Question: Beth R. Jordan lives at 2322 Skyview

Beth R. Jordan lives at 2322 Skyview Road, Mesa, AZ 85201. She is a tax accountant with Mesa Manufacturing Company, 1203 Western Avenue, Mesa, AZ 85201 (employer identification number 11-1111111). She also writes computer software programs for tax practitioners and has a part-time tax practice. Beth is single and has no dependents. Beth was born on July 4, 1974, and her Social Security number is 123-45-6785. She did not engage in any vitual currency transactions during the year, and she wants to contribute $3 to the Presidential Election Campaign Fund. Beth received the appropriate coronavirus recovery rebates (economic impact payments); related questions in ProConnect Tax should be ignored.

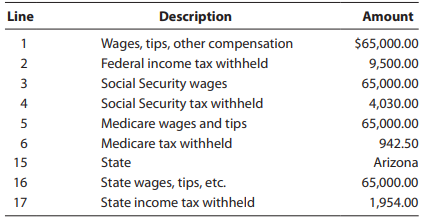

The following information is shown on Beth’s Wage and Tax Statement (Form W–2) for 2020.

During the year, Beth received interest of $1,300 from Arizona Federal Savings and Loan and $400 from Arizona State Bank. Each financial institution reported the interest income on a Form 1099–INT. She received qualified dividends of $800 from Blue Corporation, $750 from Green Corporation, and $650 from Orange Corporation. Each corporation reported Beth’s dividend payments on a Form 1099–DIV.

Beth received a $1,100 income tax refund from the state of Arizona on April 29, 2020. On her 2019 Federal income tax return, she used the standard deduction.

Fees earned from her part-time tax practice in 2020 totaled $3,800. She paid $600 to have the tax returns processed by a computerized tax return service.

On February 8, 2020, Beth bought 500 shares of Gray Corporation common stock for $17.60 a share. On September 12, 2020, Beth sold the stock for $14 a share.

On January 2, 2020, Beth acquired 100 shares of Blue Corporation common stock for $30 a share. She sold the stock on December 19, 2020, for $55 a share. Both stock transactions were reported to Beth on Form 1099–B; basis was not reported to the IRS.

Beth bought a used sport utility vehicle for $6,000 on June 5, 2020. She purchased the vehicle from her brother-in-law, who was unemployed and was in need of cash. On November 2, 2020, she sold the vehicle to a friend for $6,500.

During the year, Beth records revenues of $16,000 from the sale of a software program she developed. Beth incurred the following expenses in connection with her software development business.

Cost of personal computer ……………………………..$7,000

Cost of printer ………………………………………………..2,000

Furniture ……………………………………………………….3,000

Supplies ……………………………………………………………650

Fee paid to computer consultant 3,500 Beth elected to expense the maximum portion of the cost of the computer, printer, and furniture allowed under the provisions of § 179. These items were placed in service on January 15, 2020, and used 100% in her business.

Although her employer suggested that Beth attend an in-person conference on current developments in corporate taxation, Beth was not reimbursed for the travel expenses of $1,420 she incurred in attending the meeting. The $1,420 included $200 for the cost of meals.

During the year, Beth paid $300 for prescription medicines and $2,875 for doctor bills and hospital bills. Medical insurance premiums were paid by her employer. Beth paid real property taxes of $1,766 on her home. Interest on her home mortgage (Valley National Bank) was $3,845, and credit card interest was $320. Beth contributed $2,080 in cash to various qualifying charities during the year. Professional dues and subscriptions totaled $350.

Beth paid estimated taxes of $1,000.

Part 1—Tax Computation

Compute Beth Jordan’s 2020 Federal income tax payable (or refund due), and complete her tax return using appropriate forms and schedules. Suggested software: ProConnect Tax.

Part 2—Tax Planning

Beth is anticipating significant changes in her life in 2021, and she has asked you to estimate her taxable income and tax liability for 2021.

Beth just received word that she has been qualified to adopt a two-year-old daughter. Beth expects that the adoption will be finalized in 2021 and that she will incur approximately $2,000 of adoption expenses. In addition, she expects to incur approximately $3,500 of child and dependent care expenses relating to the care of her new daughter, which will enable her to keep her job at Mesa Manufacturing Company. However, with the additional demands on her time because of her daughter, she has decided to discontinue her two part-time jobs (i.e., the part-time tax practice and her software business), and she will cease making estimated income tax payments.

