Question: Below are the last three years’ financial

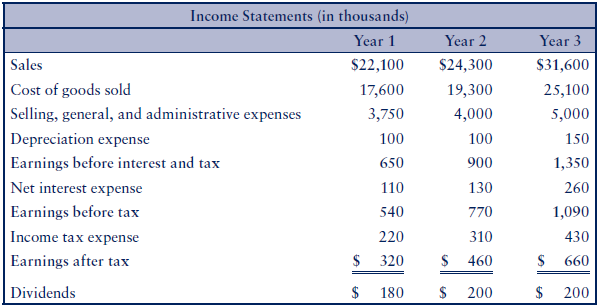

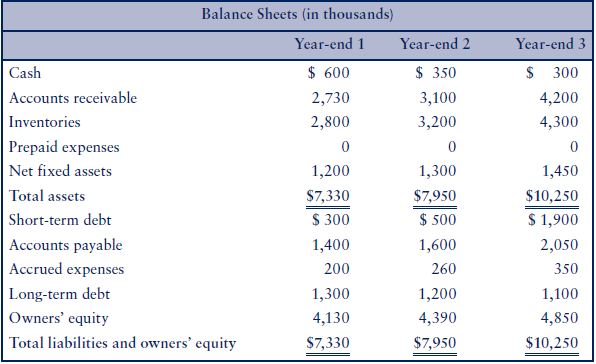

Below are the last three years’ financial statements for Sentec Inc., a distributor of electrical fixtures.

a. Compute Sentec Inc.’s working capital requirement (WCR) at year-end 1, year-end 2, and year-end 3.

b. Prepare Sentec Inc.’s managerial balance sheets at year-end 1, year-end 2, and year-end 3.

c. Compute Sentec Inc.’s net long-term financing (NLF) and net short-term financing (NSF) at year-end 1, year-end 2, and year-end 3. Comment on the change in Sentec Inc.’s financing policy. Has it become more conservative? Aggressive? What caused this change?

d. In year 3, firms in the same sector as Sentec Inc. had an average collection period of 30 days, average payment period of 33 days, and inventory turnover of 8 days. Suppose that Sentec Inc. had managed its operating cycle like the average firm in the sector. At year-end 3, what would its WCR have been? Its managerial balance sheet, NLF, and NSF? What would have been the effect on its financing strategy?

> Thorenberg Inc. is considering the purchase of a machine from Hydraulic Engineering Company (HECO) to make hard pressed-metal sheets. The machine will cost $100,000 and would replace the currently used one. Savings are expected to be $60,000 per year, an

> Micro-Electronics Corporation (MEC) has just announced that it will issue 10 million shares of common stock through a rights issue at a subscription price of $20. Before the announcement, MEC shares were trading at $26, and there were 50 million shares o

> Micro-Electronics Corporation (MEC) has just announced that it will issue 10 million shares of common stock through a rights issue at a subscription price of $20. Before the announcement, MEC shares were trading at $26, and there were 50 million shares o

> Murlow Company is a privately held firm. David Murlow, its owner-manager, has been approached by Murson Inc. for a possible acquisition. The firm has no debt. What is the minimum price David Murlow should ask, given the following information about his fi

> The Southern Appliance Company (SAC) has a current free cash flow of $10 million that is expected to grow in perpetuity at a constant annual rate of 5 percent. The firm has $40 million of cash and 10 million shares outstanding. SAC has no debt and its sh

> Briefly explain the distinction between the two items that make up each of the following pairs: a. Direct financing versus indirect financing b. Primary markets versus secondary markets c. Organized exchanges versus over-the-counter markets d. Domestic s

> Financial analysts expect Theron Co.’s earnings and dividends to grow at a rate of 16 percent during the next three years, 12 percent in the fourth and fifth years, and at a constant rate of 6 percent thereafter. Theron’s dividend, which has just been pa

> You borrowed $80,000 to finance the purchase of a property through a standard, 30-year fixed rate mortgage with an annual interest rate of 8 percent, compounded monthly. a. What is your monthly mortgage payment? b. How much interest and how much principa

> Therol Inc. has no debt. Its invested capital generates $5 of earnings per share, and all these earnings are paid out as dividends. a. Suppose that Therol’s shareholders require a return of 10 percent on their invest- ment in the firm. What is Therol’s s

