Question: Bentley Corp. and Rolls Manufacturing are

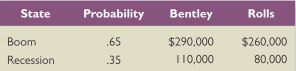

Bentley Corp. and Rolls Manufacturing are considering a merger. The possible states of the economy and each company’s value in that state are shown here:

Bentley currently has a bond issue outstanding with a face value of $125,000. Rolls is an all-equity company.

a. What is the value of each company before the merger?

b. What are the values of each company’s debt and equity before the merger?

c. If the companies continue to operate separately, what are the total value of the companies, the total value of the equity, and the total value of the debt?

d. What would be the value of the merged company? What would be the value of the merged company’s debt and equity?

e. Is there a transfer of wealth in this case? Why?

f. Suppose that the face value of Bentley’s debt was $90,000. Would this affect the transfer of wealth?

Transcribed Image Text:

State Probability Bentley Rolls Boom .65 $290,000 $260,000 Recession .35 T10,000 80,000

> Bethesda Mining is a midsized coal mining company with 20 mines located in Ohio, Pennsylvania, West Virginia, and Kentucky. The company operates deep mines as well as strip mines. Most of the coal mined is sold under contract, with excess production sold

> Purple Feet Wine, Inc., receives an average of $13,800 in checks per day. The delay in clearing is typically three days. The current interest rate is .018 percent per day. a. What is the company’s float? b. What is the most the company should be willing

> Use the information in Figure 31.1 to answer the following questions: a. What is the six-month forward rate for the Japanese yen in yen per U.S. dollar? Is the yen selling at a premium or a discount? Explain. b. What is the three-month forward rate for B

> Fair-to-Midland Manufacturing, Inc. (FMM), has applied for a loan at True Credit Bank. Jon Fulkerson, the credit analyst at the bank, has gathered the following information from the company’s financial statements: The stock price of F

> The exchange rate for the Australian dollar is currently A$1.40. This exchange rate is expected to rise by 10 percent over the next year. a. Is the Australian dollar expected to get stronger or weaker? b. What do you think about the relative inflation ra

> Explain why diversification per se is probably not a good reason for merger.

> For the year just ended, you have gathered the following information about the Holly Corporation: a. A $200 dividend was paid. b. Accounts payable increased by $500. c. Fixed asset purchases were $900. d. Inventories increased by $625. e. Long-term debt

> After extensive research and development, Goodweek Tires, Inc., has recently developed a new tire, the SuperTread, and must decide whether to make the investment necessary to produce and market it. The tire would be ideal for drivers doing a large amount

> What are some of the characteristics of a firm with a long cash cycle?

> What options are available to a firm if it believes it has too much cash? How about too little?

> Suppose the rate of inflation in Mexico will run about 3 percent higher than the U.S. inflation rate over the next several years. All other things being the same, what will happen to the Mexican peso versus dollar exchange rate? What relationship are you

> Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota. Dan Dority, the company’s geologist, has just finished his analysis of the mine site. He has estimated that the mine would be productive for

> In what form is trade credit most commonly offered? What is the credit instrument in this case?

> What are some benefits of financial distress?

> Refer to Table 25.2 in the text to answer this question. Suppose you sell five March 2015 silver futures contracts on January 8, 2015, at the last price of the day. What will your profit or loss be if silver prices turn out to be $16.61 per ounce at expi

> Consider the following premerger information about firm X and firm Y: Assume that Firm X acquires Firm Y by paying cash for all the shares outstanding at a merger premium of $5 per share. Assuming that neither firm has any debt before or after the merg

> Blizzard Corp. has a book value of equity of $14,750. Long-term debt is $8,300. Net working capital, other than cash, is $1,950. Fixed assets are $20,730 and current liabilities are $1,930. How much cash does the company have? What are current assets?

> Each business day, on average, a company writes checks totaling $14,400 to pay its suppliers. The usual clearing time for the checks is four days. Meanwhile, the company is receiving payments from its customers each day, in the form of checks, totaling $

> Use the information in Figure 31.1 to answer the following questions: a. Which would you rather have, $100 or £100? Why? b. Which would you rather have, 100 Swiss francs (SF) or £100? Why? c. What is the cross-rate for Swiss francs in terms of British po

> The Paden Corporation has annual sales of $29.5 million. The average collection period is 27 days. What is the average investment in accounts receivable as shown on the balance sheet?

> If a firm is buying call options on pork belly futures as a hedging strategy, what must be true about the firm’s exposure to pork belly prices?