In your computations, assume that all other 2021 income and expenses will be the same as 2020 amounts.

> Cheryl incurred $8,700 of medical expenses in November 2021. On December 5, the clinic where she was treated mailed her the insurance claim form it had prepared for her with a suggestion that she sign and return the form immediately to receive her reimbu

> Bailey owns a small rental townhouse complex that generates a loss during the year. Under what circumstances can Bailey deduct a loss from the rental activity? What limitations apply?

> On July 16, 2021, Logan acquires land and a building for $500,000 to use in his sole proprietorship. Of the purchase price, $400,000 is allocated to the building, and $100,000 is allocated to the land. Cost recovery of $4,708 is deducted in 2021 for the

> Lee owns land and a building (held for investment) with an adjusted basis of $75,000 and a fair market value of $250,000. The property is subject to a mortgage of $400,000. Because Lee is in arrears on the mortgage payments, the creditor is willing to ac

> Isabelle invests in land, and Grace invests in taxable bonds. The land appreciates by $8,000 each year, and the bonds earn interest of $8,000 each year. After holding the land and bonds for five years, Isabelle and Grace sell them. There is a $40,000 rea

> Comment on the following transactions. a. Mort owns 500 shares of Pear, Inc. stock with an adjusted basis of $22,000. On July 28, 2021, he sells 100 shares for $3,000. On August 16, 2021, he purchases another 100 shares for $3,400. Explain why Mort’s rea

> Thelma inherited land from Sadie on June 7, 2021. The land appreciated in value by 100% during the six months Sadie owned it. The value has remained stable during the three months Thelma has owned it, and she expects it to continue to do so in the near f

> During the year, Rachel earned $18,000 of interest income on private activity bonds that she had purchased in 2016. She also incurred interest expense of $7,000 in connection with amounts borrowed to purchase the bonds. How do these amounts affect Rachel

> Amee moved to the San Francisco Bay Area to work for a technology startup 25 years ago. The startup eventually went public, and Amee is now one of the company’s most senior and successful employees. Amee has owned a house in Nob Hill for the past 20 year

> Noah Yobs, who has $62,000 of AGI (solely from wages) before considering rental activities, has $70,000 of losses from a real estate rental activity in which he actively participates. He also actively participates in another real estate rental activity f

> Peyton sells an office building and the associated land on May 1 of the current year. Under the terms of the sales contract, Peyton is to receive $1,600,000 in cash. The purchaser is to assume Peyton’s mortgage of $950,000 on the property. To enable the

> Suki and Dave each purchase 100 shares of stock of Burgundy, Inc., a publicly owned corporation, in July for $10,000 each. Suki sells her stock on December 31 for $8,000. Because Burgundy’s stock is listed on a national exchange, Dave can ascertain that

> On July 1, 2021, Katrina purchased tax-exempt bonds (face value of $75,000) for $82,000. The bonds mature in five years, and the annual interest rate is 3%. a. How much interest income and/or interest expense must Katrina report in 2021, assuming that st

> Ava and her husband, Leo, file a joint return and are in the 24% tax bracket in 2021. Ava’s employer offers a child and dependent care reimbursement plan that allows up to $5,000 of qualifying expenses to be reimbursed in exchange for a $5,000 reduction

> In 2021, Ivanna, who has three children under age 13, worked full-time while her spouse, Sergio, was attending college for nine months during the year. Ivanna earned $47,000 and incurred $6,400 of child care expenses. Determine Ivanna and Sergio’s child

> In 2021, Santiago and Amy are married and file a joint tax return. They have three dependent children, ages 12, 14, and 19. All parties are U.S. citizens. The couple’s AGI is $140,000. Determine any available child tax credit and dependent tax credit.

> Determine the additional Medicare taxes for these individuals. a. Mario, who is single, earns wages of $440,000. b. George and Shirley are married and file a joint return. During the year, George earns wages of $138,000, and Shirley earns wages of $210,0

> In 2021, Miranda records net earnings from self-employment of $158,500. She has no other income. Determine the amount of Miranda’s self-employment tax and her for AGI income tax deduction.

> Elijah is single. He has a $12,000 AMT credit from 2020. In 2021, his regular tax liability is $28,000 and his tentative minimum tax is $24,000. Does Elijah owe AMT in 2021? How much (if any) of the AMT credit can Elijah use in 2021?