> Hellenic Vultures is expected to generate $100,000 of net cash flows next year, $120,000 the year after, and $150,000 for the following three years. It is expected that the firm could be sold for $500,000 at the end of the fifth year. The owners of Helle

> A two-year corporate bond has a coupon rate of 4 percent. The 1-year spot rate is 3 percent and the forward rate is 5 percent. The bond’s credit spread is 1 percent for both the one-year and the two-year maturities. a. What is the price of the bond expre

> Five years ago, your favorite aunt won a $1million lottery. The prize money is paid out $50,000 per year for 20 years. Unfortunately, your aunt needs as much as $250,000 cash now to pay for medical bills that she and your uncle incurred as a result of an

> The municipal government has imposed a temporary, five-year tax increase on the value of property that will raise $80 million at the end of the first year. Property values are estimated to grow at a rate of 3 percent per year. a. What is the present valu

> Although he was initially satisfied by the apparent profitability of the new project, the Avon company’s chief executive officer (CEO) was troubled by some other aspects of the project that he thought the finance manager had left out of the analysis. Fir

> According to the Modified Accelerated Cost Recovery System (MACRS) of depreciation imposed by US tax law, autos and computers must be depreciated the following way for tax purposes: a. What is the present value of the interest tax shield from the purchas

> Reviewing the cash-flow forecasts of a new investment project that appear in the fol- lowing table, the Avon company’s finance manager noted that there was no mention of any effect of the investment on the firm’s accou

> The Great Eastern Toy Company management is considering an investment in a new product. It would require the acquisition of a piece of equipment for $16 million with a ten-year operational life, providing regular maintenance is carried out. Salvage value

> Assume that the Clampton Company in the previous question expects to pay income taxes of 40 percent and that a loss on the sale or disposal of equipment is treated as an ordinary deduction, resulting in a tax saving of 40 percent. The Clampton Company wa

> Mergecandor Corp. is considering the acquisition of Tenderon Inc. Mergecandor has two million shares outstanding selling at $30, or 7.5 times its earnings per share, and Tenderon has one million shares outstanding selling at $15, or five times its earnin

> The Clampton Company is considering the purchase of a new machine to perform operations currently being performed on different, less efficient equipment. The pur- chase price is $110,000, delivered and installed. A Clampton production engineer estimates

> The company’s financial manager and accountant were arguing over how to properly take account of inflation when analyzing capital investment projects. The accountant typically included estimates of price-level changes when estimating and projecting futur

> Maintainit Inc. is asked to submit a bid for watering and spraying trees in a housing development for the next five years. To provide this service, Maintainit would have to buy new equipment for $100,000 and invest $30,000 in its working capital requirem

> Suppose you have decided to set up a personal pension fund for your retirement. You have just turned 25. You expect to retire at age 65 and believe it is reasonable to count on living at least 20 years after retirement. Furthermore, you wish to have an a

> Your brother-in-law offers you the opportunity to invest $15,000 in a project that he promises will return $17,000 at the end of the year. Because you have only $3,000 in cash, you will have to borrow $12,000 from your bank. The bank charges interest at

> The Alpha Printer Company is considering the purchase of a $2 million printing machine. Its economic life is estimated at five years, and it will have no resale value after that time. The machine would generate an additional $200,000 of earnings after ta

> You are currently a member of a club whose annual membership fee is $2,000. The fee is expected to increase by 3 percent per year. a. Would you buy for $65,000 a lifelong family membership to the club that can be passed down to your descendants? You can

> You must choose between the two projects whose cash flows are shown below. The projects have the same risk. a. Compute the net present value (NPV) and the profitability index (PI) for the two projects. Assume a 10 percent discount rate. b. Which of the p

> Consider the three projects A, B, and C. The cost of capital is 12 percent, and the projects have the following expected cash flows: a. What is the internal rate of return of the three projects? b. What is the net present value of the three projects? c.