> Indicate whether you think the following claims regarding takeovers are true or false. In each case, provide a brief explanation for your answer. a. By merging competitors, takeovers have created monopolies that will raise product prices, reduce producti

> Ben Bates graduated from college six years ago with a finance undergraduate degree. Although he is satisfied with his current job, his goal is to become an investment banker. He feels that an MBA degree would allow him to achieve this goal. After examini

> In the previous problem, assume that the probability of default is 15 percent. Should the orders be filled now? Assume the number of repeat customers is affected by the defaults. In other words, 30 percent of the customers who do not default are expected

> Solar Engines manufactures solar engines for tractor-trailers. Given the fuel savings available, new orders for 125 units have been made by customers requesting credit. The variable cost is $11,400 per unit, and the credit price is $13,000 each. Credit i

> Warf Computers, Inc., was founded 15 years ago by Nick Warf, a computer programmer. The small initial investment to start the company was made by Nick and his friends. Over the years, this same group has supplied the limited additional investment needed

> Saché, Inc., expects to sell 700 of its designer suits every week. The store is open seven days a week and expects to sell the same number of suits every day. The company has an EOQ of 500 suits and a safety stock of 100 suits. Once an order is placed, i

> In Problem 15, what is the break-even price per unit under the new credit policy? Assume all other values remain the same.

> In Problem 14, what is the break-even price per unit that should be charged under the new credit policy? Assume that the sales figure under the new policy is 3,150 units and all other values remain the same.

> From our discussion of the Fisher effect in Chapter 8, we know that the actual relationship between a nominal rate, R, a real rate, r, and an inflation rate, h, can be written as follows: 1 + r = (1 + R)/(1 + h) This is the domestic Fisher effect. a. Wha

> In Problem 14, what is the break-even quantity for the new credit policy?

> In the previous problem, assume the equity increases by 1,750 solaris due to retained earnings. If the exchange rate at the end of the year is 1.24 solaris per dollar, what does the balance sheet look like?

> Kevin Nomura is a Japanese student who is planning a one-year stay in the United States. He expects to arrive in the United States in eight months. He is worried about depreciation of the yen relative to the dollar over the next eight months and wishes t

> Suppose there were call options and forward contracts available on coal, but no put options. Show how a financial engineer could synthesize a put option using the available contracts. What does your answer tell you about the general relationship between

> Atreides International has operations in Arrakis. The balance sheet for this division in Arrakeen solaris shows assets of 43,000 solaris, debt in the amount of 14,000 solaris, and equity of 29,000 solaris. a. If the current exchange ratio is 1.20 solaris

> The Chocolate Ice Cream Company and the Vanilla Ice Cream Company have agreed to merge and form Fudge Swirl Consolidated. Both companies are exactly alike except that they are located in different towns. The end-of-period value of each firm is determined

> What are some of the characteristics of a firm with a long operating cycle?

> The Silver Spokes Bicycle Shop has decided to offer credit to its customers during the spring selling season. Sales are expected to be 700 bicycles. The average cost to the shop of a bicycle is $650. The owner knows that only 96 percent of the customers

> William Santiago is interested in entering the import/export business. During a recent visit with his financial advisers, he said, “If we play the game right, this is the safest business in the world. By hedging all of our transactions in the foreign exc

> This morning you agreed to buy a one-year Treasury bond in six months. The bond has a face value of $1,000. Use the spot interest rates listed here to answer the following questions: a. What is the forward price of this contract? b. Suppose shortly aft

> You are evaluating a proposed expansion of an existing subsidiary located in Switzerland. The cost of the expansion would be SF 25 million. The cash flows from the project would be SF 6.9 million per year for the next five years. The dollar required retu

> Plant, Inc., is considering making an offer to purchase Palmer Corp. Plant’s vice president of finance has collected the following information: Plant also knows that securities analysts expect the earnings and dividends of Palmer to g

> Happy Times currently has an all-cash credit policy. It is considering making a change in the credit policy by going to terms of net 30 days. Based on the following information, what do you recommend? The required return is .95 percent per month. Cu

> Cleveland Compressor and Pnew York Pneumatic are competing manufacturing firms. Their financial statements are printed here. a. How are the current assets of each firm financed? b. Which firm has the larger investment in current assets? Why? c. Which fir

> You enter into a forward contract to buy a 10-year, zero coupon bond that will be issued in one year. The face value of the bond is $1,000, and the 1-year and 11-year spot interest rates are 5 percent and 7 percent, respectively. a. What is the forward p

> In May 2004, Sysco Corporation, the distributor of food and food-related products (not to be confused with Cisco Systems), announced it had signed an interest rate swap. The interest rate swap effectively converted the company’s $100 million, 4.6 percent

> If financial markets are perfectly competitive and the Eurodollar rate is above that offered in the U.S. loan market, you would immediately want to borrow money in the United States and invest it in Eurodollars. True or false? Explain.

> Is it possible for a firm to have too much cash? Why would shareholders care if a firm accumulates large amounts of cash?