> Yanni, who is single, provides you with the following information for 2021. Salary ……………………………………………………………………………………………..$250,000 State income taxes ………………………………………………………………………………..25,000 Mortgage interest expense on principal residence ($480,000 mortgage

> In 2021, Henri, a U.S. citizen and calendar year taxpayer, reports $30,000 of income from France, which imposes a 10% income tax, and $50,000 from Italy, which imposes a 40% tax. In addition, Henri reports taxable income of $90,000 from within the United

> Donna donates stock in Chipper Corporation to the American Red Cross on September 10, 2021. She purchased the stock for $18,100 on December 28, 2020, and it had a fair market value of $27,000 when she made the donation. a. What is Donna’s charitable cont

> Ángel was in an accident and required cosmetic surgery for injuries to his nose. He also had the doctor do additional surgery to reshape his chin, which had not been injured. Will the cosmetic surgery to Ángel’s nose qualify as a medical expense? Will th

> Compute the 2021 AMT exemption for the following taxpayers. a. Bristol, who is single, reports AMTI of $650,000. b. Marley and Naila are married and file a joint tax return. Their AMTI is $1,528,000.

> In March 2021, Serengeti exercised an ISO that had been granted by his employer, Thunder Corporation, in December 2018. Serengeti acquired 5,000 shares of Thunder stock for the exercise price of $65 per share. The fair market value of the stock at the da

> Pierre, a cash basis, unmarried taxpayer, had $1,400 of state income tax withheld during 2021. Also in 2021, Pierre paid $455 that was due when he filed his 2020 state income tax return and made estimated payments of $975 toward his 2021 state income tax

> Jason, a single parent, lives in an apartment with his three minor children, whom he supports. Jason earned $27,400 during 2021 and uses the standard deduction. Calculate the amount, if any, of Jason’s earned income credit.

> This year, Amy purchased a personal residence at a cost of $1,000,000. She borrowed $800,000 secured by the home to make the purchase. This year, she paid interest expense on this mortgage of $12,000. How much may she deduct?

> Green Corporation hires six individuals on January 4, 2021, all of whom qualify for the work opportunity credit. Three of these individuals receive wages of $8,500 during 2021, and each individual works more than 400 hours during the year. The other thre

> Reba is a single taxpayer. Lawrence, Reba’s 84-year-old dependent grandfather, lived with Reba until this year, when he moved to Lakeside Nursing Home because he needs specialized medical and nursing care. During the year, Reba made the following payment

> For calendar year 2021, Giana was a self-employed consultant with no employees. She had $80,000 of net profit from consulting and paid $7,000 in medical insurance premiums on her policy covering 2021. How much of these premiums may Giana deduct as a dedu

> Use the following data to calculate Chiara’s AMT base in 2021. Chiara will itemize deductions and will file as a single taxpayer. Taxable income ………………………………………………………….$248,000 Positive AMT adjustments ………………………………………………73,000 Negative AMT adjustments ……

> In 2021, Bianca earned a salary of $164,000 from her employer. Determine the amount of FICA taxes and Medicare taxes withheld from her salary.

> Sally owns real property for which the annual property taxes are $9,000. She sells the property to Kate on March 9, 2021, for $550,000. Kate pays the real property taxes for the entire year on October 1, 2021. a. How much of the property taxes can be ded

> Rafael and Lucy, married taxpayers, each contribute $2,900 to their respective § 401(k) plans offered through their employers. The AGI reported on the couple’s joint return is $44,000. Determine their credit for retirement plan contributions (the Saver’s

> Paola and Isidora are married; file a joint tax return; report modified AGI of $148,000; and have one dependent child, Dante. The couple paid $12,000 of tuition and $10,000 for room and board for Dante (a freshman). Dante is a full-time student. Determin

> Derek, a cash basis, unmarried taxpayer, had $610 of state income tax withheld during 2021. Also in 2021, Derek paid $50 that was due when he filed his 2020 state income tax return and made estimated payments of $100 toward his 2021 state income tax liab

> Jesse, an engineer, operates a separate business that he acquired eight years ago. If he participates 85 hours in the business and it incurs a loss of $34,000, under what circumstances can Jesse claim an active loss?

> Samuel and Annamaria are married, file a joint return, and have three qualifying children. In 2021, they earn wages of $34,000 and no other income. Determine the amount of their earned income credit for 2021.