> Starline & Co. has no debt, and its cost of equity is 14 percent. It can borrow at 8 percent. The corporate tax rate is 40 percent. a. Calculate the cost of equity and the weighted average cost of capital (WACC) of Starline if it decides to borrow up to

> You expect that your daughter will go to college ten years from now. Taking account of inflation, you estimate that you will need $160,000 to support her during her years in college. Assume an interest rate of 4 percent on your saving accounts. How much

> You are buying a car. No Better Deals will give you $500 off the list price on a $10,000 car. a. You can get the same car from Best Deals if you pay $4,000 down and the rest at the end of two years. If the interest rate is 12 percent, where would you buy

> You can invest in a machine that costs $500,000. You can expect revenues net of any expense, except maintenance costs, of $150,000 at the end of each year for five years. You will subcontract the maintenance costs at a rate of $20,000 a year, to be paid

> A basketball player has just signed a $30 million contract to play for three years. She will receive $5 million as an immediate cash bonus, $5 million at the end of the first year, $8 million at the end of the second year, and the remaining $12 million a

> Rollon Inc. is comparing the operating costs of two types of equipment. The standard model costs $50,000 and will have a useful life of four years. Operating costs are expected to be $4,000 per year. The superior model costs $90,000 and will have a usefu

> Suppose you deposit $1,000 in one year, $2,000 in two years, and $4,000 in three years. Assume a 4 percent interest rate throughout. a. How much will you have in five years? b. Suppose you plan to withdraw $1,500 in four years and there is no penalty for

> You must choose between the two projects whose cash flows are shown below. The projects have the same risk. a. Compute the internal rate of return and the net present value for the two projects. Assume a 10 percent discount rate. b. Which of the projects

> Mars Electronics is a distributor for the Global Electric Company (GEC), a large manufacturer of electrical and electronics products for consumer and institutional markets. On the next page are the semi-annual financial statements of the company for the

> You have just read an advertisement stating, “Pay us $100 a year for the next ten years and we will pay you $100 a year thereafter in perpetuity.” If this is a fair deal, what is the implied rate of interest?

> Below are the last three years’ financial statements of Sentec Inc., a distributor of electrical fixtures. / / a. Compute Sentec Inc.’s working capital requirement (WCR) and prepare its mana- gerial balance sheets at Year-end 1, Year-end 2, and Year-end

> Below are summarized balance sheets and income statements of three US companies: // a. Compute the working capital requirement of the three firms and prepare their managerial balance sheets. b. Compute the three firms’ operating margin, invested capital

> Comment on the following statements: a. “Only synergistic mergers have the potential to create value.” b. “If a merger cannot generate synergistic gains through cost reductions, it will not create value.” c. “Conglomerate mergers can create value through

> Under what intuitive condition will an increase in debt (either short-term or long- term) relative to equity always increase a firm’s return on equity? Can the structure of return on equity relationship be used to determine a firm’s optimal debt-to-equit

> Cite two cases in which a bad decision (that is, a decision that negatively affects the market value of a firm) would increase its return on equity.

> a. If a firm has a return on equity (ROE) of 15 percent, a financial multiplier of 2, and does not pay any tax, what is its return on invested capital before tax? b. If a firm has an ROE of 15 percent, a financial cost effect of 0.9, and a pre-tax ROIC o

> Return on equity (ROE) can be estimated using financial statements (book value) or financial market data (market value). The book value of ROE over an accounting period is earnings after tax divided by owners’ equity. The market value of ROE is the retur

> From the balance sheets and income statements of OS Distributors in Exhibits 6.1, 6.2, and 6.3, compute the firm’s return on invested capital before tax (ROICBT) , return on capital employed before tax (ROICBT), return on business assets (ROBA), and retu

> The International Industrial Company has an investment project with the following cash flows: a. What is the net present value of these cash flows at 0, 25, 50, and 100 percent discount rates? b. What is the internal rate of return of this project? c. Un

> Ambersome Inc. has decided against borrowing and to have all its assets financed by equity. Furthermore, it intends to keep its payout ratio at 40 percent. Its assets turnover ratio is 0.9, its profit margin (defined as earnings before interest and tax d

> Indicate the effects of the following transactions on operating margin, invested capital turnover, and debt ratio. Use + to indicate an increase, – to indicate a decrease, and 0 to indicate no effect.

> You can purchase a car with one of the following two financing plans. You make a down payment of $12,000 and 36 monthly payments of $400 starting immediately. Alternatively, you can make 60 monthly payments of $492 starting next month without any down pa

> Which of the following three companies has a matching, a conservative, and an aggressive financing strategy? Explain why.

