the annual financial statements dated December 31, current year. Ending inventory information about the four major items stocked for regular sale follows: Required: Compute the

> H.T. Tan Company is preparing the annual financial statements dated December 31 of the current year. Ending inventory information about the five major items stocked for regular sale follows: Required: Compute the valuation that should be used for the cur

> Ford Motor Company is one of the world’s largest companies, with annual sales of cars and trucks in excess of $155 billion. A recent annual report for Ford contained the following note: Warranties We accrue obligations for warranty costs at the time of s

> Based on its physical count of inventory in its warehouse at year-end, December 31 of the current year, Plummer Company planned to report inventory of $34,000. During the audit, the independent CPA developed the following additional information: a. Goods

> Using the following categories, indicate the effects of the transactions listed in E6-10. Use + for increase and − for decrease and indicate the accounts affected and the amounts.

> Green Valley Company prepared the following trial balance at the end of its first year of operations ending December 31. To simplify the case, the amounts given are in thousands of dollars. The “Ref.” column is for the

> Identifying Investing and Financing Activities Affecting Cash Flows Marriott International, Inc., is a leading global lodging company, with more than 7,000 properties in 134 countries. Information adapted from the company’s recent annua

> Facebook, Inc., which also owns Instagram, Messenger, WhatsApp, and Oculus (virtual reality products),generates substantially all of its revenue from selling advertising placements to marketers. Following is a trial balance listing accounts that Facebook

> Salesforce.com, inc., is a leading provider of enterprise software, delivered through the cloud, with a focus on customer relationship management, or CRM. The Company helps its customers to connect with their customers through cloud, mobile, social, bloc

> Inferring Typical Investing and Financing Activities in Accounts The following T-accounts indicate the effects of normal business transactions: Required: 1. Describe the typical investing and financing transactions that affect each T-account. That is, wh

> Warren Corporation had the following transactions in Year 1: 1. On April 1, Warren received a $30,000, 10 percent note from a customer in settlement of a $30,000 account receivable. According to the terms, the principal and interest on the note are payab

> Kinney-Harvey, Inc., publishers of movie and song trivia books, made the following errors in adjusting the accounts at year-end (December 31): a. Did not accrue $1,400 owed to the company by another company renting part of the building as a storage facil

> Alphabet Inc. is the parent company for a collection of businesses—the largest of which is Google. The following activities were adapted from a recent annual report of Alphabet Inc. Dollars are in millions; shares are as shown. a. Issued 8,000 shares of

> Gig Harbor Company purchased a new piece of shipping equipment at the beginning of Year 1 for $1,800,000. The expected life of the asset is 15 years with no residual value. The company uses straight-line depreciation for financial reporting purposes and

> Preparing a Summarized Income Statement, Statement of Stockholders’ Equity, and Balance Sheet Bennett Inc. was organized four years ago. At the end of the current year, the following financial data are available:

> Preparing a Statement of Stockholders’ Equity Plummer Stonework Corporation was organized on January 1, 2022. For its first two years of operations, it reported the following: Required: On the basis of the data given, prepare a statemen

> The following accounts are used by Emily Consultants Company, with a fiscal year ending December 31. Required: For each of the following independent situations, prepare the journal entry by entering the appropriate code(s) and amount(s). The first transa

> Refer to E4-9. Required: For each of the transactions in E4-9, indicate the amount and the direction of effects of the adjusting entry on the elements of the balance sheet and income statement. Using the following format, indicate + for increase, − for d

> Refer to E4-8. Required: For each of the transactions in E4-8, indicate the amount and the direction of effects of the adjusting entry on the elements of the balance sheet and income statement. Using the following format, indicate + for increase, â

> Jameson Consultants, Inc., provides marketing research for clients in the retail industry. At the end of the current year, the company had the following unadjusted accounts with normal debit and credit balances: Required: Prepare in good form an unadjust

> Penny’s Pool Service & Supply, Inc. (PPSS) is completing the accounting process for the first year of operations ended on December 31. Transactions during the year have been journalized and posted. The following trial balance spread

> Pool Corporation, Inc., sells swimming pool supplies and equipment. It is a publicly traded corporation that trades on the NASDAQ exchange. The majority of Pool’s customers are small, family-owned businesses. Required: 1. Using the SEC EDGAR service at s

> Pool Corporation, Inc., sells swimming pool supplies and equipment. It is a publicly traded corporation that trades on the NASDAQ exchange. The majority of Pool’s customers are small, family-owned businesses. The company issued the following press releas

> Pool Corporation, Inc., sells swimming pool supplies and equipment. It is a publicly traded corporation that trades on the NASDAQ exchange. The majority of Pool’s customers are small, family-owned businesses. Assume Pool Corporation completed the followi

> Ramirez Foods Company acquired a corn flour milling machine for $20,000 and depreciated it on a straight-line basis over an eight-year useful life with a residual value of $3,000. At the end of the prior year, the machine had been depreciated for a full