> Alison incurs the following research expenditures. In-house wages …………………………..$60,000 In-house supplies …………………………….5,000 Payment to ABC, Inc., for research …..80,000 a. Determine the amount of qualified research expenditures. b. Assuming that the base a

> During 2021, Lincoln Company hires seven individuals who are certified to be members of a qualifying targeted group. Each employee works in excess of 600 hours and is paid wages of $7,500 during the year. Determine the amount of Lincoln’s work opportunit

> Describe the exposure (i.e., wage base and tax rate) of a self-employed individual to the self employment tax for 2021.

> Kathy, a sole proprietor, owns and operates a grocery store. Kathy’s husband and her 16-year-old daughter work in the business and are paid wages. Will the husband and daughter be subject to FICA? Explain.

> The IRS provides a web-based tool to help taxpayers determine whether they are eligible for the earned income tax credit. Locate the EITC Assistant at the IRS website. Then apply the facts related to Walt in Example 21 for either 2020 or 2021. Determine

> Barbara incurred the following expenses during 2021: $840 dues at a health club she joined at the suggestion of her physician to improve her general physical condition, $240 for multiple vitamins and antioxidant vitamins, $3,500 for a smoking cessation p

> Is the earned income credit a form of negative income tax? Why or why not?

> How do U.S. individuals generate their income? Does it vary by size of income (AGI)? Go to the IRS tax statistics website (irs.gov/statistics), and download a recent tax year’s information on “sources of income.” Compare the following types of income by

> Which tax credits are most often claimed by individual taxpayers? Do the credits claimed vary by size of income (AGI)? To answer these questions, go to the IRS Tax Statistics page (irs.gov/statistics) and download the Microsoft Excel spreadsheet for the

> Dan, a self-employed individual taxpayer, prepared his own income tax return for the past year and has asked you to check it for accuracy. Your review indicates that Dan failed to claim certain business meals expenses. Will the correction of this omissio

> Paul and Donna Decker are married taxpayers, ages 44 and 42, respectively, who file a joint return for 2021. The Deckers live at 1121 College Avenue, Carmel, IN 46032. Paul is an assistant manager at Carmel Motor Inn, and Donna is a teacher at Carmel Ele

> Alice J. and Bruce M. Byrd are married taxpayers who file a joint return. Their Social Security numbers are 123-45-6784 and 111-11-1113, respectively. Alice’s birthday is September 21, 1973, and Bruce’s is June 27, 197

> John Benson, age 40, is single. His Social Security number is 111-11-1111, and he resides at 150 Highway 51, Tangipahoa, LA 70465. John has a 7-year-old child, Kendra, who lives with her mother, Katy. As a result of his divorce in 2016, John pays alimony

> Alton Newman, age 67, is married and files a joint return with his wife, Clair, age 65. Alton and Clair are both retired, and during 2020, they received Social Security benefits of $10,000. Both Alton and Clair are covered by Medicare. Alton’s Social Sec

> Jacob, age 42, and Jane Brewster, age 44, are married and file a joint return in 2021. The Brewsters have two dependent children, Lukas and Alexa, 14-year-old twins. Unless otherwise noted, all of the income and expense amounts in the problem relate to t

> William, a high school teacher, earns about $50,000 each year. In December 2021, he won $1,000,000 in the state lottery. William plans to donate $100,000 to his church. He has asked you, his tax adviser, whether he should donate the $100,000 in 2021 or 2

> Robert A. Kliesh, age 41, is single and has no dependents. Robert’s Social Security number is 111-11-1115. His address is 727 Big Horn Avenue, Sheridan, WY 82801. He does not contribute to the Presidential Election Campaign fund through the Form 1040. Ro

> Tim and Sarah Lawrence are married and file a joint return. Tim’s Social Security number is 123-45-6789, and Sarah’s Social Security number is 111-11-1111. They reside at 100 Olive Lane, Covington, LA 70434. They have two dependent children, Sean and Deb

> Betty is age 34 and has AGI of $50,000 and regular taxable income of $35,000. The following items may qualify as itemized deductions for Betty: Qualified medical expenses (before percentage of AGI floor) ……………………..$3,000 Real estate tax ……………………………………………

> Betty is age 34 and has AGI of $50,000. The following items may qualify as itemized deductions for Betty: Qualified medical expenses (before 7.5% AGI floor) ………………………….$6,000 Real estate tax ………………………………………………………………………………….1,200 State income tax ……………………

> Which of the following may not be claimed as a deduction by a taxpayer who claims the standard deduction? a. Interest penalty on early withdrawal of savings b. Self-employed health insurance c. State income tax paid d. IRA contribution