> Mirandel Inc. is considering the acquisition of Tarantel Corp. Mirandel’s earnings after tax are $2 million, it has two million shares outstanding, and its price-to-earnings ratio (PER) is 20. Tarantel’s earnings are $1.5 million, it has 0.5 million shar

> Below are selected accounting data of four US firms: a. For each of the firms, compute the following: working capital requirement (WCR), WCR-to-revenue ratio, collection period in days (using 365 days per year), and inventory turnover (using revenue rath

> Following the bankruptcy of Lehmann Brothers on September 15, 2008, the short- term credit market came to a halt. Many companies found themselves unable to renew their short-term debt and fell into financial distress. If, at that time, your company held

> Algebra Ltd. is selling inventory management software for small to mid-sized firms. Currently, the computer program is sold only for cash. In order to increase its revenues, the company is considering the alternative of offering a credit for one month to

> It is often the case that suppliers offer their customers to either pay the full amount of the invoice within a certain number of days, for example within 30 days, or receive a discount if they pay earlier, for example within 15 days. The first option wo

> Maltonese Inc. has five million shares outstanding selling at $60 each, and its price- to-earnings ratio (PER) is 10. Targeton Corp. has 1.5 million shares outstanding with a market price of $30 each, and its PER is 6. Maltonese is considering the acquis

> Indicate which of the following four statements are right or wrong: a. Because working capital requirement (WCR) = net long-term financing ( NLF ) + net short-term financing (NSF), I can reduce my investment in the operating cycle by either reducing my l

> Use the following information to complete the balance sheet below. a. Collection period: 40 days b. Inventory turnover: 6 times sales c. Working capital requirement/sales: 20 percent d. Liabilities/total assets: 60 percent e. Cash in days of sales: 20 da

> Mars Electronics is a distributor for the Global Electric Company (GEC), a large manufacturer of electrical and electronics products for consumer and institutional markets. Below are the semi-annual financial statements of the company for the last year a

> Indicate the effects of the following transactions on net long-term financing (NLF), working capital requirement (WCR), net short-term financing (NSF), and net profit. Use  to indicate an increase,  to indicate a decre

> Indicate the effect of the following transactions on working capital requirement (WCR), net operating cash flow (CFOPE) , cash flow from investing activities (CFINV) , cash flow from financing activities (CFFIN) , and owners’ equity. Us

> a. What would be the compounded value of one dollar in three years if the annual interest rate is 3 percent in Year 1 and is expected to rise to 5 percent in Year 2 and 6 percent in Year 3? b. What constant annual interest rate would produce the same com

> Explain why each of the following statements is generally incorrect: a. “Price-earnings ratios should increase when the yield on government securities rises.” b. “A company’s discounted cash-flow value is usually dominated by the magnitude of its expecte

> Prepare the managerial balance sheet of the following US company balance sheet (the company applies US GAAP):

> Indicate the effect of the following transactions on the working capital requirement: a. More customers pay with cash instead of credit b. More of raw material is paid for with cash c. More discounts are offered to customers d. More finished goods are pr

> From the following data, reconstruct the balance sheet at the end of the year.

> The following chart plots the net present value (NPV) of projects A and B at different discount rates. The projects have similar risk and are mutually exclusive. a. What is the significance of the point on the graph where the two lines intersect? b. What

> Below is some income statement information on company ABD. Prepare an income statement for each of the three years. Show your computations.

> Below is some income statement information on company DEF. Prepare an income statement for each of the three years. Show your computations.

> Below are incomplete balance sheets of OQ Corporation (figures in millions). a. Compute the missing amounts, and show the balance sheet at year-ends 1, 2, 3, and 4. Show your computations. b. Comment on the asset and liability structure of the firm.

> Below are incomplete balance sheets of ABC Corporation (figures in millions). a. Compute the missing amounts and show the balance sheet at year-ends 1, 2, 3, and 4. Show your computations. b. What transactions might explain the change in total assets bet

> a. How would you explain that a firm can generate a profit, when at the same time its cash flow from operations is negative? b. How would you explain that a firm showing a net loss can have a positive cash flow from operations?

> Find the missing values for the following three firms. Show your computations.

> Below are the recent performances of four investment funds, a market index (M), and a risk-free asset (F): a. Fill in the empty cells in the table above. b. What are the alphas of the above portfolios? How did the investment funds perform?

> Why are companies with a weak board of directors likely to be under-levered (they would use less debt than the optimal amount they could issue)?