> Pool Corporation, Inc., is the world’s largest wholesale distributor of swimming pool supplies and equipment. Required: 1. Pool Corp. reported the following information related to bad debt estimates and write-offs for a recent year. Pre

> Easley-O’Hara Office Equipment sells furniture and technology solutions to consumers and to businesses. Most consumers pay for their purchases with credit cards and business customers make purchases on open account with terms 1/10, net

> Comparing Companies within an Industry Refer to the financial statements of Target Corporation in Appendix B and Walmart Inc. in Appendix C. Required: 1. Total assets is a common measure of the size of a company. Which company had the higher total assets

> Finding Financial Information Refer to the financial statements of Walmart Inc. in Appendix C at the end of this book. All dollar amounts are in millions. Required: 1. What is the amount of “Consolidated net income” for the most recent year?______ 2. Wha

> Refer to the financial statements of Target Corporation in Appendix B at the end of this book. Required: Skim the annual report. Look at the income statement, balance sheet, and cash flow statement closely and attempt to infer what kinds of information t

> Analysis of Investing and Financing Activities of a Public Company (an Individual or Team Project) In your web browser, search for the investor relations page of a public company you are interested in (e.g., Papa John’s investor relations).Select SEC Fil

> In your web browser, search for the investor relations page of a public company you are interested in (e.g., Papa John’s investor relations). Select SEC Filings or Annual Report or Financials to obtain the 10-K for the most recent year available.* Requir

> Refer to the financial statements of Target (Appendix B) and Walmart (Appendix C) and the Industry Ratio Report (Appendix D) at the end of this book. Required: 1. Compute the receivables turnover ratio for both companies for the most recent year. For Tar

> Refer to the financial statements of Target (Appendix B) and Walmart (Appendix C) at the end of this book. Required: 1. (a) Compute return on assets for the most recent year. Round the percentage to two decimal places. (b) Which company provided the high

> Carey Corporation has five different intangible assets to be accounted for and reported on the financial statements. The management is concerned about the amortization of the cost of each of these intangibles. Facts about each intangible follow: a. Goodw

> Refer to the financial statements of Target given in Appendix B at the end of this book. At the bottom of each statement, the company warns readers to “Refer to Notes to Consolidated Financial Statements.” The following questions illustrate the types of

> The following amounts were selected from the annual financial statements for Genesis Corporation at December 31, 2024 (end of the third year of operations): Required: Analyze the data on the 2024 financial statements of Genesis by answering the questions

> Refer to the financial statements of Walmart Inc. in Appendix C at the end of this book. All dollar amounts are in millions. 1. Did the company accrue more or pay more in income taxes during the most recent year? By how much? 2. By what percentage did Ac

> Refer to the financial statements and footnotes of Walmart given in Appendix C at the end of this book. All dollar amounts are in millions. Required: 1. What is the amount of cash Walmart paid to repurchase shares of their own stock during the most recen

> Finding Financial Information Refer to the financial statements of Walmart Inc. in Appendix C at the end of this book. All dollar amounts are in millions. 1. What amount does the company report for common stock for the most recent year (in millions)?____

> Refer to the financial statements and footnotes of Target given in Appendix B at the end of this book. All dollar amounts are in millions. Required: 1. What is the amount of cash Target paid to repurchase shares of their own stock during the most recent

> In your web browser, search for the investor relations page of a public company you are interested in (e.g., Zoom investor relations). Select SEC Filings or Annual Report or Financials to obtain the 10-K for the most recent year available.* Required: 1.

> In your web browser, search for the investor relations page of a public company you are interested in (e.g., Nike investor relations). Select SEC Filings or Annual Report or Financials to obtain the 10-K for the most recent year available.* Required: 1.

> Refer to the financial statements and footnotes of Target given in Appendix B at the end of this book. All dollar amounts are in millions. Required: 1. What is the amount of accrued wages and benefits at the end of the most recent fiscal year? a. $1,931

> Refer to the financial statements of Walmart Inc. in Appendix C at the end of this book. All dollar amounts are in millions. 1. What depreciation method does Walmart use for its property and equipment? 2. What was the balance of accumulated depreciation

> The notes to a recent annual report from Lakshmi Financial Services Corporation indicated that the company acquired another company, Sanjeev Insurance Company. Assume that Lakshmi finalized the purchase of Sanjeev on January 2 of the current year. Lakshm

> Russeck Incorporated is a small manufacturing company that makes model trains to sell to toy stores. It has a small service department that repairs customers’ trains for a fee. The company has been in business for five years. At the end

> In your web browser, search for the investor relations page of a public company you are interested in (e.g., Papa Johns investor relations).Select SEC Filings or Annual Report or Financials to obtain the 10-K for the three most recent years available.* R

> Refer to the financial statements of Target Corporation in Appendix B at the end of this book. All dollar amounts are in millions. Use the notes to the financial statements for answering some of the questions. 1. How much did the company spend on propert

> In your web browser, search for the investor relations page of a public company you are interested in (e.g., Papa John’s investor relations). Select SEC Filings or Annual Report or Financials to obtain the 10-K for the most recent year available.* Requir