> Sally recently invested $10,000 (tax basis) in a limited partnership interest. Her atrisk amount is also $10,000. The partnership lost $6,000 this year, and Sally’s share of the loss is $2,000. Sally has $40,000 in wage income and $2,000 of dividend inco

> In early year 8, Alice sold Tom, her son, 20 shares of common stock for $20,000. Alice had paid $25,000 for the stock in year 2. In late year 8, Tom sold the stock to an unrelated third party for $35,000. How much gain must Tom report in his year 8 tax r

> On January 25, year 10, Mother Hall gave her daughter, Nadyne, 500 shares of common stock of XYZ, Corp. The fair market value of the stock on January 25 was $2,000. Mother Hall had paid $4,000 for the stock three years earlier. Nadyne decided a month aft

> On February 1 of the current year, Duffy learned that he was bequeathed 1,000 shares of common stock under his father’s will. Duffy’s father had paid $12,500 for the stock 20 years ago. Fair market value of the stock on February 1 of the current year, th

> Madison and Nick Koz have two children, ages 8 and 10. Both children meet the definition of qualifying child. The Koz family has adjusted gross income of $300,000. What is the amount of the child tax credit on the couple’s income tax return? a. $1,000 b.

> Matt, who is single, always has elected to itemize deductions rather than take the standard deduction. In prior years, his itemized deductions always exceeded the standard deduction by a substantial amount. Based on recent tax law changes and the fact th

> On March 5, 2016, the Hortons borrowed $100,000 against the equity in their personal residence with the loan secured by that home. For 2016 and 2017, they were able to deduct the interest expense on this loan as home equity interest expense [an itemized

> Marcia, a shareholder in a corporation with stores in five states, donated stock with a basis of $10,000 to a qualified charitable organization in 2020. Although the stock of the corporation was not traded on a public stock exchange, many shares had been

> On his 2020 Federal income tax return, Rigved deducted state income taxes of $8,000 for amounts withheld and estimated tax payments made in 2020. When he filed his 2020 state income tax return in April 2021, he discovered that he had overpaid his state i

> Many see the “step-up in basis at death” rule as an expensive tax loophole enjoyed by the wealthy. Find the latest estimates of the revenue loss to the Treasury that is attributable to this rule. a. How does Canada’s tax law determine the basis of proper

> How are transactions using bitcoin (or another virtual currency) treated under U.S. tax law? Locate the current IRS guidance on this question. Some background on bitcoin can be found at bitcoin.org/en/faq. In addition, locate the American Institute of CP

> Ruth Ames died on January 10, 2021. In filing the estate tax return, her executor, Melvin Sims, elects the primary valuation date and amount (fair market value on the date of death). On March 12, 2021, Melvin invests $30,000 of cash that Ruth had in her

> Taxpayers who purchase health insurance coverage through the Health Insurance Marketplace may be eligible for the premium tax credit under § 36B. Use the IRS website to determine which taxpayers are eligible for the credit. Send a one-page summary of you

> What would you expect the relationship to be between a taxpayer’s AGI and AMT liability? Find Figure D in Section 3 (Individual Tax Rates) of the 2015–2018 editions of IRS Publication 1304, Individual Income Tax Returns Complete Report. Use the informati

> Use the IRS’s Statistics of Income page to determine how many individual income tax returns reported an AMT liability from 2013 to 2018. What percentage of returns filed in this time period report an AMT liability? What percentage of tax revenues collect

> The TCJA of 2017 repealed the corporate AMT provisions. However, any unused AMT credits a corporation had at that point in time were allowed to be used over four tax years, beginning in 2018. The 2020 Coronavirus Aid Relief and Economic Security Act (CAR

> Robin inherits 1,000 shares of Walmart stock from her aunt Julieta in 2021. According to the information received from the executor of Julieta’s estate, Robin’s adjusted basis for the stock is $55,000. Albert, Robin’s fiancé, receives 1,000 shares of Wal

> Investment interest is incurred when taxpayers borrow money that is used to purchase investment property. Using IRS Tax Statistics for the most recent year available (www.irs.gov/statistics), determine (a) the number of taxpayers who claimed a deduction

> Oil and gas ventures operating as publicly traded partnerships typically attract sophisticated investors who purchase limited partnership interests. Investments in these types of publicly traded partnerships are subject to a restrictive set of passive ac

> Since the first bitcoin transaction in 2009, the number of virtual currencies has grown to over 1,500 and some taxpayers trade the currencies multiple times each day (i.e., like a day trader). Find a reliable article on investment strategies for virtual

> Look for reliable data on how many individuals are affected by the $10,000 SALT cap. Use that data to make an argument for or against the cap.