> A bank is charging you an annual interest rate that is compounded monthly. If the effective interest rate you are paying is 6.17 percent, what is the annual percentage rate (APR)?

> Shares of the Pacific Electric Corporation (PEC) have an estimated beta of 1.10. PEC funds its assets with 50 percent debt at an average after-tax cost of debt of 6 percent. The excess return on the market portfolio is 5 percent and the risk-free rate is

> A project with a cash outlay now is followed by positive expected cash flows in the future and a payback period less than its economic life. Is its net present value posi- tive or negative? Explain. Now suppose that the discounted payback period is less

> What are the potential sources of value creation and value destruction in a leveraged buyout when compared with an acquisition?

> Because the cost of debt is lower than the cost of equity, firms must increase their use of debt as much as possible to increase the firm’s value. What is your answer to this argument? From the capital asset pricing model presented in Chapter 12, how can

> Alberton Inc., an all-equity-financed equipment manufacturer, has announced that it will change its capital structure to one that will have 30 percent of debt, using the proceeds from the debt issue to buy back shares. The firm has one million shares out

> Assume a zero corporate tax rate. Because both the risk of a firm’s equity and debt increase with debt financing, then the value of the firm should decrease when it uses more and more debt. True or false?

> How can shareholders expropriate wealth from bondholders?

> Chloroline Inc. has two million shares outstanding and no debt. Earnings before interest and tax (EBIT) are projected to be $15 million under normal conditions, $5 million for a downturn in the economic environment, and $20 million for an economic expans

> FarWest Inc. manufactures telecommunication equipment and communication soft- ware. The equipment division is asking the finance department of FarWest for an estimate of its cost of capital. FarWest can borrow long term at 7 percent; its corporate tax ra

> Stock A has an expected return of 13 percent and a 25 percent volatility. Stock B has an expected return of 9 percent and a 30 percent volatility. An investor can only purchase one of the two stocks. a. An investor bought stock A. What is her attitude to

> You have been asked to estimate the cost of capital for the CAT corporation. The com- pany has 4 million shares and 125,000 bonds outstanding at par value $1,000. In addi- tion, it has $20 million in short-term debt from its bank. The target capital stru

> Suppose that Tale Inc. has the following target capital structure: 50 percent stock, 40 percent debt, and 10 percent preferred stock. Its cost of equity is estimated at 10 percent, that of debt 6 percent, and that of preferred stock 4.5 percent. The tax

> According to the capital asset pricing model: where E (Ri) – the expected return on security i – is the sum of the return on a risk-free investment /the expected extra return over the risk-free rate for taking on the r

> The dividend of Onogo Inc. is currently $2 per share and is supposed to grow at 5 percent a year forever. Its share price is $50. Its beta is 1.08. The market risk premium is 5 percent and the risk-free rate is 4 percent. What is your best estimate of On

> Cordona Corp. has bonds outstanding that will mature 12 years from now. These bonds are currently quoted at 110 percent above par value. The issue makes annual payments of $80 on $1,000 bond face value. What is Cordona’s cost of debt?

> Your chief operating officer argues the following: a. “Our stock price is currently $60, and our dividend per share is $6. It means that it costs us 10 percent to use shareholders’ cash ($6 divided by $60).” b. “From our balance sheet our liabilities are

> Do you agree or disagree with the following statements? Explain. a. “The best forecast of future returns on the stock market is the average over the past ten years of historical returns.” b. “Because stocks offer a higher return over the long term than b

> A diversified company plans to sell a division as part of a restructuring program. The division to be sold is a regional airline that was acquired by a previous management. The finance department has been asked by the chief executive officer (CEO) to est

> The following table shows the annual realized returns on the following US securities from 1997 to 2016: the stock market (S&P 500), corporate bonds, government bonds, and Treasury bills. a. Theory suggests that the riskier the investment, the higher

> The Rolleston Company (TRC), an all-equity financed company, generates perpetual free cash flow of $40 million. It holds $100 million of cash, has 50 million shares outstanding, and its shareholders require a 10 percent return on their investment in the

> A junior employee, who just turned 25, decides to set up a personal retirement fund to supplement her government-funded pension plan during her first 20 years of retirement. She wants to have an annual income of $50,000 starting when she turns 65 and end

> What is the interest rate that makes you indifferent between $1,000 in one year and $1,180 in three years?

> What should the company do now to regain its customers trust?