> Lakonishok Equipment has an investment opportunity in Europe. The project costs €19 million and is expected to produce cash flows of €3.6 million in Year 1,€4.1 million in Year 2, and €5.1 million in Year 3. The current spot exchange rate is $1.04/€ and

> The Harrington Corporation is considering a change in its cash-only policy. The new terms would be net one period. Based on the following information, determine if Harrington should proceed or not. The required return is 2.5 percent per period. Curr

> Rework Problem 13 assuming the following: a. Wildcat maintains a minimum cash balance of $20 million. b. Wildcat maintains a minimum cash balance of $10 million. Based on your answers in (a) and (b), do you think the firm can boost its profit by changing

> For the following scenarios, describe a hedging strategy using futures contracts that might be considered. a. A public utility is concerned about rising costs. b. A candy manufacturer is concerned about rising costs. c. A corn farmer fears that this year

> The forward price (F) of a contract on an asset with neither carrying costs nor convenience yield is the current spot price of the asset (S 0) multiplied by 1, plus the appropriate interest rate between the initiation of the contract and the delivery dat

> Wildcat, Inc., has estimated sales (in millions) for the next four quarters as follows: Sales for the first quarter of the year after this one are projected at $120 million. Accounts receivable at the beginning of the year were $34 million. Wildcat has

> Suppose the spot exchange rate for the Hungarian forint is HUF 251. The inflation rate in the United States is 2.8 percent per year and is 3.7 percent in Hungary. What do you predict the exchange rate will be in one year? In two years? In five years? Wha

> Harrods PLC has a market value of £360 million and 30 million shares outstanding. Selfridge Department Store has a market value of £144 million and 18 million shares outstanding. Harrods is contemplating acquiring Selfridge. Harrods’s CFO concludes that

> Prove that when carrying costs and restocking costs are as described in the chapter, the EOQ must occur at the point where the carrying costs and restocking costs are equal.

> Define financial distress using the stock-based and flow-based approaches.

> If a U.S. firm raises funds for a foreign subsidiary, what are the disadvantages to borrowing in the United States? How would you overcome them?

> If a U.S. company exports its goods to Japan, how would it use a futures contract on Japanese yen to hedge its exchange rate risk? Would it buy or sell yen futures? Does the way the exchange rate is quoted in the futures contract matter?

> Last month, BlueSky Airline announced that it would stretch out its bill payments to 45 days from 30 days. The reason given was that the company wanted to “control costs and optimize cash flow.” The increased payables period will be in effect for all of

> An unfortunately common practice goes like this (Warning: Don’t try this at home): Suppose you are out of money in your checking account; however, your local grocery store will, as a convenience to you as a customer, cash a check for you. So, you cash a

> What is the duration of a bond with two years to maturity if the bond has a coupon rate of 6.4 percent paid semiannually, and the market interest rate is 4.9 percent?

> The sales budget for your company in the coming year is based on a quarterly growth rate of 10 percent, with the first-quarter sales projection at $185 million. In addition to this basic trend, the seasonal adjustments for the four quarters are 0, 2$16,

> Cow Chips, Inc., a large fertilizer distributor based in California, is planning to use a lockbox system to speed up collections from its customers located on the East Coast. A Philadelphia-area bank will provide this service for an annual fee of $12,000

> Suppose the spot and three-month forward rates for the yen are ¥115.13 and ¥114.35, respectively. a. Is the yen expected to get stronger or weaker? b. What would you estimate is the difference between the inflation rates of the United States and Japan?

> The Trektronics store begins each week with 675 phasers in stock. This stock is depleted each week and reordered. If the carrying cost per phaser is $73 per year and the fixed order cost is $340, what is the total carrying cost? What is the restocking co

> Fly-By-Night Couriers is analyzing the possible acquisition of Flash-in-the-Pan Restaurants. Neither firm has debt. The forecasts of Fly-By-Night show that the purchase would increase its annual aftertax cash flow by $425,000 indefinitely. The current ma

> Refer to Table 25.2 in the text to answer this question. Suppose you purchase a March 2015 cocoa futures contract on January 8, 2015, at the last price of the day. What will your profit or loss be if cocoa prices turn out to be $3,027 per metric ton at e

> An investment in a foreign subsidiary is estimated to have a positive NPV after the discount rate used in the calculations is adjusted for political risk and any advantages from diversification. Does this mean the project is acceptable? Why or why not?

> What is the difference between transactions and economic exposure? Which can be hedged more easily? Why?

> Another option usually available is to reduce the firm’s outstanding debt. What are the advantages and disadvantages of this use of excess cash?

> Ted and Alice Hansel have a son who will begin college 10 years from today. School expenses of $30,000 will need to be paid at the beginning of each of the four years that their son plans to attend college. What is the duration of this liability to the c

> Show that the NPV of a merger can be expressed as the value of the synergistic benefits, DV, less the merger premium.