> In your web browser, search for the investor relations page of a public company you are interested in (e.g., Papa John’s investor relations). Select SEC Filings or Annual Report or Financials to obtain the 10-K for the most recent year available.* Requir

> In your web browser, search for the investor relations page of a public company you are interested in (e.g., Papa Johns investor relations). Select SEC Filings or Annual Report or Financials (whichever the website provides) to obtain the 10-K for the mos

> Finding Financial Information Refer to the financial statements of Target Corporation in Appendix B at the end of this book. All dollar amounts are in millions. (Note: Fiscal year 2019 for Target runs from February 2, 2019 to February 1, 2020.) 1. What i

> In your web browser, search for the investor relations page of a public company you are interested in (e.g., Zoom investor relations). Select SEC Filings or Annual Report or Financials to obtain the 10-K for the most recent year available. Required: For

> In your web browser, search for the investor relations page of a public company you are interested in (e.g., Papa John’s investor relations).Select SEC Filings or Annual Report or Financials to obtain the 10-K for the most recent year available.* Require

> In your web browser, search for the investor relations page of a public company you are interested in (e.g., Zoom investor relations). Select SEC Filings or Annual Report or Financials to obtain the 10-K for the most recent year available.* Required: 1.

> Using the financial information presented in Exhibit 13.1, calculate the following ratios for fiscal 2020 for The Home Depot: • Net profit margin ratio • Quality of income ratio • Receivables turnover ratio • Cash ratio • Times interest earned ratio • Pr

> The Gap, Inc., is a global retailer of apparel, accessories, and personal care products for women, men, and children under the Gap, Banana Republic, Old Navy, Athleta, Intermix, Janie and Jack, and Hill City brands. The Company operates approximately 3,9

> You have the opportunity to invest $10,000 in one of two companies from a single industry. The only information you have is below. Which company would you select? Justify your choice.

> The price/earnings ratio provides important information concerning the stock market’s assessment of the growth potential of a business. The following are price/earnings ratios for selected companies. Match the company with its ratio and

> IBM recently redefined its strategy to focus the company on cloud computing and artificial intelligence. IBM employs over 345,000 people across more than 175 countries. Assume a recent statement of cash flows contained the following information (in milli

> Mulkilteo Company obtained a charter from the state in January of this year. The charter authorized 1,000,000 shares of common stock with a $5 par value. During the year, the company earned $429,000. Also during the year, the following selected transacti

> Several years ago, Ben & John Company issued bonds with a face value of $2,000,000 for $2,090,000. As a result of declining interest rates, the company has decided to call the bonds at a call premium of 5 percent over par. The bonds have a current book v

> Several years ago, Max Company issued bonds with a face value of $2,000,000 for $2,090,000. As a result of declining interest rates, the company has decided to call the bonds at a call premium of 5 percent over par. The bonds have a current book value of

> Assume that on January 1 of Year 1, Tesla, Inc., decided to start a fund to build an addition to its plant. Tesla will deposit $320,000 in the fund at each year-end, starting on December 31 of Year 1. The fund will earn 9 percent annual interest, which w

> Kameamea Company was granted a charter on January 1 that authorized the following stock: Common stock: $40 par value; 100,000 shares authorized Preferred stock: 8 percent; $5 par value; 20,000 shares authorized During the year, the following transactions

> On January 1 of this year, Pablo Insurance Corporation issued bonds with a face value of $4,000,000 and a coupon rate of 9 percent. The bonds mature in five years and pay interest annually every December 31. When the bonds were sold, the annual market ra

> Use the data from Alternate Problem AP9-4 to complete this problem. Required: For each transaction (including adjusting entries) listed in Alternate Problem AP9-4, indicate the effects (e.g., Cash + or −) using the format below. You do

> A recent annual report for AMERCO, the holding company for U-Haul International, Inc., included the following note: AMERCO subsidiaries own property, plant, and equipment that are utilized in the manufacture, repair, and rental of U-Haul equipment and th

> Use data from Problem AP9-2 to complete this problem. Required: For each transaction (including adjusting entries) listed in Problem AP9-1, indicate the effects (e.g., Cash + or −) using the format below. You do not need to include amou

> Use the data presented in AP6-1, which were selected from the records of Sharkim Company for the year ended December 31, current year. Required: 1. Give the journal entries for these transactions, including the write-off of the uncollectible account and

> Newell Brands Inc. is a leading global consumer goods company with a strong portfolio of well-known brands, including Sharpie, Paper Mate, Mr. Coffee, Rubbermaid, Yankee Candle, and others. The items reported on its income statement for the year ended De

> What do profitability ratios focus on? What is an example of a profitability ratio and how is it computed?

> What are component percentages? Why are they useful?

> What are the two general methods for making financial comparisons?

> Explain why rapid growth in total sales might not necessarily be a good thing for a company.

> Explain how a company’s accounting policy choices can affect its ratios.