> The Federal government incurs a cost for every item that is deductible in the computation of taxable income. These costs, which take the form of forgone tax revenue, are often referred to as “tax expenditures.” The Joint Committee on Taxation regularly e

> During 2021, Susan incurred and paid the following expenses for Beth (her daughter), Ed (her father), and herself: Surgery for Beth ………………………………………………………………..$4,500 Red River Academy charges for Beth: Tuition ………………………………………………………………………………..5,100 Room, b

> Arthur Wesson, an unmarried individual who is age 58, reports taxable income of $510,000 in 2021. He records positive AMT adjustments of $80,000 and preferences of $35,000. Arthur itemizes his deductions, and his regular tax liability in 2021 is $153,044

> Paul suffers from emphysema and severe allergies and, upon the recommendation of his physician, has a dust elimination system installed in his personal residence. In connection with the system, Paul incurs and pays the following amounts during 2021: Doct

> Emma Doyle is employed as a corporate attorney. For calendar year 2021, she had AGI of $75,000 and paid the following medical expenses: Medical insurance premiums ……………………………………………………………….$3,700 Doctor and dentist bills for Bob and April (Emma’s parents)

> Linda, who files as a single taxpayer, had AGI of $280,000 for 2021. She incurred the following expenses and losses during the year: Medical expenses (before the 7.5%-of-AGI limitation) ………………………………..$33,000 State and local income taxes ……………………………………………

> Paola exercised an incentive stock option on March 1, 2021. She acquired 2,000 shares of stock at an exercise price of $3 per share when the fair market value of the stock was $15 per share. However, Paola was concerned that the stock was overvalued, so

> Evan is single and has AGI of $277,300 in 2021. His potential itemized deductions before any limitations for the year total $52,300 and consist of the following: Medical expenses (before the 7.5%-of-AGI limitation) ………………………………..$31,000 Interest on home

> Bart and Elizabeth Forrest are married and have no dependents. They have asked you to advise them whether they should file jointly or separately in 2021. Bart incurred some significant medical expenses during the year related to an unexpected surgery. Th

> Heather wants to invest $40,000 in a relatively safe venture and has discovered two alternatives that would produce the following reportable ordinary income and loss over the next three years: She is interested in the after-tax effects of these alternati

> On December 27, 2021, Roberta purchased four tickets to a charity ball sponsored by the city of San Diego for the benefit of underprivileged children. Each ticket cost $200 and had a fair market value of $35. On the same day as the purchase, Roberta gave

> Ramon had AGI of $180,000 in 2022. He is considering making a charitable contribution this year to the American Heart Association, a qualified charitable organization. Determine the current allowable charitable contribution deduction in each of the follo

> Liz had AGI of $130,000 in 2021. She donated Bluebird Corporation stock with a basis of $10,000 to a qualified charitable organization on July 5, 2021. a. What is the amount of Liz’s deduction assuming that she purchased the stock on December 3, 2020, an

> In 2021, Geoff incurred $900,000 of mine and exploration expenditures. He elects to deduct the expenditures as quickly as the tax law allows for regular tax purposes. a. How will Geoff’s treatment of mine and exploration expenditures affect his regular t

> In March 2021, Helen Carlon acquired used equipment for her business at a cost of $300,000. The equipment is five-year property for regular tax depreciation purposes. a. If Helen depreciates the equipment using the method that will produce the greatest d

> Nichole, who is single and uses the cash method of accounting, lives in a state that imposes an income tax. In April 2021, she files her state income tax return for 2020 and pays an additional $1,000 in state income taxes. During 2021, her withholdings f

> Angela, who is single, incurs circulation expenditures of $270,000 during 2021. She is deciding whether to deduct the entire $270,000 or to capitalize the expenses and deduct them over a three-year period. Angela is in the 37% bracket for regular tax pur

> In 2007, Malik purchased an office building for $500,000 to be used in his business. He sells the building in the current tax year. Explain whether his recognized gain or loss for regular tax purposes will be different from his recognized gain or loss fo

> Jaimee and Mike live in Austin, Texas. They married early in January 2020. They had saved a significant amount of money for their wedding, but instead decided to elope. The couple used the money they had saved for the wedding to buy some vacant, unimprov