> Here are the most recent balance sheets for Country Kettles, Inc. Excluding accumulated depreciation, determine whether each item is a source or a use of cash, and the amount: COUNTRY KETTLES, INC. Balance Sheet 2015 2016 Assets Cash $ 48,180 $ 45,8

> Time Bird’s Eye Treehouses, Inc., a Kentucky company, has determined that a majority of its customers are located in the Pennsylvania area. It therefore is considering using a lockbox system offered by a bank located in Pittsburgh. The

> You observe that the inflation rate in the United States is 1.8 percent per year and that T-bills currently yield 1.95 percent annually. What do you estimate the inflation rate to be in: a. Australia if short-term Australian government securities yield 4

> Fhloston Manufacturing uses 1,860 switch assemblies per week and then reorders another 1,860. If the relevant carrying cost per switch assembly is $6.25, and the fixed order cost is $730, is the company’s inventory policy optimal? Why or why not?

> Suppose it is your task to evaluate two different investments in new subsidiaries for your company, one in your own country and the other in a foreign country. You calculate the cash flows of both projects to be identical after exchange rate differences.

> In a typical month, the Warren Corporation receives 140 checks totaling $113,500. These are delayed four days on average. What is the average daily float?

> Last month, BlueSky Airline announced that it would stretch out its bill payments to 45 days from 30 days. The reason given was that the company wanted to “control costs and optimize cash flow.” The increased payables period will be in effect for all of

> At least part of Dell’s corporate profits can be traced to its inventory management. Using just-in-time inventory, Dell typically maintains an inventory of three to four days’ sales. Competitors such as Hewlett-Packard and IBM have attempted to match Del

> Suppose a firm enters a fixed for floating interest rate swap with a swap dealer. Describe the cash flows that will occur as a result of the swap.

> One option a firm usually has with any excess cash is to pay its suppliers more quickly. What are the advantages and disadvantages of this use of excess cash?

> If you are an exporter who must make payments in foreign currency three months after receiving each shipment and you predict that the domestic currency will appreciate in value over this period, is there any value in hedging your currency exposure?

> Last month, BlueSky Airline announced that it would stretch out its bill payments to 45 days from 30 days. The reason given was that the company wanted to “control costs and optimize cash flow.” The increased payables period will be in effect for all of

> ABC Company and XYZ Company need to raise funds to pay for capital improvements at their manufacturing plants. ABC Company is a well-established firm with an excellent credit rating in the debt market; it can borrow funds either at 11 percent fixed rate

> Consider the following premerger information about Firm A and Firm B: Assume that Firm A acquires Firm B via an exchange of stock at a price of $13 for each share of B’s stock. Both A and B have no debt outstanding. a. What will the e

> Here are some important figures from the budget of Cornell, Inc., for the second quarter of 2016: The company predicts that 5 percent of its credit sales will never be collected, 35Â percent of its sales will be collected in the month of the

> No More Books Corporation has an agreement with Floyd Bank, whereby the bank handles $2.9 million in collections a day and requires a $350,000 compensating balance. No More Books is contemplating canceling the agreement and dividing its eastern region so

> Take a look back at Figure 31.1 to answer the following questions: a. If you have $100, how many euros can you get? b. How much is one euro worth in dollars? c. If you have 5 million euros, how many dollars do you have? d. Which is worth more, a New Zeal

> Suppose the spot and six-month forward rates on the Norwegian krone are Kr 6.97 and Kr 7.06, respectively. The annual risk-free rate in the United States is 3 percent, and the annual risk-free rate in Norway is 5 percent. a. Is there an arbitrage opportu

> Leeloo, Inc., is considering a change in its cash-only sales policy. The new terms of sale would be net one month. Based on the following information, determine if the company should proceed or not. Describe the buildup of receivables in this case. The r

> Why do so many firms file for legal bankruptcy when private workouts are so much less expensive?

> Acquiring firm stockholders seem to benefit little from takeovers. Why is this finding a puzzle? What are some of the reasons offered for it?

> Explain why a swap is effectively a series of forward contracts. Suppose a firm enters a swap agreement with a swap dealer. Describe the nature of the default risk faced by both parties.

> Last month, BlueSky Airline announced that it would stretch out its bill payments to 45 days from 30 days. The reason given was that the company wanted to “control costs and optimize cash flow.” The increased payables period will be in effect for all of

> It is sometimes argued that excess cash held by a firm can aggravate agency problems (discussed in Chapter 1) and, more generally, reduce incentives for shareholder wealth maximization. How would you describe the issue here?

> We discussed five international capital market relationships: Relative PPP, IRP, UFR, UIP, and the international Fisher effect. Which of these would you expect to hold most closely? Which do you think would be most likely to be violated?

> If a company’s inventory carrying costs are $5 million per year and its fixed order costs are $8 million per year, do you think the firm keeps too much inventory on hand or too little? Why?